Lithium Ionic Corp. (LTH:TSX.V; LTHCF:OTCQX; H3N:FSE) received a letter of interest (LOI) from the Export-Import Bank of the United States (EXIM) proposing up to US$266 million (US$266M) in debt financing, which would cover initial capex of its feasibility study (FS)-stage Bandeira lithium project in Brazil, reported Clarus Securities Analyst Varun Arora in a Nov. 27 research note.

"We think securing up to 100% of the project capex in nondilutive financing with a U.S. government agency, a highly coveted strategic partner, is a big win for the project and the team," Arora wrote.

725% Return Potential

Lithium Ionic is trading now around CA$0.97 per share, at about a 70% discount to the August takeout valuation of neighbor Latin Resources Limited, for CA$509M by Pilbara Minerals Ltd. (PLS:ASX), noted Arora. Lithium Ionic's valuation, however, is likely to rise for a few reasons.

"Given Bandeira's robust economics, potentially fully funded status, current cash balance of about CA$30M, near-term milestones (including permitting potentially before year-end) and increasing mergers and acquisitions activity in the sector, we see a significant rerate opportunity for Lithium Ionic," Arora wrote.

Clarus' target on the Canadian lithium company is CA$8, suggesting a significant potential return for investors of 725%.

Lithium Ionic remains rated Speculative Buy.

Financing Likely to Happen

Bandeira aligns with EXIM's China and Transformational Export Program, or CTEP, the purpose of which is to help secure critical minerals and energy supply for the country, Arora wrote.

The LOI from the U.S. government's credit agency to Lithium Ionic "demonstrates Bandeira's strategic importance amidst a push from the U.S. to secure the supply of critical minerals," added the analyst. "Hence, while currently nonbinding, we see high likelihood that the debt funding will materialize given the geopolitical environment and a strong interest from the U.S. in securing critical minerals supply."

Arora described the financing as the final hurdle before Bandeira could be advanced to construction, and this LOI from EXIM derisks it. He noted that Lithium Ionic has a long time, 15 years, to repay the debt.

Also, noted Arora, the expressed interest in Bandeira from the U.S. Department of Defense's Southern Command and U.S. Department of State suggest there is a good potential for offtake agreements between Lithium Ionic and U.S. agencies, pertaining to future supply.

Project Could be Enhanced

Arora summarized the highlights of the 2024 Bandeira FS and pointed out elements offering "significant near-term upside."

The FS outlines a 14-year operation producing about 178,000 tons per year at a cost of US$444 per ton and an all-in sustaining cost of about US$600 per ton. The project would yield a net present value discounted at 8% (NPV8%) of US$1.3 billion (US$1.3B) and an internal rate of return of 40%. Payback would take 3.4 years.

About 5,000,000 tons (5 Mt) of Measured & Indicated resource could be added to Bandeira now, which would extend its life of mine by about three to four years and increase its NPV8% by 15–20% toward US$1.5B.

There is an Inferred near-surface resource of about 3–5 Mt within 200 meters of the FS-outlined mine, which should allow for mining at shallow levels with only minimal incremental capital development required.

Incorporating these resources into the mine plan early on could increase the grade in the first years and lead to greater early production and free cash flow.

Including both the M&I and Inferred resources mentioned would add 8–10 Mt, thereby increasing the mine life to 20-plus years and the NPV8% by about 40% toward US$1.7B.

Upside to Lithium Developer

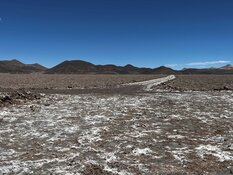

Arora discussed exploration upside to Lithium Ionic, at both Bandeira and Salinas. As for Bandeira, the resource there, now at about 42 Mt of 1.35% lithium dioxide, is still growing. Bandeira accounts for only 1% of the company's 17,000-hectare land package but about 70% of its global resource of about 60 Mt, suggesting "massive upside from regional exploration," the analyst purported.

Regarding Salinas, summer 2024 drill results showed the Noe zone could nearly double the existing resource to about 30 Mt, from its current 14.8 Mt. (Pilbara's adjacent Colina project has a current 77.7 Mt resource.) Latin Resources' acquisition metric implies a valuation of about CA$75M for just the current 15 Mt resource at Salinas alone, noted the analyst. Pilbara's takeout of Latin Resources "has massively enhanced Salinas' strategic value," Arora wrote.

Further, there is potential to consolidate Colina and Salinas down the line, given that about 8–10 Mt of the Colina resource may not be mineable because it is located on the claim boundary with Salinas.

"Consolidating the projects would avoid any sterilization at Colina, while further growing the mineable inventory and exploration upside with the addition of Salinas," Arora added.

Near-Term Catalysts

Lithium Ionic management expects to receive construction permit approval for Bandeira by year-end, which would put the company ahead of peer, Colina owner Pilbara, by 12–18 months with respect to time to first production. First production at Bandeira is anticipated sometime in late 2026 to early 2027.

Before the end of 2024, a resource update for Salinas is expected, too. In the meantime, investors should watch for an offtake agreement tied to Bandeira production.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |