There is a clear road ahead for Goldshore Resources Inc. (TSXV: GSHR; OTCQB: GSHRF ; FWB: 8X00) and also for its stock especially as, despite strong gains last year, it still has not broken out of a giant base pattern that we will look at later which promises much greater gains ahead against the background of an expected major precious metals sector bull market.

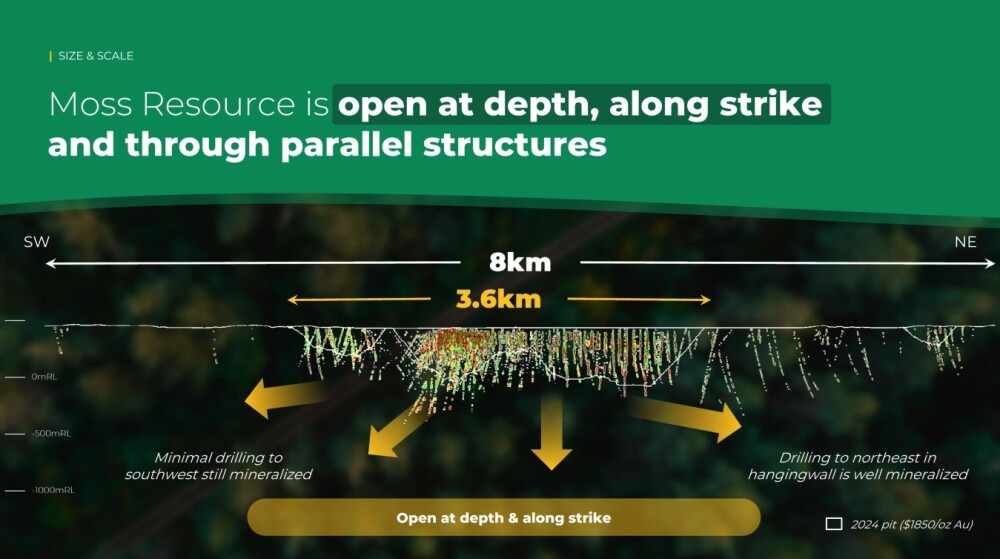

Goldshore Resources has already delineated a substantial gold resource in Ontario, its flagship Moss Project which is well on its way to becoming a district scale project with very significant expansion potential.

Now, we will proceed to overview the fundamentals of the company using slides taken from its new January 2025 investor deck and other illustrations from the company website.

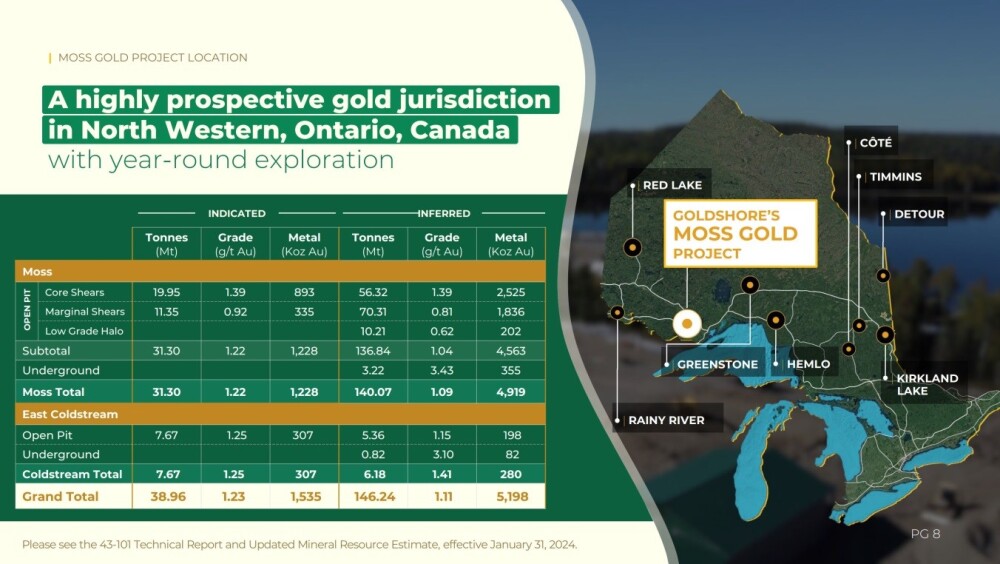

We start by orienting ourselves with this first slide, which shows the location of the Moss Project in Ontario and its position relative to other major projects in the province and the Great Lakes and summarizes the resources at the Moss Project and the lesser East Coldstream resource.

