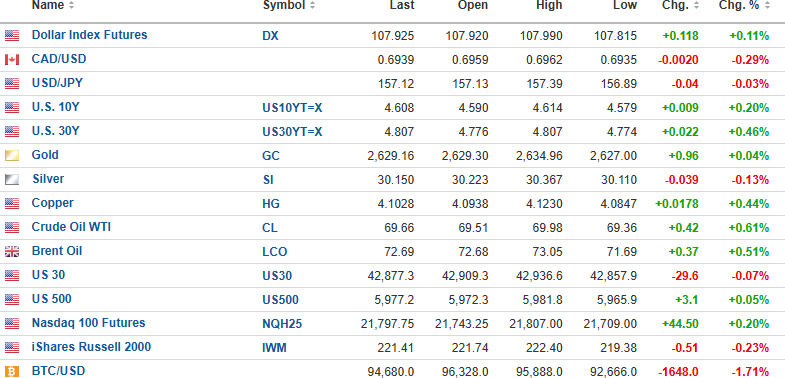

The USD Index futures are up 0.11% to 107.925, with the 10-year yield up 0.20% to 4.608% and the 30-year yield up 0.46% to 4.807%.

Gold (+0.04%) and copper (+0.44%) are higher, but silver (-13%) is lower.

Oil (+0.61%) is higher by $0.42 to $69.66/bbl. Stock index futures are mixed, with the DJIA down 29.6, but the S&P is up 3.1 and the NASDAQ up .44.50. Risk barometer Bitcoin is lower again this morning, down 1.71% at $94,680.

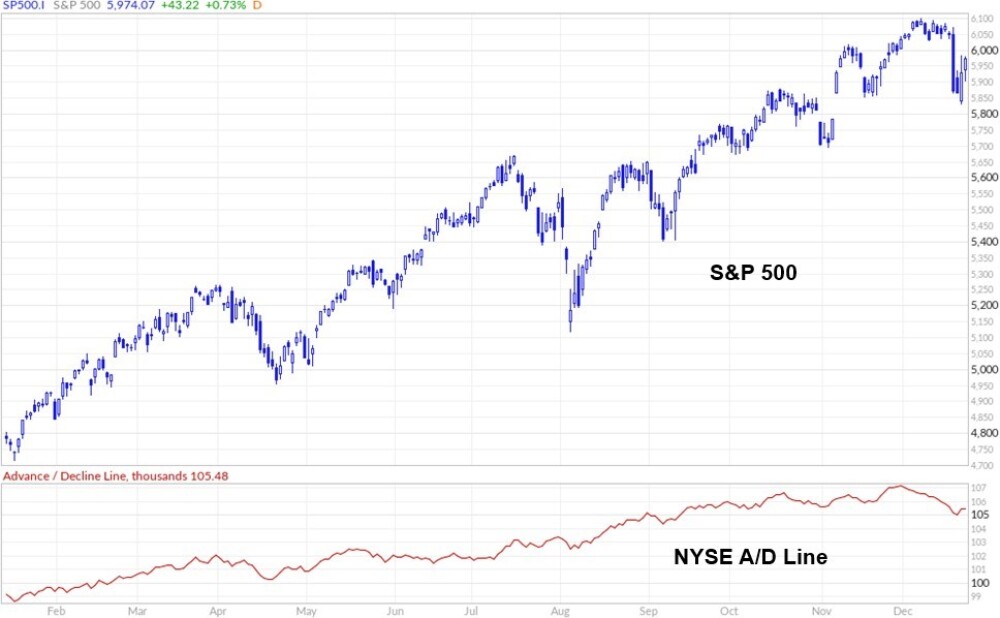

Markets in Canada are regular hours today but close early in the U.S.. Canada re-opens on Friday, while the U.S. re-opens on December 26 with regular hours. The SCR countdown begins today, but judging from the advance/decline line, I doubt whether there will be a positive outcome.

Market breadth has been deteriorating steadily since early December, meaning that the majority of stocks (S&P 500 stocks less the 10 largest names) are in decline while a handful of the usual suspects are creating the illusion of a strong year-end rally.

I am fully hedged as we head into the end-of-year dash and will increase the size of the UVIX:US and SDS:US positions as January unfolds. I am also using the VIX January $10 calls, which weakened sharply yesterday, closing just above my $6.85 cost-based at $7.02.

Another indication of deteriorating internals is the comparison of the S&P 500 to its little brother, the unweighted S&P where the biggest market cap stocks are assigned weightings that are equal as opposed to the regular S&P 500 that overweights the MAG Seven.

Now, the big boys on Wall Street will do their damnedest to keep stock "bid" through Monday so as to protect those big bonuses that are ready to be plucked from the excess cash sitting in the funds.

Once we get into 2025, though, I see a rush to profit-taking and portfolio hedges in advance of the uncertainty of what happens after Inauguration Day. There is no better indication of how important the U.S. markets have become to the global investment arena than the chart shown above, where the VEU:US (Global markets ex-USA) has gained a paltry 5.93% YTD. Take away the U.S. investment markets and you are left with a 1966-1982-style bear market.

Enjoy the holiday.

| Want to be the first to know about interesting Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.