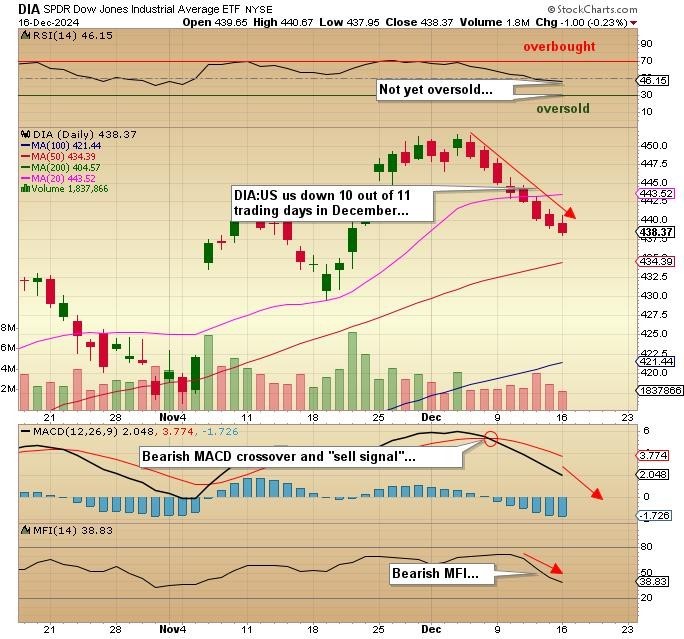

There is a massive divergence happening between the Dow Jones Industrial Average, the Dow Jones Transportation Average and the S&P, the NASDAQ, and the Russell 2000 and while it might be shrugged off to year-end rebalancing, I find it odd to see the blue-chip index coming under such pressure.

Last year, the DJIA rose eight of the first eleven sessions in the month of December, while 2022 had six sessions up and five down in the same stretch. In both 2021 and 2020, there were seven wins and four losses in the same time period in both years. Weakness in the Dow averages cannot be seen as positive.

Note the strength all day today in the NASDAQ, the S&P 500, and the Russell 2000, and yet the VIX closed on the high for the day, moving from a low under 14.00 going out at the high for the day at 14.69. If we get the same type of move tomorrow, the VIX December $10 calls could get skated quickly onside, which would signal that someone is scrambling to get hedged while moving into the FOMC meetings.

If that is the case, then tomorrow and again Wednesday morning, those portfolio managers looking to lock in the spectacular 2024 returns are either sellers of stock or they are buyers of protection. If they are sellers, then the VIX has to advance; if they scramble for protection, the VIX also has to advance.

Any way you cut it, the VIX might be the best end-of-year trade in years.

The UVIX:US, to which I added last week at $3.15, closed at $3.275 after a $3.29 print late in the day. If I were not hearing rumors of a possible reverse split (a really ugly habit by the managers of that ETF), I would be going "ALL-IN" on it as my proxy for volatility (portfolio insurance). I have a feeling that calls on the actual VIX index might be a safer avenue to take this time around. If you cannot do options, then the SDS:US or SQQQ:US, both "reverse ETFs" designed to simulate short positions on both the SPY:US and the QQQ:US will suffice.

The VIX December $10 calls went out at $4.90 against my average cost of $6.00. While the VIX January $10 calls are now ahead nicely to $6.65 (I paid $6), I will hold these until the Powell press conference that will arrive Wednesday at 2:30 pm (EST).

If Powell even hints at a "pause" or says anything that will convey restraint in the widely expected 2025 rate cuts, I will wait for the right moment to roll December into January and then await the results of the Santa Claus Rally ("SCR") and the First Five Days ("FFD") in order to either cash the ticket or double down.

It's heating up!

| Want to be the first to know about interesting Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.