As the AI revolution gathers pace and moves into the mainstream, Treatment.com AI Inc. (TRUE:CSE; TREIF:OTCMKTS; 939:FRA) is centrally positioned to transform the healthcare industry, making it more efficient for both healthcare professionals and patients alike. Gone will be the days when patients had to make long journeys to hang around, sometimes for hours, waiting to see a doctor or other healthcare professionals.

Likewise, with advanced AI able to cater to the needs of the majority of patients virtually, doctors (and nurses) could be freed from the burden of routine cases that can be handled without their attention and also from the burden of the associated paperwork.

Before we proceed to examine the most positive stock charts for the company, we will see Treatment.com AI's platform works using slides from the company's latest investor deck.

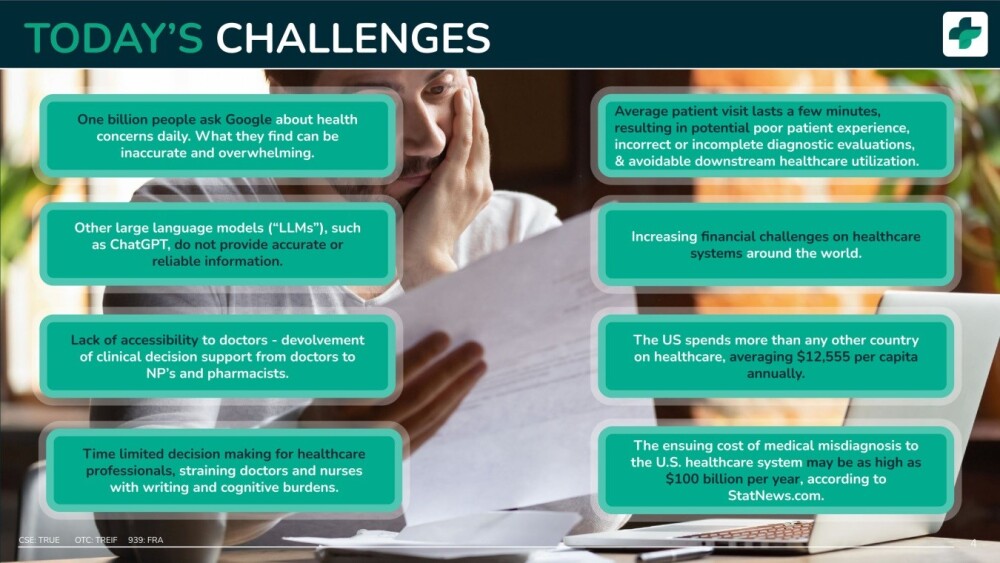

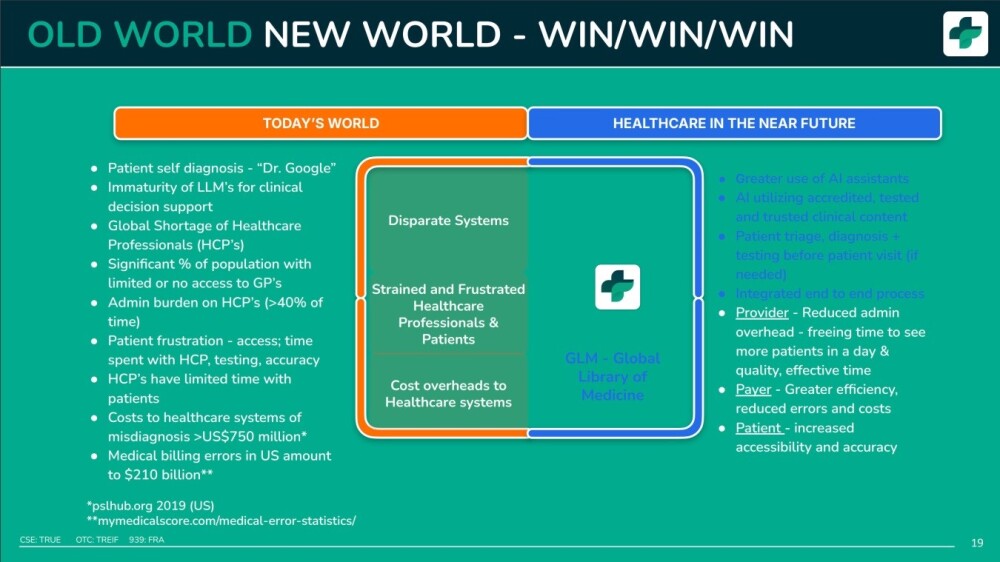

The challenges facing the healthcare industry and its customers, or patients, on a daily basis for many decades are condensed and presented on this one slide:

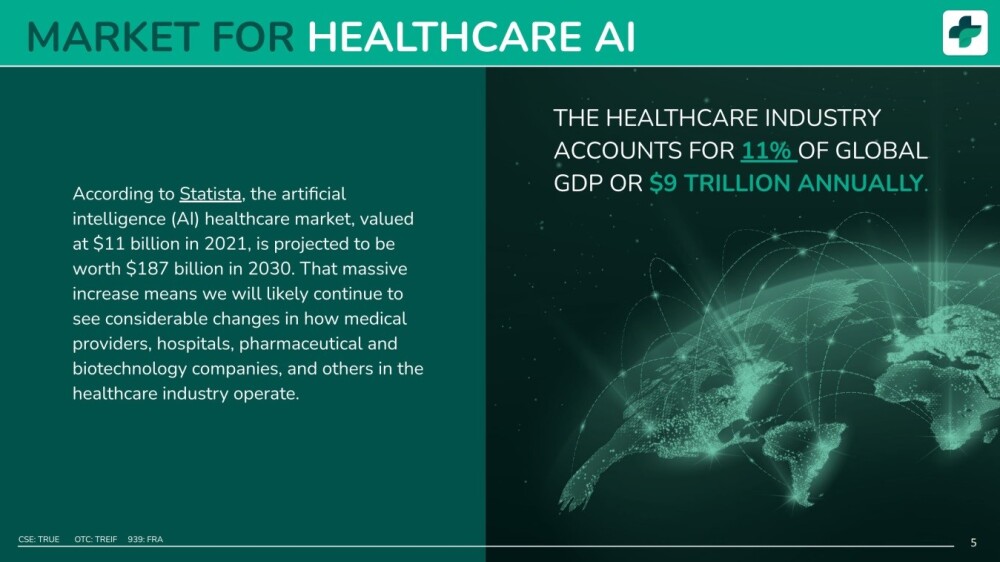

The AI healthcare market is on the verge of a massive boom, and Treatment AI.com is centrally positioned to be a key player in this sector.

