Red Cloud Securities analyst Timothy Lee, in a research report published on November 15, 2024, provided his initial analysis of Silver North Resources Ltd. (SNAG:TSX; TARSF: OTCQB) following the company's announcement of drill results from its Haldane silver project in the Yukon.

Lee viewed these results positively, stating, "In our opinion, these are positive results. The overall width of the fault system encountered in each hole bodes well for the size potential of the Main Fault."

He added that "these new results demonstrate that the Main Fault may have greater size potential and could be the primary focus for drilling going forward."

The analyst highlighted significant drill results from the Main Fault target, including "1,491 grams per tonne silver equivalent (g/t AgEq) (incl. 1,088 g/t silver (Ag), 3.9 g/t gold (Au), 1.89% lead (Pb), 0.63% zinc (Zn)) over 1.83m, and 174 g/t AgEq over 28.36m, including 491 g/t AgEq over 5.81m" from Hole HLD24-30.

Regarding the continuity of mineralization, Lee noted that "Two holes at the Main Fault are ~50m apart, and multiple mineralized intersections at both holes demonstrates the continuity of mineralization in this area."

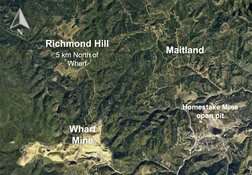

The report emphasized the strategic location of the project, noting that "Haldane is located 25km west of Keno City, adjacent to Hecla's producing Keno Hill mine."

Red Cloud Securities has not assigned a rating or target price to Silver North Resources at this time. The company's share price at the time of the report was CA$0.10, with a market capitalization of CA$4.5M.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Silver North Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver North Resources Ltd.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Disclosures for Red Cloud Securities, Silver North Resources Ltd., November 15, 2024

Red Cloud Securities Inc. is registered as an Investment Dealer and is a member of the Canadian Investment Regulatory Organization (CIRO). Red Cloud Securities registration as an Investment Dealer is specific to the provinces of Alberta, British Columbia, Manitoba, Ontario, Quebec, and Saskatchewan. We are registered and authorized to conduct business solely within these jurisdictions. We do not operate in or hold registration in any other regions, territories, or countries outside of these provinces. Red Cloud Securities bears no liability for any consequences arising from the use or misuse of our services, products, or information outside the registered jurisdictions. Part of Red Cloud Securities Inc.'s business is to connect mining companies with suitable investors. Red Cloud Securities Inc., its affiliates and their respective officers, directors, representatives, researchers and members of their families may hold positions in the companies mentioned in this document and may buy and/or sell their securities. Additionally, Red Cloud Securities Inc. may have provided in the past, and may provide in the future, certain advisory or corporate finance services and receive financial and other incentives from issuers as consideration for the provision of such services. Red Cloud Securities Inc. has prepared this document for general information purposes only. This document should not be considered a solicitation to purchase or sell securities or a recommendation to buy or sell securities. The information provided has been derived from sources believed to be accurate but cannot be guaranteed. This document does not take into account the particular investment objectives, financial situations, or needs of individual recipients and other issues (e.g. prohibitions to investments due to law, jurisdiction issues, etc.) which may exist for certain persons. Recipients should rely on their own investigations and take their own professional advice before investment. Red Cloud Securities Inc. will not treat recipients of this document as clients by virtue of having viewed this document. Red Cloud Securities Inc. takes no responsibility for any errors or omissions contained herein, and accepts no legal responsibility for any errors or omissions contained herein, and accepts no legal responsibility from any losses resulting from investment decisions based on the content of this report.

Company Specific Disclosure Details In the last 12 months preceding the date of issuance of the research report or recommendation, Red Cloud Securities Inc. has performed investment banking services for the issuer.

Analysts are compensated through a combined base salary and bonus payout system. The bonus payout is determined by revenues generated from various departments including Investment Banking, based on a system that includes the following criteria: reports generated, timeliness, performance of recommendations, knowledge of industry, quality of research and client feedback. Analysts are not directly compensated for specific Investment Banking transactions. Recommendation Terminology Red Cloud Securities Inc. recommendation terminology is as follows: • BUY – expected to outperform its peer group • HOLD – expected to perform with its peer group • SELL – expected to underperform its peer group • Tender – clients are advised to tender their shares to a takeover bid • Not Rated or NA – currently restricted from publishing, or we do not yet have a rating • Under Review – our rating and target are under review pending, prior estimates and rating should be disregarded. Companies with BUY, HOLD or SELL recommendations may not have target prices associated with a recommendation. Recommendations without a target price are more speculative in nature and may be followed by “(S)” or “(Speculative)” to reflect the higher degree of risk associated with the company. Additionally, our target prices are set based on a 12-month investment horizon.

Dissemination Red Cloud Securities Inc. distributes its research products simultaneously, via email, to its authorized client base. All research is then available on www.redcloudsecurities.com via login and password.

Analyst Certification Any Red Cloud Securities Inc. research analyst named on this report hereby certifies that the recommendations and/or opinions expressed herein accurately reflect such research analyst’s personal views about the companies and securities that are the subject of this report. In addition, no part of any research analyst’s compensation is, or will be, directly or indirectly, related to the specific recommendations or views expressed by such research analyst in this report.