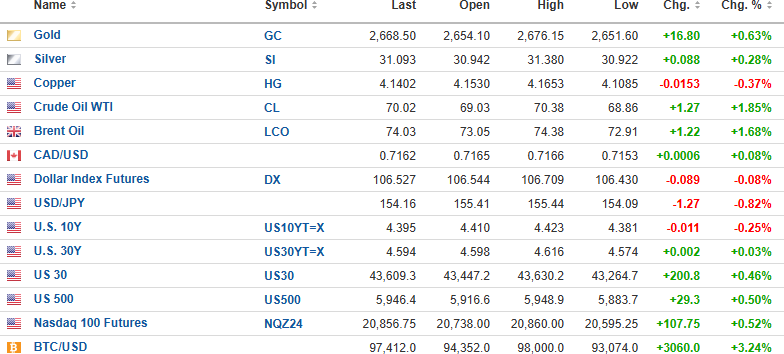

USD Index futures are down 0.08% to 106.527 with the 10-year yield (- 0.25%) down to 4.395% during the 30-year period yield (+0 .03 %) is higher to 4.94%.

Metals are mixed with gold (+0.63%), up $16.80; silver ( 0.26%) is up $.088, but copper (- 0.37%) is down $0.015.

Oil is up 1.85% to $70.02. Stocks are again higher, with the DJIA (+0.46%), S&P 500 (+0.50%), and NASDAQ (+0.52%) all higher.

Risk barometer Bitcoin is up 3.24% to another record high at $97,412. The $100,000 threshold is a virtual shoe-in.

Stocks and Volatility

Market leader Nvidia Corp. (NVDA:NASDAQ) reported absolutely astonishing earnings last night after the close and immediately sold off 4% as expectations were set in the stratosphere, resulting in knee-jerk profit-taking and a print down to $142.73. However, overnight buyers came to their senses and decided that the earnings were just too spectacular to keep the stock down, and this morning, it is called $2.25 higher, taking it to within $2.63 of its all-time high of $149.77.

The DJIA ETF (DIA:US), which was the focus of the end-of-day option straddle, is called to open $2.14 higher at $436.43, taking to within $8.44 of its all-time high at $444.87.

How NVDA trades today will determine how the straddle will perform, but since there will be an upward bias initially, I expect to see the upside breakeven price of $438.55 before the November 29 expiry date.

The worst outcome I can envision is a flat market going into U.S. Thanksgiving, but according to The Stock Trader's Almanac, the "Thanksgiving Trade" is to be long going into the Thanksgiving week but to exit just before the actual holiday next Thursday.

Ergo, I will be looking to exit into strength in anticipation of weakness in the weeks immediately following the end-of-month holiday. Also, the first two weeks of December tend to be weak as mutual fund distributions trigger selling pressures and tax-loss selling begins to intensify. In line with this seasonal tendency, I expect to see the VIX:US and UVIX:US positions move higher after U.S. Thanksgiving.

| Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.