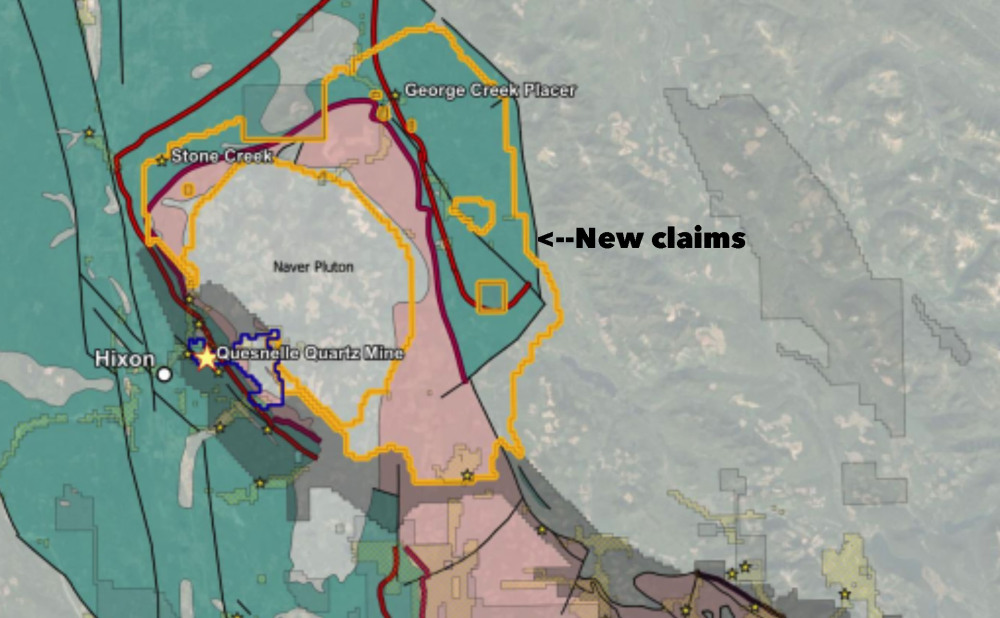

Just one week after Golden Cariboo Resources Ltd. (GCC:CSE; GCCFF:OTC; A0RLEP:WKN; 3TZ:FSE) announced a significant expansion of its Halo discovery at its Quesnelle Quartz Mine in British Columbia, the company said it had staked 90,898 hectares (ha) of contiguous mineral claims.

The company now holds 95,122 ha at the project, making it the third-largest claim holder in the historic Cariboo Gold District, Golden Cariboo said in a release.

"The first thing we did after making the Bonanza Ledge discovery in the Wells-Barkerville camp nearly 25 years ago was to stake most of the entire belt surrounding it," President and Chief Executive Officer Frank Callaghan said, noting his earlier success advancing another project in the district. "It is hard to fathom that the opportunity has presented itself to do it over again this past fall."

Callaghan said the Halo discovery "redefined the gold potential this far north in the Cariboo," leading the company to secure more than 900 square kilometers of prospective ground over a parallel belt to our discovery and our project.

Callaghan said the Halo discovery "redefined the gold potential this far north in the Cariboo," leading the company to secure more than 900 square kilometers of prospective ground over a parallel belt to our discovery and our project.

The new claims cover an area with a similar geological setting to that of Quesnelle, as well as having a history of placer gold production. The company said it has seen limited modern exploration for lode gold.

'Key Ingredients for a Productive Mineral System'

The potential for significant orogenic gold systems in the northern region of the Cariboo district was identified by the company's recent discovery of the Halo zone, from which 1.77 grams per tonne gold (g/t Au) over 136.51 meters was intersected in diamond drill hole QGQ24-13.

"Following the discovery, the company staked a geological belt encircling a regional-scale intrusion known as the Naver pluton," Golden Cariboo said in a release. "This belt contains key geological criteria encountered on the project, and at major gold deposits in the Cariboo Gold District."

According to the company, some of those criteria include:

- The presence of the Nicola Group (Quesnel terrane), which contains the host rock formations to the project and several others in the Cariboo Gold District, including the 4.7-million-ounce (Moz) Spanish Mountain Deposit.

