Atlas Lithium Corp. (ATLX:NASDAQ) is centrally positioned for great success going forward.

It is an established lithium and other battery metals explorer with substantial 100% owned projects in favorable jurisdictions where year-round operations are possible, with the fully permitted flagship Minas Gerais Lithium Project set to go into production soon, and it even has important customers lined up for its product with offtake agreements already in place. All of this is against the background of a lithium price that has stabilized in a base pattern after a severe bear market and looks set to begin a new bull market.

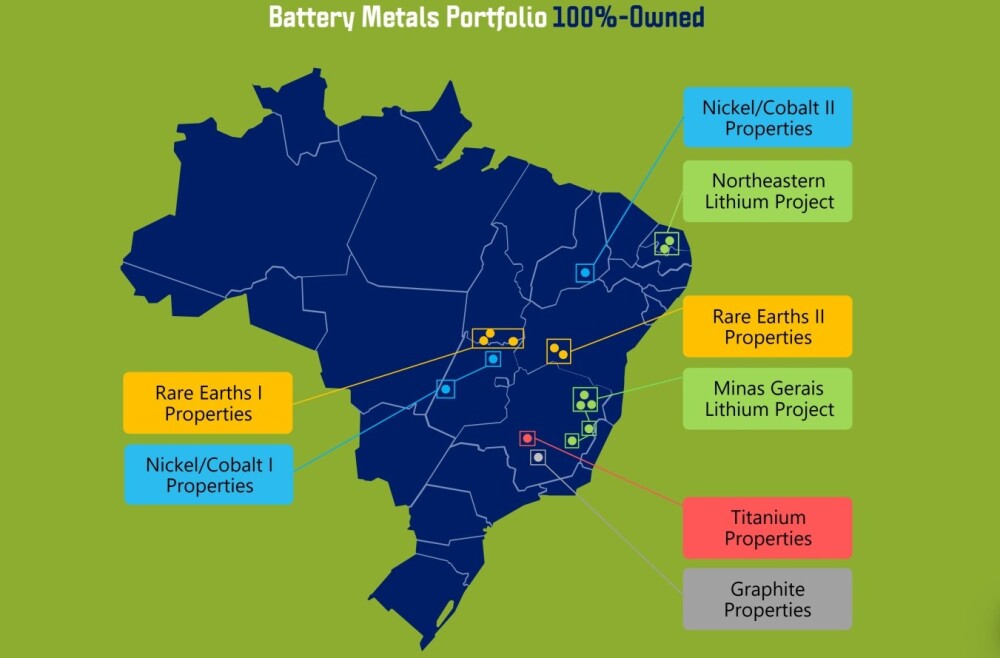

The following map from the company website shows all of the company's projects in Brazil with the lithium properties flagged in Green.

Despite making good progress towards its objectives this year, Atlas' stock has continued to drift lower in a downtrend, which is considered to be largely due to investor interest being sidelined by the continuing weakness in the lithium price.

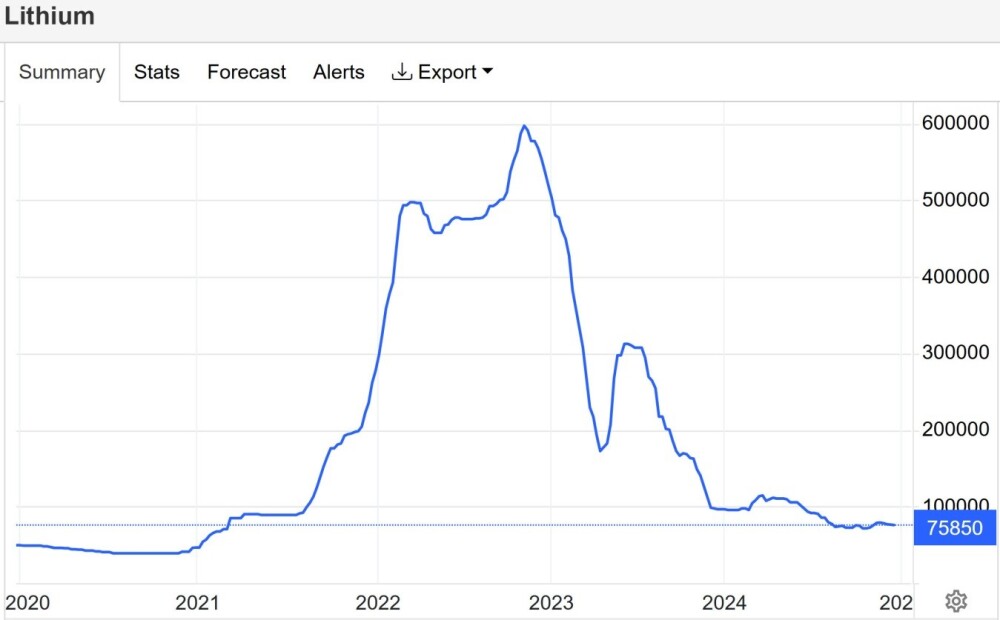

Yet, as we can see on the following 5-year lithium price chart, the bear market in lithium has slowed significantly this year, with it appearing to be basing in a zone of strong support near to the upper boundary of the large base pattern that led to the huge ramp in the lithium price in 2021 and 2022.

Chart courtesy of tradingeconomics.com

Relevant to this is that Goldman Sachs has reported that China's EV sales grew by an impressive 51% year-on-year, albeit supported by a trade-in subsidy, and is expected to grow by about 20% YoY in 2025. Clearly, if the basing action on the lithium chart leads to a new bull market, then it should have a highly beneficial effect on Atlas's stock price, especially given the progress being made by the company.

Now, we will proceed to overview the company using selected slides from the company's recent November investor deck.

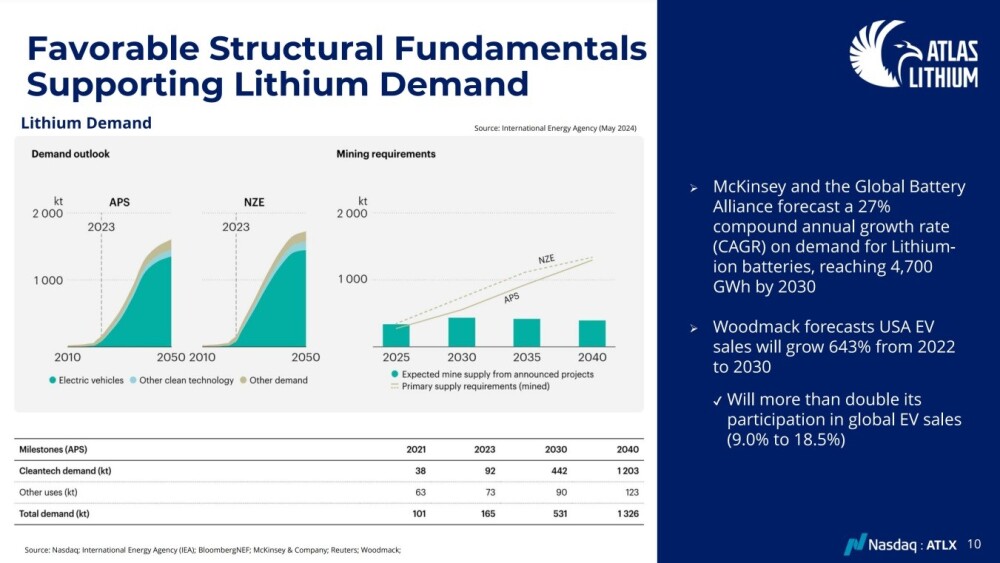

The first and perhaps most important point is that lithium demand is set to soar between now and 2050, while expected mine supply from announced projects (up to now) is set for only modest growth, as shown on the following slide. Clearly, this is a recipe for a major and very possibly spectacular lithium bull market.

