Giant Mining Corp. (CSE: BFG; OTC:BFGFF; FWB:YW5) is focused on further exploration and development of the Majuba Hill copper-gold-silver property in Nevada.

Its stock appears to be powering up to begin a major bull market, as we will proceed to see later when we review its stock charts, and it will help that the company just announced the closing of a significant financing that will enable it to move forward with its 2025 drilling program.

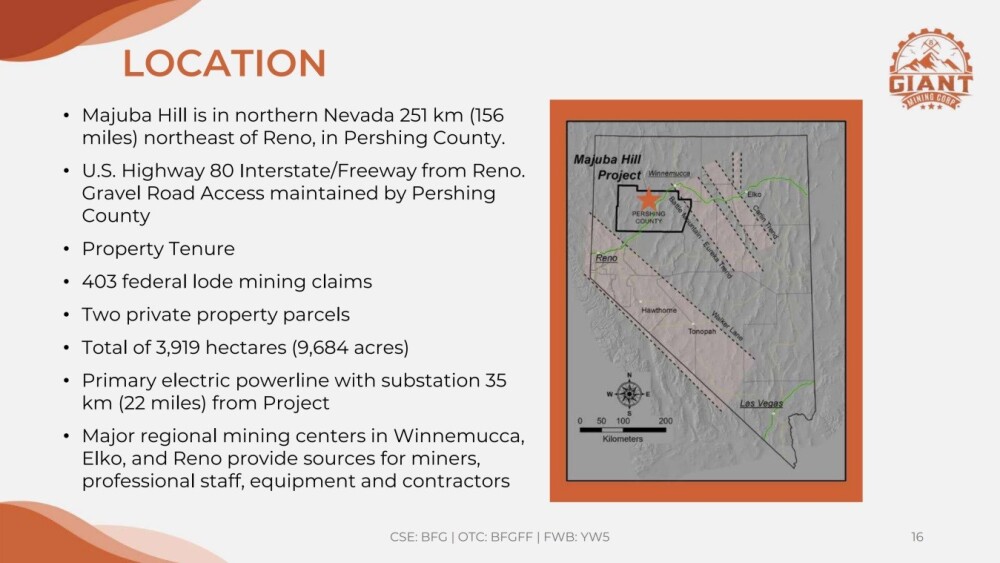

The Majuba Hill Project is situated northeast of Reno in northern Nevada, as shown on the following slide from the investor deck.

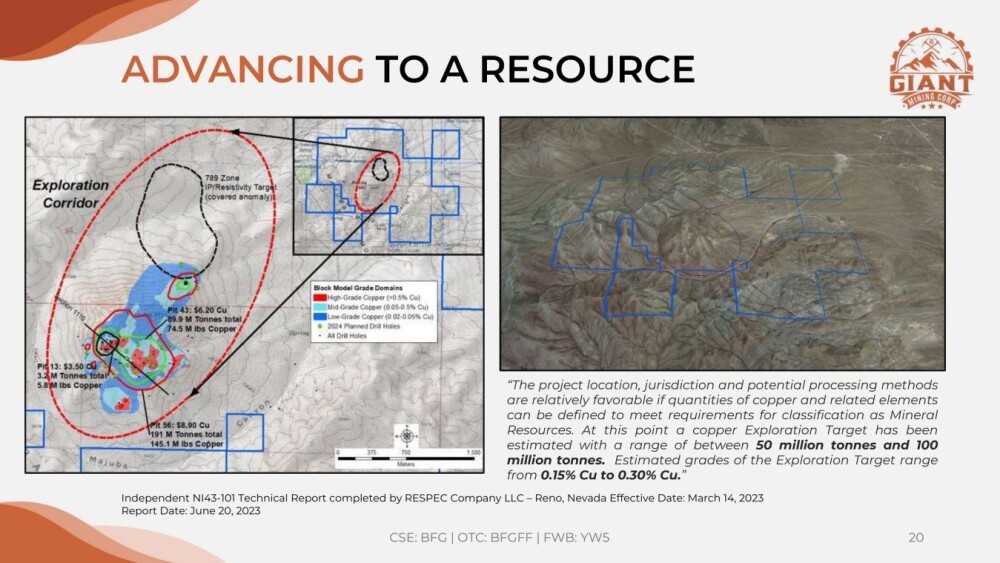

An NI43-101 report on the property was produced in March 2023, the primary conclusions of which are as follows:

The local infrastructure is excellent, as we would expect, as the project is in Nevada.