- The Snowshoe Group (Barkerville subterrane), which contains the host rock formations to the 5.3 Moz Cariboo Gold Project currently under construction by Osisko Development Corp.

- Major thrust faults on the terrane boundary between Quesnel terrane and the Barkerville subterrane, namely the Eureka and Spanish thrusts, which are the inferred deep-seated crustal faults that produced orogenic gold systems across the Cariboo Gold District.

- Presence of placer gold occurrences situated at the confluence of the above faults.

"The newly staked ground contains the key ingredients for a productive mineral system, highlighted by deep-seated structures and receptive host rocks, which come together right next door to the Quesnelle Gold Quartz Mine property," said Dr. Sarah Palmer, consulting structural geologist for the company. "That, along with placer gold surface indicators, provides a strong technical framework for an underexplored geological belt.”

Visible Gold

The Quesnelle Gold Quartz Mine Property is located 4 kilometers northeast of Hixon in central British Columbia. It is accessible year-round via an industrial road. Historic mining in the area dates back to the 1860s, with placer and hard rock operations contributing to a long-standing legacy of gold production.

During its exploration, Golden Cariboo has continued to find multiple occurrences of visible gold in its core results.

"Visible gold in current drilling indicates potential for high-grade assays from mineralized targets," Couloir Capital Senior Mining Analyst Ron Wortel wrote of the project in a recent research report.

Couloir Capital assigned a "Buy" recommendation to company's stock, citing Golden Cariboo's exploration initiatives as a unique opportunity for exposure to gold resource discovery in a Tier 1 jurisdiction.

Even before the release of recent assay results expanding the Halo Zone, Couloir assigned a fair value of CA$0.40 per share to the stock, projecting an upside of 286% from the current share price at the time of the report.

The Catalyst: Gold Market Waits Out Fed

Gold prices were modestly down in quieter early trading Tuesday, just ahead of the key U.S. data point of the week, the Federal Reserve meeting that could lead to another interest rate cut, according to Kitco News.

Reuters reported that spot gold was down 0.5% Tuesday morning at US$2,638.16 per ounce. U.S. gold futures shed 0.6% to US$2,652.90, the wire service said.

"Investors are preparing themselves for tomorrow's rate announcement from the U.S. Federal Reserve’s FOMC," David Morrison of Trade Nation wrote in an email dispatch, according to Kitco. "There's currently a 96% probability of a 25 basis-point rate cut. So, investors will be paying more attention to the FOMC's quarterly summary of economic projections, which provides forecasts for GDP growth, unemployment, inflation, and the fed funds rate for 2025 and beyond.”

Gold may also see buying interest limited in part by concerns of U.S. stagflation, with the potential for a slowing labor market meeting higher inflation, constraining the Fed's ability to cut interest rates, Kitco noted.

But most experts agree gold is still in a bear market. FX Empire's A.G. Thorson recently predicted a run towards US$3,000-plus by next March or April.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Golden Cariboo Resources Ltd. (GCC:CSE; GCCFF:OTC; A0RLEP:WKN;3TZ:FSE)

Writing for Money on December 4, Marc Guberti noted that gold was up by more than 31% in 2024 and delivered more than an 82% gain over the past five years. "Many big banks believe that gold is set to continue its rally in 2025 and beyond," he wrote.

Ownership and Share Structure

According to Golden Cariboo, management and insiders own 30% of Golden Cariboo Resources.

President and CEO Frank Callaghan owns 16.45% or 6.93 million shares; Elaine Callaghan has 0.97% or 0.41 million shares; Director Andrew Rees has 0.79% or 0.33 million shares; and Director Laurence Smoliak has 0.3% or 0.13 million shares.

Retail investors hold the remaining. There are no institutional investors.

The company said it has 50.3 million shares outstanding, 24.83 million warrants, and 3.8 million options.

Its market cap is CA$9.66 million. Over the past 52 weeks, Golden Cariboo has traded between CA$0.08 and CA$0.36 per share.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Golden Cariboo Resources Ltd. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Golden Cariboo Resources Ltd.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.