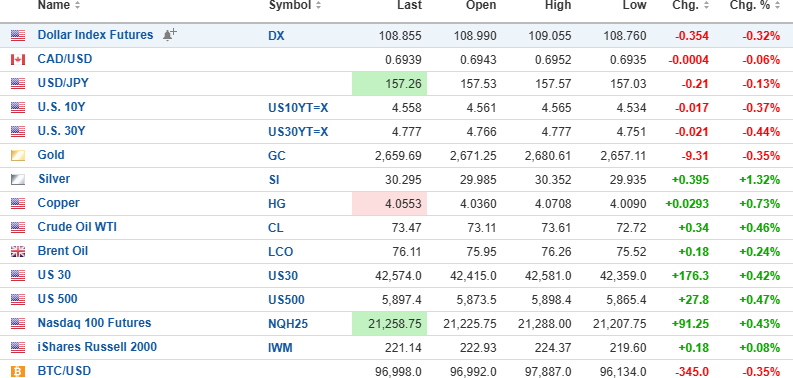

The USD Index futures are down 0.354% to 108.855 with the 10-year yield down 0.37% to 4.558% and the 30-year yield down 0.44% to 4.777%.

Gold (-0.35%) is down, while silver (+1.32%) and copper (+0.73%) are higher. Crude oil (+0.46%) is higher by $0.34 to $73.47/bbl.

Stock index futures are moderately higher, with the DJIA futures up 176.30, the S&P is up 27.8, and the NASDAQ up 91.25. Risk barometer Bitcoin is lower this morning, down 0.35% at $96,998.

Santa Claus Rally

This morning, stock index futures are again pointing to a higher opening, but that was also the case on Tuesday and Thursday, and given that this is the last day of the week and the final tracking session for the SCR, it is unlikely that it will turn out to be a strong "up" day. We need a 594.63 (1.4%) advance in the DJIA to turn the SCR positive.

For the NASDAQ, a 484.09-point (2.5%) advance would flip the SCR positive, while the S&P 500 needs a 105.52-point (1.8%) gain to provide the first of two legs of a positive early warning signal for the January Barometer.

The Wall Street cheerleaders are pointing to last year's failed SCR and FFD that did not portend a down market but with several trillion dollars in liquidity pumped into the economy and markets by both the Fed and the Biden Treasury, these were "extenuating circumstances," the opposite of which are being promised by the Department of Government Efficiency under Musk and Ramaswamy.

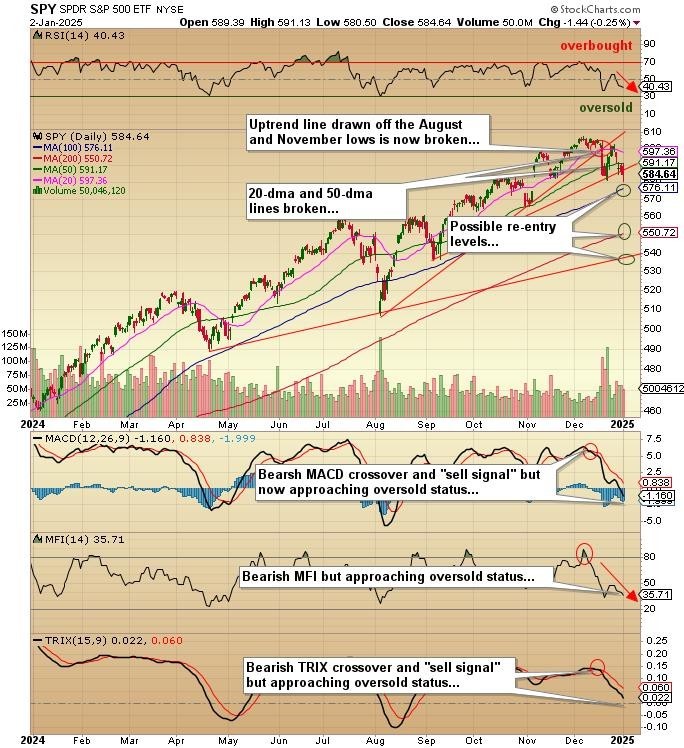

I added to the UVIX:US yesterday but will refrain from any further hedging as the SPY:US is now sporting oversold readings on MACD and MFI, and with the RSI just above 40, it is a sub-optimal time to begin shorting or hedging despite the poor tape action since the start of December.