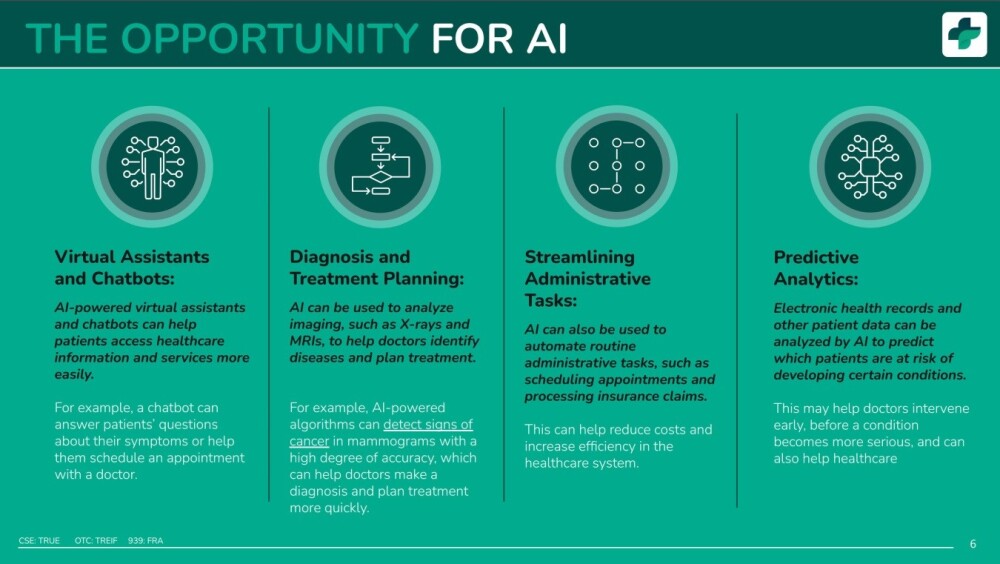

On the following slide, we see how AI could revolutionize the healthcare industry, streamlining it to become vastly more efficient for both healthcare professionals and patients.