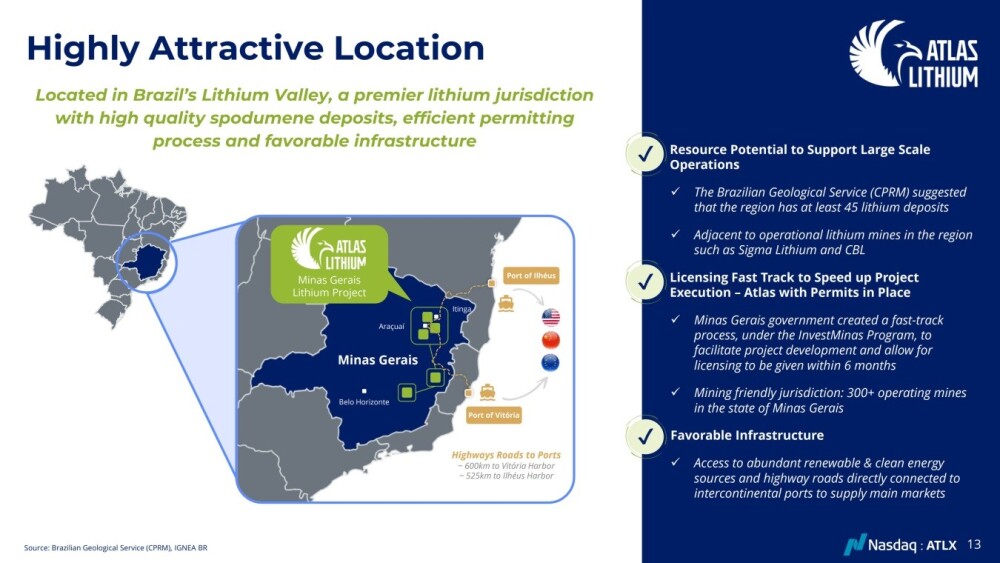

This slide shows the exact location of the company's flagship Minas Gerais lithium project and its proximity to ports.

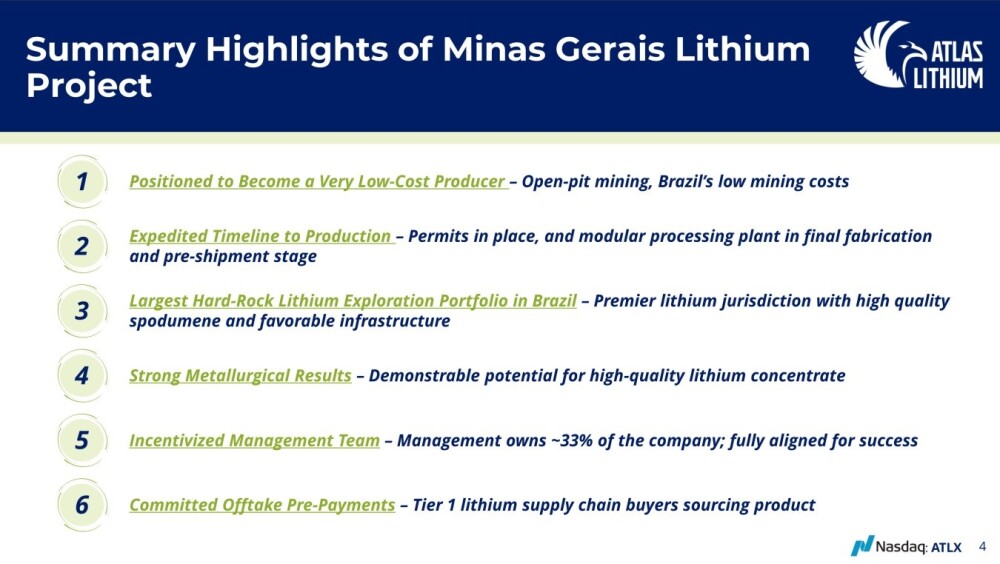

This one overviews the main attributes of the Minas Gerais project.

Summary highlights of Minas Gerais are below.

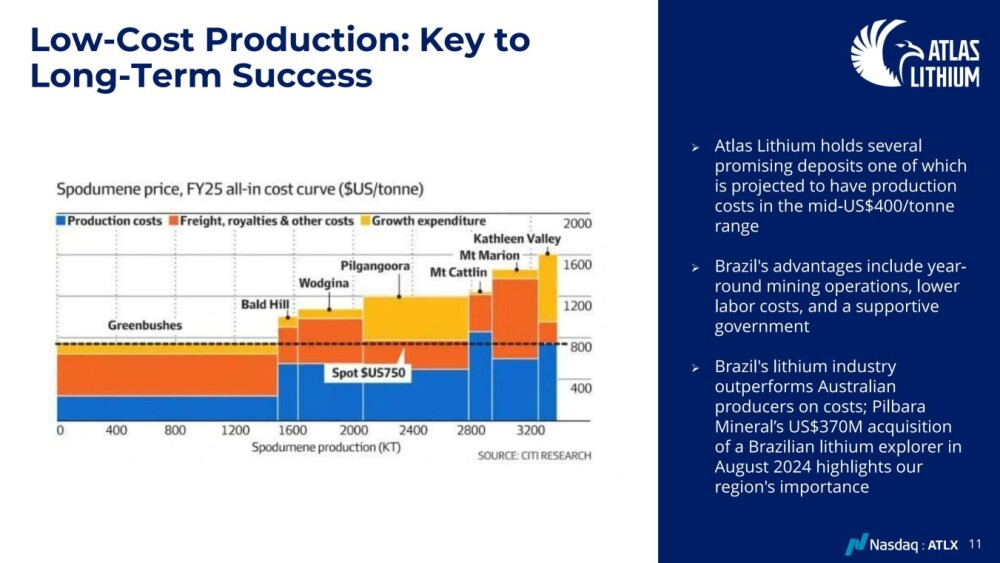

A key advantage for Atlas is that it will be a low-cost producer.

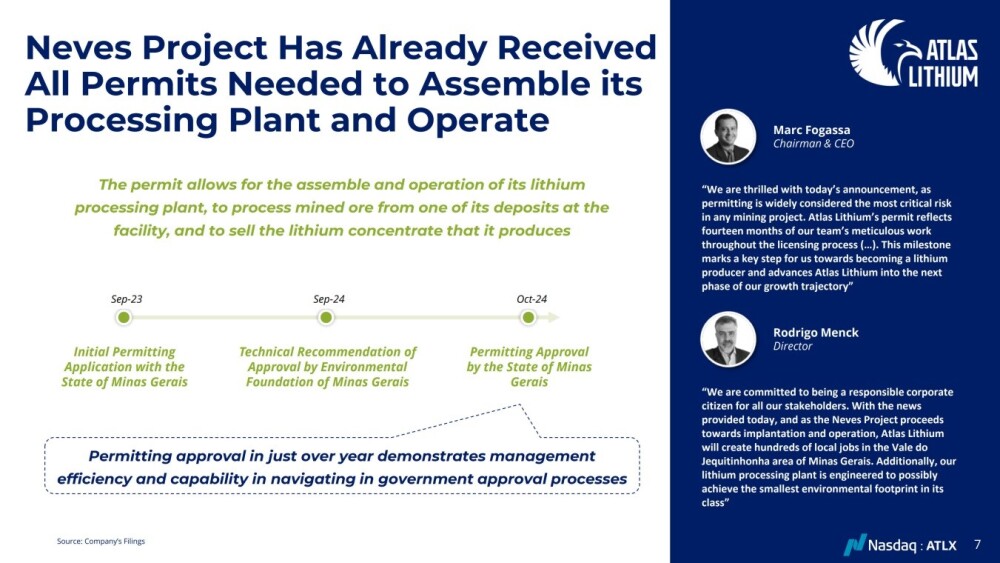

Also, the Neves Project within Minas Gerais has all the necessary permits in place.

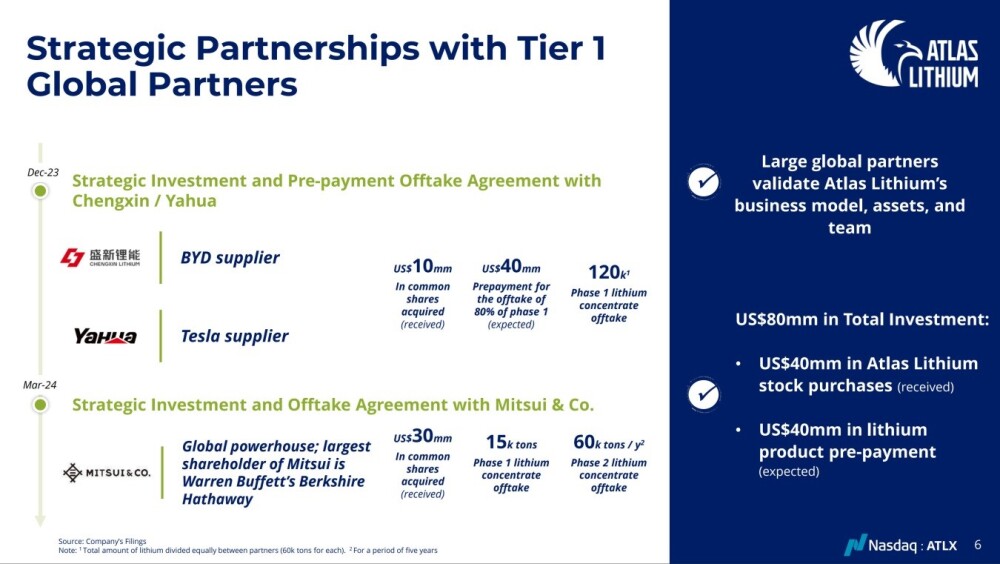

With strategic partnerships with important customers and end users already organized, Atlas should "hit the ground running" once Minas Gerais goes into production.

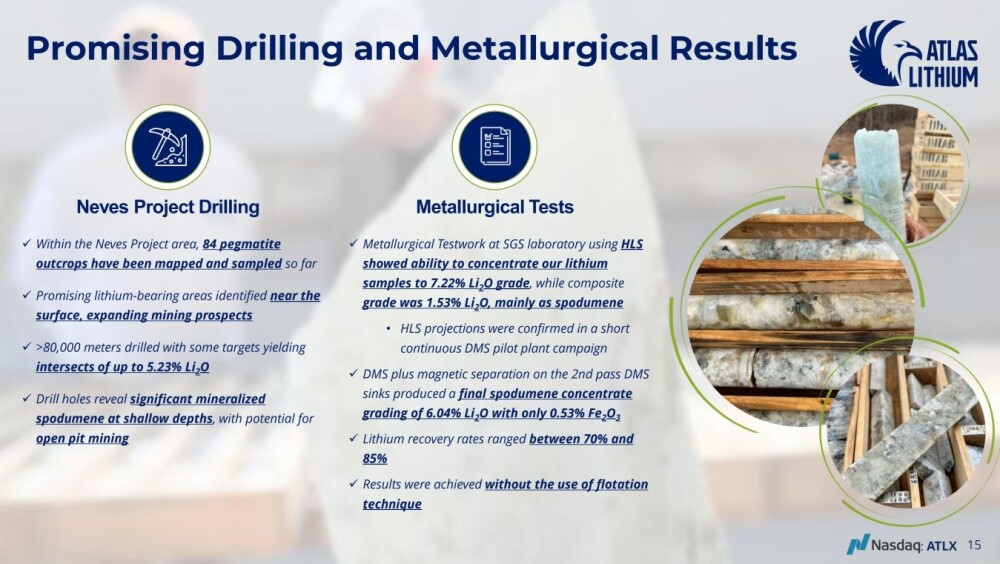

Promising drilling and metallurgical results have already been achieved at Neves, and it's noteworthy that significant mineralization has been encountered at shallow depths, which means that the deposit can be subjected to low-cost open-pit extraction.

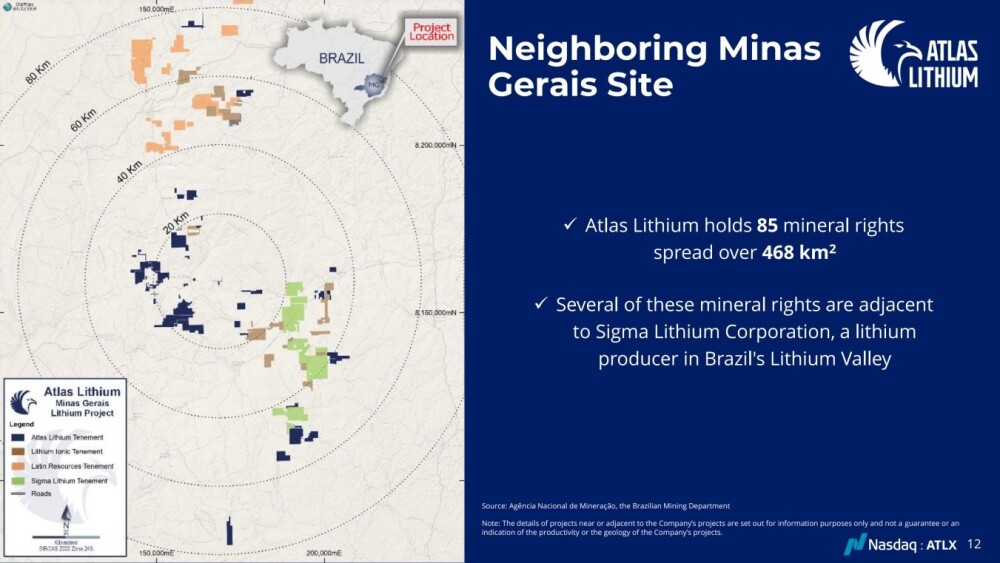

It's always a good sign when other companies are active in the area, and as the following map shows, Atlas is in good company with Latin Resources, Lithium Ionic Corp. (LTH:TSX.V; LTHCF:OTCQX; H3N:FSE) and Sigma Lithium Corp. (SGML:TSXV; SGML:NASDAQ) all nearby. Several of Atlas' properties are adjacent to Sigma Lithium, which is a significant lithium producer in Brazil's Lithium Valley.

