Whenever I pick up a newsletter that focuses on various aspects of investing, I can tell within the first two or three paragraphs whether it is the product of an A-type or B-type personality, where the A-type is a charming, gifted orator whose silky smooth deliveries move mountains and have policemen turning in their badges while the B-type are somnambulistic fact-finders that spend more time explaining the footnotes than they do the original topic and are common replacements for counting sheep when insomnia invades the psyche.

CEOs are usually A-types but invariably have B-types surrounding them in the boardroom and before they release anything to the public upon which they have placed their signature. How many episodes of Sherlock Holmes have I seen before realizing that Dr. Watson was the invaluable B-type to Holmes' A-type persona?

These days, the C-suites of the junior mining industry are filled with ex-institutional salesmen and/or analysts who have successfully completed the CFA (Certified Financial Analyst) course and have it emblazoned for the rest of time on any stationary or business card that dons their names. It is a coveted moniker due to the extreme difficulty of passing the course. It has been said that the CFA exam is tougher than the bar exams for lawyers and even more difficult than the CFE (Common Final Exam) for accountants. I have never written the CFA (nor the bar exam or the CFE), but I did successfully complete the CFA's little brother, the CIM exam (Certified Investment Manager) course that reminded me why I celebrated for days after receiving my B.Sc.B.A. in 1976, marking the last time I would ever need to write "final exams."

Back in the 1990s, an era when the exploration companies were run by wild-eyed A-types more akin to Mississippi Riverboat gamblers than CFA graduates, the majority of successful juniors had a salesman as CEO and an experienced mine-finder as the vice president of exploration. When they came into meetings within our corporate finance boardroom, the retail salespeople were addressed by the CEO, while the corporate finance group, which included the analysts and bankers, always listened only to the V.P.-Exploration because, at the end of the day, he was the only company representative that knew anything about the rocks. It was always the corporate finance people who could sniff out the "experienced mine finder" versus the "inexperienced mine seeker," and that was what always separated the wheat from the chaff in junior mining deals.

I was having a discussion last evening with a dear friend whom I first met over the telephone back in 1991 while authoring a rag-sheet called "The Venture Capital Update" that turned out to be more of a "jewel finder" than a "rag-sheet" after nailing the Mountain Province Mining discovery of 1995. After naming it "top pick" in the 1995 Forecast Issue at CA$0.47, it took a mere six months to see the stock at CA$9.75, making it the talk of the town in mining circles.

Anyway, his name is Fred Bechhold, and he hails from southern Missouri, a small burg in the Ozarks that I visited many times in the 1970s in my St. Louis University off-season. A veteran trader and incredibly astute observer of capital flows (meaning "deal flows"), he and I were the driving forces in 1992 behind a masterful stock promotion called United Reef Petroleums, which ironically was a rare "penny dreadful" trading on the Toronto Stock Exchange (as opposed to the TSX Venture or "Vancouver Stock Exchange as it was then known) at around CA$0.10 per share.

That year, thanks in no small part to Mr. Bechhold, that little company became the most active stock on the TSE and the largest percentage gainer on the entire exchange. Thanks also and in large to my Missouri mate, after the company booked the Royal York for a corporate presentation, what started off in a low-capacity anteroom graduated to standing room only in the main ballroom of the hotel. The staff had to mount monitors outside the ballroom to accommodate the overflow crowd that had flown on from places in the Middle East and Europe to learn of this magical new "diamond deal" emanating out of "deep dark Africa" and a surefire path to untold riches.

Fast forward to last evening, as we were discussing the glaring differences between the junior mining scene in 1995 versus 2024, when he mentioned a little junior of which he was a director. While I will refrain from mentioning the name of the company, it was a company developing a technology for extracting the rare earth elements from the "fines" associated with the desert sands of the U.S. Southwest. It started out as a CA$0.15 financing on the old Alberta Stock Exchange and was languishing at around CA$0.30 for month after month as the original CA$.15 investors kept a lid on the price every time it tried to rally (remind you of anything?).

This is where the story gets the hair on the back of my neck to stand up and start tingling because it epitomizes everything utilized today by the technology and cryptocurrency gang in the masterful art of promotion. Feeling constrained by the PHDs — the "B-types" — that were guiding the corporate directive with a palpable disdain for either the stock price or the company's flailing image, Fred decided to do something proactive in order to protect and augment "shareholder value" (an imperative long lost upon the new breed of managers in 2024) so what he did was nothing short of brilliant.

