If ever a mining company can be said to be "in the right place at the right time" Westward Gold Inc. (WG:CSE; WGLIF:OTCMKTS) takes the cake.

The company has consolidated a very high potential Carlin style land package in the heart of the Battle Mountain — Eureka / Cortez Gold Trend in Nevada with a crack team of very experienced and accomplished geologists who believe they have defined the location of the "Motherlode" of the project — and this at a time when gold is in a robust and accelerating bull market.

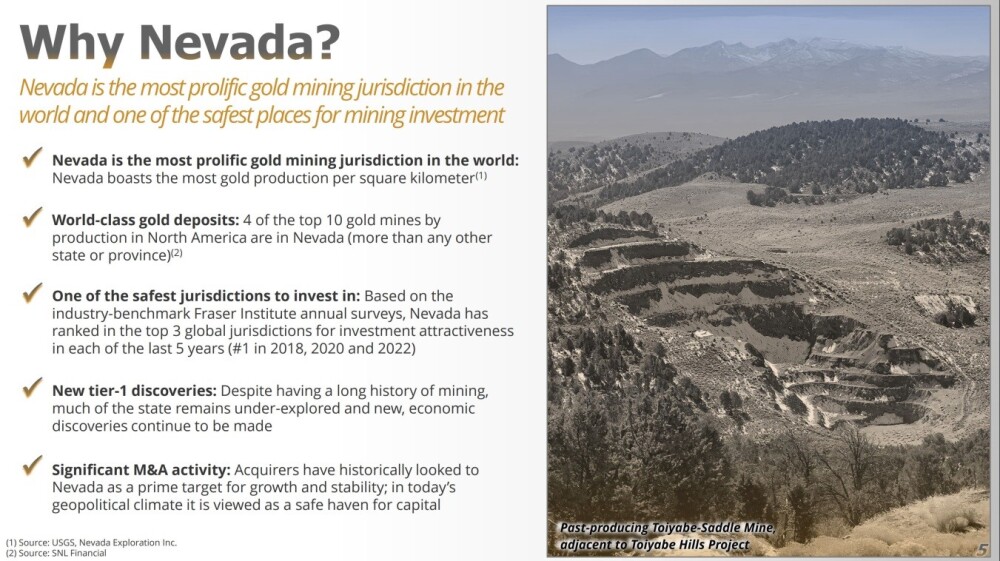

Nevada is a very good place to look for gold.

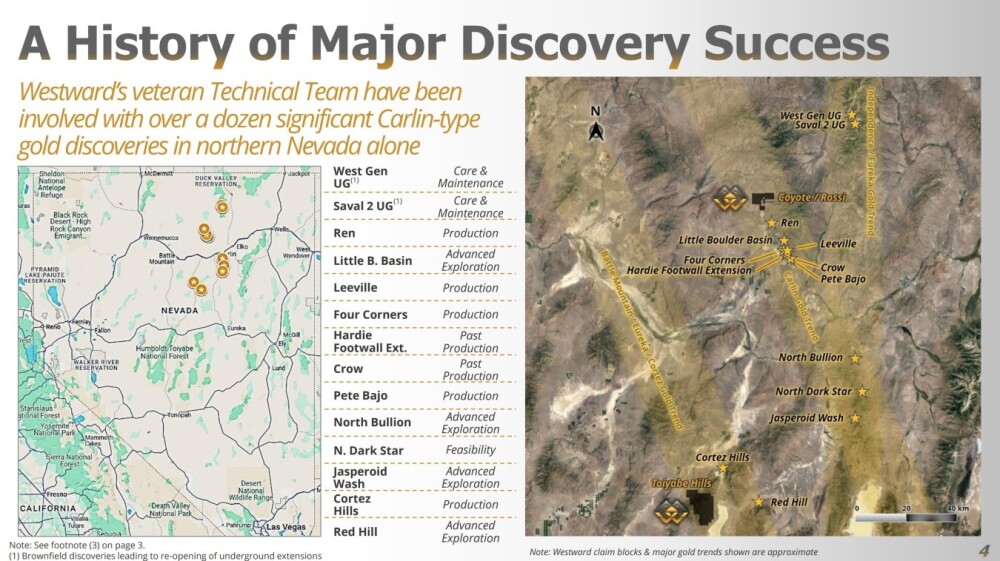

Westward's technical team has a history of major discovery successes.