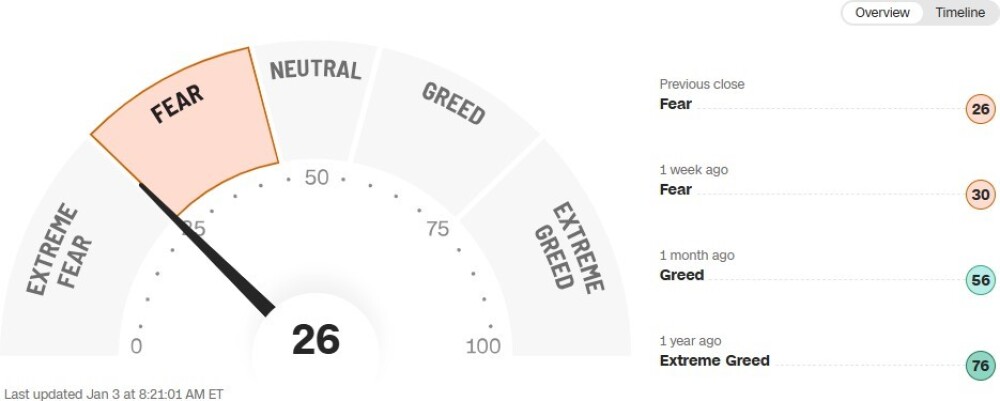

One look at the CNBC Fear-Greed index confirms that sentiment has shifted from the post-election euphoria that juiced stocks in November.

The SPY:US is shown below with a clear picture of how much short-term technical damage has been done, keeping very much in mind that the longer-term technical picture is still in a clear uptrend with little evidence of a top. At best, a corrective move to deflate the excessive bullishness that is seen everywhere would be a welcome event for most seasoned market players. Everyone hates it when markets correct because the majority of new-generation investors have never experienced a secular bear market.

To be sure, there have been big drawdowns like December 2018, March 2020, and August 2024, but never anything resembling the 1973-1974 bear ("Papa Bear") or the 1929-1933 bear (the "GrandDaddy Bear") or even the 1981-1982 bear that crushed inflation thanks to 20% interest rates in Canada and 16% in the U.S.

The SPY:US (now at $584.64) has given up the uptrend line drawn off the August-November lows as well as the 20-and-50-dma lines with the next support at the 100-dma (at $576.11) then the 200-dma (at $550.72). If the SPY:US closes back above the 50-dma (at $591.17 today, I will be looking to close out the SPY January $575 puts with a view to re-establishing the position with the March series. Fifteen days to expiry is a very short leash, especially with a few of the indicators approaching oversold status.

Getchell Gold Corp.

Technical analysis is not terribly useful when looking at the junior resource sector, but it is an interesting exercise to observe the tape action when you know that a big "tail event" (the upcoming PEA) is expected in a couple of weeks. You always have to assume that "someone knows something" best described by the immortal words of my great and kind mentor, James Biddell, "the tape never lies."

I find it interesting that recent tape action in Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) has established a modest but definable uptrend that has drawn off the lows of October 2023 and October 2024. If the stock can grind its way up through CA$0.22 and then CA$0.26 by mid-month, it sets up a possible momentum play in the event that the PEA is "robust."

I do not want the stock to suddenly "spike" to CA$0.26-0.30; I want a slow advance on escalating volume, clearly spelling out "accumulation" by parties comfortable with the story.

Gold is acting extremely well as we enter 2025, and considering that all the headlines are still on large-cap names like those in the Mag Seven, gold has done pretty much what I expected and wrote about after the Trump victory in early November. Gold hit a low on November 14 at $2,541.50 versus mid-December back in 2016, so I think the bearish effects of the Trump victory and proposed policy initiatives are now being totally discounted by those who take one look at the $34.7 trillion debt bomb and choose gold over U.S. Treasuries with little or no debate.

The current 2.317 million ounces in Nevada are going to not only grow with further drilling but also experience revaluation as the gold price makes its assault on $3,000 per ounce.

Getchell Gold is a "Buy" and the tape is confirming it…

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Getchell Gold Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.