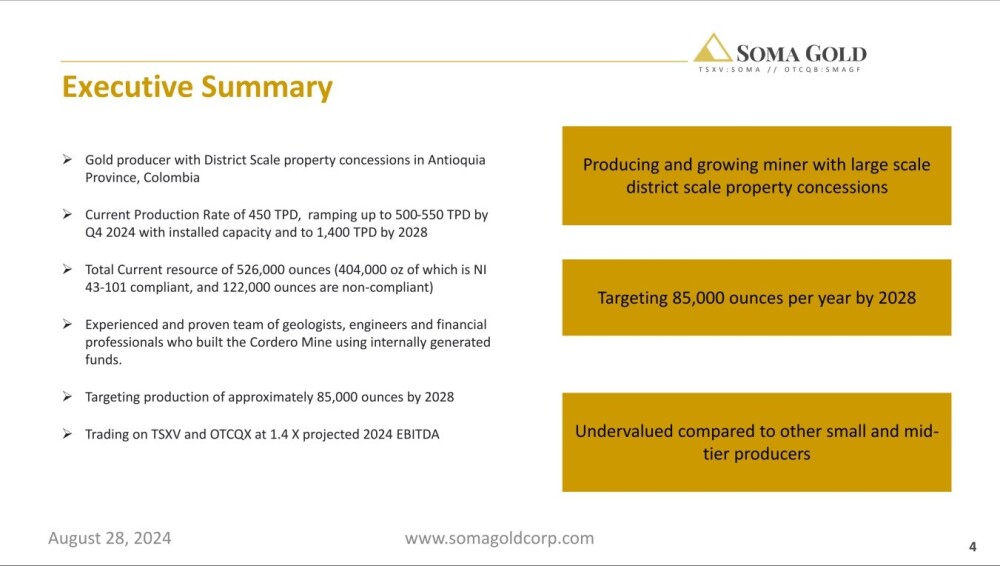

Soma Gold Corp. (TSXV:SOMA; OTC:SMAGF; WKN:A2P4DU) is a producing and growing gold miner with District Scale properties in Columbia.

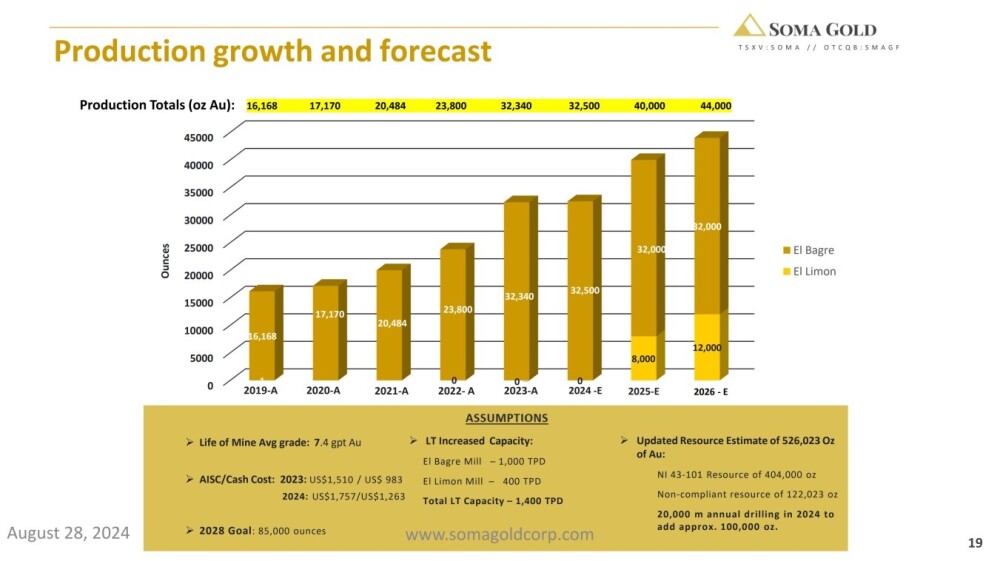

Currently, Soma is targeting production of 85,000 ounces per year by 2028.