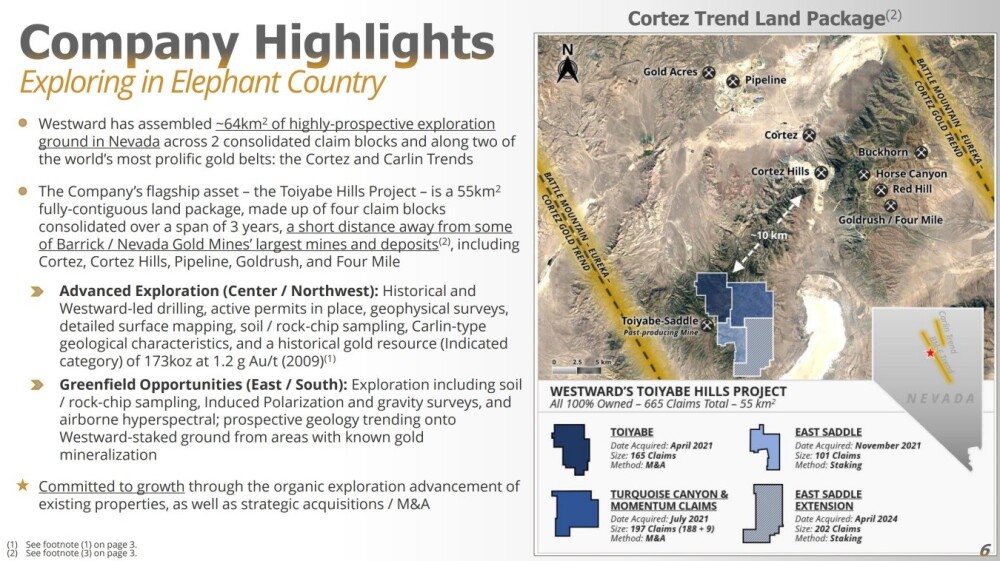

An advantage of the 5,500-hectare land package, which is comprised of three properties (four if you add in the East Saddle extension acquired in April of this year) — Toiyabe, Turquoise Canyon, and East Saddle — is that they are contiguous, meaning that they butt each other and thus for practical purposes can be considered to be one property.

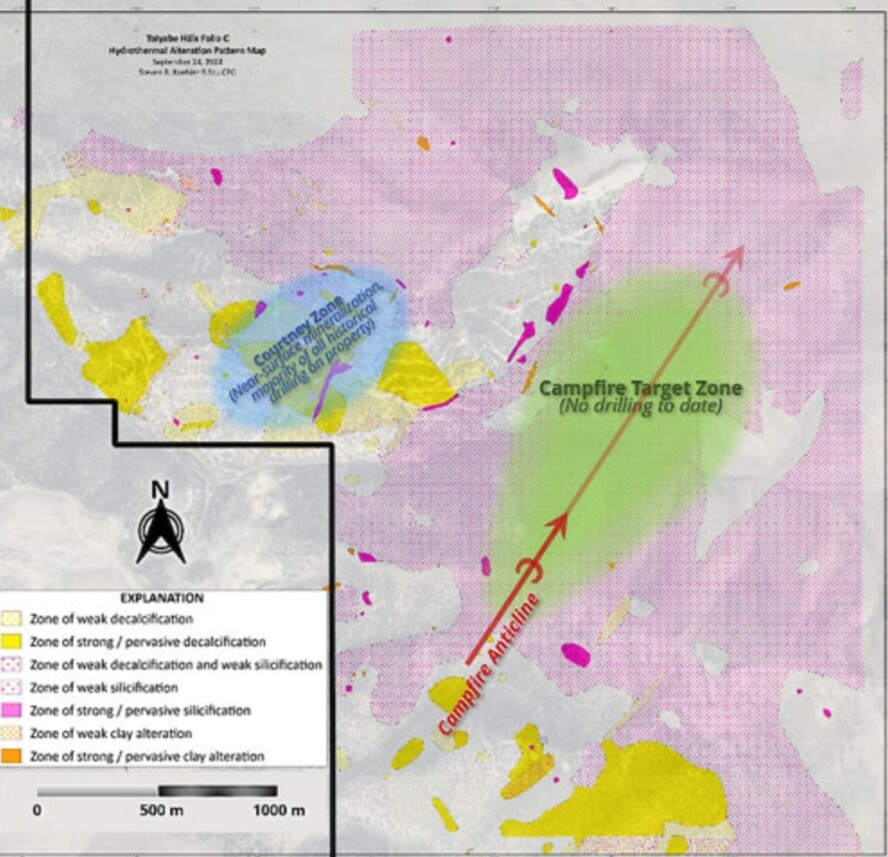

This is very important because Westward's geological team has determined that the Motherlode lies in the so-called Campfire Target that straddles the three properties. This is why it has never been drilled — it straddled three properties with different owners.

The solution? Buy or gain control of all three (four) and then you can go ahead and drill it without reservation (no pun intended), and that is exactly what they plan to do.

The map on the following slide from the company's November 2024 investor deck shows the land areas comprising the property and how they fit together neatly to form one large project.

It is certainly helpful that the company has acquired and consolidated these contiguous properties given that its highly experienced geological team has determined that the motherlode is situated in the Campfire target, which straddles their boundaries.

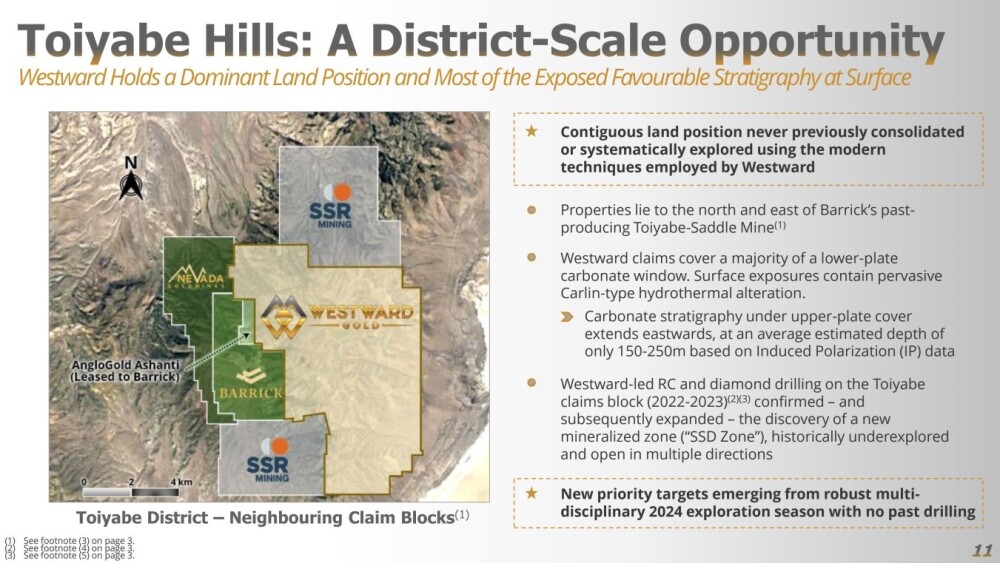

Toiyabe Hills is a district scale project and on the following slide we can see how it is the dominant land position in the area.

