Although Interra Copper Corp. (IMCX:CSE; IMIMF:OTCQB; 3MX:FRA) is almost unchanged from when we last looked at it on October 7; its fundamental situation has improved greatly in a relatively short space of time. At the time of the last update, the company had entered into a purchase agreement for the Stars Copper Project.

The difference that this will make to the company was summed up by President and CEO of Interra Brian Thurston, who commented, "Acquiring the Stars Property is transformative for Interra. The company changes from a junior exploring to make a discovery to a junior with a discovery that is looking to define a resource. The Stars Property has two complementary exploration upsides, with an established zone of higher-grade mineralization that Interra can grow and define and a much broader under-explored area with high potential for new discovery."

This development is therefore viewed as a big "move to the right" on a chart showing the steps from exploring to being a producer. If only for this reason, the company is viewed as a candidate for revaluation, especially given its current very low valuation and, more generally, the rapidly improving outlook for the copper price. The transaction contemplated by the Purchase Agreement is expected to close on or before December 15, 2024, and is subject to customary closing conditions and approvals, including the approval of Aurwest shareholders as it relates to the sale of the Property.

The big positive news that came out following the last update is that Intera increased its Stars property land package by 5,932 hectares. Brian Thurston, president and chief executive officer of Interra, commented: "We are pleased to have more than doubled the size of the Stars property by staking. Staking in British Columbia is the most economical way to acquire mineral tenures, in this case, adding shareholder value at a very minimal cost. With the expanded land package, we see an increased exploration upside, with the inclusion of an additional copper mineral showing, geophysical anomaly, and strategic ground accessible via logging roads." The potential additional value of this expansion of the Stars Property is self-evident.

Then, just last Friday, the company came out with the news that Interra Copper sampled up to 7.15% Cu at Thane. Again, this is self-evidently very positive, and it appears some investors thought so too, as the stock price started to advance on heavy volume.

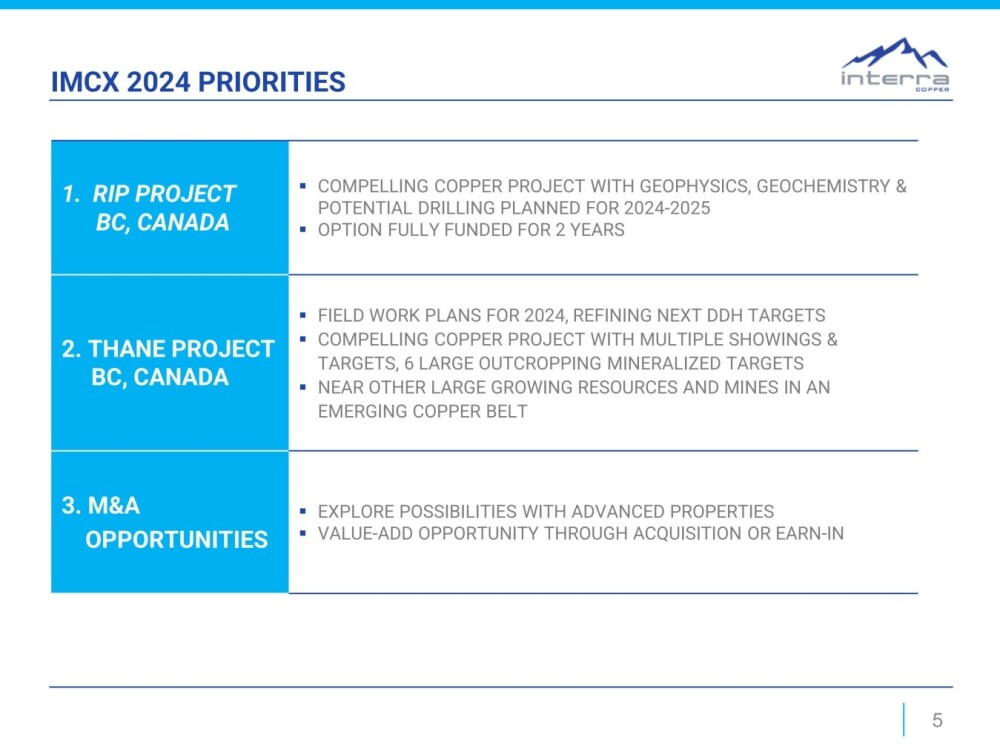

When we look at the following slide from the company's investor deck showing its 2024 Priorities, we see that it is definitely living up to Item 3.

