"The writing is on the wall" with respect to Pasofino Gold Ltd. (VEIN:TSX.V), even if many investors evidently haven't seen the wall yet. It's no secret that the company is a takeover candidate, and its shares are trading at approximately a 40% discount to what a transaction could deliver soon in terms of value to shareholders — and it could be more.

Pasofino Gold is developing its 100% owned Dugbe Gold Project in Liberia, and after a long and severe bear market followed by a period of base building, its stock looks ready to commence a major new bull market.

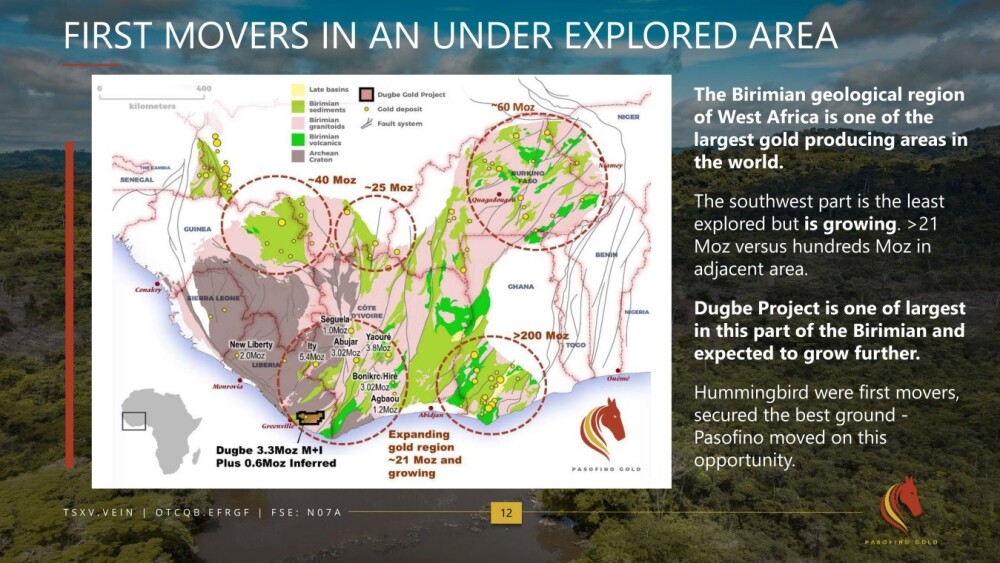

The following map shows the location and extent of the Dugbe Gold Project in Liberia and how it relates to other major gold deposits in the prolific Birimian Gold Belt which extends to the north and east of Liberia into the Ivory Coast, Ghana, Burkina Faso and even into Senegal. The proximity of these major deposits within the belt obviously bodes well for further discoveries at Dugbe…

An important and highly pertinent reason for showing this map at the outset of this article is that it helps to make clear the strategic importance of the company's Dugbe Project, given the fact that powerful Chinese companies and investors are active in various parts of Africa acquiring assets and influence and they have been very active in the prolific Birimian Gold Belt which is an area that is attracting their interest and it is now clear that interested parties are "making their move" on Pasofino with several showing up to do Due Diligence and site visits.

Chinese companies and investors particularly like large-scale quality projects such as Pasofino's Dugbe. The company has already received offers in the order of CA$100 million, which translates to CA$0.90 per share, so the stock is clearly undervalued at its current price of about CA$0.58.

The attractions of the company and its major Project are many and various, as set out below:

- Pasofino has a management team that is very experienced in taking a project through all its stages of development to build shareholder value to the point where it becomes attractive in the M&A arena.

- Liberia is a stable democracy and an established mining-friendly jurisdiction. Furthermore, it is English-speaking with a strong U.S. presence. Local infrastructure for the construction of a major mine is good, and the Port of Greenville is only 76 km away.