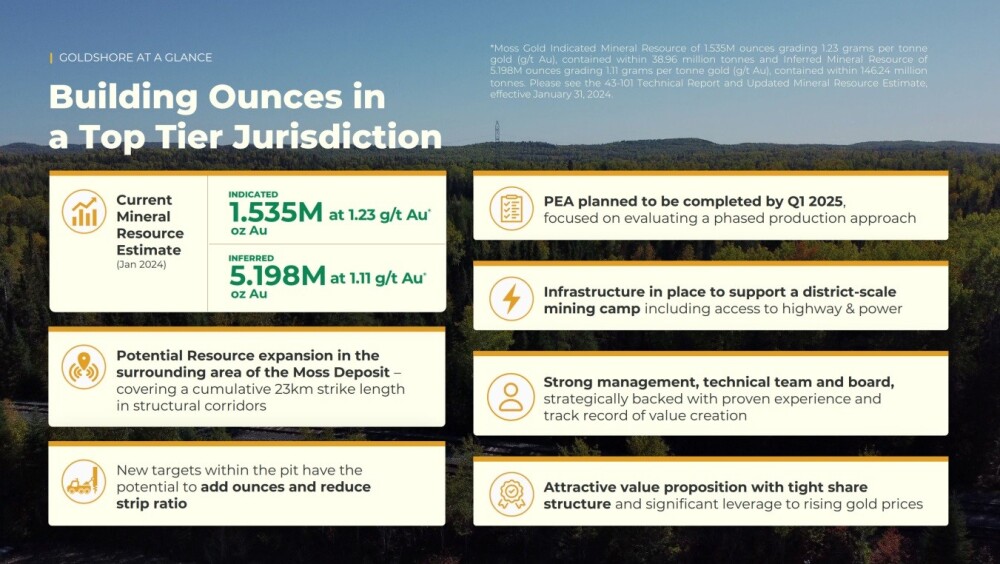

Next, below you will see an overview of the company and its project.

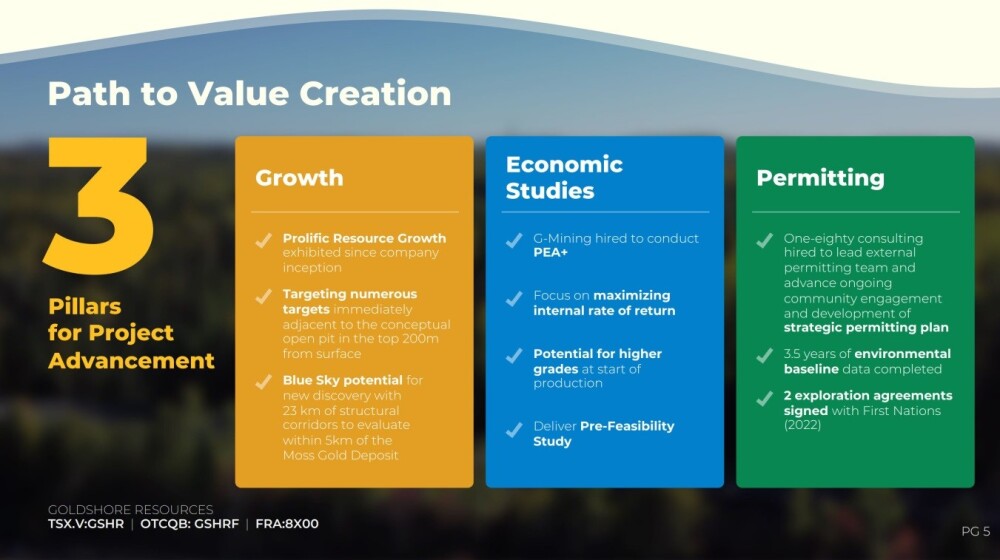

The next slide shows the clear path Goldshore has ahead of itself.

This useful slide below shows the geography of the Goldshore land package, the location of the Moss deposit within it, and the location of the lesser East Coldstream Project.

It also makes clear that the project has excellent infrastructure, being close to a major highway and power supply.

