iMetal Resources Inc. (IMR:TSX.V; ADTFF:OTCBB; A7V:FRA) is regarded as a most attractive junior gold exploration stock. Following a bear market that erased 99% of the stock's value, it is coming to the end of a basing process with clear signs that it has been under accumulation for a long time.

Before considering its latest stock charts, we will overview the company using slides from its latest investor deck and links to the most important recent news releases.

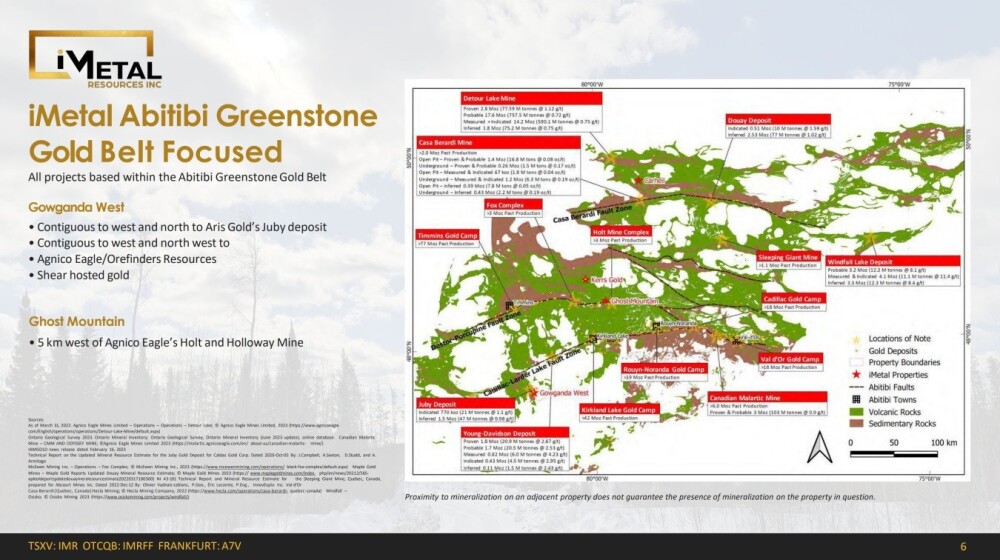

All of the company's properties are based within the Abitibi Greenstone Gold Belt in Ontario, Canada. They are shown on the map on this slide, which also makes clear that this is a prolific gold-bearing region with many mining companies active in the area with big deposits delineated, which certainly bodes well for the company making worthwhile finds on its properties.

Note that back in March, the company came out with the news that it has opted out of the Kerrs property option in order to concentrate on its core Gowganda West asset.

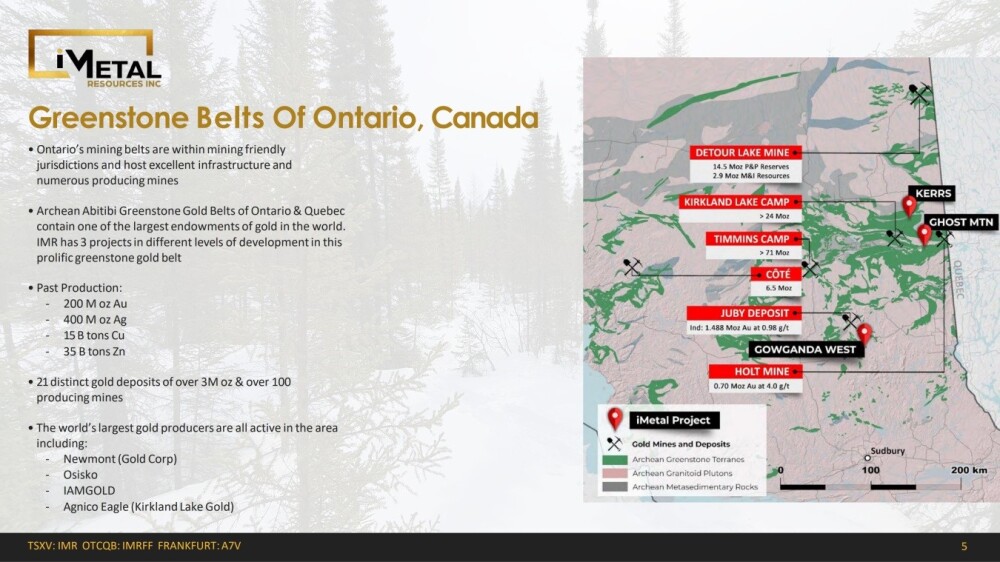

The following slide zooming on the company's projects making it easier to see where they are in relation to nearby projects in the area operated by other companies and this slide also gives some general information on producing mines in the Abitibi Greenstone Belt.

