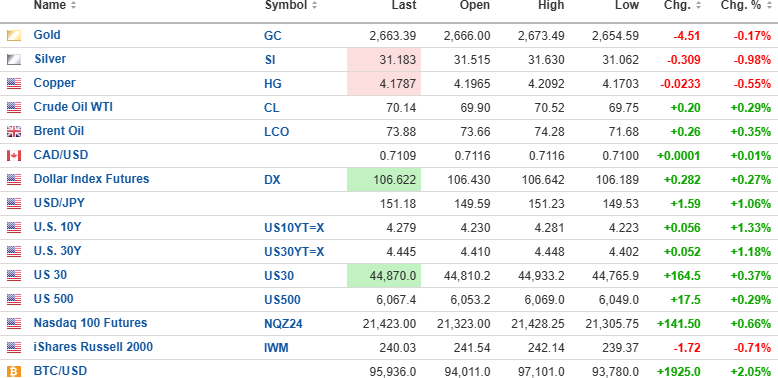

USD Index futures are up (+0.27%) this morning, with the 10-year yield (+1.33%) and 30-year yield (+1.18%) both up to 4.279% and 4.445%, respectively.

Gold (-0.17%), silver (-0.98%), and copper (-0.55%) are backing off to $2,663.39, $31.183, and $4.1787 respectively.

Stock index futures are all higher with the DJIA (+0.37%) 164 points, the S&P 500 (+0.29%) 17.5 points, and the NASDAQ (+0.66%) 141.50 points.

Risk barometer Bitcoin (+2.05%) is up $1,925 to $95,936.

Stocks

December is typically stronger during the first week of trading, with increased volatility during the second and third weeks as mutual fund distributions and rebalancing bring in selling pressure. This year, with the S&P 500 up 26.84% YTD, the rebalancing could be particularly impactful due to the presence of these monolithic generalist finds that adhere to the 60% equities / 40% bonds portfolio structure.

These funds represent trillions of dollars and include pension funds, sovereign wealth funds, and hedge funds that are all now sitting on portfolios that are more like 80% equities / 20% bonds due to the superior performance of stocks relative to bonds since October.

In fact, since the Fed slashed the Fed Funds rate by 50 basis points on September 18, yields on the 10-year U.S. Treasury bond have jumped 67 basis points or 0.67%.

The 20-year U.S. bond ETF (TLT:US) goes into the rebalancing period down 2.4% YTD versus the 26.84% increase in the S&P 500, setting up a relatively large amount of equity that might need to be moved to bonds.

If a 60-40 portfolio manager was managing a billion dollars last January, the $600 million allocated to equities is now worth $761 million, while the $400 million allocated to bonds is now worth $390.4 million. Total portfolio goes into year-end with a value of $1.1514 billion, and therefore, to be properly rebalanced, he needs to trim the equity portion down to $690.8 million and increase the bond portion to $460.6 million.

If you take the percentage of equity that will need to be sold as part of the 2024 rebalancing effort, it is 21% of all stocks held in the portfolio. Multiplying that by the trillions of dollars globally, all following the S&P and all using the 60-40 portfolio approach, that is a mammoth amount of selling pressure in a market already egregiously overvalued and approaching outright "overbought."

Strategy

Using the upcoming rebalancing period as a premise for action, I am going to be long the TLT:US by Friday and short the SPY:US by way of call options on the former and put options on the latter. I am assuming that most portfolios are tracking the S&P but I might also split the put options between the SPY:US and the QQQ:US in order to be short more technology, given its stellar performance in 2024.

For those subscribers that do not use options, you can use the SDS:US (ProShares Ultra Short S&P 500 (ARCA)) or the SQQQ:US (ProShares Trust (NSD) as proxies for puts.

In the GGMA 2024 Trading Account:

- Buy 50 calls TLT January $90 at $4.00

- Buy 50 puts SPY January $600 at 6.00 and/or 50 puts QQQ January $510 @ $6.50

For non-options traders:

- Buy 500 TLT:US at $92.50

- Buy 1,000 SDS:US at $18.75 and/or 1,000 SQQQ:US at $30

This trade should feel the full force of the rebalancing efforts by December 20, which is 16 days away. For those leery of being short stocks into year-end due to the incredible momentum displayed each and every session since the big Fed rate cut in September, then just use the TLT:US on the assumption that a huge amount of money currently in equities will be shifted to bonds and that will certainly drive yields lower and bond prices higher.

| Want to be the first to know about interesting Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.