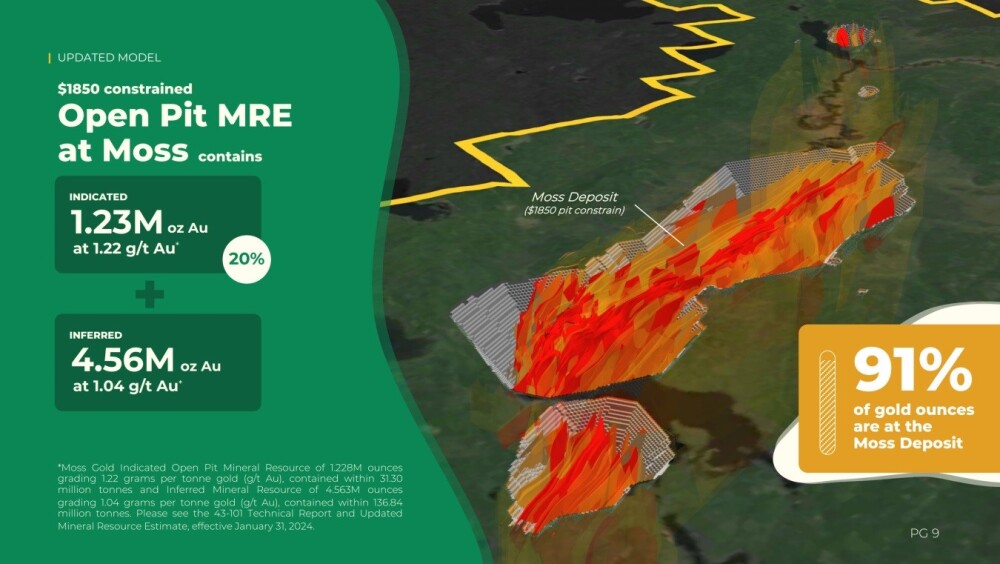

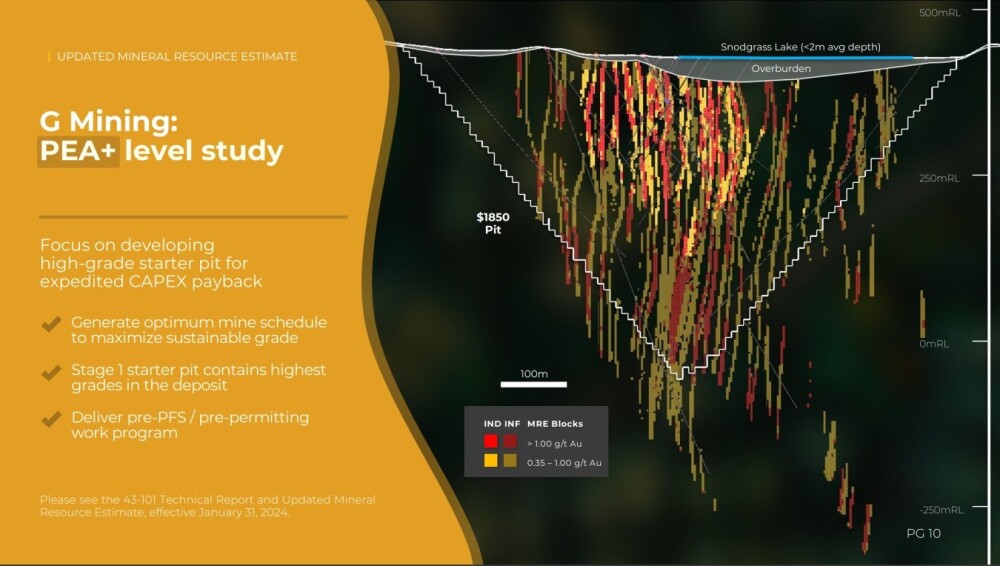

A substantial part of the Moss resource is open-pitiable, which means that extraction costs are relatively low.

A high-grade starter pit will provide significant cash flow to fund the project's advancement.

There is also plenty of scope for expansion.