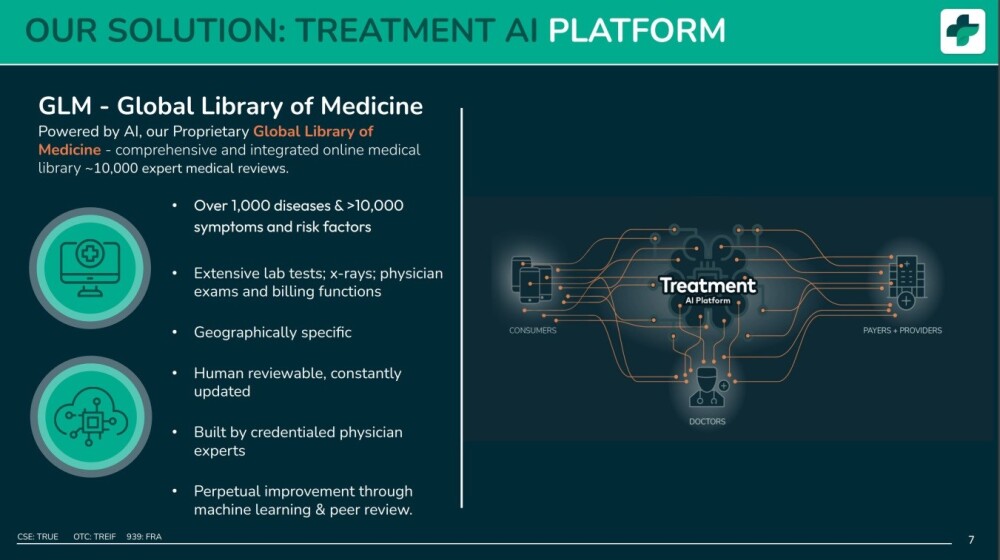

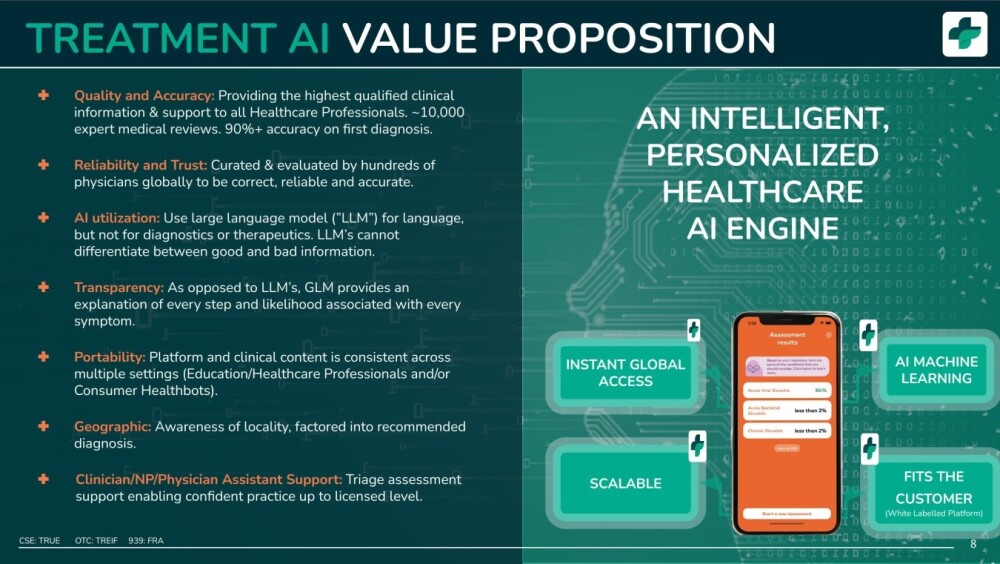

A key point is that Treatment.com's AI platform is powered by its proprietary Global Library of Medicine (GLM), a comprehensive and integrated online medical library powered by AI which is perpetually improving — it improves itself.

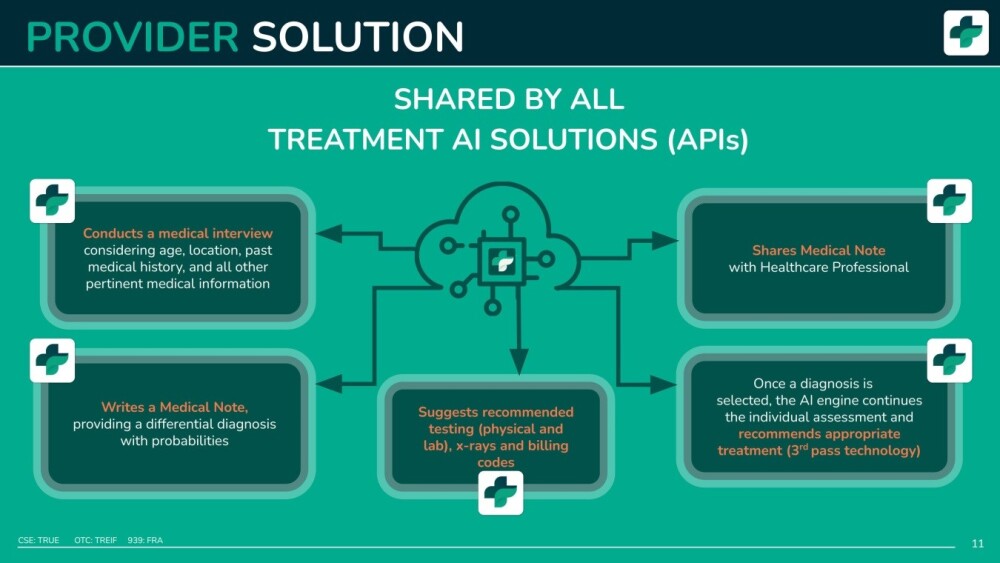

Here is how it works:

The attributes of Treatment.com's AI platform are set out in the below slide.

As we can see, they are certainly impressive and wide-ranging.

