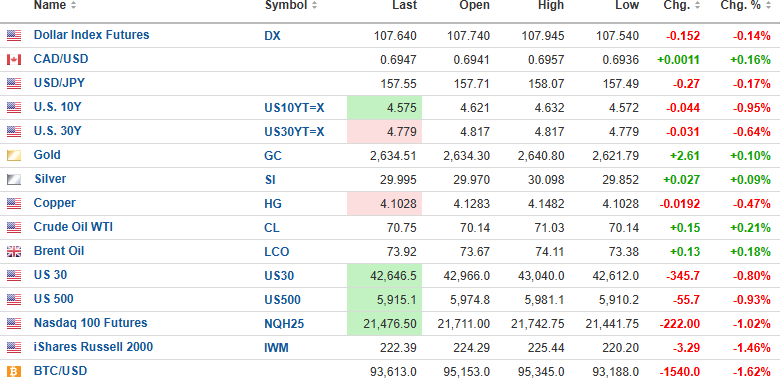

The USD Index futures are down 0.14% to 107.640 with the 10-year yield down 0.95% to 4.575% and the 30-year yield down 0.64% to 4.779%.

Gold (+0.10%) and silver (+0.09%) are higher while copper (-0.47%) is lower.

Crude oil (+0.21%) is higher by $0.15 to $70.75/bbl. Stock index futures are lower, with the DJIA down 345.7, the S&P is down 55.7, and the NASDAQ down 222.

Risk barometer Bitcoin is lower again this morning, down 1.62% at $93.013.

Stocks look to add to the Friday losses, which threw the SCR into negative territory for the S&P 500, which began the SCR sprint at 5,974.07 and went out on Friday's close at 5,970.84. Based on the morning futures, it is due to open at around 5,911.34. The NASDAQ started the period at 19,764.88 and went out at 19,722.03, placing it in negative territory for the SCR.

The only index still sporting a rally for the Yuletide race is the DJIA, whose Friday close at 42,992.21 is still ahead of the December 24 close of 42,906.95. The SCR ends on the closing price on the second full trading day of the New Year, which is also the second trading day of the FFD.

I was listening to an interview with Barron's Roundtable member Felix Zulauf of Zulauf Asset Management last evening and found it interesting that he, too, thinks that 2025 is going to be a year of challenges with as much as a 20% drawdown likely in Q1 followed by a rally and then new lows in 2026. I have followed Felix since the 1990s when he was the only member of the Barron's Roundtable who held gold and during a period in which the precious metals did essentially nothing.

You could see the other Roundtable members yawning fitfully when he began expounding the reasons that gold at $300/ounce was a "good investment" while the rest of the group was engrossed with Pets.com or Enron.

Also noteworthy was the end-of-year summary given by Adam Taggart and Lance Roberts, who listed half a dozen statistics symptomatic of market tops. While Taggart is a perma- bear that hates Wall St., Roberts is nearly the opposite (but very good), so I discount Taggart's bearish viewpoint,t but to have his partner-in-crime rattle off those bearish signals was surprising, albeit he threw in disclaimers at least three times in which he said "Now this doesn't mean you go out and sell everything. . ." but of course that is exactly what it means, given the extent of overvaluation the markets have achieved.

Also interesting was an article in ZeroHedge this morning by Ed Dowd in which he lambasted the Biden-Harris administration for its flagrant spending during an election year designed to artificially inflate the U.S. economic numbers (in favor of votes). He writes: "We had 10% deficit to GDP during the Great Financial Crisis (2008 – 2009) when we actually had a crisis. We had 8% deficit to GDP during this election year. You have to ask yourself, what was the crisis?"

With all that government spending juicing stocks, one has to wonder what will happen to that perpetual "bid" that shows up every hour of every day once the Department of Government Efficiency chokes off the liquidity hose. Speaking of the Department of Government Efficiency, it is being run by a billionaire entrepreneur who made his fortune off government subsidies.

For subscribers coming into the New Year unhedged, I would take out an insurance policy such as the UVIX:US just in case the SCR and FFD end up negative.

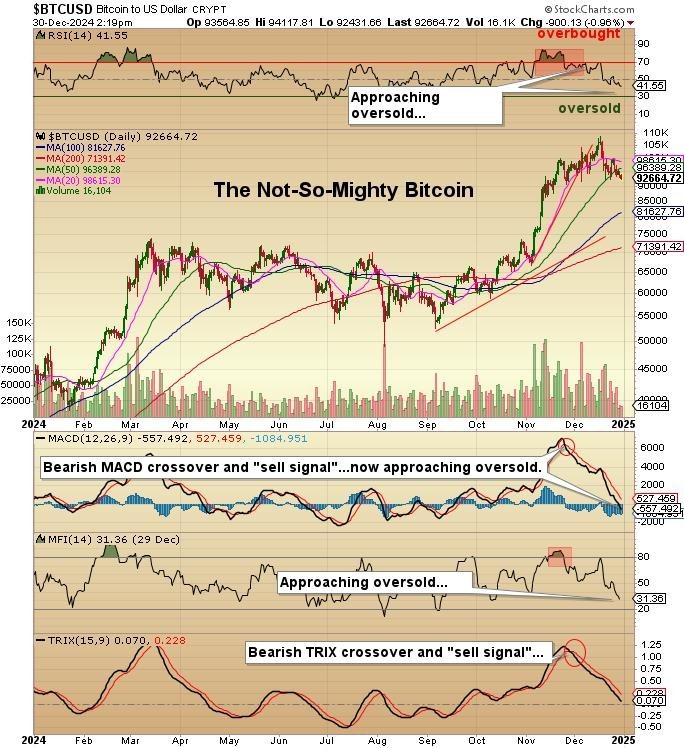

Bitcoin

This is a follow-up to the technical opinion I provided to subscribers back on December 5 after Bitcoin exploded above $100,000. I know that many subscribers own crypto, and while I am too long in the tooth to try and understand its value, I purposely refrain from making any fundamental assessment of Bitcoin, largely because I do not know where to begin.

However, price action is completely generic, and whether it is Bitcoin or Roundhill Cannabis, certain price patterns provide powerful clues to future direction.

As I wrote back then: "It does not mean it has to crash, but I see a whipsaw reversal waiting to happen and would avoid it like a swim in the Don River."

First, take a look at the chart I provided on December 5:

Now, take a peek at the chart from this morning. At $92,664, it has broken down below the 20- dma and 50-dma levels, with the next support at $82,358, the 100-dma.

If I owned Bitcoin (and I do not), I would sell it based purely on price action with no comment on its longer-term merits.

| Want to be the first to know about interesting Cryptocurrency / Blockchain and Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: UVIX. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.