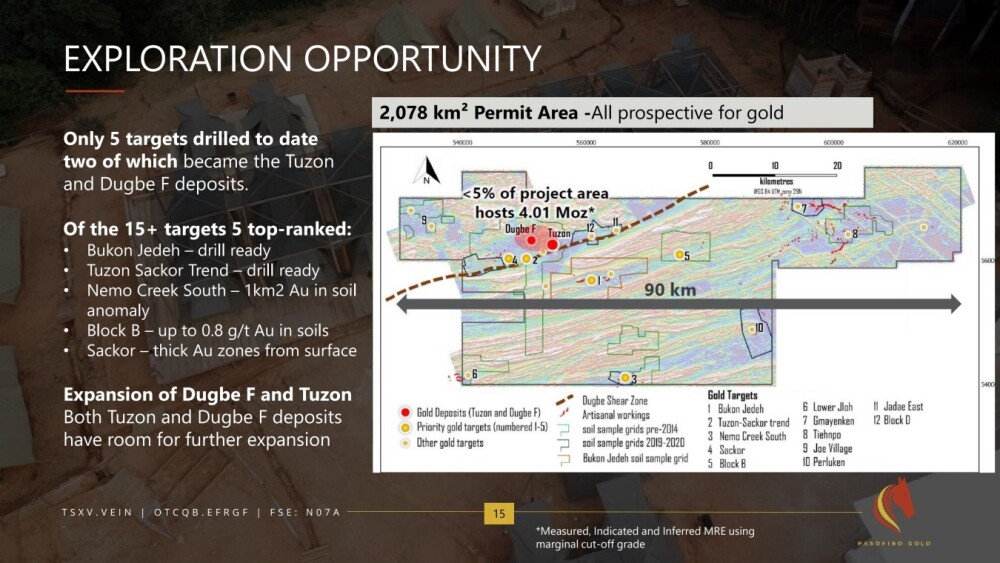

- Pasofino Gold has acquired a district-scale, highly prospective land package under a permit of 2,000 sq km. A very important point is that the company is already attracting major interest despite the fact that only five targets have been drilled to date, which have found the Dugbe B and Tuzon deposits — that leaves another 15 high-priority targets remaining to drill with three of these being drill ready and furthermore the Dugbe B and Tuzon deposits have plenty of room for expansion along strike and at depth. So, there is the potential for many additional deposits on the property.

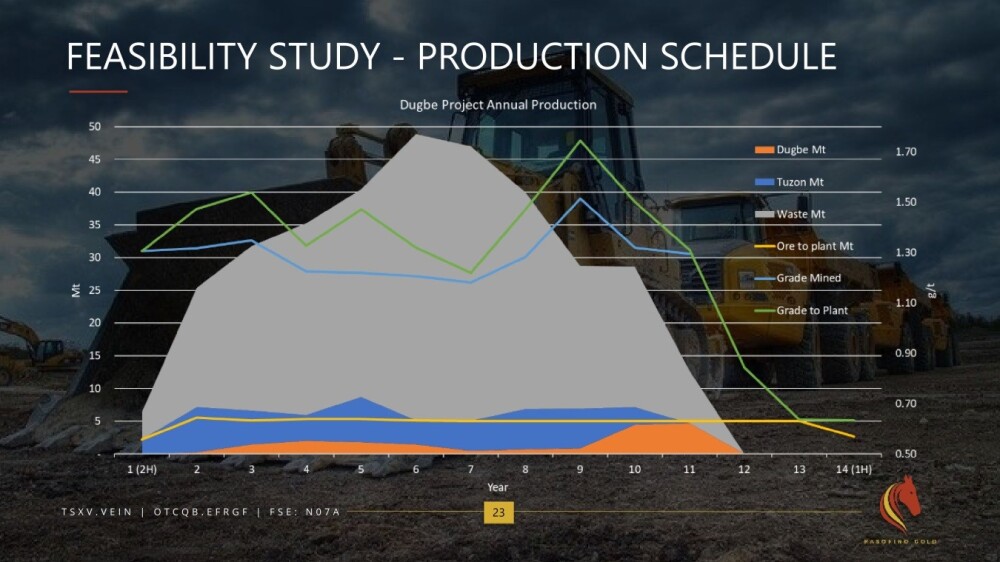

- The attributes of the deposit prior to further discoveries being made include an established 2.760M oz gold (Au) Reserves at US$1,700 Au, the prospect of two open pits 4 km apart with a final depth of 350 meters, 66 million tonnes of ore at 1.3 grams / tonne containing 2.3 million ounces of Au over a 14-year LOM, the ore is non-refractory with good liberation, a bankable Feasibility Study by DSA South was completed in 2022, recoveries of 83% have already been achieved and with further metallurgical test work and minor plant design changes this could be improved to 90%, greatly improving the economics of the Project.