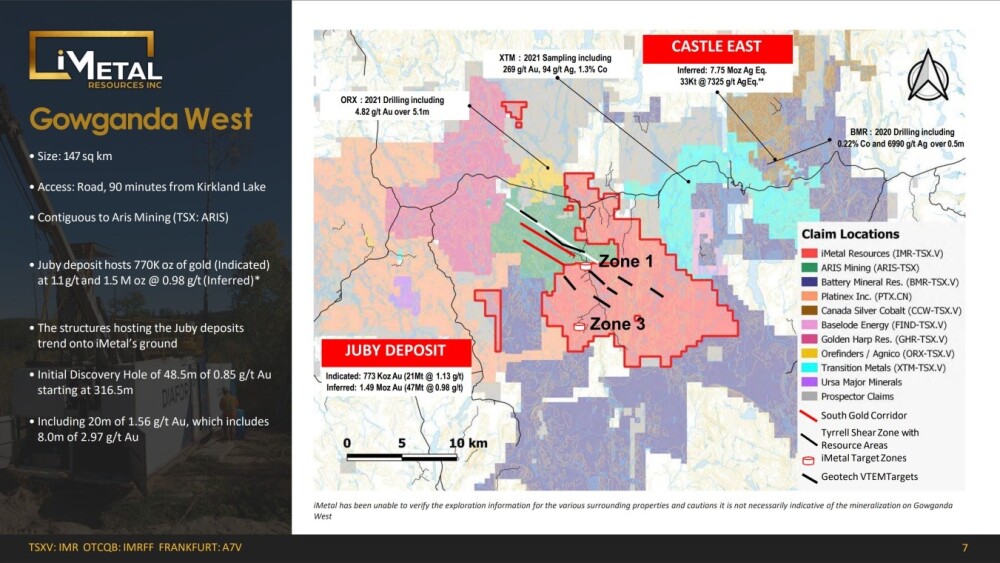

The next slide overviews the Gowganda West property, and an important point it makes is that the structures hosting the Juby Deposit, owned by Aris Mining, trend onto iMetal's ground.

This slide overviews the Ghost Mountain Project.

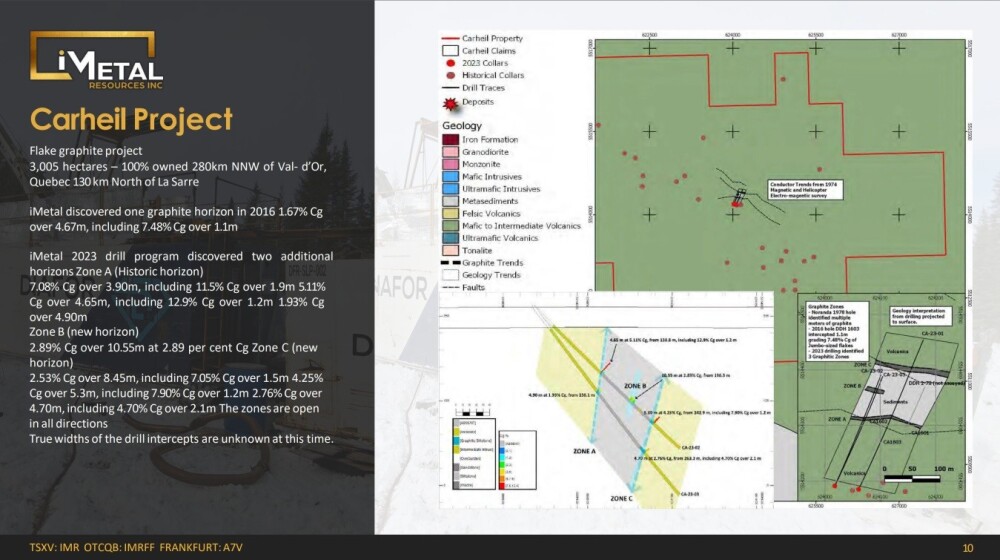

Much larger in terms of land area, at 3005 hectares, is Carheil, a flake graphite project where graphite has already been found.

Exploration is ongoing at all of the properties, and drill results could have a significant effect on the stock price, especially at the current level.

