Omineca Mining and Metals Ltd. (OMM:TSX.V; OMMSF:OTCMKTS) announced it has started diamond drilling at its Wingdam gold project in British Columbia's historic Cariboo Mining District after road access and the first drill pads were completed.

TerraLogic Exploration Services has designed a 10-hole, 4,000-meter hard rock exploration program "in close proximity, but importantly downstream of the Wingdam underground placer gold recovery project," Omineca said in a release.

"The holes are on trend to the west of the Eureka Thrust Fault with several sited at lower elevations than previous programs with drill lengths of approximately 400 meters targeting bedrock at and below the depth of the underground gold-enriched paleochannel," the company noted.

The Saskatoon, Saskatchewan-based junior exploration company is pursuing 2.4 kilometers of a rich, placer gold-bearing channel buried 50 meters underneath Lightning Creek in Cariboo. Geologist Stephen Kocsis has described the channel as "containing some of the highest placer gold concentrations historically reported in all of the Cariboo mining district and perhaps British Columbia that remains unmined."

Research Capital Corp. Analyst Bill Newman, in a September research report, noted the use of conventional mining and tunneling methods will provide "cost, safety, and execution time advantage."

The method "is more efficient and cost-effective compared to the previous grouted spilling method," he wrote.

"This positive development reinforces our Speculative Buy recommendation," wrote the analyst, who put a target price of CA$0.55 on the stock. "Success in this exploration could position OMM as both a placer and hard rock gold producer, significantly enhancing the project's value."

First Hole Nearly Complete

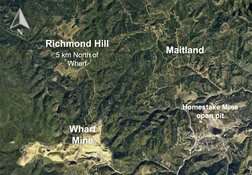

The eight drill pads for the 10-hole program are situated on or to the west of the Eureka Thrust Fault where several orogenic gold systems have been found along the western side of this geological trend, the company said in its release.

"Of note, Spanish Mountain Gold Ltd.'s (SPA:TSX.V) 2.34 (Moz) deposit 50 kilometers to the south of Wingdam and Karus Gold Corp.'s high-grade FG discovery 125 kilometers south of Wingdam are both located just west of the Eureka Thrust Fault," the company said. "More recently, Golden Cariboo Resources Ltd. (GCC:CSE; GCCFF:OTC; A0RLEP:WKN; 3TZ:FSE) has encountered visible gold in four holes at its Quesnelle Gold Quartz project 50 kilometers north of Wingdam, also located along and to the west of the Eureka Thrust Fault."

Omineca said the first drill hole at Wingdam was nearly completed and it would provide updates as results are received, a positive catalyst for the stock.

In May, the company announced it had recovered gold-bearing gravels from the project: 10.25 ounces of placer gold (Au) with 90.9% Au purity from the first 2.5 meters of advance into a paleochannel.

The Catalyst: Gold on the Rebound

Gold rose nearly 2% on Monday after hitting a two-month low last Thursday, according to Reuters.

The yellow metal came back "as the U.S. dollar's surge stalled and heightened uncertainty over the Russia-Ukraine conflict rekindled safe-haven demand," the news service said.

Spot gold jumped 1.9% to US$2,608.88 per ounce by 10:17 a.m. ET, Reuters said. U.S. gold futures climbed 1.7% to US$2,613.40.

"Gold is currently facing resistance at US$2604.39, a critical technical level that traders are watching closely," wrote James Hyerczyk for FX Empire. "A sustained break above this level could generate momentum, pushing prices toward the 50-day moving average at US$2,653.63 and the retracement zone between US$2,663.51 and US$2,693.40. However, if new sellers emerge at these higher levels, it could signal continued pressure on gold."

Most experts agree gold is in a bull market that is not disappearing anytime soon. Ian Salisbury wrote for Barron's that "most of the arguments gold bulls make — and have been making throughout 2024 — look stronger after Trump's win."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Omineca Mining and Metals Ltd. (OMM:TSX.V; OMMSF:OTCMKTS)

"We are still relatively constructive on gold," said Taylor Krystkowiak, investment strategist at Themes ETFs, according to Salisbury's report. "Why does gold go up? It's geopolitical uncertainty, it's deficit spending, and it's inflation. Right now, all those stars are aligned."

Ownership and Share Structure

The company is 31% owned by insiders and management, according to the company. The rest is retail.

Top shareholders include 49 North Resources Inc. with 25.31%, Sprott Asset Management LP with 5.05%, President and CEO Thomas MacNeill with 4.34% and Chief Financial Officer/Director Andrew Davidson with 2%, according to Reuters.

Omineca has 180 million shares outstanding.

The company's market cap is CA$11.73 million, and its 52-week price range is CA$0.04−0.14 per share.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Omineca Mining and Metals Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. Golden Cariboo Resources Ltd. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Omineca Mining and Metals Ltd. and Golden Cariboo Resources Ltd.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.