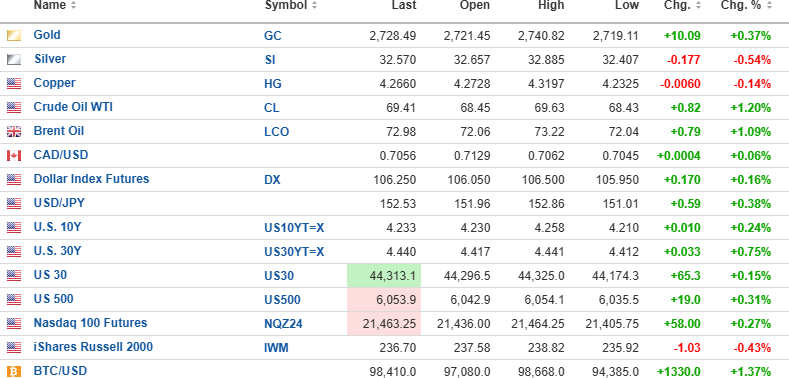

USD index futures are up 0.16% to 106.250 this morning, with the 10-year yield (+0.24%) up 0.010 to 4.233% and the 30-year yield (+0.75%) up 0.033 to 4.440%.

Metals are mixed with gold (+0.37%) up $10.09 to $2,728.49, silver (-0.54%) down 0.177 to $32.570, and copper (-0.14%) down $0.0060 to $4.2660.

Oil (+1.20%) is up $0.82 to $69.41/bbl.

Stock index futures are higher, with the DJIA (+0.15%) up 65.30 points, the S&P (+0.31%) up 19.0 points, and the NASDAQ (+0.27%) up 58.00. Risk barometer Bitcoin is up 1.37% to $98,410.

CPI

The Consumer Price Index came in at 0.3% (as expected), with the core (ex-food & energy) at 0.3%, so CPI can be seen as a "nothing burger," with stock futures rallying slightly higher and bond yields moving slightly lower but still up on the morning session.

Volatility

The VIX is lower pre-opening by .42 to 13.76 after hitting 14.43 yesterday. UVIX:US, to which I added another 5,000 shares yesterday at $3.15, is called a $0.13 lower at $3.05. I want to see how the market reacts to this morning's CPI with a view to adding to the VIX January $10 calls under $6.00, where I bought the first tranche.

The VIX December $10 calls are going to be rolled into January in the next seven trading sessions, so if the rebalancing effect is going to bring bonds higher and stocks lower, it must present itself on a day like today with stock bid higher on the opening.

Gold

Gold prices continue to grind ahead and are now almost $200/ounce off the post-election reactionary lows as Asian buying continues to absorb the Western selling that has accompanied the Trump victory. In 2016, it took until mid-December for gold to bottom, but that was due to a huge shock from the Trump victory, while this year, markets had anticipated the win. I also believe that the "smart money" recognizes the futility of the Trump campaign promises and is looking out to 2025 and possible turmoil if he tries to implement them.

However, I own gold through the junior developers and explorers primarily through my shares, warrants, and debentures on Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) and through copper-gold projects being developed or explored by Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) and Vortex Metals Inc. (VMSSF:OTCMKTS; VMS:TSX; DM8:FSE).

The Senior and Junior Gold Miners (GSX:US / GDXJ:US) continue to lag the gold price and are approximately 15% below the 2024 high versus gold, which is now a mere 3.2% below the all-time last seen on October 30.

Are the miners an omen of lower gold prices ahead? Can silver's underperformance be foreboding of further weakness in 2025?

It remains to be seen on both counts but what it means to me is that I refrain from adding to positions and am sidelined on any GLD:US or SLV:US leveraged or derivative trades.

| Want to be the first to know about interesting Gold, Silver, Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp., Fitzroy Minerals Inc., and Vortex Metals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.