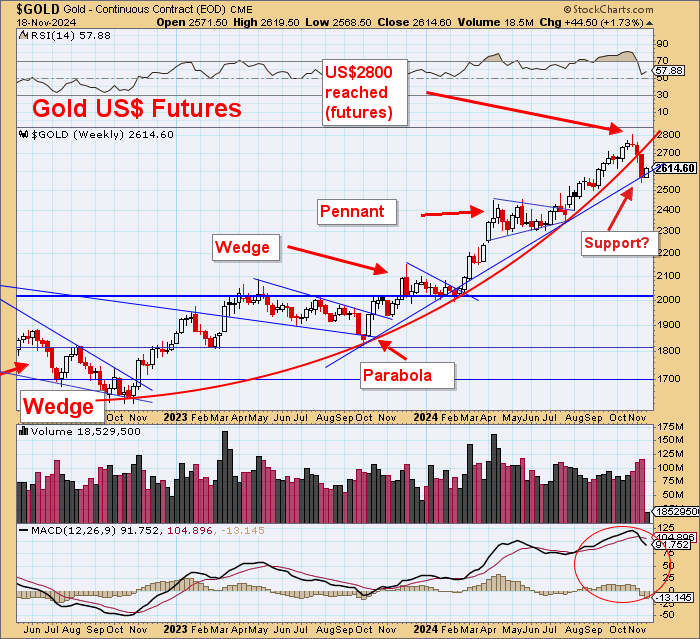

The gold price peaked out in late October and in doing so completed a wave 5 and now we have probably finished wave A down. We can look forward to a B wave rise before a second correction in the C wave.

These waves aren't easy to assess (it is an art, not a science), but this is an attempt.

Five waves up will be followed by three corrective waves. The coming run higher will be interesting.

Gold has often made 'irregular' B waves that run to highs above wave 5, so it will be interesting to see how far it runs before it pulls back again. The C wave correction is then the true entry point if all works out.

Keep in mind gold stocks are likely to run their own race as market breadth improves and market participation grows.

The 2-year parabola has been breached, but gold has held onto its 1-year uptrend line.

Best guess is gold rallies to retest the parabola and then pulls back in a C wave that declines but holds the uptrend.

This is a bull market, remember!

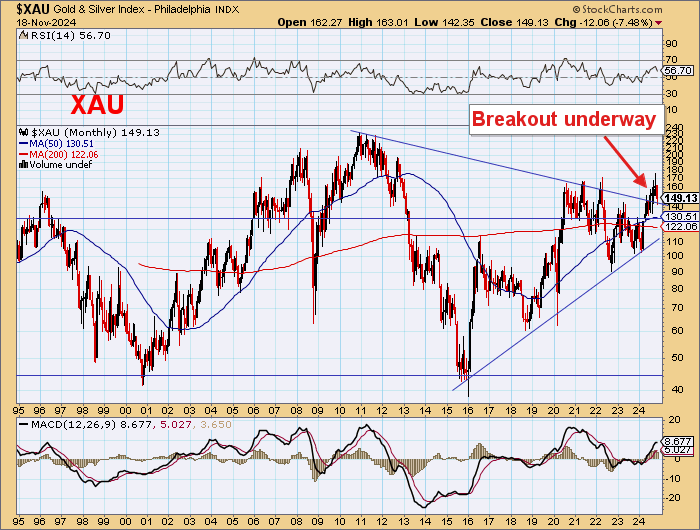

Gold Stocks

Gold stocks found very good support around a 145 level for XAU, so they should be able to run to 170 reasonably quickly.

Market interest is now picking up, so market breadth (more stocks participating) will continue to improv.e

The break of this 13-year downtrend is very significant.

XAU has had a breakout, is backtesting, and so should now surge.

The recent pullback seems to have formed the RHS of a MAJOR reversal of gold stocks vs. US$ gold.

This means gold stocks should strongly outperform gold, and the number of stocks moving will increase.

The CDNX on the TSX-V also seems to have completed a RHS reversal.

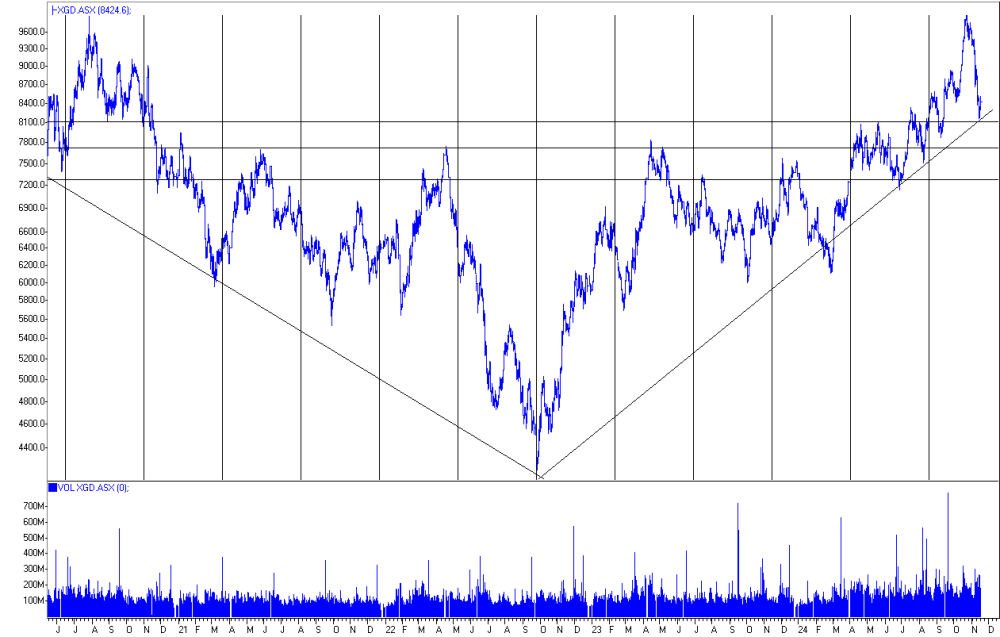

SX Gold Index

The XGD pulled back to its uptrend and found support around 8100. This should rally sharply to the 10,000 area of recent highs.