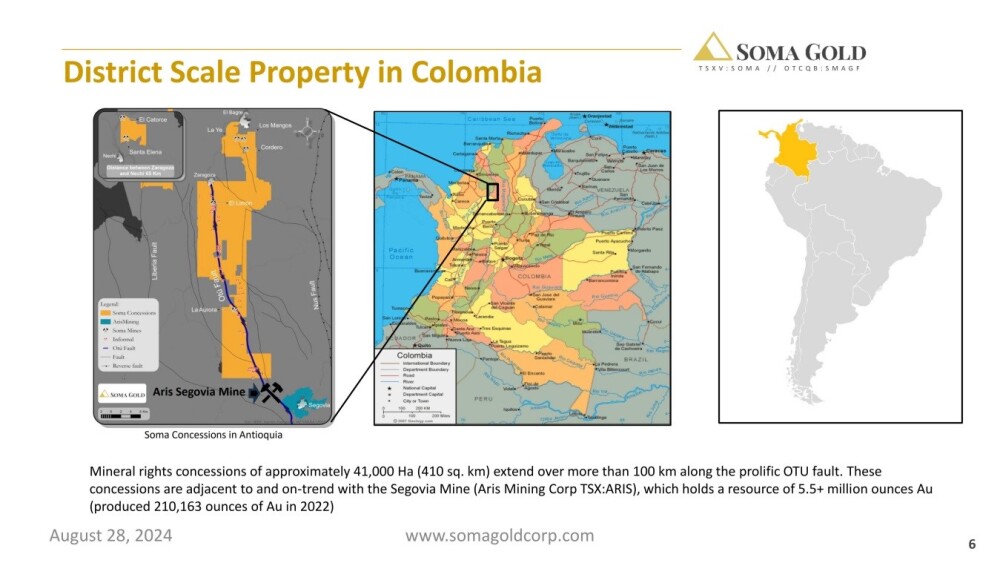

The following slide from the company's investor deck shows the location and extent of the company's District Scale property in the Antioquia district of north central Columbia.

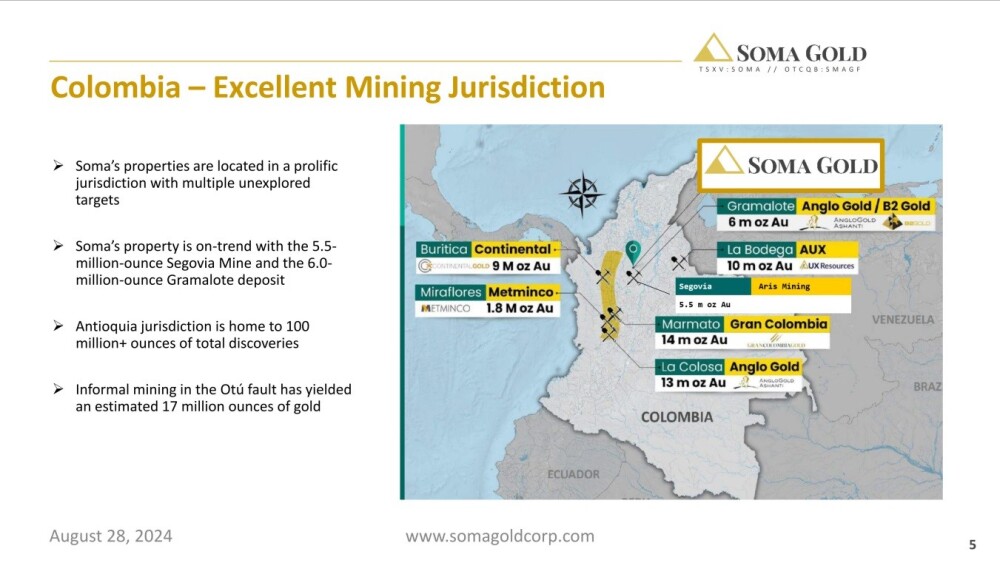

This slide shows the proximity of the company's properties to big deposits on the same trend such as Aris Mining Corp's Segovia mine which holds a resource of 5.5+ million ounces of gold and the 6 million ounce Gramalote deposit.