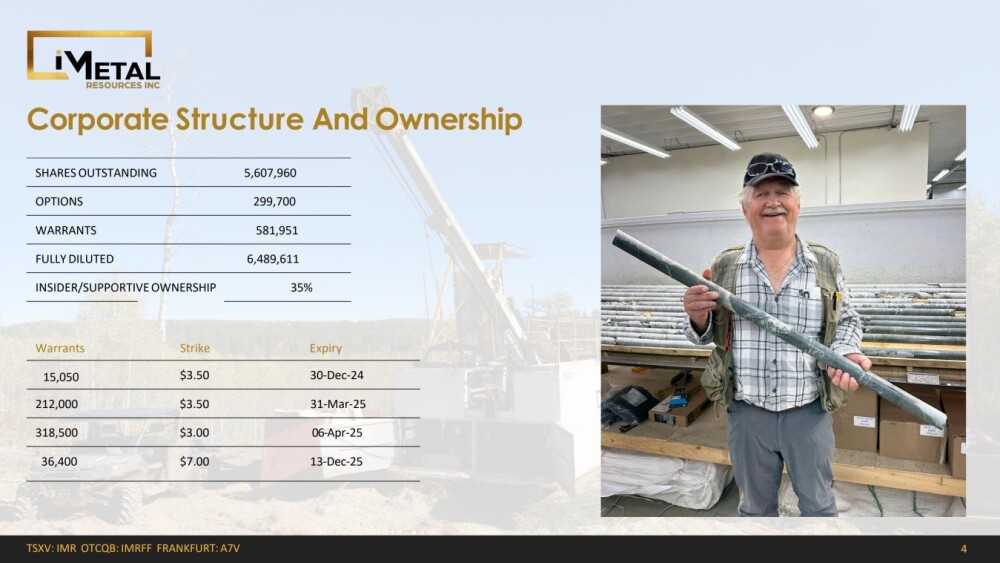

This last slide shows the company's capitalization. On it, we see that with only 5.6 million shares in issue, it won't take much of an increase in interest in the stock to really get it moving, as we saw early last week.

Having overviewed the fundamentals of the company, we will now proceed to examine its latest stock charts.

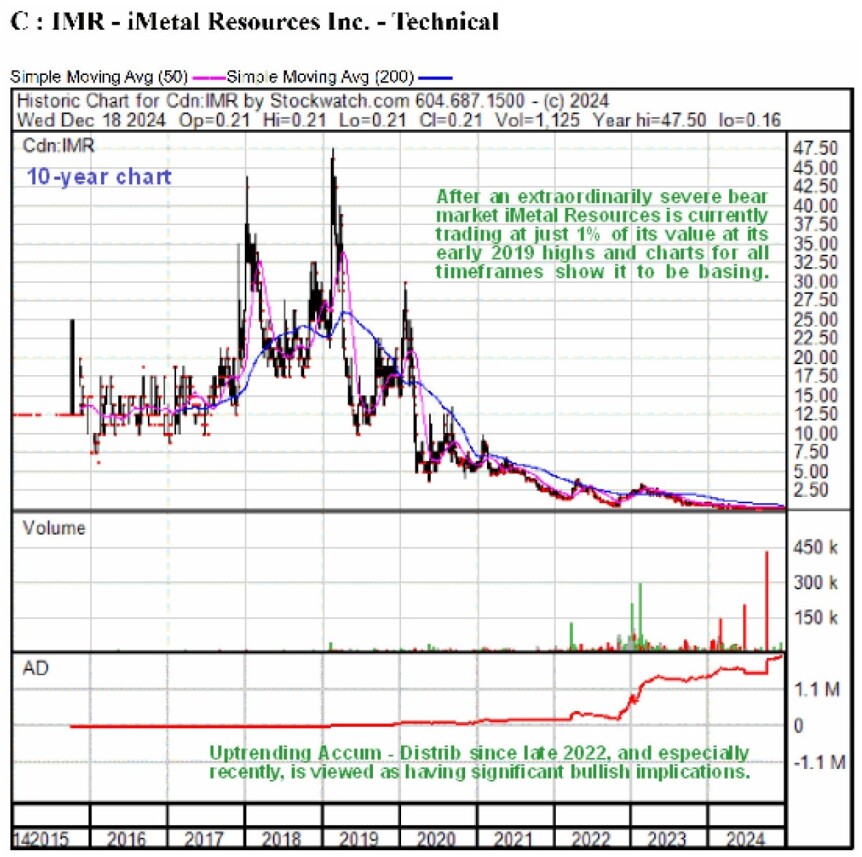

iMetal Resources has been at the tail end of an extremely severe bear market this year, which erased 99% of its value at its early 2019 peak. The good news is that not only is it at a most attractive entry point as a result, but it has also been basing for much of this year with evidence that it has been under accumulation.