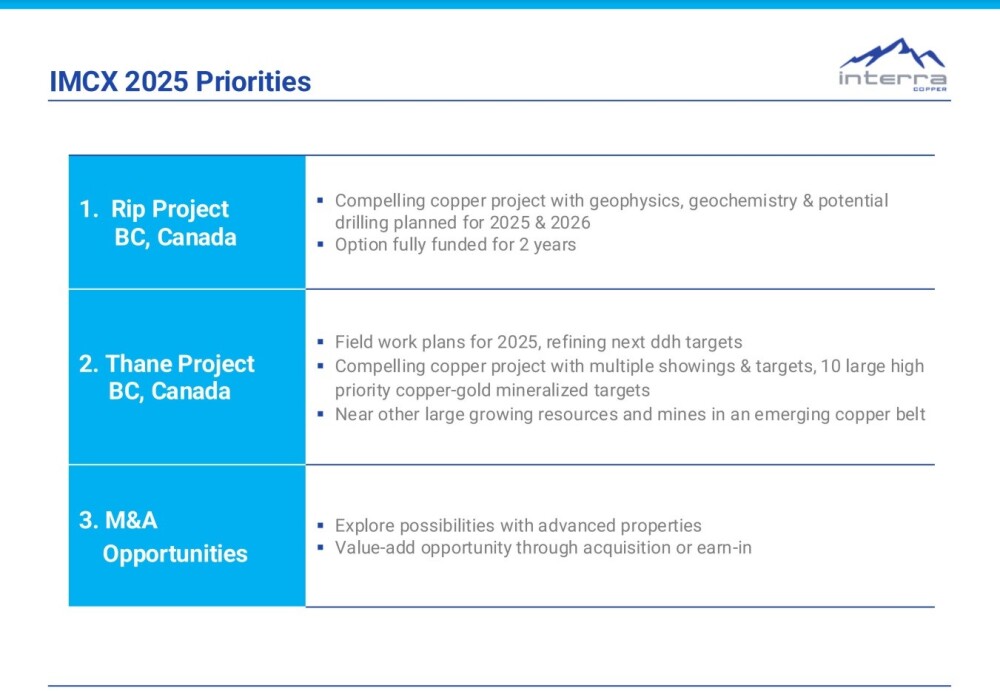

The slide showing the priorities for 2025 reveals that there are now 10 large high-priority copper-gold mineralized targets, up from six last year.

