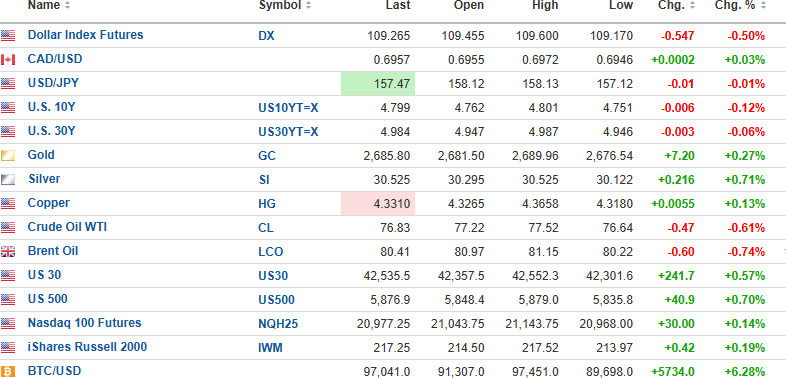

The USD index futures are lower by 0.50% to 109.265 while the 10-year yield is lower by 0.12% to 4.799%, and the 30-year yield is also lower by 0.06% to 4.984%.

Gold (+0.27%), silver (+0.71%), and copper (+0.13%) are all higher, while oil is down 0.61% to $76.83/bbl.

Stock index futures are up, with the DJIA up 241.7, the S&P 500 up 40.9, and the NASDAQ up 30. Risk barometer Bitcoin is rallying, up $5,734 to $97,041.

PPI

This morning, the Commerce Department in the U.S. released the monthly Producer Price Index ("PPI") with the number coming in at 0.2% versus the estimate for core PPI unchanged at 0.4% and non-core CPI at 0.3% versus 0.1% last month.

The market had been discounting a "hot" PPI, so this print comes in much cooler than the expected numbers, triggering a pop in stock futures until at least tomorrow when CPI is released but probably until next Monday, which is Inauguration Day for Trump and a market holiday for Martin Luther King Day.

Volatility

The VIX:US responded to the cooler-than-expected PPI and has backed off to 18.69 with the pre-opening call on the UVIX:US at $3.59-3.60.

I will be taking advantage of this pullback to add to volatility, which I contend will spike after Inauguration Day. As CNBC's Rick Santelli (the only CNBC anchor I like) said this morning: "The year-over-year CPI number has a "3" handle, not "2" so to think inflation is not impacting bond yields is flawed."

I will continue to hold the VIX Feb $15 calls with a view to adding on weakness this week. With CPI coming in tomorrow, today's rally could be reversed in a heartbeat.

Stocks

I flattened the SPY January $600 and $590 puts but left the $575 puts intact, looking for a "hot" CPI number tomorrow. My rationale is that the profit I took on the rebalancing and large-cap- small-cap trade more than covers my exposure on the SPY Jan $575 calls, so I can afford to speculate on weakness/rising volume later in the week.

Again, tomorrow's CPI print could derail things quickly, so bear that in mind before taking on new positions.

GTCH/GGLDF

Getchell Gold Corp.'s (GTCH:CSE; GGLDF:OTCQB) much-awaited PEA is due out this week, and while I do not expect a massive buying panic, I do expect the results to force a rerating of valuation as they are disseminated throughout the investment community.

Sentiment for developers has not yet shifted, so it is going to take some serious marketing to move the needle. I remain confident that will happen this year and look for higher prices.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Getchell Gold Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.