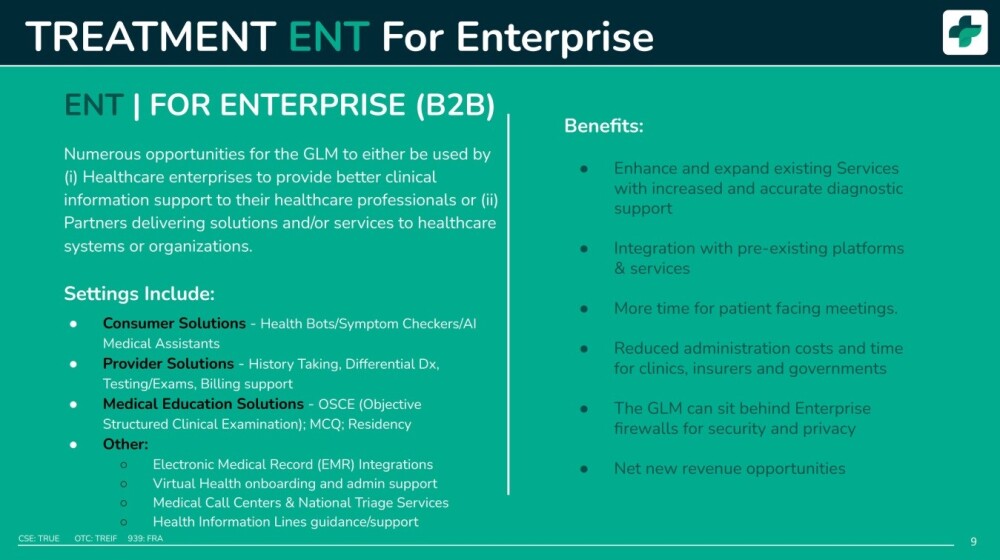

The GLM (Global Library of Medicine) has many practical applications across the healthcare sector. You can see this on the slide below.

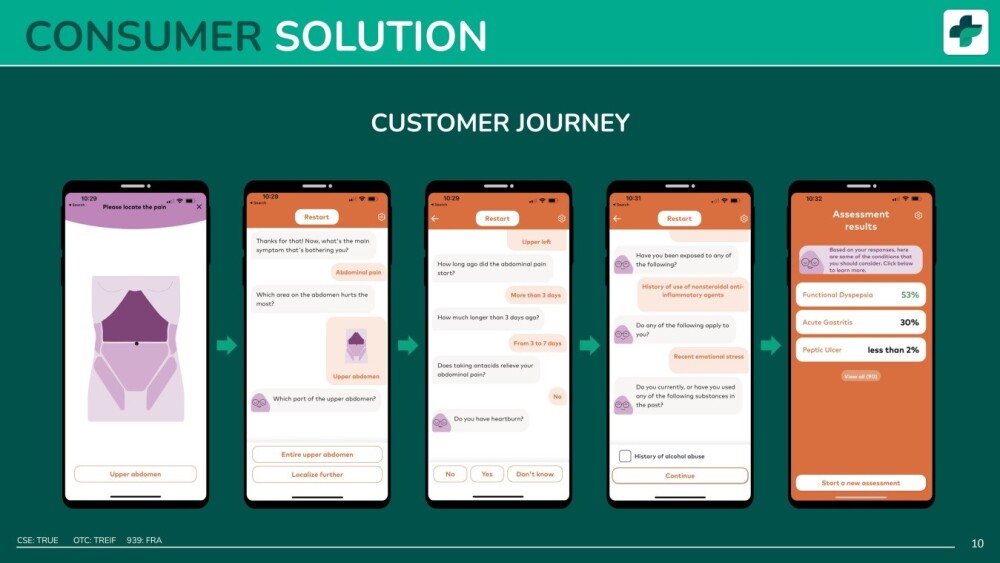

For the customer / patient using the Treatment AI.com platform is a simple step-by-step process.