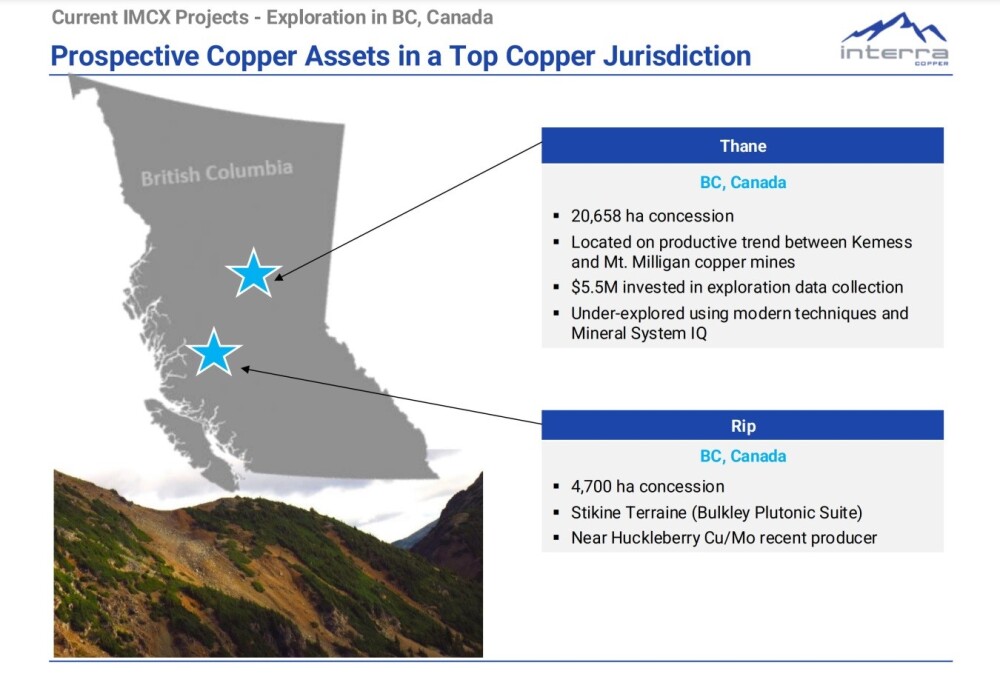

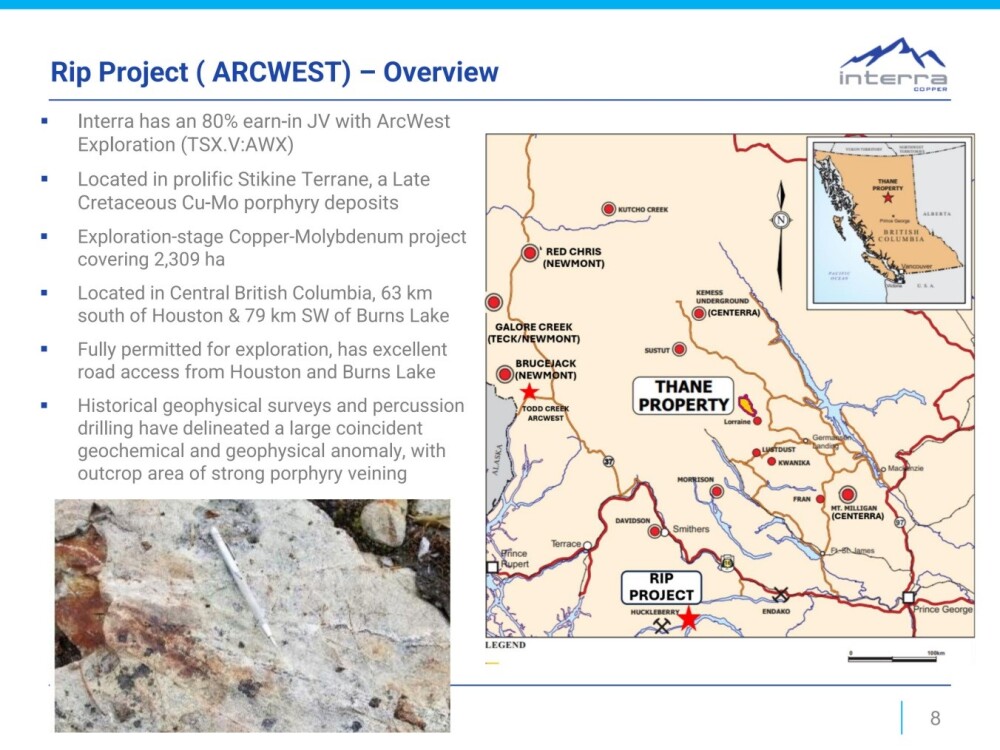

The company's two main properties prior to the impending acquisition of Stars are Thane and Rip, whose locations in British Columbia are shown on this slide below.