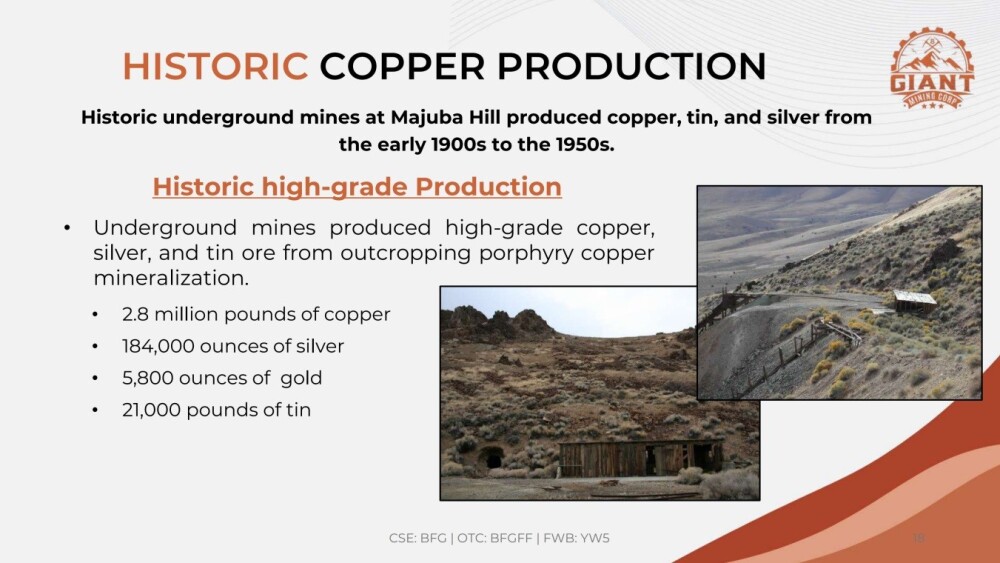

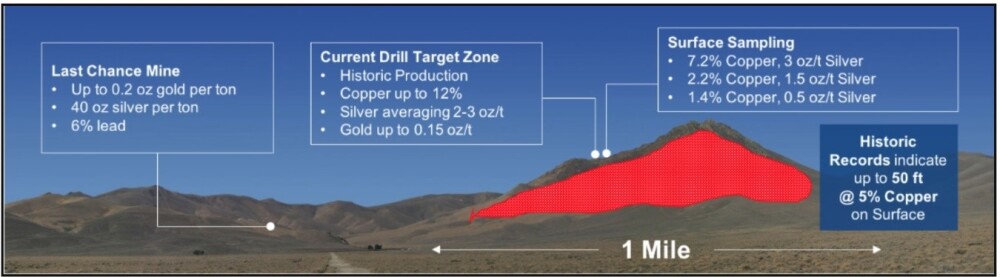

Majuba Hill has some history of high-grade production, albeit probably of an artisanal nature.

This is not merely of academic interest — it is a clear indication that there are worthwhile deposits there that are more economically viable now, given modern mining techniques and higher metals prices.

