Markets are closed in memoriam for the recently deceased former president Jimmy Carter, but futures remain open.

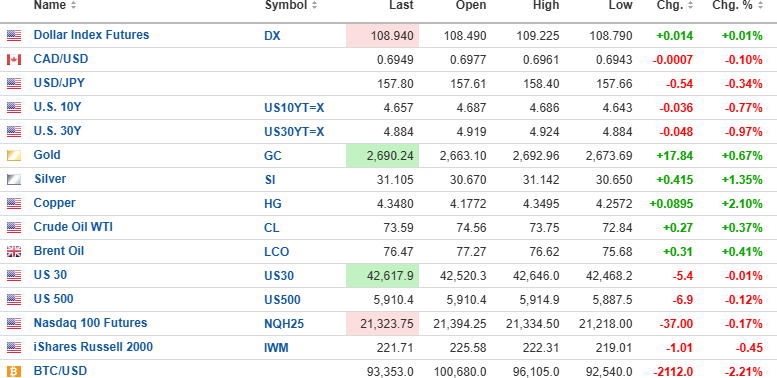

The USD index futures are ahead 0.01% to 108.940 this morning with the 10-year yield down 0.77% to 4.657 and the 30-year yield down 0.97% to 4.884%.

Gold (+0.67%), silver (+1.35%), copper (+2.10%), and oil (+0.37%) are all higher.

Stock futures are mixed, with the DJIA down 5.4 points, the S&P 500 futures down 6.9 points, and the NASDAQ down 0.17%. Risk barometer Bitcoin (-2.21%) is down $2,112 to $93,353.

First Five Days Indicator

The First Five Days indicator tracks market performance for the period and ends this afternoon at 4:00 pm. With the S&P 500 closing yesterday at 5,909.03, it is a mere 27.4 points above the 2024 closing level of 5,881.63. If it holds that level today, it eliminates the likelihood of a down January (and failed January Barometer). If it closes below that level, it increases the odds of 2025 being a down year or, at best, sharply reduced gains.

Statistically, if any one of the SCR, FFD, or JB has a negative outcome, the failed "trifecta" results in a 59.5% probability of an up year (versus 90.6% for a full "Trifecta") with an average gain of just 2.9%. Richard Russell used to say that the FFD only provided a clue to the outcome for January and not for the full year. He placed far greater emphasis on the JB.

December Seasonality Trades

In early December, I suggested that year-end rebalancing would favour bonds over stocks and that a "Long TLT/Short SPY" set-up would benefit from portfolio managers selling stocks and buying bonds in order to get the portfolio weightings back to 60% stocks-40% bonds. Well, one half of that trade worked beautifully with the SPY:US down 1.8% for the month.

Conversely, the bond market get walloped as bonds were sold off with the 10-yr. and 30-yr. yields rising 50 basis points in December.

We bought the combination at the following prices:

- TLT January $90 calls: $4.35

- SPY January $600 puts: $6.10 Total: $10.45

As of month end, prices went out at:

- TLT January $90 calls: $0.06

- SPY January $600 puts: $15.09 Total: $15.15

Profit: $4.70 44.98% return

We also provided a year-end strategy whereby small-cap stocks outperform large-cp stocks due to excessive tax-loss selling in the more speculative small-cap issues. That, too, failed to adhere to historical norms.

In early December, we put on the following trade:

- SPY January $590 puts at $3.75

- IWM January $245 calls at $5.00 Net debit: $8.75

As of month end, prices went out at:

- SPY January $590 puts at $15.09

- IWM January $245 calls at $.03 Net debit: $15.12

Profit: $6.37 72.8% return

These trades worked well, but to be brutally honest, it was totally for reasons that were far removed from my expectations. That bonds and small caps went wonky in a seasonally strong period is extremely bearish.

Getchell Gold Corp.

Getchell Gold Corp.'s (GTCH:CSE; GGLDF:OTCQB) widely-expected PEA is due out shortly, and I for one, am speculating that it will result in a rerating and higher prices.

I have been quietly accumulating more stock at current prices and looking for a pop-by month-end.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Getchell Gold Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.