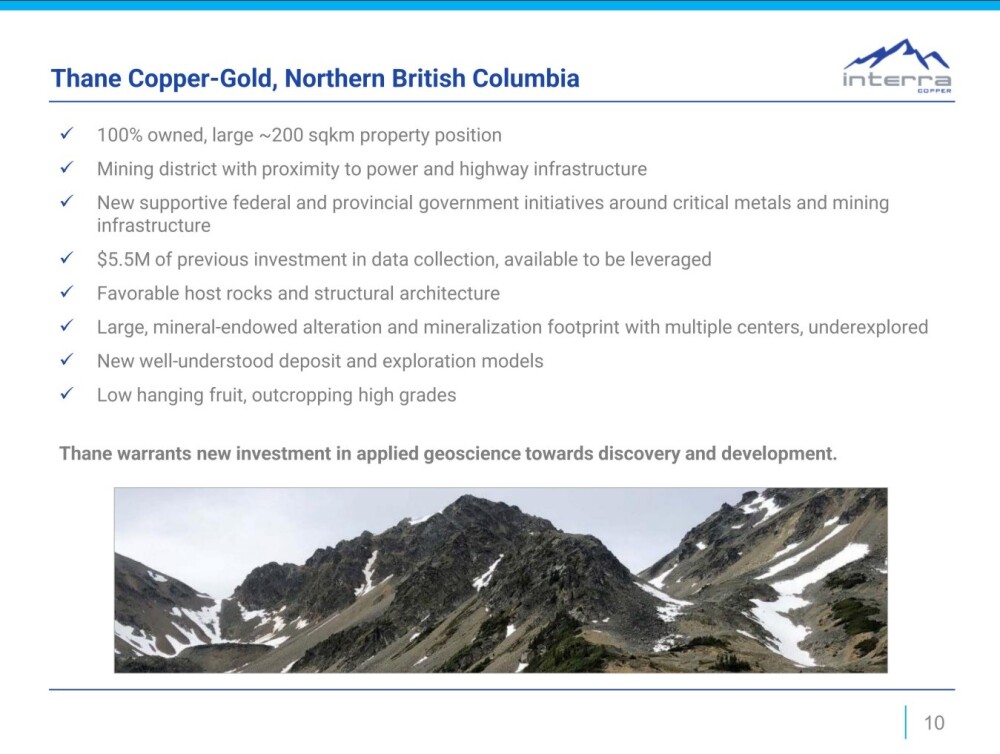

This slide highlights the attributes of the Thane copper-gold project.

This one highlights the attributes of the Rip property.