The proximity of such major finds on the same trend certainly augurs well for further important discoveries on the company's property, especially given its size.

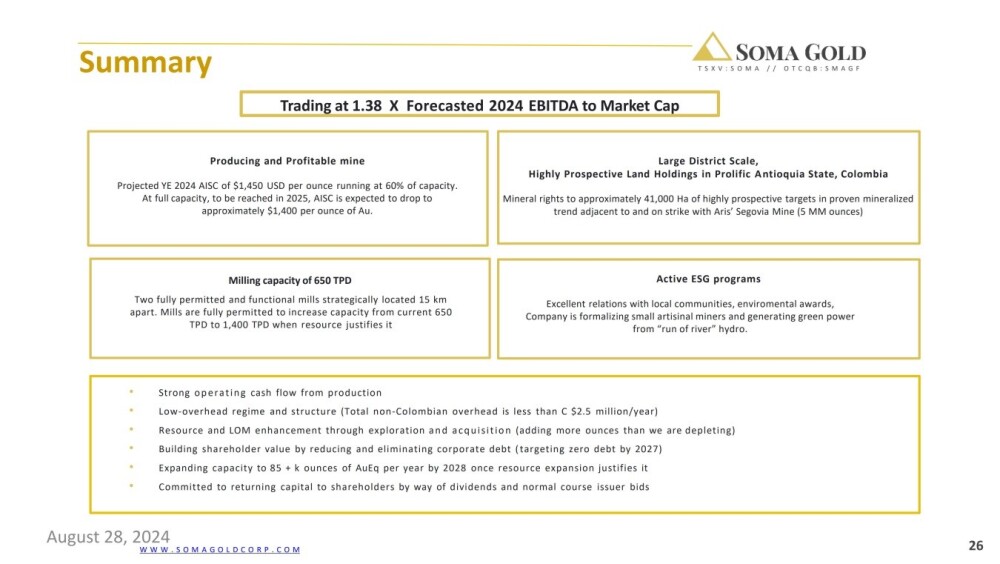

The principal attributes of the company are. . .

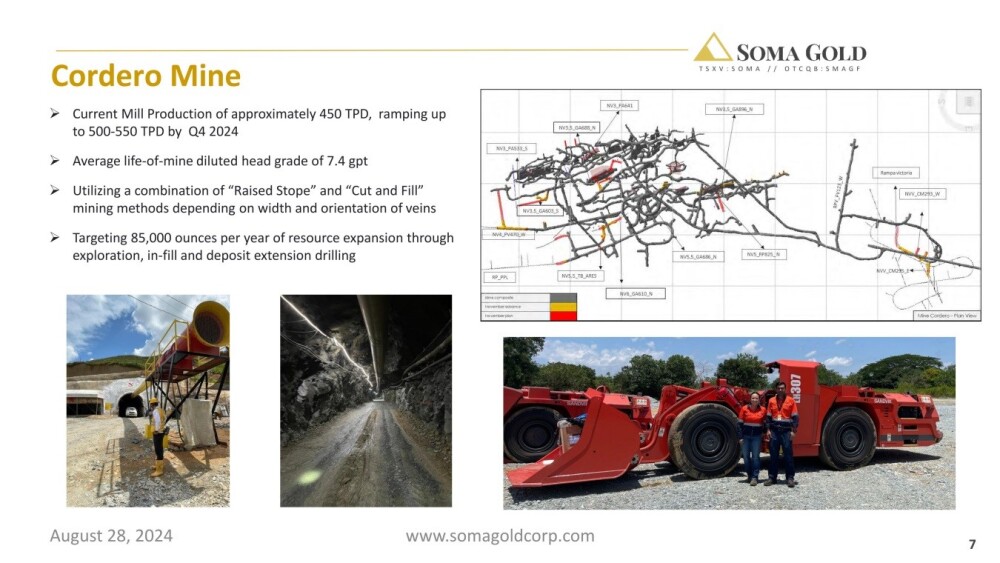

The company's flagship producing mine and revenue generator is the Cordero Mine. Work started on this mine in September 2020, and it went into production at the start of 2023.