He booked a flight to Arizona, rented a backhoe, hired a cameraman and a couple of illegal immigrant laborers, and bought an old used tin shack from Army Surplus. He then proceeded to "the property," where he proceeded to take two dozen pictures of the backhoe in action, complete with laborers in yellow vests all toiling away against the backdrop of the tin shack. He then came back to Missouri, got a student to edit the footage and overdub it with the CEO's narration (a Doctor of Mineral Economics), and then sent the finished product out to over 500 fund managers and high net worth individuals over the next few weeks. The entire exercise cost US$5,600.

The story had not changed but what investors gleaned from the shear simplicity of the presentation was that there was work being carried out on the property which meant that results were pending.

In the next several months, the company grew to the point where one of the big U.S. wirehouses initiated coverage, taking the stock by way of institutional interest to a high of over CA$20 per share, sporting a market cap of several hundred million dollars. And it all started for the grand total of US$5,600.

The point Fred was making is that sometimes, in fact, most times, it is not the "grandiose plan" that gets the jobs done. It is the minor detail that gets either ignored or dealt with effectively that can change the fortunes of a junior explorer. Today's investor relations "experts," usually in their late 20s or early 30s, think that social media is the only avenue to pursue in today's world of stock marketing, but I refute that because the most successful stock promoter on the planet, Steve Jobs, began with his Apple conferences where he stook in front of an overflow crowd and trotted out tiny models of the MacBook showing it to the delighted, screaming crowd. Was that model MacBook functional? Of course not, but it did not need to be because it was a presentation of the dream that counted, and it proceeded to drive his stock price higher — much higher.

Elon Musk then took a page out of the Jobs handbook and went many steps further as he presented the "driverless electric vehicle" that could take one to a destination while one was playing Grand Theft Auto on one's tablet, using a model being operated remotely as one would operate a remote control toy. It mattered not that the technology was flawed, resulting in multiple cases of crashes, injury, and death once released to the public, but rather that Elon's dream of a "driverless vehicle" was brilliant, enviable, and appealing to all who watched him present.

Thanks to the mercurial talents of Mr. Musk, Tesla Inc.'s (TSLA:NASDAQ) stock price moved to the highest market cap in history for a brief time, all because of the illusion that the presentation was legitimate. The tactics of Jobs and Musk were masterful in advancing shareholder values, which is precisely the role of the CEO of all public companies in the year 2024.

Since failure to do so has resulted in on-the-spot termination and public humiliation, CEOs will now stop at nothing to avoid that demise. Just as the many dozens of shareholders that have followed Fred around for over 30 years, grateful as hell for the enrichment he brought, it all happened as a function of a backhoe, yellow vests, and a used tin shack, tactics far less refined but no less impactive than the high-tech gadgetry used today.

The junior miners could take lessons from their geriatric forefathers who mastered the art of "selling dreams" rather than constantly trying to shed the unsightly image of "a hole in the ground with a liar at the top." After all, this is 2024.

Gold

After beginning the week with three strong advances, the gold market gave back all but $16.20 of the advance as it sold off hard on Thursday and Friday into year-end portfolio rebalancing and realignment.

As I wrote about last week, there are few portfolio managers who want their customers to see a year-end statement including any of those underperforming, carbon-creating, planet-warming gold mining stocks in their portfolios despite the fact that gold is outperforming both the S&P 500 and silver on a year-to-date basis.

However, judging from the action in the gold and silver miners, the HUI is up a mere 22.39%, completely abandoning its traditional role as the preferred leveraged bet on gold prices.

Portfolio managers the world over have rejected the miners in favor of technology, and why shouldn't they? One of the best mining companies on the planet is Tesla Inc. (TSLA:NASDAQ), sporting a return on capital of 16.53%. BHP Billiton Ltd. (BHP:NYSE; BHPLF:OTCPK) carries a 13.96% ROC, while gold mining rockstar Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) is at 13.10%.

By contrast, Newmont Corp. (NEM:NYSE) is at 4.42% (negative 4.48% return on equity), while Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) sports a ROC of 6.64% and a ROE of 7.35%. That is little solace when one considers that NEM is the largest weighting in both the HUI:US Index and the GDX:US. It is little wonder that they cannot seem to get out of their own way with NEM smelling up the place.