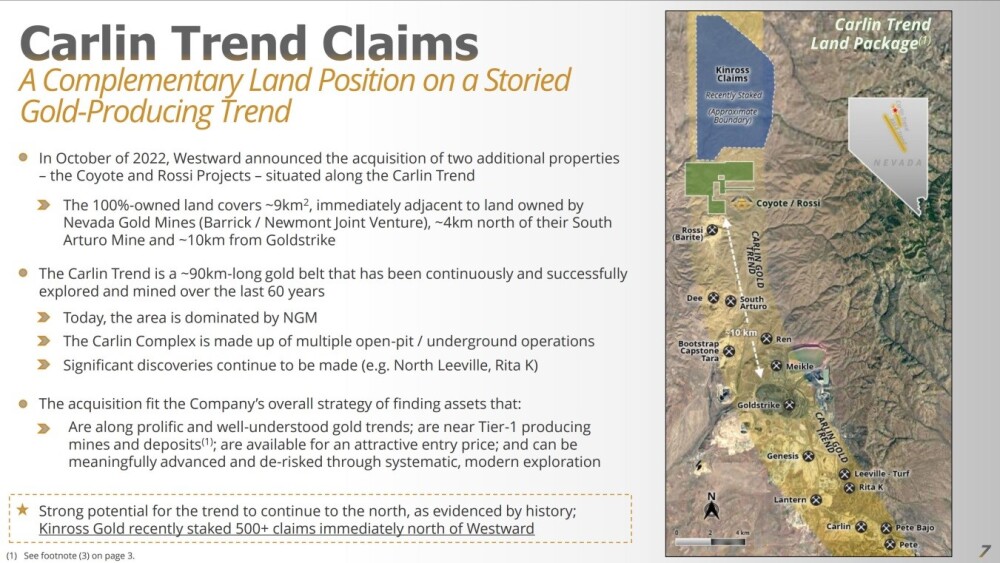

In addition to the Toiyabe Hills Project Westward, also acquired in 2022, the Coyote and Rossi projects further up the Carlin Trend, which are 100% owned by the company and 9 square km in extent.

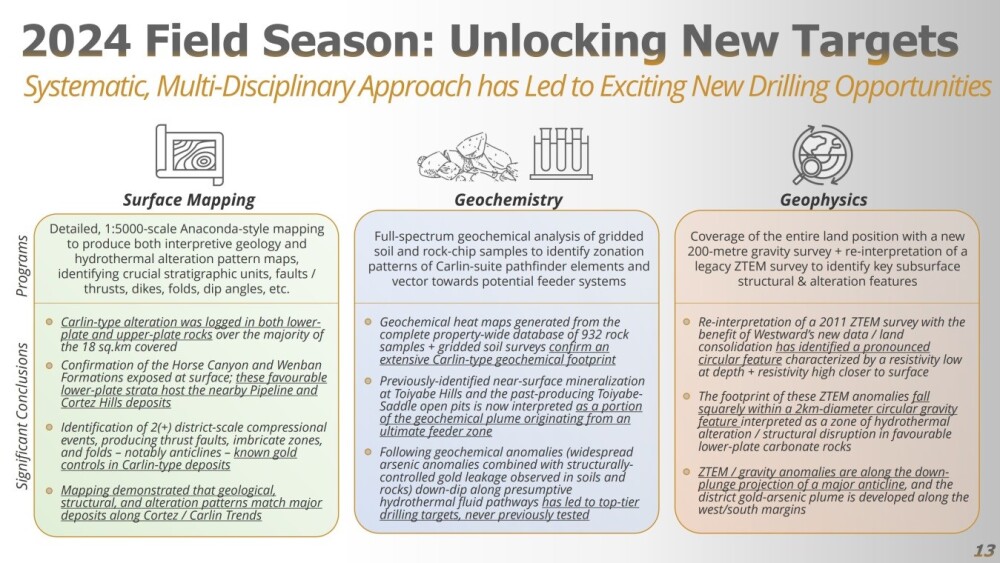

The 2024 Field Season has been unlocking new targets.

See the company's investor deck for more details on the geology of the properties.