The company did have a couple of legacy mines, La Ye and Los Mangos, but these were mined out and decommissioned early in 2023.

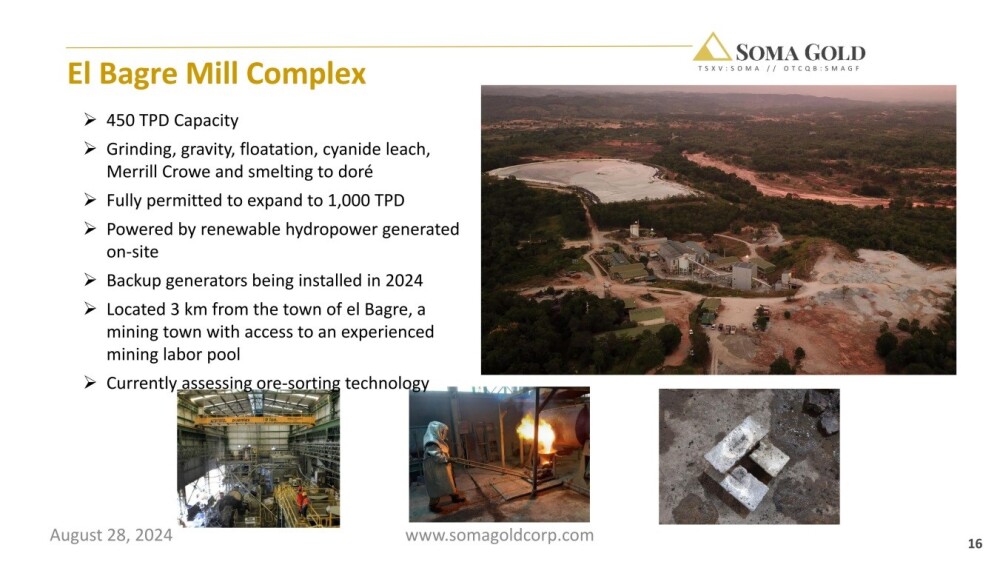

The company owns a couple of mills, El Bagre and El Limon Mill, and ore from Cordero is sent to El Bagre for processing.

As production ramps up and exceeds the capacity of El Bagre, El Limon Mill, which has been on care and maintenance, will be brought on stream.