Forgive the repetitious nature of my sermonizing, but gold and silver, and especially the miners, are going to be under pressure right through to the last day of tax-loss harvesting, which is December 30. I think the lows are going to be in by the end of next week, but if this post-election scenario does a rinse-and-repeat of the last Trump victory, gold and silver should be hitting their selling climaxes next week unless the last two sessions did the trick.

I am a card-carrying bull on gold and copper going into 2025, and while the world is collectively turning tail on the electrification trade where three dominant "green" metals — uranium, lithium, and copper — dominate the demand picture for the balance of the decade, the Trumpsters out there are trumpeting the arrival of a new paradigm with far less regulation and far greater appreciation for conventional energy sources like oil and gas and coal. Uranium remains high on the list for the Trump policy shifts, but where I see risks for copper is not in the abandonment of the EV cycle and the rejection of renewables as sources of clean energy.

For example, with over 50 new nuclear reactors under construction in China, the increase in electricity flowing forth from those new reactors is going to need a transmission system, and that system will require massive amounts of copper wiring to handle the added load. This has nothing to do with the electrification movement or demand for renewables.

The risk for copper lies in the establishment (or not) of tariffs by the Trump administration, especially if it gets an equal and opposite reaction from traditional American trading partners, of which Canada is numero uno. If the world over decides to repeat the 1930 Smoot-Hawley Tariff Act and its reprisals, world trade will contract sharply, as happened in the 1930-1933 period when it declined by approximately 66%.

Unemployment in the U.S. increased by over 600% in the same time frame, and industrial production fell by nearly 50%. Therein lies the risk for copper, but when one assesses the likelihood of Trump policy moves being made while ignoring the lessons of the 1930s, one is forced to conclude that all this "tariff talk" is more of a negotiating tactic falling directly into the category of "Trump bluster," a tactic well-covered in his book "The Art of the Deal."

Regardless of the copper outlook, I have no such fears for gold as demand is squarely centered in the Far East and independent of the machinations of the new American leadership. The Russians, the Chinese, and most of the Middle East will continue to hoard gold (and, to a lesser degree, silver) while moving to disengage from the U.S.-controlled SWIFT payment system, another bloc of nations caught in the Trump crosshairs of tariff threats. How he can be openly supportive of the cryptocurrency movement that promotes its usage as a replacement for the U.S. dollar while lambasting the BRICS group for trying to create a replacement for the U.S. dollar as the world's reserve currency is a contradiction of the highest order.

At the end of the day, both Trump and Fed Chairman Powell agree that the only way to solve impending doom brought about by out-of-control debt and deficits is through internal growth, but the problem remains whether they are referring to economic growth or monetary growth because the world is not going to let them "print away" the debt by uncontrolled monetary debasement so the alternative cannot include tariffs or mass deportation of the American labor force, illegally domiciled or otherwise. Tariffs are a tax, and taxes are inflationary, and that is one development that the average American worker will not accept.

As we head into 2025, the gold miners are cheap beyond all recognition, and if the portfolio managers want to throw them overboard, I would (and will) stand in there and accumulate Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) rather than the HUI:US or GDX:US where unwanted exposure to Newmont and Barrick torpedoes the outcome. AEM is the best-managed of all gold mining entities, while Freeport-McMoRan Inc. (FCX:NYSE) is the ideal home for those wanting the one-two punch of copper gold for 2025.

Stocks

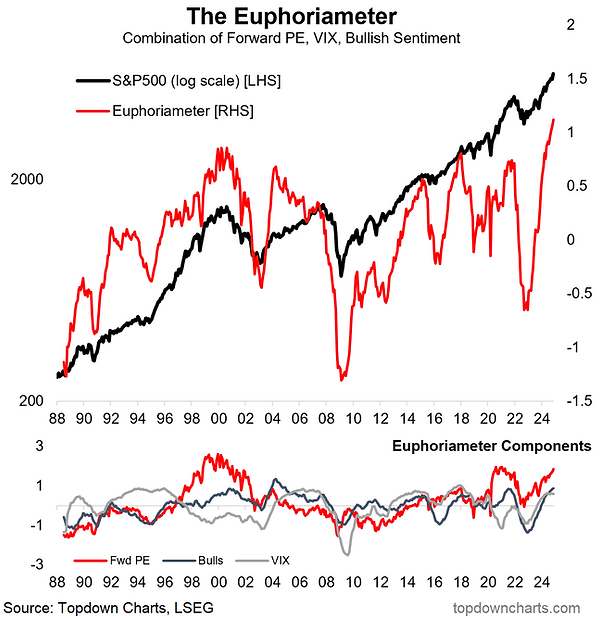

Thirty-six years ago, someone invented the "Euphoriameter," a tool used to determine the degree to which sentiment has moved to extremes that could only result in reversals. In that time frame, using forward P/E's, bullish sentiment and the VIX as inputs, there has never been a reading as high as the one we are getting since the election.