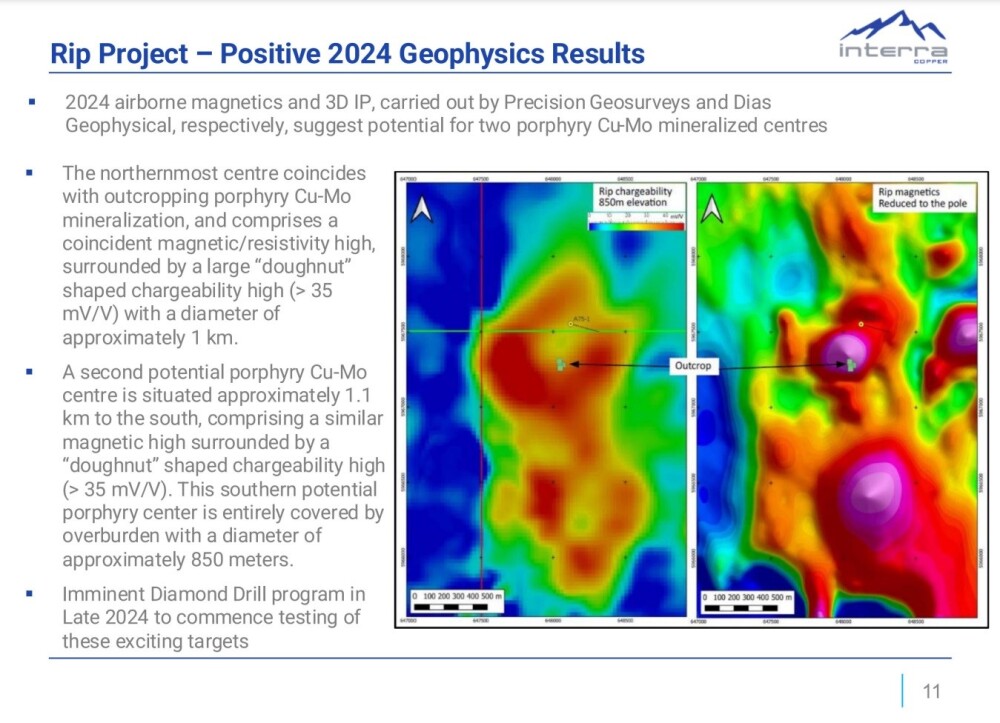

Two copper–molybdenum targets have been identified at Rip thanks to an aerial survey undertaken this year, whose most important findings are shown on the following slide.

After the August news was published, a new copper zone was discovered at Thane, which is called the Bananas Showing, it, along with the previously known Gail showing, is ranked the highest priority with strong copper-gold mineralized alteration systems in favorable host rocks.

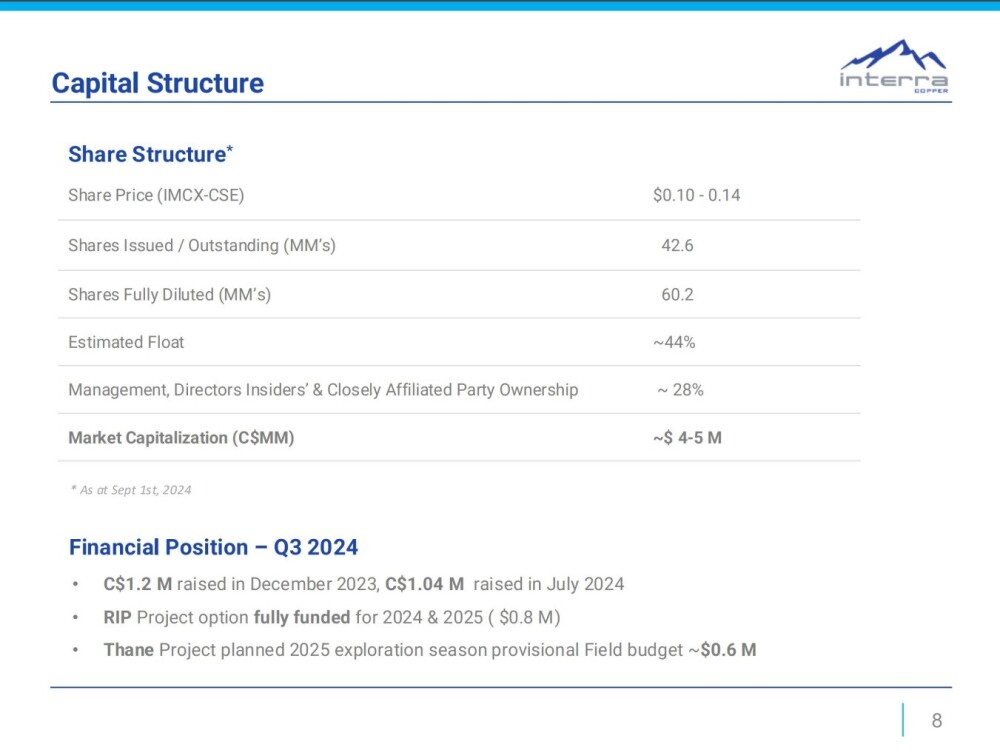

This last slide from the investor deck shows the capital structure of the company, with the most important point to note being that of the 42.6 million shares in issue, an estimated 44% are in the float.