On the 10-year chart, we can see the brutal bear market from the early 2019 peak in its entirety and also how price has been tracking sideways at a very low level this year.

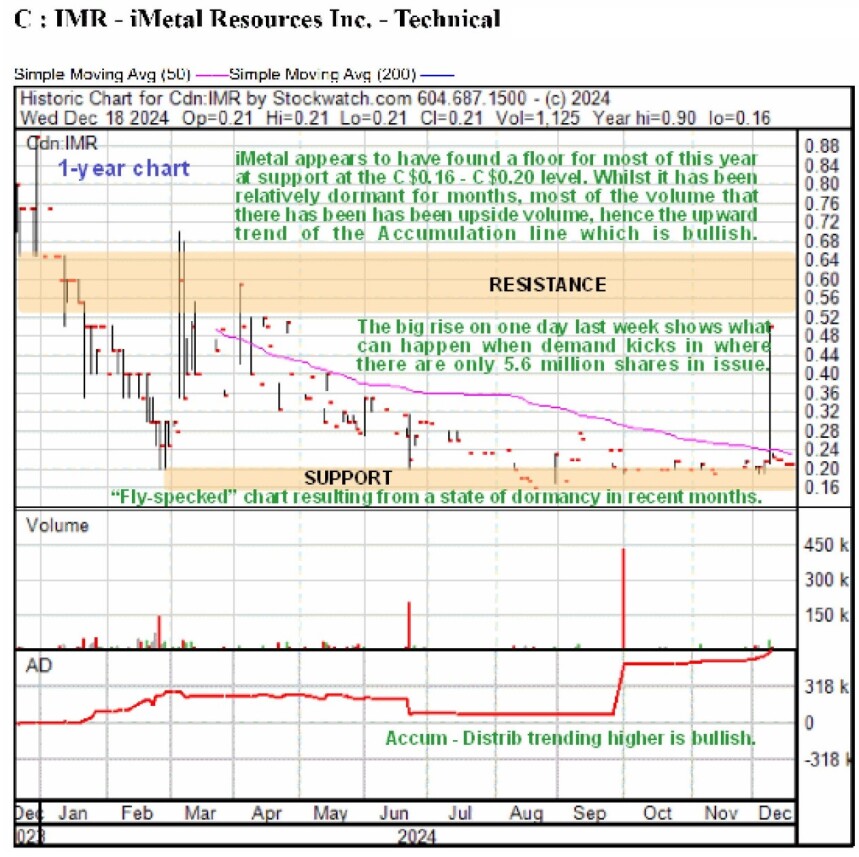

Zooming in via the 3-year chart enables us to see that even from the 2022 and 2023 peaks, which are at a much lower level than the 2019 peak, the price has still dropped a lot in percentage terms. The price broke out of the orderly downtrend in force from the 2023 peak in the Spring of this year and has since been tracking more or less sideways, marking out a base pattern at a low level.

An important point to note is that the Accumulation line has been trending higher not just from early this year but from late 2022 — this is a bullish divergence, which implies that a major new bull market is incubating. In instances like this, where the On-balance Volume line has been trending lower during the same period, the Accumulation line is ascribed more validity because it is calculated using intraday data, whereas On-balance Volume is based on end-of-day data.

On the 1-year chart, we can see this year's base pattern in much more detail and how selling pressure had exhausted itself by February of this year. After the bounce in March, the stock went into a state of dormancy where it largely tracked sideways on very light and sometimes non-existent volume, which is why the chart appears to be "fly-specked." An effect of this is that the appearance of any buying interest in the stock quickly translates into significant price movement, and we saw this last week when it quickly rocketed from 22 cents up to 50 cents in one day, with this move no doubt being magnified by the low number of shares in issue at 5.6 million and in the float.

It is also worth noting that the duration of the base pattern this year has allowed time for the 50-day moving average to drop down closer to the price, putting the stock in a better position to advance, and that sharp upward stab last week may be regarded as a "preliminary breakout" that will soon be followed by the real thing, i.e., a breakout where a significant portion of the gains stick. It is viewed as a positive that the stock has recently been trading well above the issue price of a $1.5 million private placement announced on November 4.

This is, therefore, considered to be an excellent point to buy iMetals Resources' stock, and being at such a level, it is possible to acquire a significant position for a relatively modest outlay.

iMetal Resources' website.

iMetal Resources Inc. (IMR:TSX.V; ADTFF:OTCBB; A7V:FRA) closed for trading at CA$0.21, US$0.155 on December 18, 2024.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.