It is now higher than just before the dotcom crash of 2001-2003, higher than the peak that preceded the 2008-2009 GFC crash, and higher than the top in February 2020 just before the pandemic arrived, causing a huge but very brief crash rescued and reversed by unprecedented monetary and fiscal stimulus that resulted in a 9% inflation rate by June 2022. Combining that with the Buffett Indicator and the action in risk vehicles like end-of-day option buying and risk barometer Bitcoin above $100,000, you have the ultimate recipe for a sharp reversal of fortune for what appears to be an army of complacent bulls all thoroughly convinced that stocks are the only place to be in 2025 and beyond.

To wit, now that they have the ultimate warrior in Donald Trump, whose personal scorecard includes the S&P 500 along with his golf handicap, these new legions of option-buying, crypto-worshipping speculators are being led by the nose directly into the line of fire of mean regression and P/E repression thanks largely to the steps being proposed by the Trump election campaign.

Even if Trump elects to forego the tariff malarkey and instead simply concentrates on deregulation of the banking system as well as opening up Federal lands for oil & gas exploration and development, it will not be sufficient to alter the debilitating impact of reducing (if not eliminating) the government spending that has largely kept the U.S. economy afloat since the COVID CRASH. The fiscal stimulus of the past four years has been the driver of the American economy, including the unemployment numbers, where fiscal programs have played a significant role.

In my opinion, this is a "Be careful what you wished for" moment for the bulls, and I am moving toward a fully-hedged position using SPY:US and QQQ:US long-dated put options as well as the VIX:US and UVIX:US as proxies for portfolio protection.

I do not expect the markets to make it through Q1/2025 without a meaningful drawdown, the onset of which is difficult to predict because it will be concomitant with a sudden disillusionment with the MAGA narrative.

Safest Trade in the Junior Space

I believe that the safest trade in the junior space going into year-end is Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB), which has in recent days come under pressure due to year-end tax-loss harvesting and portfolio rebalancing but also because for many investors in this name, the "shelf life" or "Sell by date" has expired.

This is what happens to great little companies that fail to gather any degree of price performance because the new breed of investor cares not a whit about "value-per-ounce" or "jurisdictional safety." They only care about how the investment is affecting their profit-and-loss statement, and GTCH/GGLDF has been unable to convince the markets that their Fondaway Canyon Gold Project is going to be rerated by analysts and investors alike. So, they sell, and I buy because the upcoming PEA in January is going to reveal the economics that lay in store for the project, and my speculation is that it is going to arrive as a "robust" PEA that will be ever more "robust" once they resume drilling next spring.

The delicately wrapped gift under the Hannukah Bush this year is going to be GTCH/GGLDF on the expectation that the recently-appointed IR firm, Capital Markets Advisory, under the tutelage and direction of seasoned veteran Karen Mate, will take the PEA and use it as a calling card to the vast list of high net worth and institutional investors that populate her database. Many investors have discounted that corporate development from last October, but not this investor.

As Karen said to me after agreeing to take Getchell on as a new client, "All this needs is a new set of eyes." She is absolutely right about that assumption. (Note: Her campaign was intended to commence in November with the expected arrival of the PEA but had to be postponed due to the machinery issues that cropped up unexpectedly in November.)

As a contrarian trade and as my 2024 Christmas present,

- Buy Getchell Gold Corp. at CA$0.135 limit / US$0.095

- Target: CA$0.30 / US$0.21 by end-of-January

| Want to be the first to know about interesting Gold, Critical Metals, Silver, Base Metals, Uranium, Battery Metals, Oil & Gas - Exploration & Production, Cobalt / Lithium / Manganese and Cryptocurrency / Blockchain investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp., Agnico Eagle Mines Ltd., and Barrick Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.