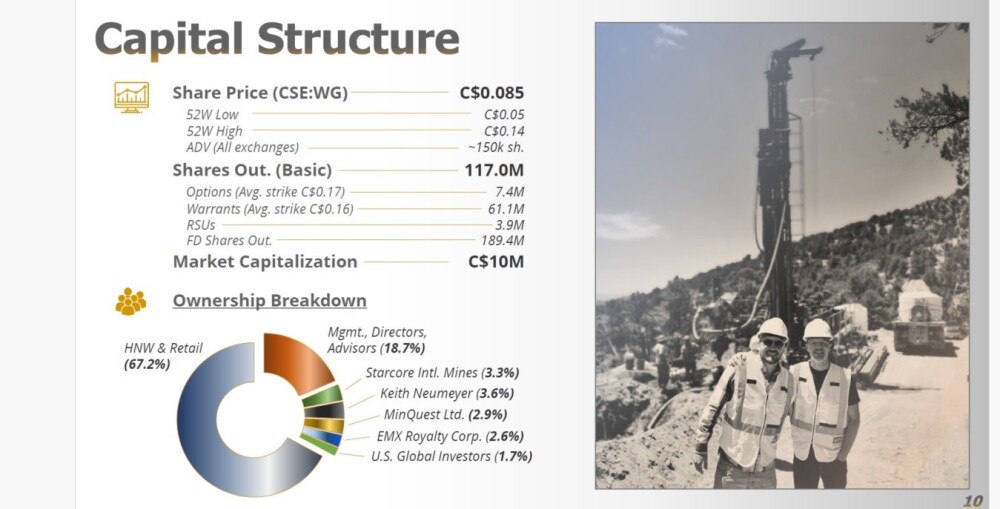

The last slide from the deck shows the capitalization of the company. On it we see that of the 117 million shares out (189.4 million fully diluted), Management and large stakeholders have about 34% of them with the balance of 66% being in the hands of HNW (high net worth) individuals and retail investors.

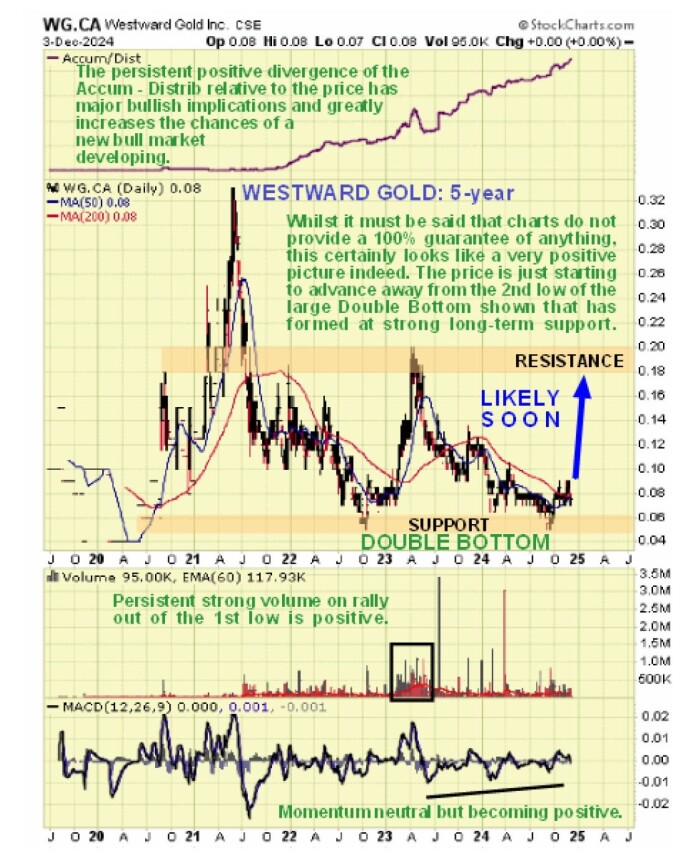

The charts for Westward Gold present a classic strongly bullish setup, and while even the most promising setup doesn't always deliver simply because, on occasion, unexpected developments can "come out of left field," what they certainly do indicate is a high probability of a positive outcome — that is to say, in this case, a major bull market getting underway soon.

On the 5-year chart, we can see how, after peaking at about CA$0.33 in 2021, Westward went into a severe bear market that took it all the way down to just 5 cents by the time it hit bottom in the Fall of 2022. Thereafter a giant Double Bottom base pattern formed with the price retracing back to the 5 cent level again as recently as this past September.

