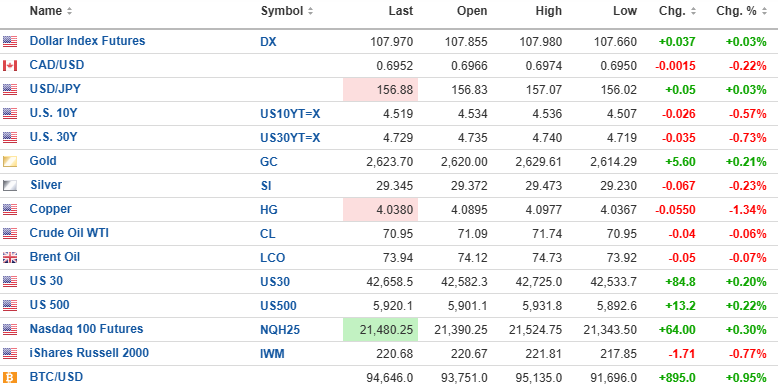

The USD Index futures are up 0.03% to 107.970, with the 10-year yield down 0.57% to 4.519% and the 30-year yield down 0.73% to 4.729%.

Gold (+0.03%) is higher, but silver (-0.23%) and copper (-1.34%) are lower. Crude oil (- 0.06%) is lower by $0.04 to $70.95/bbl. Stock index futures are higher, with the DJIA futures up 84.8, the S&P is up 13.2, and the NASDAQ up 64. Risk barometer Bitcoin is higher this morning, up 0.95% at $94,646.

Stocks are rallying modestly this morning, and based upon pre-opening futures levels, they still will be below their SCR starting levels of DJIA 42,906.95, the S&P 500 5,974.07, and NASDAQ 19,764.88. Markets have until Friday's close to surpass those levels in order to convey a positive early warning signal for January and the full year.

The First Five Days indicator ("FFD") begins on Thursday morning and ends at the close of trading on Wednesday, January 8. It remains to be seen whether or not the powers that be on Wall Street make a concerted effort to juice the major averages between today and Friday, but if today's rally turns into another rout, the 2024 SCR will go down as a "FAIL."

Tax-loss Candidates

I published a list of beaten-down names to be considered as "tradable" a week ago but here is another name that is the poster child for those former high-flying lithium names of 2023.

You may recall the Email Alert published in September 2023 in which I provided a technical assessment of E3 Lithium Ltd. (ETL:TSXV; EEMMF:US), which had rocketed during the Li mania to a high of CA$5.75 during which I issued this assessment.

The stock has since plummeted almost 85% in the fifteen months since I issued the "Sell/Sell short" idea in the CA$5.50-5.75 range. It is a completely beaten-down stock, especially noticeable when you visit the CEO.CA/ETL chatroom where hundreds of cymbal-clanging cheerleaders all talking of "Takeover at $10 by ESSO!!!!" back in September 2023 have been totally replaced by a near-vacant site with only the snarky remarks of beleaguered bagholders appearing, all bitterly blaming each other (and management) for the round-trip back to under a dollar.

For those subscribers looking for a contrarian bounce in the lithium names and in this oilfield, "briner" that today carries a market cap of CA$67 million versus CA$350 million 15 months ago:

- Buy 10,000 E3 Lithium Ltd. at CA$0.90 limit

- Target: CA$1.35 by February 15.

Getchell Gold

For the record, I am a buyer of an additional 100,000 Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) at $0.125 on the speculative assumption that the upcoming PEA will be seen as "robust," as in "economically- viable." It is really quite simple.

No matter how awful sentiment has been for the miners, a gold deposit in the best jurisdiction in the U.S. (Nevada), much of it high grade and wide open to enhancements through additional drilling to depth and along strike in all directions is worth a whale of a lot more than $9.30 per ounce. I believe that investors will finally wake up and rerate the stock based on the PEA. If that fails to work, someone will just buy the asset, and the price will not be $9.30 per ounce.

I don't need any additional Getchell shares, but on a risk-reward basis, I cannot find a better opportunity anywhere in the junior space.

| Want to be the first to know about interesting Gold and Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Getchell Gold Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.