Every year since the mid-80s, I have used the American Thanksgiving weekend to reflect back on the year of trading with a view to highlighting the moves that worked and lowlighting those that did not. In my trading arsenal, I normally use gold, volatility, stock index options, and junior resource stocks as my sectors of choice.

There was a time up until August 2020 that I traded in and out of the Senior and Junior Gold Miners ETF's VanEck Gold Miners ETF (GDX:NYSEARCA:) and VanEck Junior Gold Miner ETF (GDXJ:NYSEArca), but after one of the best trades of my 45-year career — buying calls on the both of them on the exact day the miners bottomed on March 23, 2020, I have yet to re-visit them.

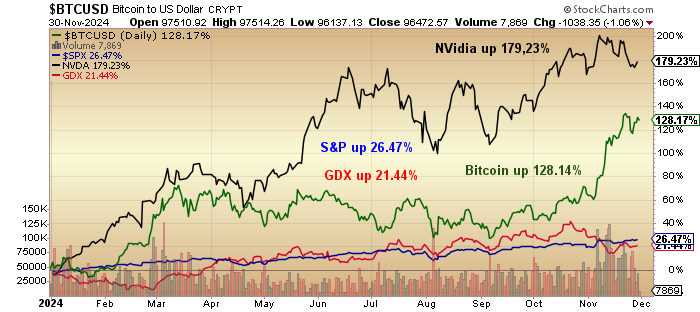

As the markets enter the home stretch of the calendar trading year, I can say with absolute accuracy that I never thought that I would see a neck-and-neck melt-up between the Nvidia Corp. (NVDA:NASDAQ) and Bitcoin ($BTC/USD) as they thunder toward the finish line. Being anchored in the fantasyland illusion that risks capital would once again return to the junior gold developers and explorers, many of my larger holdings continued all year to struggle against the competitive weight of crypto and artificial intelligence names.

The well-trodden path of explaining away the underperformance of the senior mining stocks (like Newmont Corp. (NEM:NYSE)) and Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) using the stellar performances of tech and crypto as the scapegoat is wearing exceedingly thin on portfolio managers the world over.

While Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) has been a rock star in 2024, up 57.64% and boxing the battered ears of two leaders, it is AEM's execution that has aided and abetted its journey to the top of the performance mountain within the senior gold miners sector. Alas, the index proxy for the junior gold explorers and developers — the TSX Venture Exchange — once the darling of choice for speculators throughout Europe and North America — has eked out an unremarkable 11.10% gain for the year with volumes a mere shadow of their former robust selves and financing activity relegated to just a handful of institutions and the odd major miner with the intestinal fortitude to "partner up" with even-odder cash injections.

It seems like it was only yesterday that Getchell Gold went into a last-minute overdrive to secure enough new funding to pay Canagold Resources (CCM:TSX) the final $1.6 million tranche in order to avoid losing their Fondaway Canyon project where even two big new high-grade gold zones discovered in 2022 failed to move the needle. It was my devout belief one year ago that since gold was going to hit my target price of $2,750 in 2024 (it was $2,089 at the time), such a sharp move to new highs would propel the value per ounce for all of the juniors seriously northward.

However, one year later, and very few of them have actually responded anywhere close to what was expected. Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) closed out the month up a mere two cents from its funding level of eleven months ago and seems to be living an orphan-like existence with lackluster volume and devoid of any sponsorship despite a revised resource estimate of 2.319 million ounces of relatively high-grade gold in Nevada, arguably the friendliest state in which to conduct mining operations in the U.S.

There have certainly been some exceptions in the form of American Eagle Gold Corp. (AE:TSXV; AMEGF:OTCQB) whose NAK discovery in B.C. has attracted the interest (and dollars) of Teck Resource Corp. as well as Hercules Metals Corp. (BADEF:OTCMKTS; BIG:TSXV) whose project in western Idaho has also garnered attention (and dollars) from Barrick Gold. Other notable engagements include Agnico partnering with Atex Resources (ATX:TSXV) and Rio Tinto funding Entree Resources (ETG:TSX), but by and large, the vast majority of the junior explorers are left to fend for themselves until they make a significant discovery which is problematic unless they have a source of funding in the way of a deep-pocketed gold bug (like Eric Sprott) or well-connected financial management which is rarely in the skillsets of the rockhounds that often run these juniors.

It is this challenging state of affairs for the juniors that serves as an illuminating backdrop for the funding accomplishments (and deal flow) for Fitzroy Minerals Inc. (FTZ:TSXV / FTZFF:US OTC QB) whose funding efforts as of last Friday were CA$5 million for 2024 and if they can close the most recent round announced last week before the end of December, they will have raised CA$7.5 million and about to embark upon three separate drill programs on their Chilean projects in early 2025.

Thus far for the year 2024, the highlights for me were, oddly enough, nothing to do with gold and silver or the junior developers or explorers (the exception being American Eagle) but more in the tracking of volatility. I was fortunate enough to have had a large position in the VIX call options and the UVIX:US in early August when the Japan "carry trade crash" took the VIX from $15 to $65 in less than a week and the UVIX:US from $5.50 to $19.97 in two trading sessions.

A couple of shorting ventures on Tesla Inc. (TSLA:NASDAQ) back in July worked out really well as the stock cratered from $271 to $182. I covered just before Elon roped his major shareholders into granting him the most obscene pay package in history, resulting in what can only be described as "classic Musk" as Elon finally moved back into "promoter mode," taking the stock to its highest level in two and a half years. Also high on the list were a number of trades in my favorite commodity producer on the planet — Freeport-McMoRan Inc. (FCX:NYSE) — whose execution remains near-flawless but whose share price follows the action in spot copper prices in a perfectly correlated manner. Twice I have taken profits in FCX above $52 after accumulating once under $40 and more recently in the $43-45 range. I am only 50% allocated to this wonderful producer of copper and gold and look to add the remainder before 2025 arrives.

In virtually every U.S. election year since I first began following volatility, I have been long the VIX:US (or a derivative thereof) going into election day, but in a stroke of either septuagenarian genius or advanced-age amnesia, I entered Election Day 2024 bereft of any hedges whatsoever. Notwithstanding the possibility that I might have been sensing a shift in the mood of the American electorate, the "Trump Bump" has created a new meaning for the term "all-time high," which now refers to forward P/E multiples for U.S. stocks, bullish 2025 consensus amongst the AAII gang, but more appropriately the states-of-mind of the investor class whose dependency on the "new narcotic" called common stock ownership is off the charts. The last time I heard the CNBC cheerleaders all crowing about how "a record number of U.S. households now own stocks" was in 1999, just before that record became a distant memory. If sentiment is any measure of contrarian signaling, then this Wall Street love affair with the President-elect is one rally that desperately needs to be sold and, as they say in the Book of Revenge, "sold good and hard."

Gold and Silver

Gold was off $41 for the week but up nicely from the $90 mauling it took on Monday. I am currently sidelined, as I wrote last week due to underperforming silver but also largely to the dismal performance of the Senior Gold Miner ETF (GDX:US), whose share price is now retreating from the marginal all-time high posted on October 22 at $44.22 with the prior high going all the way back to August 5, 2020, at $43.30.

The one difference that underscores the insipid performances of the miners is that the price of gold was $2,027.50 at the same time as GDX:US was hitting its multi-year high in 2020. To put this in an even starker perspective, on September 9, 2011, GDX:US traded at an all-time high of $59.63, with gold trading at $1,889.10.

Since then, gold has advanced to its all-time high above $2,800 per ounce, with GDX:US only getting to 72.6% of its all-time seen over thirteen years ago. Call it a generational disconnect or a cultural roadblock, the younger generations have soundly rejected the gold miners as "leverage plays on the gold price" and instead selected Bitcoin as the preferred "debasement protector." Five thousand years on the throne as "safe haven royalty" has been thrown into waste bin redundancy along with buggy whips, hula-hoops, and fax machines.

Sadly (or perhaps optimistically), when a newsletter writer with more than his fair share of grey chin hairs is ready, willing, and able to throw in the proverbial towel on a group of stocks he has followed since the early 1980s, you just know that a major bottom is not only close but that, in fact, a generation bull market move is in its infancy.

The new Secretary of the Treasury in the Trump cabinet will be appointed in January (assuming he gets approved). His name is Scott Bessent, a former hedge fund manager and mentor of Jim Rogers and George Soros. He is rumored to be a proponent of gold's role as an anchor to the massive U.S. treasury bond market, where new and accelerating issuance requirements are surely coming under scrutiny in 2025. I have long argued that it is the gargantuan size of the U.S. debt bubble that prompts a revaluation of the 8,133 metric tonnes of gold being held on behalf of the U.S. Treasury. If Bessent moves to underpin treasury bonds with American gold reserves by way of revaluation of those reserves, the new price will be many multiples of the current price. It makes sense because markets are far too advanced to simply allow the U.S. dollar to remain the world's reserve currency despite being allowed to "reflate away the debt" because if that starts to creep into the modern narrative, the U.S. dollar will be dumped before one can whisper "Ponzi" in closed quarters. . .

