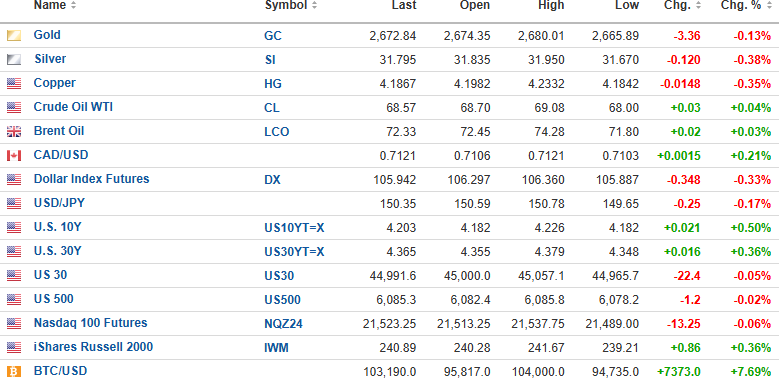

USD Index futures are down (-0.33%) this morning with the 10-yr. yield (+0.50%) and 30-yr. yield (+0.36%) both up to 4.203% and 4.4365% respectively.

Gold (-0.13%), silver (-0.38%), and copper (-0.35%) are again lower to $2,672.84, $31.795, and $4.1867, respectively.

Stock index futures are all slightly lower, with the DJIA (-0.05%) down 22.4 points, the S&P 500 (-0.02%) down 17.5 points, and the NASDAQ (+0.06%) off 23.2 points. Risk barometer Bitcoin (+7.69%) has exploded higher by $7,373, surpassing the magical century mark to $103,190.

Stocks

In the 80s, I took a three-year Securities Industry Association ("SIA") course at the highly prestigious Wharton School of Finance, which is the business school for the University of Pennsylvania, which in turn is located in Philadelphia. One of the more interesting courses was taught by Professor Jeremy Seigel, the perma-bull often quoted on CNBC, who was the first guest commentator to ever utter the "Dow 10,000" mantra back when it was trading just over 1,000.

During one of the classes, he described a phenomenon that occurs quite frequently between the middle of December and the middle of January that is related to tax-loss selling, liquidity differentials between large cap and small cap securities, and the year-end rebalancing.

Using the weighted S&P 500 ETF (SPY:US) as the proxy for U.S. large-cap stocks and the Russell 2000 ETF (IWM:US) as the proxy for small-cap stocks, there is a tendency for small caps to come under pressure by the middle of December due to both rebalancing and tax-loss selling and it usually more intense than in the large-cap space due to the massive pools of liquidity favoring large caps through the passive investing funds. However, once the tax-loss selling and portfolio rebalancing are over, the small caps usually have a sharp rally, as a submerged beach ball springs to the surface once released.

In the days when I traded futures, a similar trade would be "Long March Value Line / Short March S&P 500, where the Value Line Composite Index was comprised of 1,681 companies listed on four major North American exchanges.

This year, since the S&P has been a serious outperformer, I suspect that tax-loss selling will be less than its small-cap Russell 2000 counterpart, and since there are far greater liquidity pools in the large-cap stocks versus the small cap stocks, I am going to target a trade set-up for late next week:

In the GGMA 2024 Trading Account"

- Sell 80 SPY:US

- Buy 200 IWM:US

Differential: $400

(I.E. Sell the SPY:US at $600 buy the IWM:US at $200.)

The optimum way to play this trade is through the derivatives markets:

- Buy 50 SPY January $590 puts at $3.75

- Buy 50 IWM January $245 calls at $5.00 Net debit: $8.75

(If by late next week, the markets have moved either sharply higher or lower, I will send out an email with different instructions.)

The strategy here is to see a sharp rally in the depressed small cap index into the middle of January, where they outperform the large caps due to the "beach ball effect." Also up for consideration is that many investors are sitting on massive capital gains from the large caps, and once we get past the last day for tax-loss selling (which is December 30), there could be a torrent of profit taking into the last two trading sessions and into the first few days of 2025.

This is also going to impact the "First Five Days ("FFD")" indicator, which is part of the larger "January Barometer" which uses the "Santa Claus Rally ("SCR")" period (last five trading days of 2024 plus first two trading days of 2025) as barometers for the month. As we discussed last December, the "January Barometer" has an 83.6% accuracy ratio for predicting the market's yearly performance, which underscores the importance of tracking the SCR and FFD periods.

Bitcoin

I have no right to be critical of Bitcoin or any other cryptocurrency creations that have replaced gold and silver as the new modern protectors of the purchasing power of one's savings. Nonetheless, thanks to another crypto-friendly appointment by the President-elect, the crypto cult has taken Bitcoin above $100,000, which has many of the traditional purists up in arms over the obvious manipulation that has it acting like a Vancouver penny stock. I have no opinion other than a technical observation, which you will see below.

Bitcoin may or may not be a "Ponzi scheme," but it is here to stay, and the sooner investors can treat it like "just another trading vehicle," the easier it will be on the nerves.

I will not buy Bitcoin, but for those being lured by the legions of disciples out there all wagging their fingers at Peter Schiff and Jamie Dimon (two noted crypto-haters) as the narcotic known as "FOMO" calls out your names, it has been on a vertical rope since the U.S. election results and it now sporting an RSI of over 70 for the first time since Feb-Mar 2024 while there are bearish crossovers in both MACD and TRIX as MFI is coming off overbought conditions. It does not mean it has to crash, but I see a whipsaw reversal waiting to happen and would avoid it like a swim in the Don River.

| Want to be the first to know about interesting Cryptocurrency / Blockchain and Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.