What is remarkable on this chart is the steady upward march of the Accumulation line that began as far back as late 2021. with it continuing to make new highs despite the price plumbing the lows.

While this doesn't guarantee that the stock will perform — it hasn't had any positive effect on the price so far — it is a sign of internal strength despite the low price that increases the probability of a bull market gaining traction and the more pronounced this positive divergence, the more likely it is that a new bull market will begin, and self-evidently it is very pronounced here. The good news for investors thinking of buying the stock here is that there is still everything to go for because the stock is still not far off the lows of the Double Bottom.

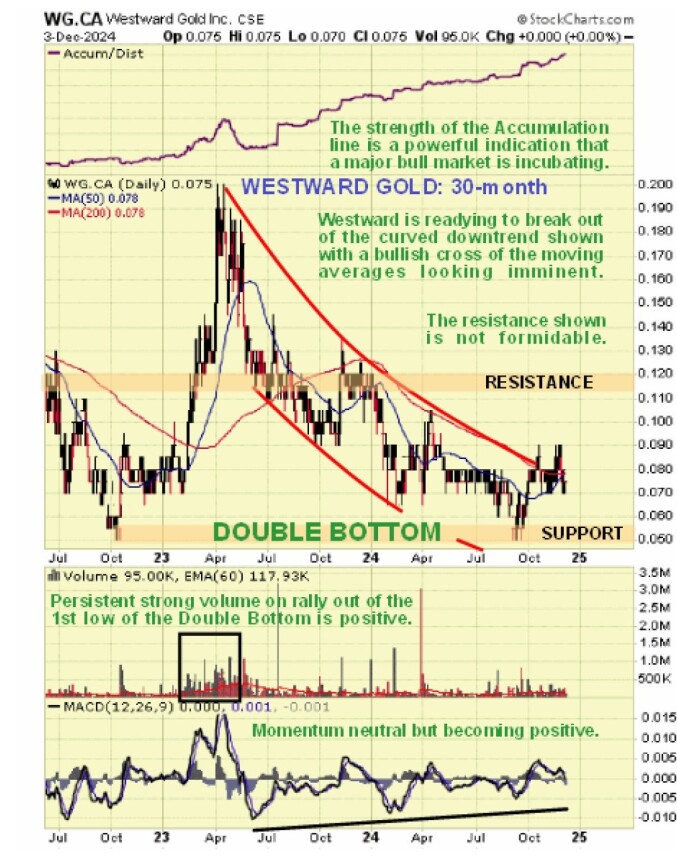

Zooming in via the 30-month chart enables us to see that the sharp rally out of the first low of the Double Bottom was followed by a reversal into the curved downtrend shown that dragged on for 17 months and brought the price back down to Double Bottom at 5 cents in September with the earlier low.

We can also see on this chart that downside momentum (MACD) has been steadily dropping out all this year to the point that it is on the point of turning positive. It is thus interesting to observe that the price has been attempting to break out of the downtrend in recent weeks and is on the point of doing it with its chances of succeeding increasing as a bullish cross of the moving averages looks imminent. The first target, if it gets moving from here as expected, is the band of resistance approaching 12 cents.

Zooming in even more using a 6-month chart, I noticed several additional points to observe. The first is that in recent weeks, the price appears to have been consolidating its advance out of the September lows in a rectangular trading range, with almost all of the volume since mid-September being upside volume that has driven the Accumulation line higher and higher.

This is very bullish and suggests that the pattern will resolve soon with another upleg. The minor reaction of the past week or two has brought it back to a very good entry point near to the support at the lower boundary of the range and renewed advance from here will quickly result in a cross of the moving averages which are already swinging into bullish alignment. So all in all, this looks like a very positive setup indeed, on all three of the charts that we have looked at here.

The unequivocal conclusion is that Westward Gold is rated a Strong Buy here for all time horizons.

Westward Gold's website.

Westward Gold Inc. (WG:CSE; WGLIF:OTCMKTS) closed for trading at CA$0.075, US$0.55 on December 3, 2024.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, $3,000.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.