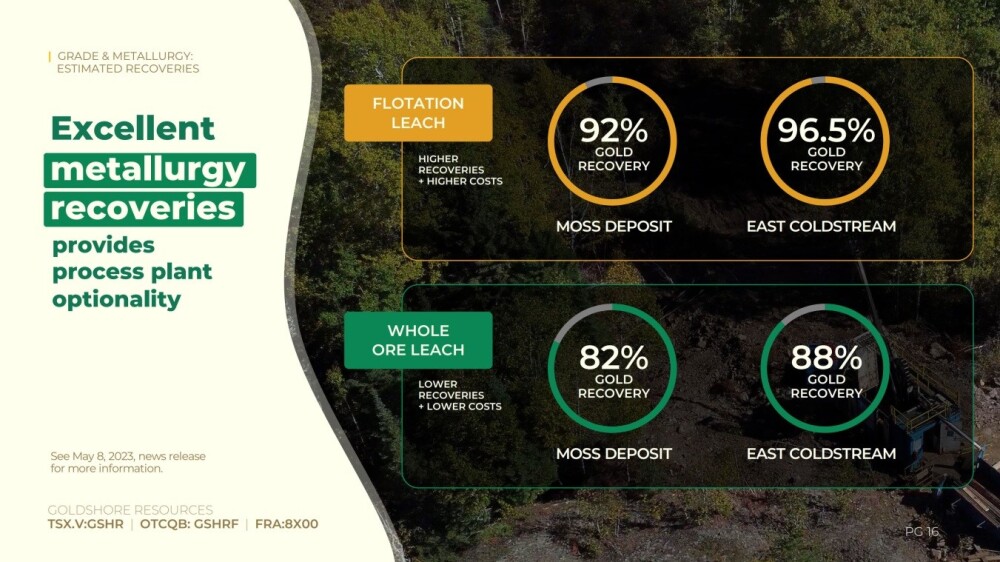

The metallurgy recoveries are very good.

For further details of the geology of the project, please refer to the company's website and / or the investor deck.

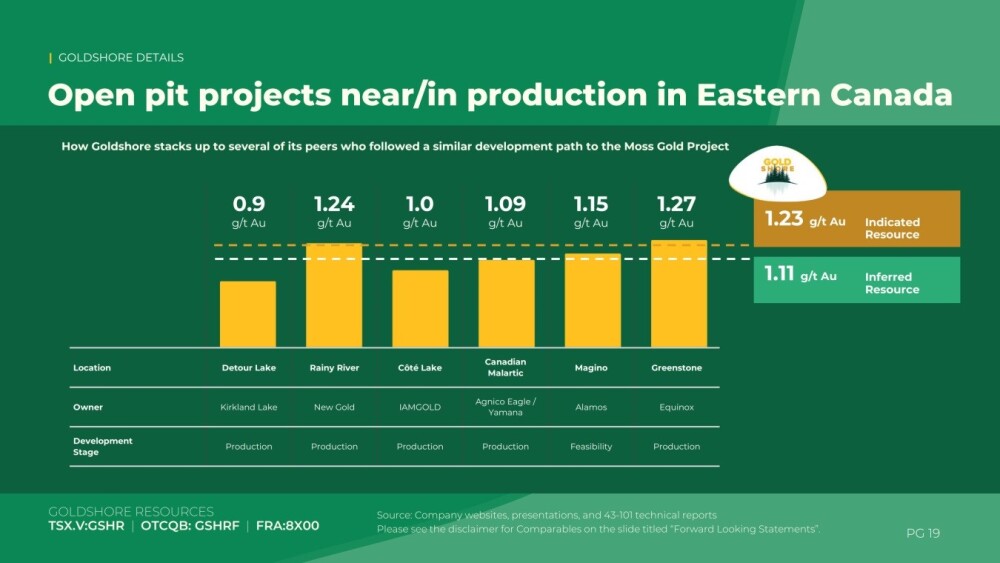

Here is how Goldshore's Moss open pit will measure up against other big open pit projects that are near / in production in Eastern Canada…

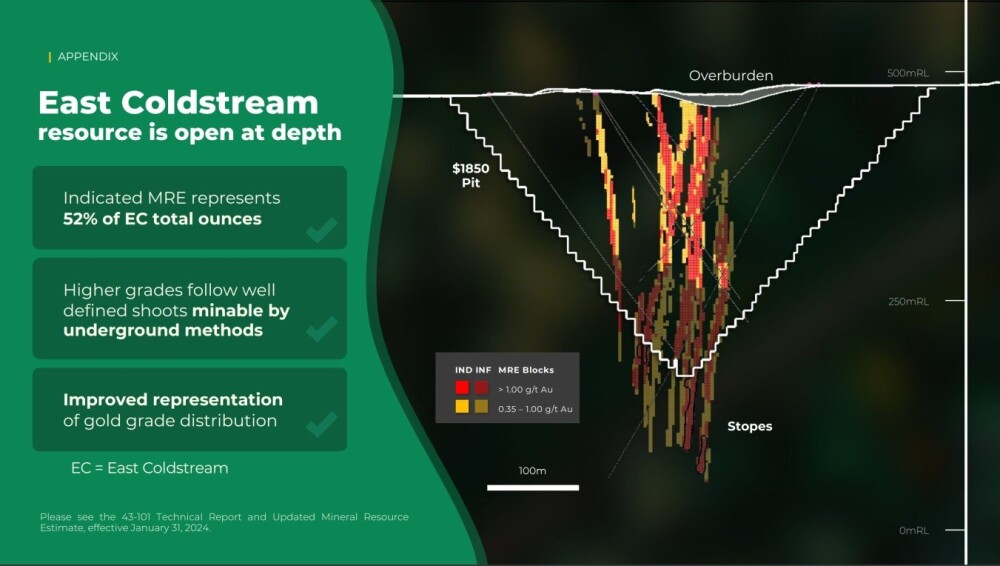

The lesser East Coldstream deposit can be mined by the open pit method and will be economically viable at a gold price of over US$1,850.

