Giant Mining Corp. (CSE: BFG; OTC:BFGFF; FWB:YW5) continues to emerge as one of the most compelling opportunities in the junior mining sector.

With its flagship Majuba Hill Copper Property in Nevada, the company has made significant strides since I last wrote about it in September 2024, when its shares were trading at CA$0.19.

Now at CA$0.35, this steady climb reflects mounting interest and potential for a transformative copper discovery.

The Strategic Importance of Copper

Copper remains indispensable to global industries and is central to the ongoing energy transition. Its applications span electric vehicles (EVs), renewable energy systems, and AI technologies. The International Copper Study Group projects global demand to grow 2-3% annually through 2035, and with copper prices currently hovering around US$4.33 per pound, the need for new high-grade deposits has never been more urgent.

Majuba Hill stands out as a potential game-changer thanks to its high-grade copper zones, accessibility, and strong exploration results.

Majuba Hill Copper Property: A Unique Asset

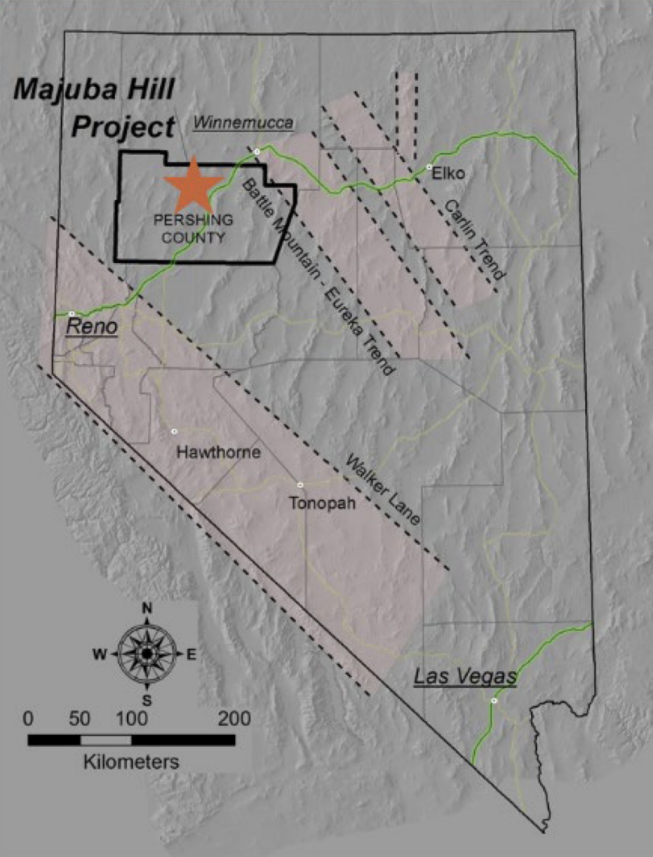

Located in mining-friendly Nevada, the Majuba Hill Copper Property combines favorable geology, existing infrastructure, and accessible location — key factors for successful development. Situated just northeast of Reno, the project benefits from year-round road access and proximity to skilled labor and mining services.

Key Property Highlights:

Historic Production: Over 2.8 million pounds of copper (Cu), 184,000 ounces of silver, and 5,800 ounces of gold produced from 1907 to 1960.

Promising Modern Exploration: Over 104 drill holes reveal copper mineralization at significant grades, such as:

44.5 meters at 1.41% Cu

113 meters at 0.45% Cu

A recent highlight of 66.4 meters at 1.35% Cu, including 22.6 meters at 2.6% Cu.

Dual Systems: Both oxide and sulfide copper mineral systems have been identified, with mineralization extending up to 490 meters below the surface.

Improved Infrastructure: Recently completed road construction enhances access to the Majuba Hill deposit, streamlining exploration logistics and laying the groundwork for development.

Majuba Hill's exploration success to date supports the potential for a district-scale copper discovery, with an exploration target between 50 million and 100 million tonnes grading 0.15-0.30% Cu, along with higher-grade zones containing 10-20 million tonnes at 0.80% Cu.

Progress and Upcoming Catalysts

Giant Mining has recently expanded its surface exploration program, targeting high-grade breccia zones and supergene-enriched copper deposits. The ongoing drilling program, featuring up to 18 new holes, is expected to provide results that will form the basis for an NI 43-101-compliant maiden resource estimate.

The company's near-term milestones include:

- Completion of its current drill program.

- Delivery of a maiden resource estimate in 2025.

- Advancing metallurgical studies to validate oxide and sulfide processing methods.

- Exploration of additional high-grade zones identified through historical data and recent mapping.

- Leveraging insights from Whittle Pit modeling to refine economic and mining strategies.

Management and Technical Expertise

Giant Mining's leadership team continues to play a pivotal role in advancing Majuba Hill. CEO David Greenway brings a proven track record in advancing mineral projects, while CFO Natasha Sever ensures financial discipline and strategic oversight.

The addition of veteran geologist Leo Hathaway to the advisory board underscores the company's commitment to technical excellence. Hathaway's experience with major copper discoveries adds significant value as the team works to unlock Majuba Hill's full potential.

Copper: A Critical Mineral in a Changing World

Copper's role in the global economy is poised to grow dramatically as the electrification of infrastructure and transportation accelerates. Each EV requires an average of 183 pounds of copper, and the metal is critical for renewable energy technologies like wind turbines and solar panels. This makes companies like Giant Mining indispensable in meeting the supply-demand gap.

Goldman Sachs' recent copper price forecast of US$10,160 per tonne by 2025 reflects the growing recognition of copper's strategic importance. For investors, Majuba Hill represents a unique opportunity to gain exposure to this essential resource in a stable jurisdiction.

Technical Analysis Outlook

Giant Mining has moved from under CA$0.20 cents to a high of CA$0.39 cents and pulled back. We are looking at the gap made in September 2024 to be filled with our first area being CA$0.55, then the previous back price resistance area, and a bigger picture target.

The shares have built a strong base here, which suggests the lows are in, and the shares can advance from here.

Why Now?

At CA$0.35 per share, Giant Mining Corp. offers significant upside potential. Its tight share structure (47 million fully diluted shares) and insider ownership of 20% reflect strong alignment with shareholder interests.

With a market cap of CA$7.6 million, the company remains undervalued given the scale of its asset and progress to date.

Conclusion

Giant Mining Corp.'s (CSE: BFG; OTC: BFGFF; FWB: YW5) systematic approach to exploration, coupled with its strategic focus on high-grade copper assets, positions it as a standout player in the junior mining space, making the shares timely at current prices. As demand for copper continues to rise, Majuba Hill's potential as a major discovery could drive substantial value for shareholders.

For investors seeking exposure to copper and the electrification revolution, Giant Mining Corp. represents a speculative yet compelling opportunity. With critical milestones on the horizon, now is the time to keep a close eye on this emerging giant.

| Want to be the first to know about interesting Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Giant Mining Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, Giant Mining Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Giant Mining Corp.

- John Newell: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.