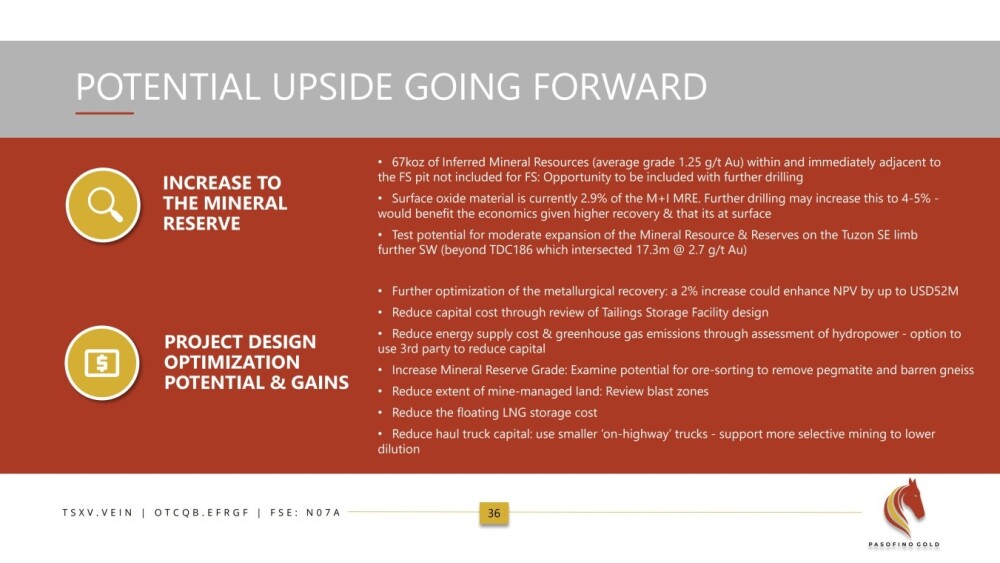

- Another important point is that the Feasibility Study was completed in 2022, and a lot has happened since that time. Even back then, the Study projected substantial economic returns based on a gold price of US$1800 - US$1900, but now the gold price is much higher, in the order of US$2,600, so, especially given that costs are relatively fixed, the returns will be a lot greater, and this clearly warrants updating the BFS in various areas.

- The economics of the Project are outstanding with inflation-adjusted CapEx of US$435 million and operating expenses of US$1,005 per ounce gold, again inflation-adjusted, which means a gross margin of US$700 per ounce and that's at US$1,700 gold and an impressive US$1,600 per ounce at US$2,600 gold price. This also means the payback point arrives after 3.3 years at US$1,700 gold and only 1.7 years at US$2,500 gold.

- Local infrastructure is good with all supplies for the Project coming though the nearby Greenville port and product from the Project being exported through the same port. Power will be generated by means of LNG (liquified natural gas) backed up by solar.

- Permitting is well advanced, and it looks like the entire process will be completed within about 12 months. The approved Mineral Development Agreement gives Dugbe a 25-year mining right with an option to extend. Various optimization studies are ongoing to improve efficiency and reduce costs.

Another point worth noting is that early in October, a non-brokered private placement was announced as the company needed to maintain liquidity through this process. This private placement was successfully completed and brought in CA$3.3 million.

Now, we will review several of the most important slides from the company's October investor deck, which readers are invited to visit to review other information, in particular as it relates to the geology of the Project.

We start with this slide as it shows the extent of the Dugbe Project and how two of the 15 drill targets became important deposits, Dugbe F and Tuzon, which are close to each other. Five of the 15 targets have been drilled to date with exploration ongoing.

The graphic below shows the projected production schedule of the property over its life.

There is scope for upside of the Project with the prospect of further discoveries being made.

The number of shares outstanding is 112.23 million, 119.02 fully diluted.

Now, we will proceed to review the company's latest stock charts.

After a long multi-year bear market an uptrend has become established in Pasofino Gold this year that looks set to gain traction and accelerate going forward.

Whilst the very long-term 19-year chart shown below is technically useless, it does at least show us that Pasofino Gold traded at much higher prices in the early 2010s, adjusted for periodic consolidations (reverse splits), and even on this chart, we can see that there has been a big volume buildup this year which is viewed as a volume breakout that will lead before much longer to a price breakout, although on this arithmetic chart it is impossible to discern the price variation at current very low levels.

Zooming in, the 11-year log chart serves to "open out" the price action at low levels, enabling us to see the tentative uptrend that has become established this year and how it is nudging the price towards a breakout from the giant Falling Wedge that has developed from the 2016 high and which is now closing up, making a breakout more and more likely.

As mentioned above, this year's uptrend has been accompanied by a volume breakout that is expected to lead to a price breakout before long, and it is already close to breaking out. The reason that the volume buildup this year is interpreted as bullish is because it signifies that a considerable quantity of stock has rotated from weaker to stronger hands since the sellers are mostly selling for a loss while the buyers will be less inclined to sell until they have turned a profit and this effectively reduces the supply of stock around these levels.

On the 6-month chart, we can see that, after trending higher into mid-September, the price has corrected back within an orderly intermediate downtrend to arrive in a zone of support in the vicinity of its rising 200-day moving average, which is, of course, a good point for it to turn higher again and already last week it tried to with an attempted breakout from the downtrend on a marked increase in volume that drove up the Accumulation line, and this price / volume action is bullish, suggesting that a new uptrend will soon become established, which fits with the improving outlook for the sector.

In conclusion, Pasofino Gold looks very undervalued here and is set to start higher again soon, and with a high and growing probability of a buyout soon on favorable terms for shareholders, it is rated an Immediate Strong Buy.

Pasofino Gold's website.

Pasofino Gold Ltd. (VEIN:TSX.V) closed for trading at CA$0.58 on December 30, 2024.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

Pasofino Gold Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Pasofino Gold Ltd.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.