Bion Environmental Technologies Inc. (BNET:OTCQB) is a company with a strong turnaround situation. The company's patented and proven core technology converts agricultural ammonia — a very large source of air and water pollution — into valuable organic fertilizer products.

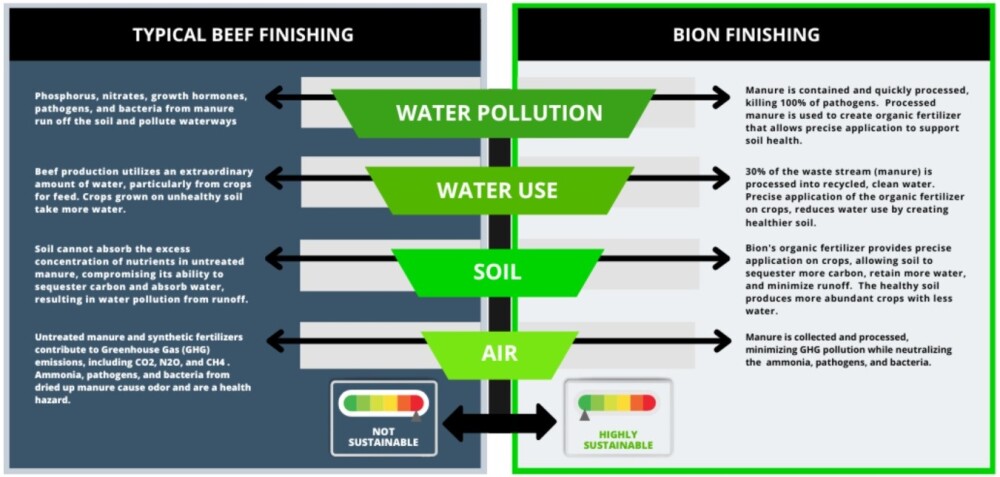

The process was developed to provide advanced treatment of farm animal waste, especially that produced by beef cattle, both for the purpose of reducing environmental contamination and recovering 'waste' as useful by-products that can be either put to use on the farm or production facility or sold to generate income. The following slide from the company presentation shows the differences between traditional methods of beef production and beef production using Bion's technologies.

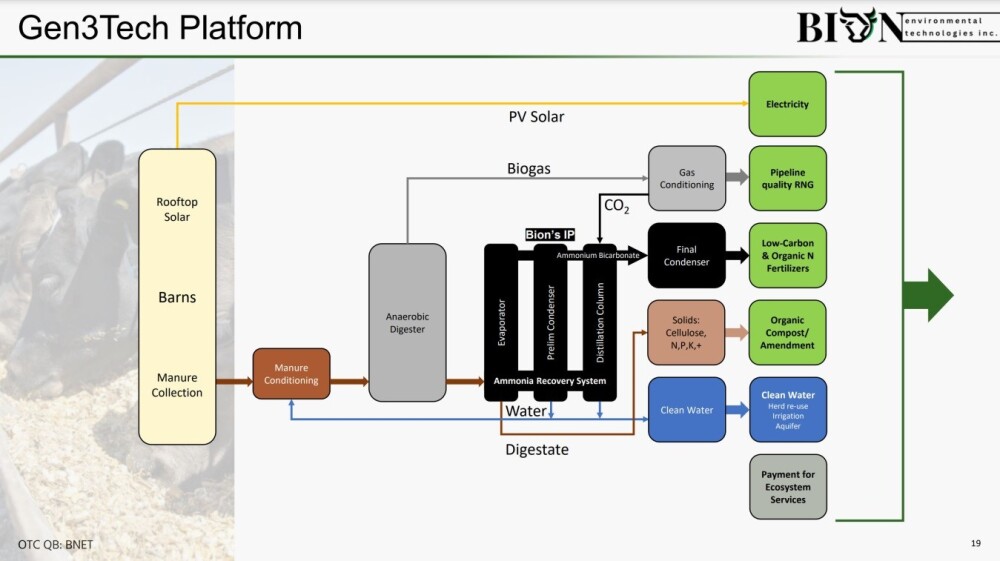

The next slide shows how Bion's GenTech 3 platform processes the waste into useful products.