Note that the XGD broke its 16-year downtrend compared to AU$gold.

It is notable that explorers are gaining market interest again.

The XGD is backtesting the 16-year downtrend vs. AU$ gold.

This is a very good sign.

US$

The US$ has rallied nicely, but the major currencies are oversold after recent significant technical breakdowns. A back test is needed, and then the US$ should surge.

The Euro, Yen, and Pound should weaken very sharply after their little bounces.

US Bonds

Still no resolution after two long years of oscillation. Elon Musk is on the job and it is amazing the amount of waste expenditures being discovered.

Reports are also coming out that many of the U.S. federal Departments are still using antiquated IT equipment and COBOL machine language with annual maintenance costs far greater than newer, more efficient computers.

We had already seen how much of the U.S. voting infrastructure was using archaic Windows technology.

Elon and Dept of Government Efficiency should make great gains!

Expenditure cuts will definitely reduce total bond sales.

Let's hope the RHS trend reversal actually happens.

Bitcoin

Epic fail achieved here?

But it still doesn't look right.

Backtesting the failed parabola?

Hugely overbought?

On massive volume.

Distrubution?

This could be another case of an irregular B wave as we saw with new highs in gold in 2011 of US$1923 before gold pulled back to bottom four years later at US$1045.

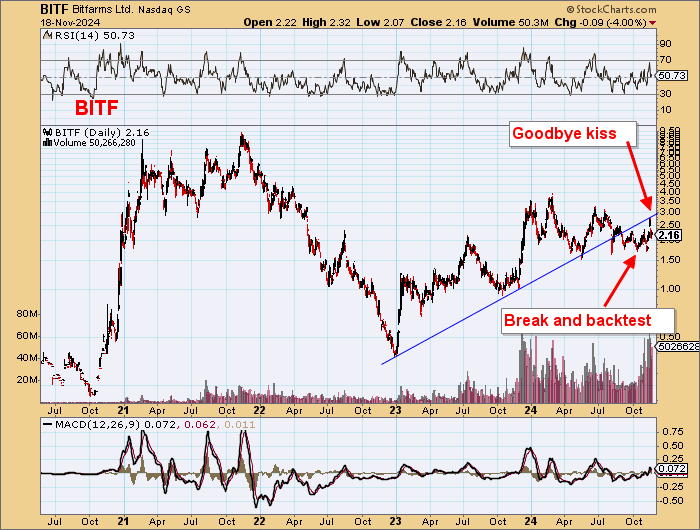

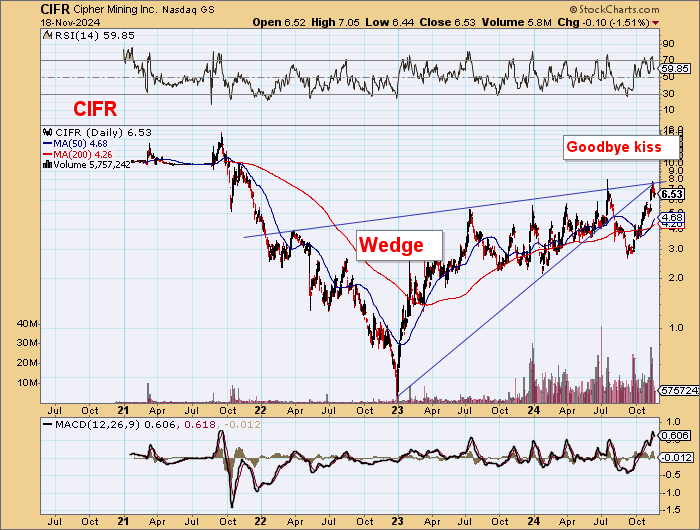

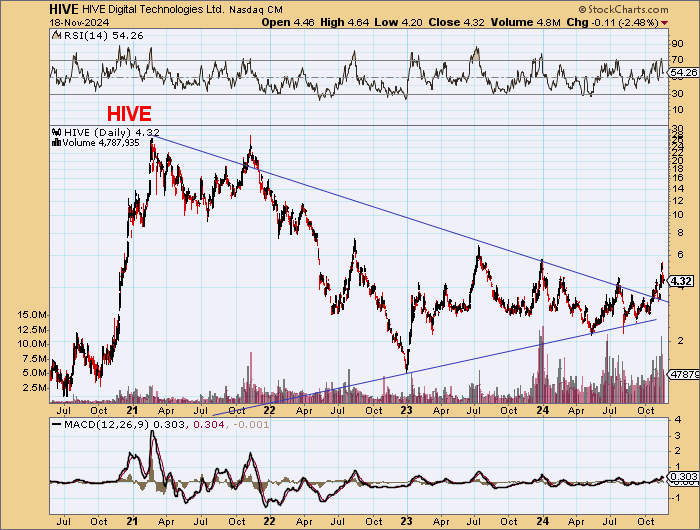

Look at these Bitcoin miner stocks.

No confirmation of Bitcoin's new highs. Island reversals and goodbye kisses everywhere.

Almost all stocks are now well below their recent spike highs.

Epic fails?

Head the markets, not the commentators.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Barry Dawes: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.