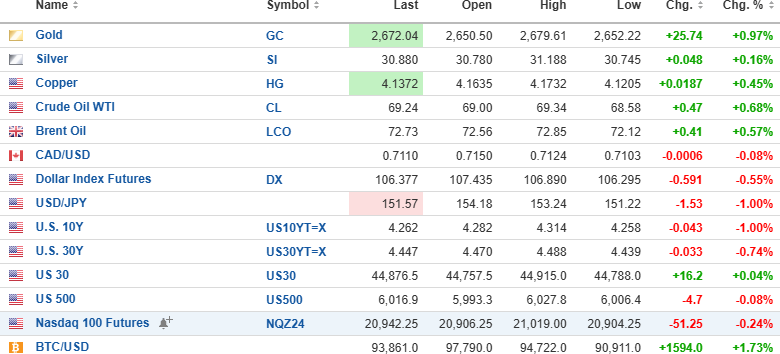

The USD index futures are lower (-0.55%) this morning to 106.377 with the 10-yr. yield (-1.00%) and the 30-yr. yield (-1.00%) both lower to 4.262% and 4.447%, respectively.

The metals are all higher, with gold (+0.97%) up $25.74, silver (+0.16%) up $.05, and copper (+0.45%) up $0.0187. Oil is up $0.47 to $69.24/bbl. Stock index futures are mixed with the DJIA (+0.04%) up 16.2, the &P 500 (-0.08%) down 4.7 points, and the NASDAQ (-0.24%) down 51.25. Risk barometer Bitcoin is up 1.73% to $93,861.

Stocks

Typically, the trading session before the U.S. Thanksgiving Holiday is a slow day and tends to include profit-taking sessions "into strength." The Wednesday-Monday track record since 1988 is 19 wins and 16 losses for a total Dow point decline of 270.35, but with the Trump Trade still locked into everyone's psyches, anything could spark a continuation move in these markets.

Goldman Sachs points out three areas where bullish positioning amongst the larger funds is now at record levels. With credit spreads now plumbing record lows and commodities weak, that is a complete contrast to 2016 when spreads were tight and commodities strong, which led to the move to record highs, with the only interruptions being the 2020 Covid Crash and the 2022-2023 Fed tightening cycle. Since the Fed took its hobnailed boots off the interest rate accelerator in October 2023, it has been basically straight up.

Meanwhile, Warren Buffett continues to sell everything that is not nailed down, which has recently included his beloved Apple Inc. (AAPL:NASDAQ), which was a core position since 2016. Buffett's Berkshire-Hathaway now holds over $350 billion in cash, a record and a definite anomaly for the world's most famous investor noted for his "stocks for the long term" approach to portfolio management.

The RSI for the S&P 500 SPDR Trust (SPY:US) is now 66.15, with overbought levels over 70. MACD is oscillating back and forth between "Buy" and "Sell" signals and refuses to be reliable in telegraphing trading set-ups, and the Money Flow Indicator ("MFI") is about to move into full "overbought" territory with any further gains in the markets.

The "Trump Bump" is getting very long in the tooth, and while I have benefitted from my bullish pre-election stance with the 109.36% gain last week in the DIA strangle, the only hedge I own is the 50% position in UVIX:US at $3.75 (now $3.37) and a 50% position in the VIX December $10 calls at $6.00 (now $5.15). I am looking to add the remaining 50% positions either today or Friday during the ½ session that ends at 1:00 pm.

In the GGMA 2024 Trading Account:

- BUY remaining 50% position UVIX:US at $3.20

- BUY remaining 20 contracts VIX December $10 calls at $5.00

New adjusted costs will be $3.475 (UVIX:US) and $5.50 (VIX Dec $10 calls).

I am looking to buy the SPY December $590 put options either today or Friday as well, but I will wait to see how today pans out before entering any orders on this high-risk trade.

| Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.