Atlas has developed a modular processing plant elsewhere, and being modular, it was deconstructed and then shipped to the site and reassembled for production.

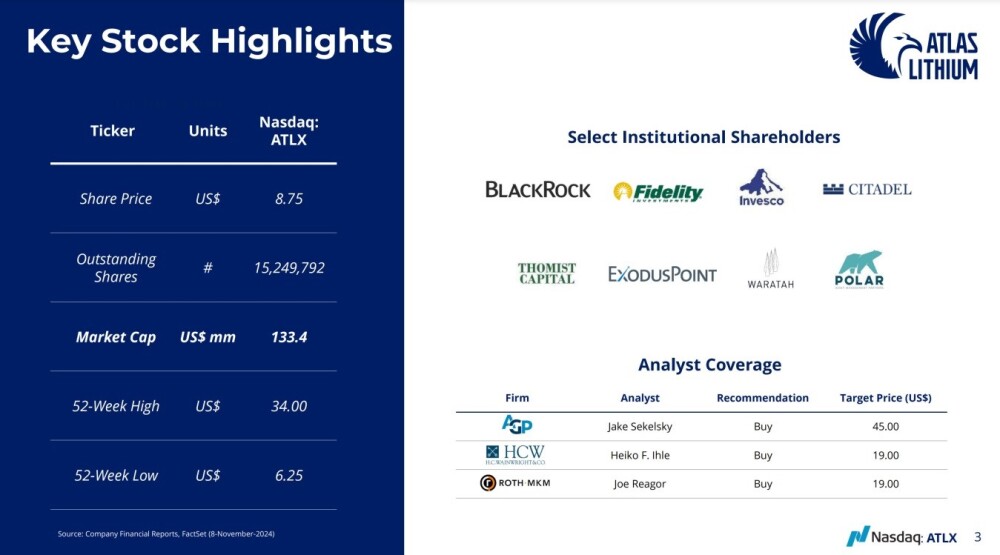

Lastly, this slide shows the stock highlights, analyst coverage, and bigger institutional shareholders in the company.

Whilst the share performance this year is "nothing to write home about" the flip side of this is that it is now most attractive for buyers and the low number of shares in issue means that it won't take much of an increase in demand to really get it moving, so the upside is big.

Looking now at the charts for Atlas Lithium, we can see on the longer-term 5-year chart that the downtrend in force this year has brought the price down to strong support at long-term cyclical lows where it is likely to reverse to the upside, and this is especially the case given the way the company is advancing towards its objectives and if the lithium price should start to advance again as looks likely the stock will "have the wind at its back" and we would then see a robust bull market.

So it is clear that the stock is very attractive in this area. Whilst we cannot rule out limited further decline, it could reverse to the upside at any time, and the probability of it doing so is growing steadily.

On the 16-month chart, we can see that Atlas has been in an orderly downtrend since the start of the year, and whilst this downtrend is still in force with moving averages still in bearish alignment, there are two important factors visible on this chart which point to a reversal into a new uptrend before much longer.

These are the diminutions of downside momentum, which are evident from the late February low, as shown by the MACD indicator, with momentum getting close to entering positive territory and the marked volume buildup since September. This is important as it means that a substantial quantity of stock has changed hands, and since most of the sellers are clearly selling for a loss, it implies that this stock is rotating from weaker to stronger hands, and since the new owners will not be inclined to sell until they have turned a profit, it is effectively reducing the amount of stock on the market. So, any significant influx of demand will quickly lead to higher prices.

For these reasons, Atlas is believed to be marking out the second low of a Double Bottom with its early October lows right now, with the recent dip very likely due in part at least to end-of-year tax loss selling, which makes it all the more likely that it will start higher at or before the New Year and this is therefore thought to be a very good price area to buy or add to positions and it is thus rated a Strong Buy here.

Atlas Lithium's website.

Atlas Lithium Corp. (ATLX:NASDAQ) closed for trading at US$6.97 on December 17, 2024.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Atlas Lithium Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,575.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Atlas Lithium Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.