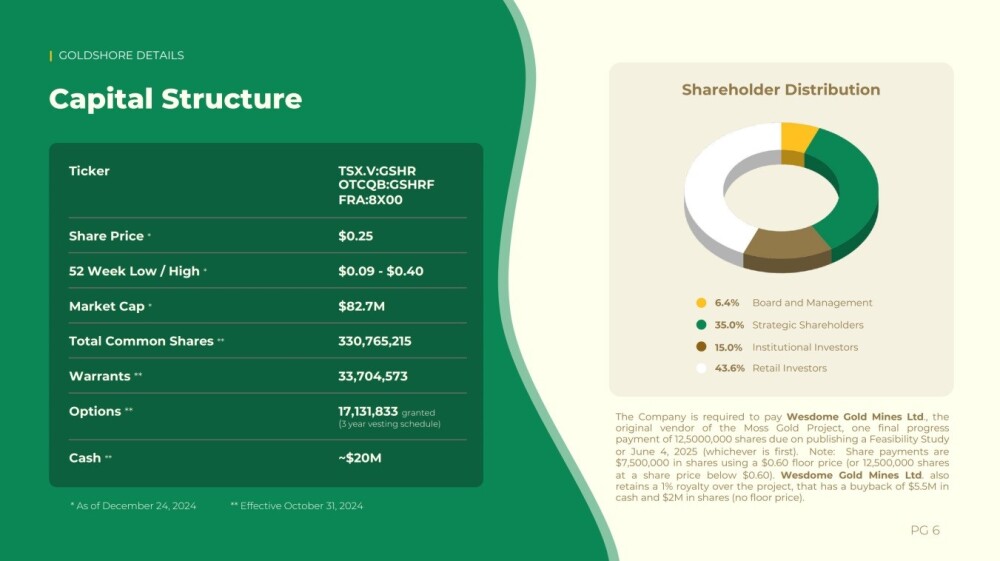

Lastly, this slide showing the capital structure of the company helps to clarify that, even though the number of shares in issue may initially seem high at 330.7 million, more than half of them are owned by board and management, institutional investors and strategic investors, leaving about 43.6% available to retail investors.

Now, we will review the latest stock charts for Goldshore Resources.

GoldShore Resources has done well since we first looked at it almost a year ago when it was priced at CA$0.10. As we can see on its latest 1-year log chart below, it took off higher in a vigorous uptrend that took it to almost CA$0.40 by the time it hit an intermediate peak late in September, after which a normal correction set in.

That uptrend was rather steep, and it is now thought that the less steep and thus more sustainable uptrend channel that has been drawn on the chart will be the operative one going forward, which is made more likely by a Double Bottom having formed in November and December above a significant support level in the CA$0.20 – CA$0.22 zone.

In fact, the entire period from the late May / early June peak through to the present can be considered to be a price / time correction as there has been little net change in the price during this period.

Now, with the price starting to advance away from the support and the tentative lower rail of the uptrend channel and away from the intermediate Double Bottom at a time when momentum (MACD) is improving, moving averages are set to swing into favorable alignment again, and On-balance Volume remains robust relative to price, everything is in place for a sizable second intermediate upleg to gain traction and become established.

Given the magnitude of Goldshore's advance from its 2024 lows early last year to its highs, it may come as a surprise to many that the stock hasn't even broken out of its base pattern yet.

On the latest 5-year arithmetic chart, we can see that last year's sizable uptrend served to complete the right side of the "Head" of the giant Head-and-Shoulders bottom shown, and it is thus clear that much greater gains are in prospect once it succeeds in breaking out of this base and given the persistent heavy volume accompanying last year's uptrend that has driven a powerful uptrend in the On-balance Volume line, this is an outcome that looks highly probable and it will probably occur against the background of the expected robust advance across the precious metals sector.

In conclusion, with the price still relatively close to the Right Shoulder low of the giant Head-and-Shoulders pattern shown on our 5-year chart, even after the gains of the past several days, this looks like a very good juncture to buy or add to positions in Goldshore Resources. Therefore, Goldshore Resources is rated a Buy.

GoldShore Resources' website.

Goldshore Resources Inc. (TSXV: GSHR; OTCQB: GSHRF ; FWB: 8X00) closed for trading at CA$0.285 US$0.20 on January 6, 2025.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Goldshore Resources Inc. is a billboard sponsor of Streetwise Reports.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Goldshore Resources Inc.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.