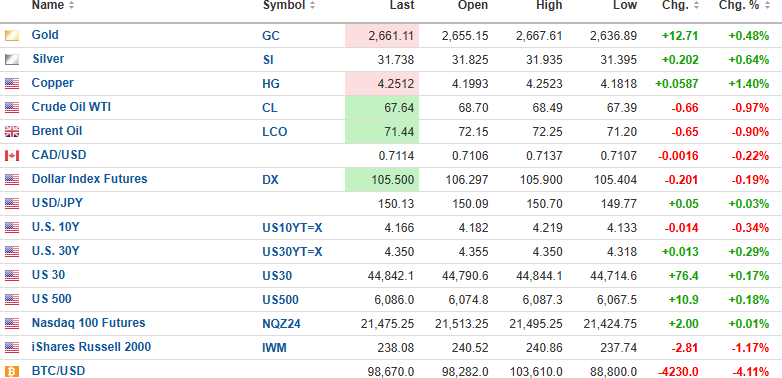

USD Index futures are down (-0.201%) this morning to 105.500 with the 10-yr. yield (-0.34%) down and the 30-yr. yield (+0.29%) up to 4.166% and 4.350%, respectively.

Gold (+0.48%), silver (+0.64%), and copper (-1.40%) are higher at $2,661.11, $31.738, and $4.512, respectively.

Stock index futures are all higher, with the DJIA (+0.17%) up 76.4 points, the S&P 500 (-0.18%) up 10.9 points, and the NASDAQ (+0.01%) off 2.00 points.

Risk barometer Bitcoin (-4.11%) is lower by $4,230, giving back the magical century mark to $98,670.

NFP ("Jobs") Report

The employment report came in pretty much "as expected" at 227,000 new jobs created versus expected 214,000, with the unemployment rate at 4.2% versus 4.1%.

Stocks reversed earlier declines and are now trending higher, with Bitcoin losing the $100,000 level and now down $5,300 from yesterday's all-time high.

TLT:US

The good news is that bond yields are declining with the TLT:US now called to open at $94.40, with the TLT December $90 calls opening north of $5.00. The combination of these calls and the SPY January $600 puts cost me $10.00 on Wednesday but closed last night at $10.93. I expect it to weaken on the opening, and for those looking to enter this trade, next week should see the start of the rebalancing with downside pressure on stocks and upside pressure on bonds as portfolios get realigned to the 60-40 equity/debt split.

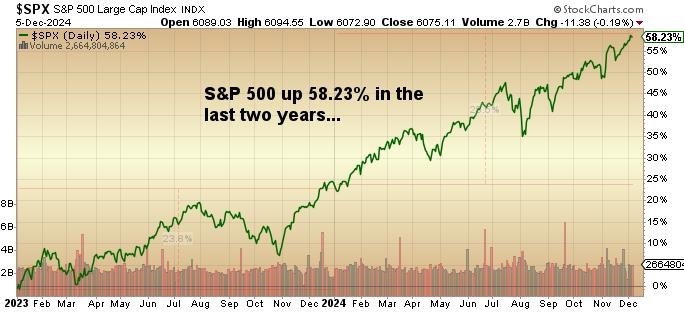

The danger in this market environment is complacency. Every portfolio manager I watch on BNN or CNBC is calling for another big year for 2025, which, while certainly possible, would be a bit of an outlier, especially after two consecutive years with gains exceeding 58%.

The average annual gain in any given year for equities is approximately 8%, so I think the safer bet is to assume that the first year of Trump 2.0 will not be as euphoric as the pundits are forecasting.

| Want to be the first to know about interesting Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.