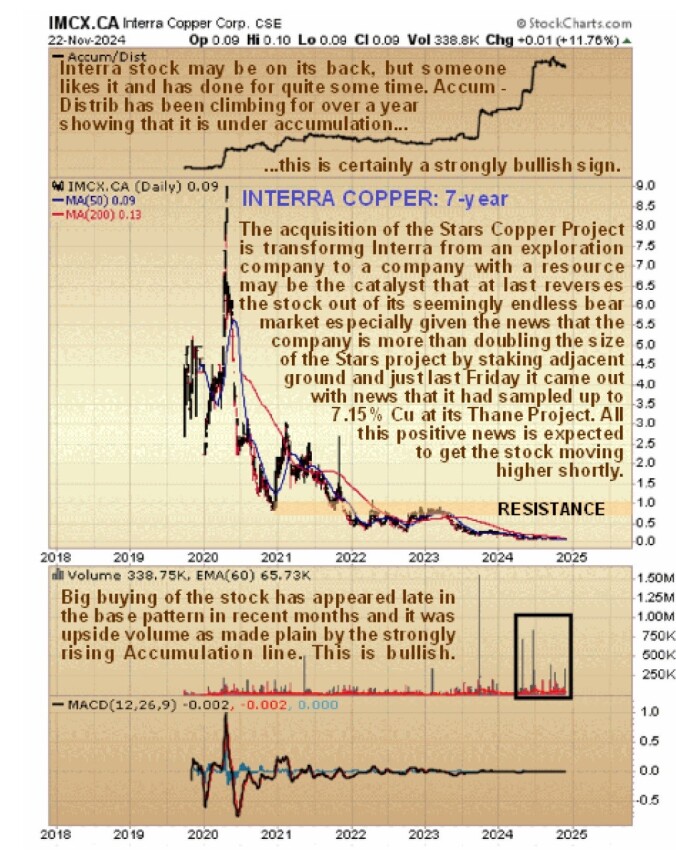

Turning to the charts, we see on the long-term 7-year chart that Interra Copper stock is at the tail end of a seemingly relentless, brutal bear market that has erased 99% of its value at its 2020 peak. According to all normal metrics, it is extremely undervalued here.

Yet despite the horrendous decline in the stock price, its Accumulation line has continued to advance, and we can see on the 29-month (2-year 5-month) chart that its rate of climb has been accelerating over the past year.

By itself, this is bullish and indicates clandestine accumulation even as the stock price has fallen, and the longer it goes on, the greater is the chance that a reversal to the upside will occur, and now, with the planned acquisition of the Stars Project, due to be finalized in the middle of December, the announcement of the major expansion of the Stars project by means of the staking of a large area of adjacent land and Friday's news of that the company has sampled over 7% copper at its Thane property</A> we, at last, have the necessary catalysts to make this happen.

Even though the price is still technically in a downtrend with the price below bearishly aligned moving averages there are other bullish factors to observe on this chart that point to a reversal soon and these include the increasing bunching of price and moving averages such as typically precedes a reversal, the predominance of upside volume in recent months and downside momentum having dropped out as shown by the MACD indicator.

The 6-month chart shows recent action in much more detail. In the original article on Interra posted in August, it was not expected to drop any further, but it did, although it was not by much, and in the October update, it was thought to be at a very favorable entry point as it was suspected to be at the second low of a potential small Double Bottom.

In the event it has just dipped back to about this level, making it the third low of a potential small Triple Bottom, and it just started to get moving on good volume on Friday on news of the rich copper sampled at Thane.

Lastly, it is worth pointing out that it looks like the volume on Friday may have been much higher, which would be correspondingly more bullish, for on the following Stockwatch 6-month chart, the volume appears to have exploded on Friday, and in this situation with a discrepancy between the two chart services, the Stockwatch data is thought to be more reliable on this occasion (it may include late trade volume).

We, therefore, stay long, and Interra Copper is rated an Immediate Strong Buy.

Interra Copper's website.

Interra Copper Corp. (IMCX:CSE; IMIMF:OTCQB; 3MX:FRA) closed for trading at CA$0.085, US$0.06925 on November 25, 2024.

Want to be the first to know about interesting Base Metals and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Interra Copper Corp.

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.