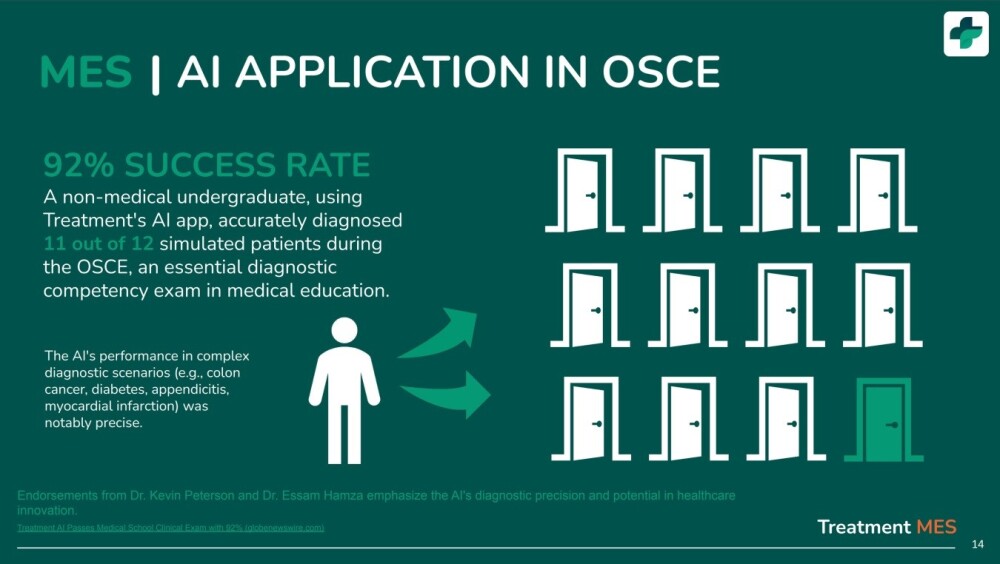

It demonstrably works for the doctor / medical student as well.

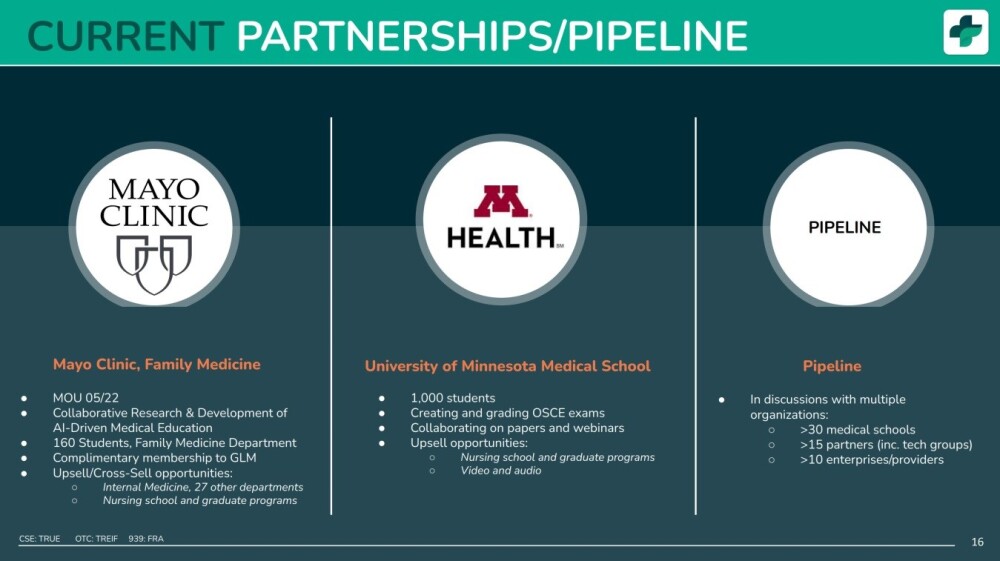

Treatment AI.com has already established partnerships with these companies.

Treatment.com AI has also announced further partnerships, which can be seen in the investor deck above.

This last slide sums up the transformation that AI could bring to the healthcare industry, and the biggest advantage for the patient is that they will have access to a wealth of information/resources at their fingertips without leaving home, but when it is necessary to visit the doctor, it will be quality, effective time.

Now, we will turn to look at Treatment.com AI's latest stock charts.

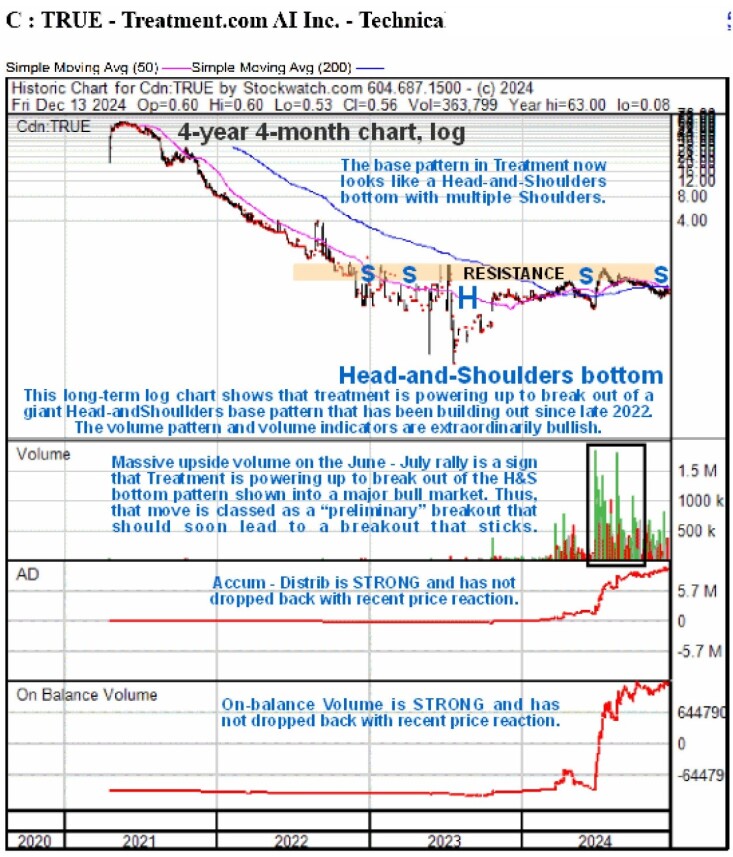

In the latest update, we did not expect the support at approximately the CA$0.68 level to be breached on account of the strength of the earlier runup in June – July, as can be seen on the 1-year chart. But although it was, no serious technical damage occurred, as we will see when we look at the longer-term 4-year, 4-month chart.

What has happened is that the correction has continued for longer and become a bullish Falling Wedge, with the price drifting lower on lighter volume. The volume pattern has remained positive throughout, with both volume indicators remaining buoyant and even making new highs. This is bullish and points to a renewed advance, especially as the Wedge pattern is closing up.

It is thus interesting to observe that the price appears to have been forming an intermediate base in recent weeks and has already broken out of the Wedge by virtue of moving sideways. This suggests that a new uptrend will gain traction soon.

The longer-term 4-year, 4-month log chart makes clear what has been going on — a log scale is used to "open out" the base pattern, which is the better way to see exactly what pattern has been completed.

Here, we see that a large complex Head-and-Shoulders bottom pattern has been building out since late 2022. The duration of this base pattern has allowed time for the 200-day moving average to drop down close to the price and flatten out, a frequent precursor to a new bull market.

By far the most important point to observe on this chart, however, is not the price pattern, which is certainly positive, but the volume pattern, which is powerfully bullish, with very heavy volume driving the advance in June and July that sent the two volume indicators shown "through the roof" and "rang the bell" on the new bull market in the stock.

As the price still has not broken above the resistance marking the upper boundary of the base pattern, it means that the June – July runup must be classed as a "preliminary breakout" that will soon lead to the real thing.

This is great news for buyers of the stock here who understand what is going on. For "the writing is on the wall" regarding where this stock is headed, it is going up and up a lot.

This is therefore considered to be a great point to buy or add to positions in Treatment AI.com and this is a stock that it is considered to be worth going overweight on.

It is worth noting that the company closed an oversubscribed private placement for almost CA$2 million on October 25 and that there are currently a reasonable 48.3 million shares in issue.

Treatment.com AI Inc.'s website.

Treatment.com AI Inc. (TRUE:CSE; TREIF:OTCMKTS; 939:FRA) closed for trading at CA$0.56, US$0.3814 on December 13, 2024.

Want to be the first to know about interesting Healthcare Services and Life Sciences Tools & Diagnostics investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- Treament.com AI Inc. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Treament.com AI Inc.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.