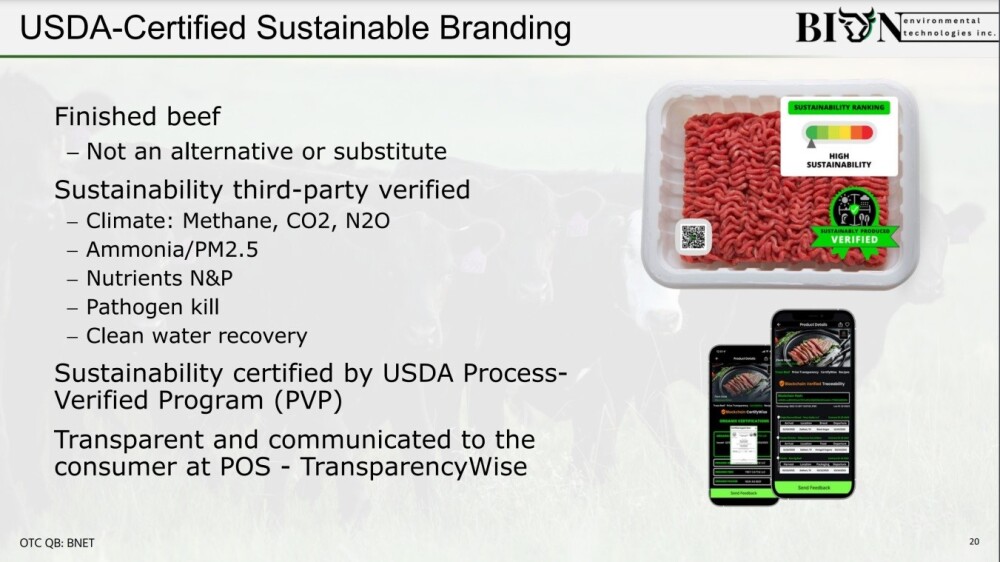

Application of the company's technologies will enable producers to meet the USDA's strict Process-Verified-Program requirements.

The company has been through a period of serious and unexpected adversity caused by a combination of delays in finalizing the development of its systems coupled with management problems centering on the illness and death of its longtime CEO and COO, Dominic Bassani.

You can read the full story in the November 18 Shareholder Update & Outlook. The following is a brief summary of what is set out there.

Technology development of the Ammonia Recovery System was almost complete when it was interrupted by the Covid debacle, and then lingering supply chain issues delayed startup at the commercial demonstration facility last year, which caused unfounded concerns about whether the technology works — it does.

The management crises peaked with the passing of the long-time CEO in November of last year. He had been a driving force of the company for about 25 years, and this development was compounded by the resignation of the person engaged to take over for him when it was learned that he was sick. Then, the longtime CFO retired in July. All these problems compounded to drive the stock price lower and lower, creating difficulties in raising capital and it appears that most of the selling was by longtime holders of stock who had really been investors in Dom (Dominic Bassani) from way back. In recent months the company has been kept going by five large investors who believe in what it is doing and its technology and have accepted a secured promissory note that will convert into shares based on the terms of a future funding or offering.

To cut a long story short, a new core management team has been established, and the company is focused on a JV that will be led by Turk Stovall, CEO of Stovall Ranching Companies and Yellowstone Cattle Feeders, where the company's technology will be put to practical demonstration and use at full commercial scale — a big development back in June was the news that Stovall Ranching companies and Bion teamed up to produce eco-friendly Montana beef.

The company's technology has been proven up, works, and works well, and with the fast-growing worldwide concern about the effective treatment of farm wastes associated with the climate crisis, the market for this technology borders on infinite. Add to that: the company learned last January that it was granted another patent, extending its IP to industrial and municipal waste streams, in addition to animal waste.

So, if the company succeeds in raising the US$3 million it needs to keep going by April 15, 2025 — and it seems likely that it will, given all this — its future looks very bright indeed.

With respect to this game-changing development, made public toward the end of August, was that Bion's commercial nitrogen fertilizer was OMRI-listed for organic use (OMRI stands for Organic Materials Review Institute). The reason that it is game-changing is that this looks set to generate a continuous and growing income stream for the company.

Turning now to the charts for Bion Environmental, we see that when, for capital markets reasons set out above, its stock broke down below key support in the Spring in the $0.90 area, it went into a severe downtrend that continued until August, which can be seen on the 15-month chart below. It then began a basing process that saw it break out of the downtrend early in October, this basing process continuing up to the present, with downside momentum steadily dropping out.

On the 6-month chart, we can see that the pattern that has been forming since early August has taken the form of a bullish Cup & Handle base that promises a probable entry into a new bull market. A breakout from this pattern will be signaled by a clear break above the line of resistance at about US$0.30, marking its upper boundary.

The long-term 20-year chart shows that this is a good point for Bion to start higher again, as the recent downtrend has brought it down to what is believed to be a cyclical low in a zone of strong support in the vicinity of past lows going back many years.

This is, therefore, considered to be an excellent point to buy Bion Environmental or add to positions.

Bion's website.

Bion Environmental Technologies Inc. (BNET:OTCQB) closed for trading at US$0.23 on November 22, 2024.

| Want to be the first to know about interesting Technology and Agriculture investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Bion Environmental Technologies Inc. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Bion Environmental Technologies Inc.

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.