Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT) has filed its interim financial statements for the three-month period ending September 30.

The gold company announced it posted a net loss of CA$27.6 million, or CA$0.31 per share, compared to a loss of CA$5.3 million, or CA$0.06 per share, during the same period last year.

"The net loss reported in the current three-month period included a non-cash loss of CA$42 million from the quarterly re-measurement of the company's secured notes, primarily driven by a decrease in discount rates, higher metal prices, and a change in the valuation date, offset by interest payments," Seabridge said in a release.

The company noted it also invested CA$28 million in mineral interests, property, and equipment during the three-month period, compared to CA$73.7 million during the same period last year.

On September 30, 2024, net working capital was CA$36 million compared to CA$54.5 million on December 31, 2023, the company said.

Major Milestone: 'Substantially Started' Status

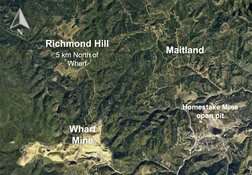

Seabridge announced this summer that it had received the "Substantially Started" designation from the British Columbia government for its massive 100%-owned KSM Project in British Columbia's Golden Triangle, a major milestone for the company.

The company has worked toward fulfilling the requirements needed to earn the designation since acquiring the project in 2001 and spent more than CA$1 billion advancing KSM, including CA$800 million after its Environmental Assessment Certificate (EAC) was issued in 2014.

A major focus for Seabridge continues to be finding a joint venture partner for the project, which Red Cloud Securities Analyst Taylor Combaluzier has described as "one of the largest, undeveloped gold-copper projects in the world."

RBC Capital Markets analyst Michael Siperco wrote the Substantially Started designation is based on three key criteria: Indigenous support for the project, the physical disturbance from permanent infrastructure, and the total expenditures on construction activities.

A major focus for Seabridge continues to be finding a joint venture partner for the project, which Red Cloud Securities Analyst Taylor Combaluzier has described as "one of the largest, undeveloped gold-copper projects in the world." RBC Capital Markets is running a formal search process.

"The company continues its pursuit of a joint venture agreement on the KSM Project with a suitable partner on terms advantageous to the company, since it does not intend to build or operate the project alone," Seabridge said in a Management's Discussion and Analysis document released with the quarterly results. "The KSM Project includes multiple deposits and provides a joint venture partner, or purchaser, flexibility in the design of the project."

Renewed License Further De-Risks Project

In September, the company received a renewed License of Occupation (LoO) from the British Columbia government for the tunnels it plans to build to connect the east and west sides of KSM.

The renewed license for the Mitchell Treaty Tunnels (MTT) is good until September 27, 2044, and is "another de-risking event for Seabridge" and the project, Cantor Fitzgerald Analyst Mike Kozak wrote in an updated research note at the time.

About 12.5 kilometers of the 23-kilometer-long parallel tunnels pass through 11 mineral claims owned by a joint venture between Tudor Gold, Teuton Resources, and American Creek Resources, for which Tudor Gold is the operator.

"The renewed LoO includes new language that limits these companies such that they may not 'obstruct, endanger or interfere with the construction, operation or maintenance of' the MTT," wrote Kozak, who rated the stock a Buy with a target price of CA$45 per share. "This provides important clarity/security for KSM."

The tunnels will use automated rail to connect ore mined and crushed from the Mitchell, East Mitchell, and Sulphurets deposits to the main Ore Processing Complex, Kozak noted.

"Not only does the renewed MTT LoO now extend by 20 years to 09/27/44, but it also provides additional clarity and security of the MTT taking priority over other select mineral claims in the area," Kozak wrote.

The Catalyst: Gold Still in Bull Market

Gold has seen some volatility in the last week since the U.S. election after hitting a fresh record high at the end of October.

With the dollar index rising 0.5% to its highest level since early July, gold became less attractive to non-dollar buyers. Last week, the index surged more than 1.5% to 105.44 following the announcement of Trump's victory, Reuters reported.

"The market's attention has focused to the second-order effect since the red wave," said Daniel Ghali, commodity strategist at TD Securities, according to Reuters.

But most experts agree the gold bull market is not disappearing soon. Ian Salisbury wrote for Barron's that "most of the arguments gold bulls make — and have been making throughout 2024 — look stronger after Trump's win."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT)

"We are still relatively constructive on gold," said Taylor Krystkowiak, investment strategist at Themes ETFs, according to Salisbury's report. "Why does gold go up? It's geopolitical uncertainty, it's deficit spending, and it's inflation. Right now, all those stars are aligned."

Ownership and Share Structure

Reuters provided a breakdown of the company's ownership and share structure, where management and insiders own approximately 3% of the company. According to Reuters, CEO and Chairman Rudi P. Fronk owns 1.41%.

Reuters reports that institutions own about 55% of the company. According to Reuters, Friedberg Mercantile Group Ltd. owns 13.34%, National Bank of Canada owns 5.15%, Van Eck Associates Corp. owns 4.2%, Kopernik Global Investors, L.L.C. owns 3.71%, Paulson & Co. Inc. owns 2.36%, and Sprott Asset Management L.P. owns 2.24%.

According to Reuters, there are 87.69 million shares outstanding, while the company has a market cap of CA$1.78 billion and trades in a 52-week range of CA$12.62 and CA$28.39.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Seabridge Gold Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Seabridge Gold Inc.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.