Silver X Mining Corp. (AGX:TSX.V; AGXPF:OTC) CFO, David Gleit, shared key updates and insights on the company's operations during a recent call with Streetwise Reports. David, who joined Silver X after a distinguished career in mining finance and corporate strategy, has held leadership roles at major companies like Volcan Compañía Minera and STRACON. His experience spans corporate development, mergers and acquisitions, and operational oversight.

During the call, David emphasized the company's progress at its Tangana and Plata mines. "We're able to produce 600 tons a day at our Tangana mine, and our plant has capacity for 650 tpd," he stated, outlining plans to increase production to 720 tons per day within existing permits. Plata, a historical mine that Silver X plans to rehabilitate, is expected to come online during 2025. A significant resource update on the mine is anticipated by the end of the year. "Plata has more interesting grades than Tangana . . . this mine is going to be quick to rehabilitate, and it's going to be a very exciting addition to our production," he said.

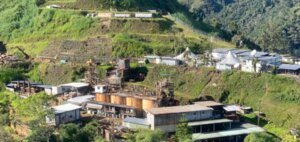

Silver X's strategy revolves around a "hub-and-spoke" model, leveraging its Recuperada plant to process ore from multiple mines in the region. "The hub is the plant . . . and we have a lot of mining concessions in this area to explore and exploit," David explained during the call. Financing remains a priority to accelerate growth and plans to expand production capacity while updating the company's Preliminary Economic Assessment (PEA).

Addressing concerns about Peru as a mining jurisdiction, David highlighted its importance as a global mining hub. "Peru remains one of the best mining jurisdictions on Earth . . . the formal mining industry here has changed a lot and is a responsible corporate citizen," he noted. Gleit then added that long-term agreements with local communities have facilitated progress at Plata.

The CFO expressed confidence in Silver X's trajectory, stating, "We're an undervalued stock. We have really good management, a great deposit, and lots of organic growth potential. Silver X is building a district-scale project that is difficult to match." The company aims to strengthen margins and achieve operational excellence as it continues to expand its footprint in Peru.

Silver Sector: Deficit Drives Demand Amid Growth Opportunities

The silver market in 2024 faced a significant supply deficit driven by increasing industrial demand. According to a report published by the Silver Institute and Metals Focus and cited by FX Street on November 15, global silver demand rose by 1% to 1.21 billion ounces. This marked the second-highest level on record. This growth was largely fueled by a 7% increase in industrial applications, particularly in electrical and electronic sectors, alongside higher demand for jewelry and silverware. Despite rising mine production and a surge in silver scrap to a 12-year high, the market experienced a deficit of 182 million ounces. Numbers like this underscore the continued tightness in supply.

On November 18, Kitco News reiterated this deficit trend. The report highlighted that 2024 marked the fourth consecutive year of a global silver shortage. According to the Silver Institute, industrial demand reached record levels while exchange-traded products saw their first annual inflows in three years. These inflows were supported by expectations of Federal Reserve rate cuts, periods of dollar weakness, and declining yields, which enhanced silver's appeal as an investment.

Adding to this narrative, Investing.com noted on November 19 that silver prices rebounded strongly after a recent correction. The article attributed this rally to both long-term structural factors, such as unmanageable debt and heightened investment interest, and immediate market dynamics, which saw silver gain 3.3% in a single trading day. It was described that the rebound as part of a "generational opportunity in metals and miners," reflecting broader optimism in the sector.

Silver X Mining: Catalysts Driving Future Growth

The company's recent call with Streetwise Reports and its November 2024 investor presentation highlights key catalysts expected to shape the company's future. At the core of Silver X's growth strategy are the Tangana and Plata mining units within the Nueva Recuperada Project. Tangana, which achieved commercial production in early 2023, is currently operating nearly 600 tons per day (tpd) with plans to expand to 720 tpd in 2025. Plata, a historic mine undergoing rehabilitation, is expected to begin production in the second half of 2024.

"Plata has better grades than Tangana . . . this mine is going to be quick to rehabilitate, and it's going to be a very exciting addition to our production," Gleit said during the call. Plata's updated resource estimate, anticipated before year-end, is expected to bolster the company's resource profile significantly.

Timothy Lee, Mining Analyst at Red Cloud Securities, maintained a Buy rating for Silver X Mining Corp. and set a target price of CA$0.80 per share. This represents a 125% upside from its last close of CA$0.36.

Silver X's hub-and-spoke model, centered on its Recuperada processing plant, is another catalyst.

This model enables efficient ore processing from multiple mines within the region's extensive land package of 20,472 hectares, which hosts over 500 identified veins. The company's broader vision includes increasing production to 1,500 tpd and tripling output to six million silver-equivalent ounces annually by 2026-2028

Additionally, the company plans to update its Preliminary Economic Assessment (PEA) to reflect the integration of Plata with Tangana. The previous PEA, published in April 2023, reported an after-tax net present value (NPV) of US$175 million with a 39% internal rate of return (IRR) for the project based on conservative production assumptions. With the inclusion of Plata, these metrics are expected to improve, providing investors with a clearer picture of the project's long-term value.

In terms of exploration, Silver X continues to unlock the potential of its land package. The Tangana unit alone encompasses 966 hectares with high-grade silver, gold, lead, and zinc resources. The company is also exploring opportunities to develop the Red Silver and Victoria gold targets, further enhancing its growth pipeline.

Gleit emphasized the importance of profitability and operational efficiency as Silver X scales its operations. "The vision is to produce six million ounces, triple our output, but we need to do it profitably," he noted. Financing efforts are underway to support these initiatives, including capacity expansion, mine development, and exploration activities.

Silver X's presence in Peru, a leading global silver producer, strengthens its strategic positioning. The company has established long-term agreements with local communities, fostering strong relationships that have facilitated project development.

Expert Insights Highlight Silver X Mining's Growth Potential

Timothy Lee, Mining Analyst at Red Cloud Securities, maintained a Buy rating for Silver X Mining Corp. and set a target price of CA$0.80 per share. This represents a 125% upside from its last close of CA$0.36.

In his October 25 report, Lee described the Nueva Recuperada project as a "steady-state" operation, with 2024 production up 30% year-over-year. Despite a dip in Q3 production due to lower gold recoveries, Lee expressed optimism about the company's development plans. He continued by highlighting the potential of the Tangana Mining Unit and the upcoming development at Plata to serve as a second ore source.

Lee's valuation was based on a sum-of-parts analysis. This included a discounted cash flow model for Nueva Recuperada. He noted that the 2023 Preliminary Economic Assessment (PEA) predicted a long-term gold recovery rate of 76%, and he anticipated further production ramp-up amid a strong precious metals price environment. "Silver X could benefit significantly from further production ramp-up," Lee stated, emphasizing the company's potential in the current market.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Silver X Mining Corp. (AGX:TSX.V;AGXPF:OTC)

The positive outlook from Red Cloud Securities underscored the company's ongoing progress and positioned it as a notable player within the sector, with tangible opportunities for growth in its Peruvian operations.

Ownership and Share Structure

According to the company, Silver X has 200.4 million shares outstanding.

According to Refinitiv, President and CEO Jose Garcia owns 7.10% of the company.

The company said institutional investors own 10%, including Baker Steel Resources Trust Ltd., which owns 9.73%. The rest is in retail.

Silver X has a market cap of CA$47.08 million and a 52-week trading range of CA$0.16 and CA$0.35 per share.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Silver X Mining Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver X Mining Corp.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.