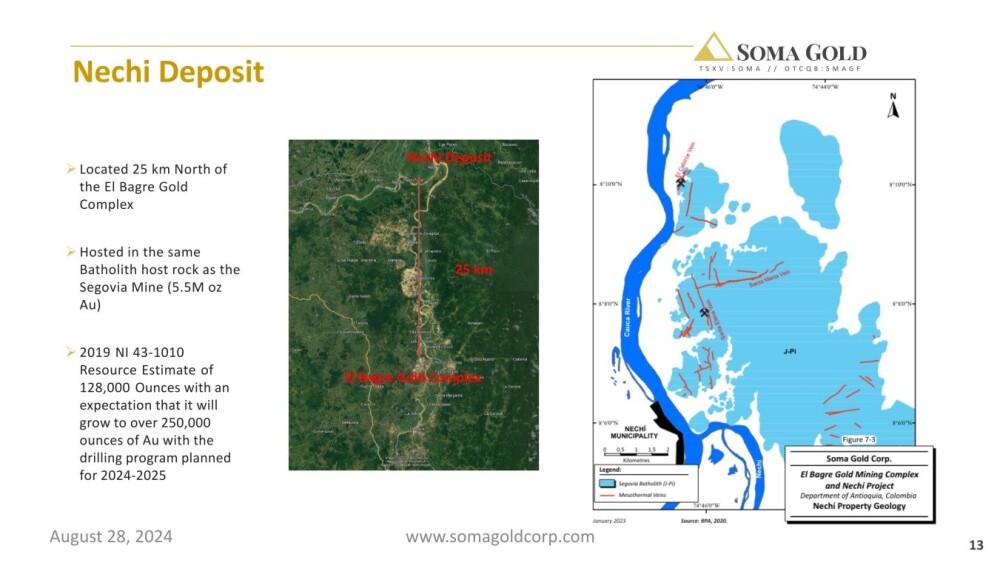

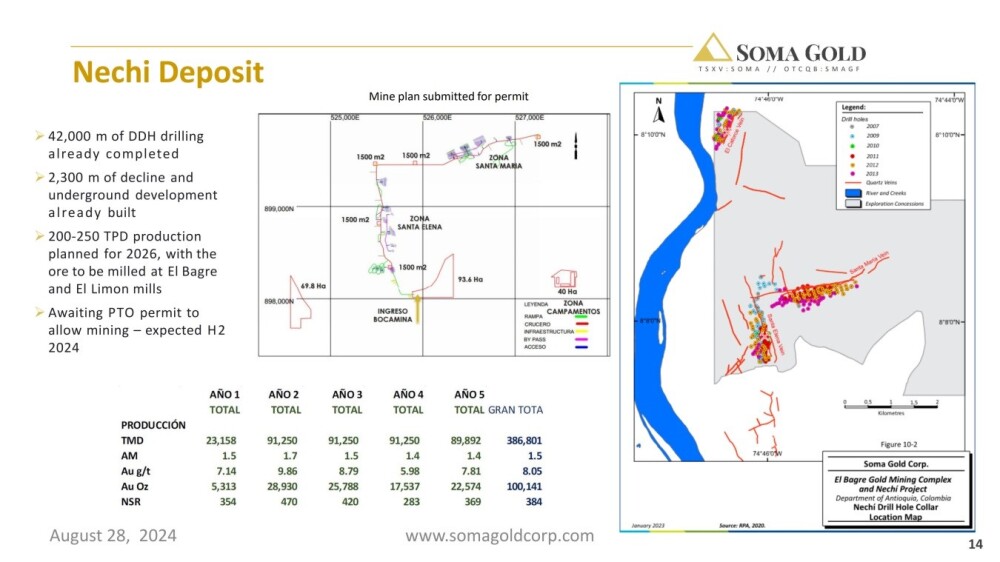

The company owns several other deposits with significant potential on its extensive property, such as the Nachi Deposit, which a 2019 NI 43-101 resource estimate put at 128,000 ounces with an expectation that it will increase to 250,000 ounces as a result of the current drilling program going into 2025.