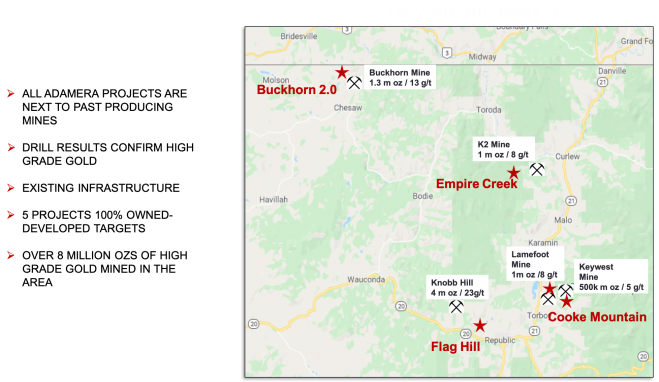

Adamera Minerals

Adamera Minerals Corp. (ADZ:TSXV / DDNFF:US): ADZ is run by former BHP exploration geologist Mark Kolebaba, who is currently probing the highly-prospective Republic Gold District of Washington state where he is engaged in drilling out the C-3 vein where outcrops yielded values of up to 6.6 g/t au. The second hole will probe another section that yielded as high as 9.1 g/t Au. The share capital was recently rolled back 10:1, leaving the company with a post-consolidation capital of around 40 million shares and a market cap of CA$8 million.

I usually try to avoid the junior exploration names until the later stages of a bull market advance, and as stated earlier, with the Senior and Junior Gold Miner ETFs impeded by the two suffering giants (NEM and GOLD) being on the defensive, I am going against the grain on this selection. However, there is a reason and a very good one.

Mark Kolebaba is overdue.

He has been sniffing, probing, and poking around this part of the world for a number of seasons in a district that has produced over 4 million ounces of gold primarily from high-grade (14.5 g/t au) sources and which is currently the home of operating (or soon to be operating) gold mines complete with turn-key mills and excellent infrastructure. The Flag Hill South project has been a priority for at least the past two years, during which Kinross had it locked up under a "first right" agreement but failed to act upon it (as in no work done), so the vendor told them to pound sand when they asked for an extension and instead optioned the property to Kolebaba's ADZ. He finally has the right property at the right time, as it is common conjecture that Kinross will be forced to re-open Kettle River or else forfeit a $50m bond reserved for reclamation. If that happens, they will be sorely under-capacity and in need of feed for their mill, and that puts any economic-grade ore at the top of the pile, as confirmed by ADZ at Flag Hill South.

I took a position in the recently-announced private placement at $0.15/unit and see it as a superb leverage play on a new discovery in a proven high-grade gold-bearing district.

Now, all we need is a "market."

Until the Trump Victory Aura Ends

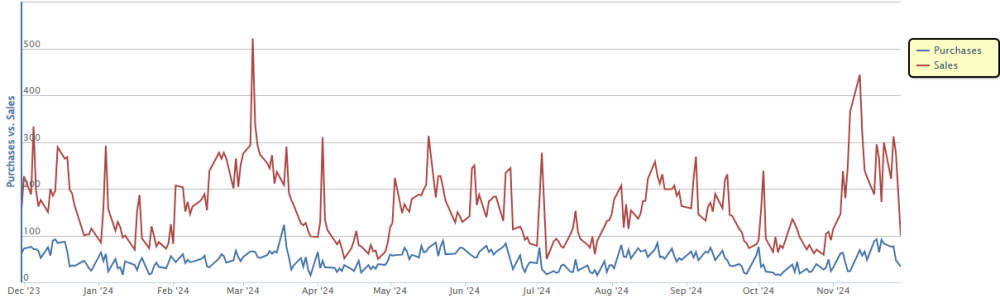

From now until the end of December, I think "da boyz" will do their utmost to keep the markets elevated in order to secure those big, fat bonuses but I still hold to the view that macroeconomic signals are revealing an ever-weakening U.S. story and that once the markets finally understand the implications of the Trump campaign promises, the potential negative impacts of tariffs and deportations of American labor will be a depressant on growth and an accelerant on inflation and for a stock market trading at historically forward P/E's with historically-high insider selling activity, it will spell volatility.

They will keep stocks "bid" until this Trump victory aura ends, and the reality of colossal debt and weakening growth torpedoes the rally.

Until then, caveat emptor. . .

| Want to be the first to know about interesting Gold, Silver, Base Metals and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick Gold Corp., Agnico Eagle Mines Ltd., Getchell Gold Corp., American Eagle Gold Corp., Fitzroy Minerals Inc., and Adamera Minerals Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.