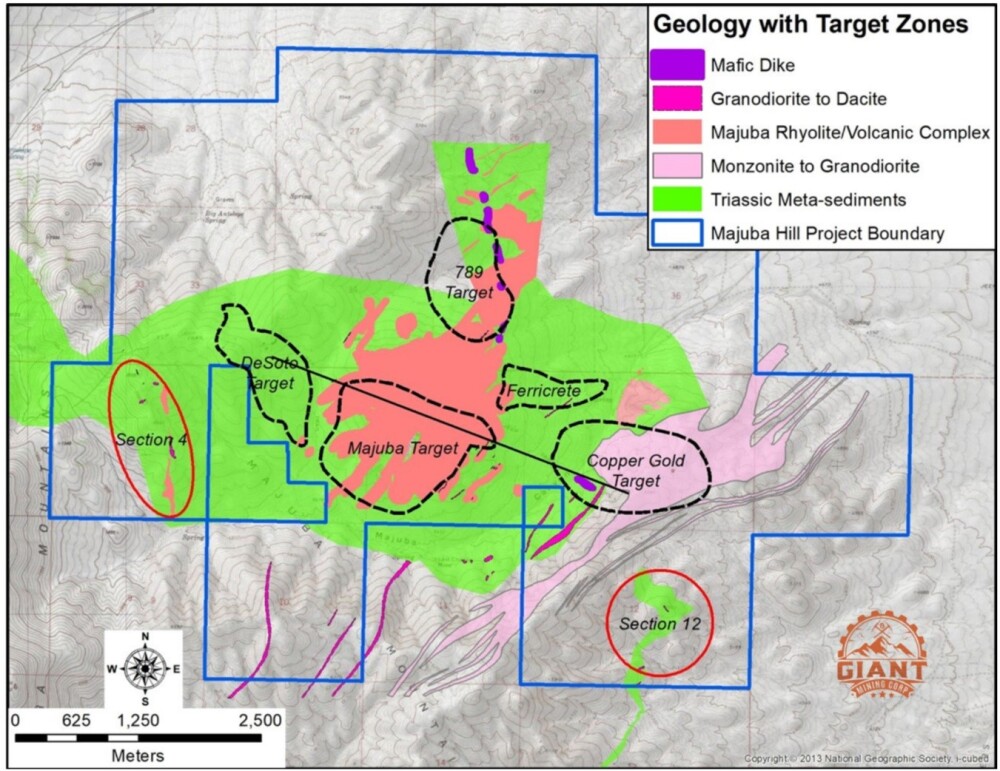

This map shows the basic geology of the property and target zones:

These maps show where the highest grades of copper have been located on the property:

Here is a side on view of Majuba Hill:

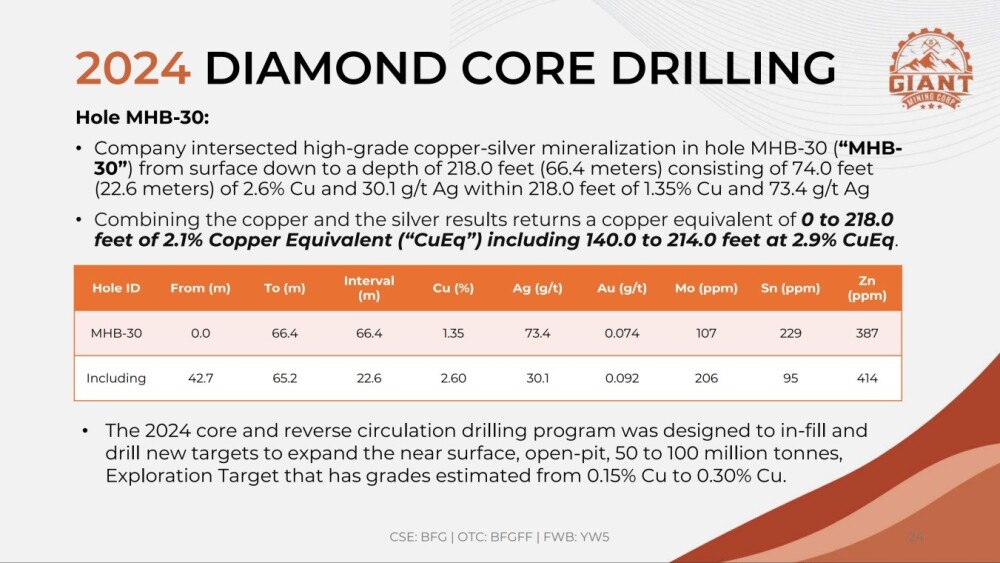

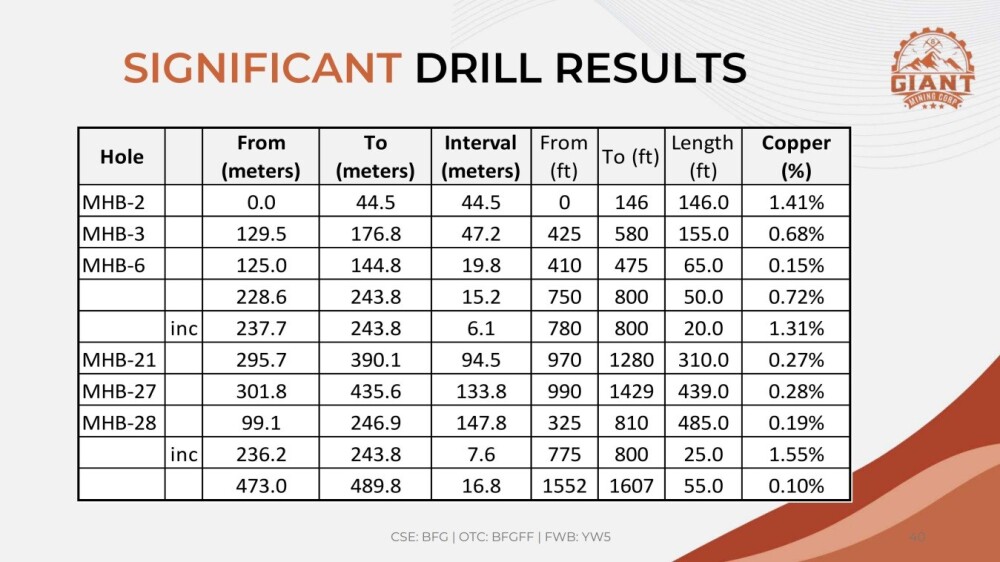

Good grades were intersected during the 2024 diamond drilling program.

Here is a table listing some significant drill results:

On December 4, the news came out that Giant Mining would start a four core hole drill program at Majuba Hill, which is intended to further define the resource.

With respect to this, David Greenway, CEO of Giant Mining, commented, "We are excited to announce this newest core drill program as a follow-up to hole MHB-30, which significantly exceeded our expectations for high-grade copper-silver mineralization. The company is steadfast in its belief of the potential at Majuba Hill and that 2025 will be a breakout year for copper, with industry insiders seeing the potential for $5-plus copper on the horizon, an undeniable shortfall of copper supply, and a new U.S. presidential administration that will focus on speeding up permitting timelines for critical, domestic mineral production."

Now, we will review the latest stock charts for Giant Mining.

After a long and really severe bear market from its 2021 spike high, shown on its 5-year chart below, Giant Mining is now beginning the process of breaking out of a low base pattern with volume indications suggesting that a major bull market is ahead.

Zooming in via the 1-year to look in much more detail at the last stages of the bear market, we see that the price trailed into what is believed to be its final lows in November and December, but prior to the lows, a fine Saucer base started to build out as far back as August – September.

This pattern has been accompanied by the classic hallmarks of a genuine Saucer with higher volume heading into the lows and much lighter volume near the bottom of the Saucer, which then picks up significantly as the price starts to rise out of it. The marked pickup in volume just this year that has driven the Accumulation line higher is certainly a bullish indication.

On the 6-month chart, we can see recent action in more detail,l and whilst the price is temporarily constrained by the short-term overbought condition shown by the RSI indicator, the still negatively aligned moving averages and the resistance towards the upper boundary of the Saucer, price / volume action is improving rapidly so these constraints are not expected to hold it in check for long.

After perhaps a brief period of consolidation or a minor reaction back toward the Saucer boundary, the price is expected to break out into a major bull market. The dramatic spike in August shows what this stock is capable of, and even though it would perhaps be unrealistic to expect a repeat of that in short order, especially as the number of shares has risen somewhat, the number of shares in issue is still modest, so a big move is very possible from the current low price.

Giant Mining is therefore rated a Strong Buy for all time horizons, with an awareness that a minor period of consolidation or slight dip is possible before it breaks out, which would be taken as an opportunity to buy more.

Giant Mining Corp.'s website.

Giant Mining Corp. (CSE: BFG; OTC:BFGFF; FWB:YW5) closed for trading at CA$0.295, US$0.20345 on January 10, 2025.

| Want to be the first to know about interesting Base Metals and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Giant Mining Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, Giant Mining Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$2,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Giant Mining Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.