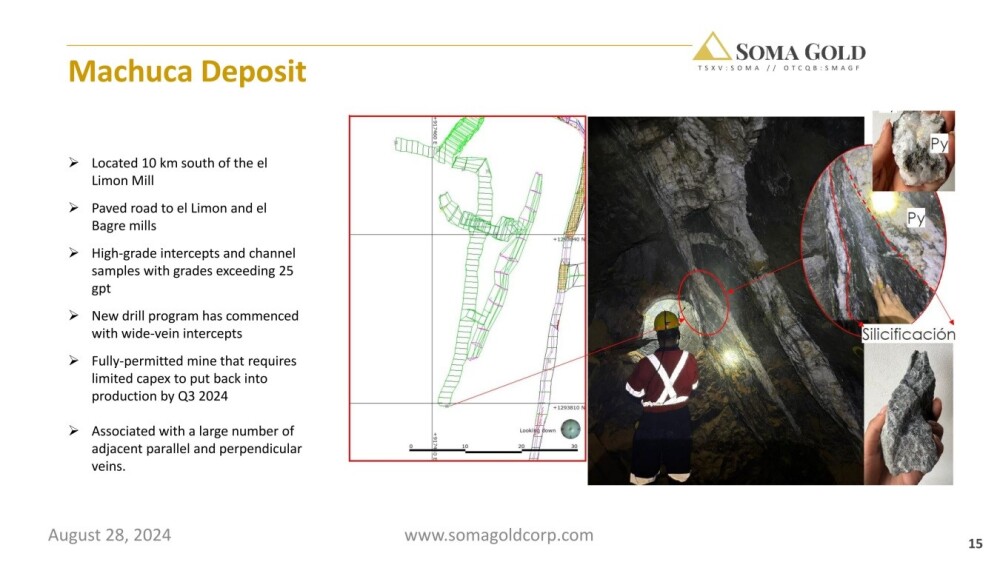

Meanwhile, high-grade intercepts have been encountered at the Machuca deposit, which has a fully permitted mine that will require limited capex to bring back into production.

So, you can see on the following chart how production is expected to expand going forward and how this increased production will necessitate bringing the El Limon Mill online, and that may already be happening and in due course this increased production may not only be from Cordero but from development of the other promising deposits on the company's extensive property.

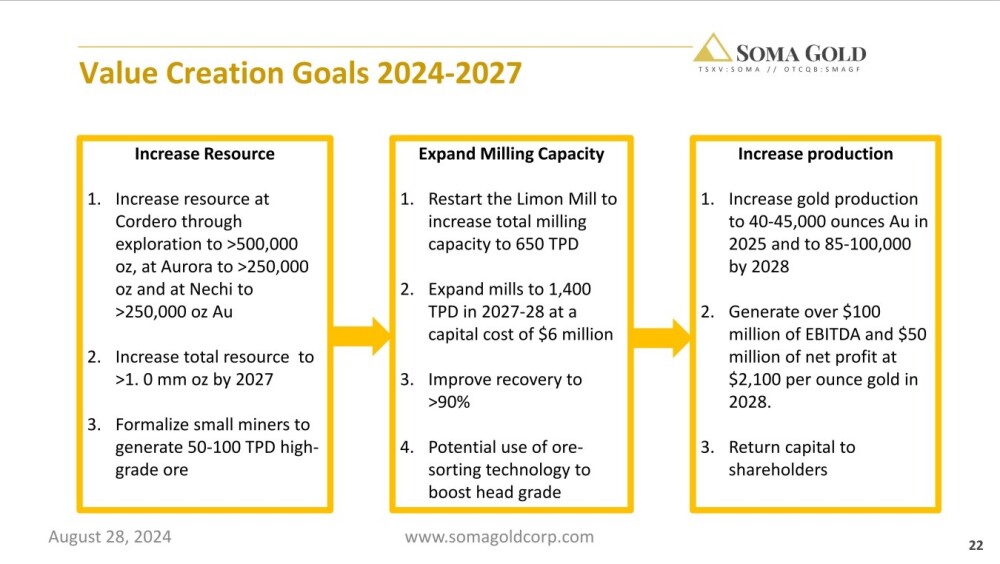

The slide below shows how the company plans to move forward over the next several years, and it even includes getting the local miners organized and legal so that they can contribute their production to the mills.

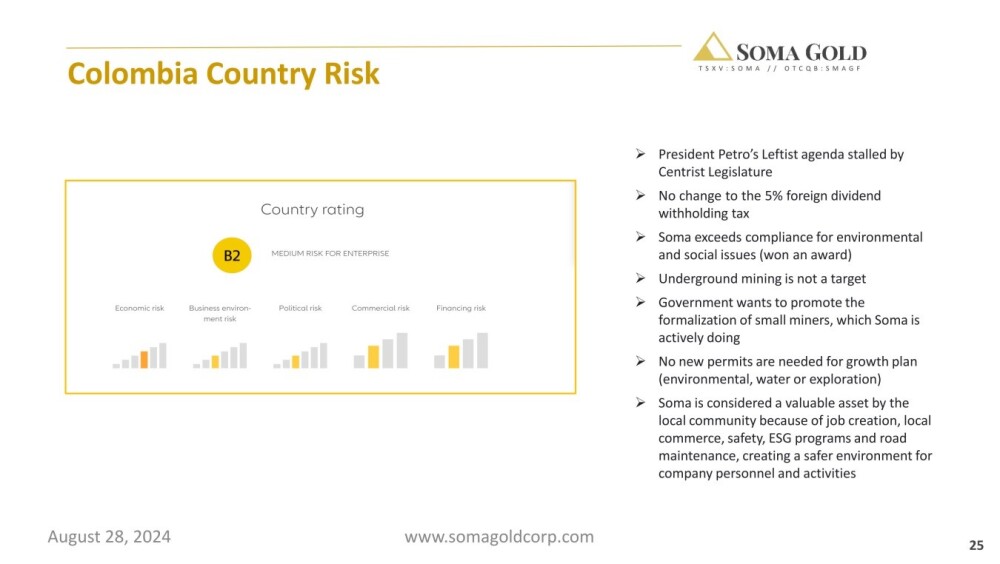

While some may initially be wary of investing in Columbia, as the following slide sets out, looked at from various aspects, enterprise risk there is far from excessive.

To sum up:

Now, we will review the latest stock charts for Soma Gold, which are most encouraging.

Technically speaking, the case for buying Soma Gold at this juncture could not be clearer — it is at the tail end of a giant base pattern and looking set to break out into a new bull market at a time when the sector as a whole looks ready to commence another major upleg.

Starting with the long-term 11-year chart, we see that, following a really severe bear market from its peak early in 2016 through early 2020, it has marked out a fine, giant Cup & Handle base that is clearly very close to or at the point of completion, meaning that it should soon break out to commence a major bull market.

The volume buildup of recent months, which can just be seen on this chart, is certainly supportive of such a development, especially as the Accumulation line is so strong — it has been forging ahead and making new highs for much of this year.

Before leaving this chart, we should note that the upside from the current price is certainly very considerable, and although it will have resistance to contend with on the way up, especially in the CA$1.10 – CA$1.30 zone, this should not prove to be a serious obstacle.

On the 2-year chart, we can see the ascent early in 2023 to complete the right side of the Cup and the subsequent Handle part of the pattern in detail. This Handle is a large, roughly rectangular trading range bounded by approximately CA$0.41 on the downside and CA$0.72 on the upside. A key point to note on this chart is that during the latter part of this range that has built out this year, the Accumulation line has been trending strongly higher, with a marked buildup in upside volume since about August.

This volume pattern is bullish and points to an upside breakout from the pattern. With the stock currently somewhat oversold beneath the middle of the range after a dip at a time when the sector looks set to start higher, we are believed to be at a good entry point here.

On the 6-month chart, we can see how the retreat over the past five weeks or so looks like a normal correction to the strong runup in September and October. This correction, which has taken the form of a bullish Falling Wedge that has been accompanied by a marked volume dieback, which is also bullish, has brought the price back to a zone of quite strong support that it has arrived at in an oversold state.

This is, therefore, a good point for it to start higher again, and a new upleg from here will quickly swing moving averages into bullish alignment. The big picture suggests that the next upleg will break the price out of the giant base pattern shown on our long-term chart to commence a major bull market advance.

The conclusion is that Soma Gold is close to starting higher and breaking out of a very large base pattern into a major bull market at a time when the sector is set to commence another major upleg. It is, therefore, rated an Immediate Strong Buy here.

Soma Gold Corp.'s website.

Soma Gold Corp. (TSXV:SOMA; OTC:SMAGF; WKN:A2P4DU) closed for trading at CA$0.55, US$0.365 on December 24, 2024 and December 26, 2024.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Soma Gold Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, Soma Gold Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Soma Gold Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.