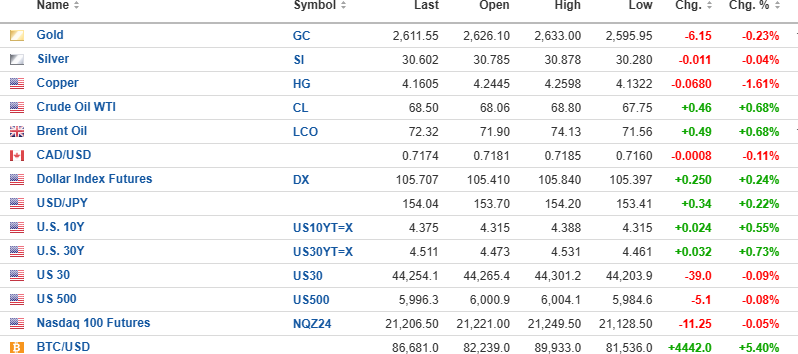

USD Index futures are up 0.24% to 105.707 with the 10-yr. yield (- 0.55%) up to 4.375%, and the 30-yr. yield (+0.73%) up to 4.511%. Metals continue to correct, with gold (- 0.23%) down $6.15, silver (-0 .04%) down $0.011, and copper (- 1.61%) down $.068.

Oil is up 0.68% to $68.50. Stocks are again down a tad, with the DJIA (- 0.09%), S&P 500 (-0 .08), and NASDAQ (-0 .05%) all lower. Risk barometer Bitcoin is up 5.40% to another record high at $86,681. Bitcoin is now the top-performing asset of the year, up 103.30% year-to-date.

Gold and Silver

As painful as it was, I bit the bullet early yesterday and dumped all positions (shares and call options) in iShares Silver Trust (ETF) (SLV:NYSE) with a view to buying everything back after this "Trump Trade" runs its course. Using the chart below, if this plays out like 2016, then the precious metals should stay under pressure until mid-to-late December, after which I expect a decent rally to all-time highs as markets take recognition that the new administration can do nothing to solve the debt problem.

It might take until Trump's inauguration in January before the "honeymoon effect" wears off, but for now, I have to respect the market's judgment, and with gold and silver uptrend lines falling like rice at an Italian wedding, I refuse to stand in the way of the steamroller. There will be bounces, but for now, the direction is DOWN until all those positions bought as hedges before the election (and there were tons of them) are unwound. That would coincide with a low during the December tax-loss harvesting period.

Stocks

In the GGMA 2024 Trading Account:

- Sold 100 Invesco QQQ ETF (QQQ:NASDAQ) at $515.00 on-stop.

This trade generated a 5.10% gain in two weeks, and when added to the profits generated by the December $525 calls, it takes me to "flat looking for re-entry."

I am going to target the iShares Russell 2000 ETF (IWM:NYSEArca) which is the ETF covering the small- cap names on the NYSE and NASDAQ. It recently broke out after two years of underperformance. However, with a RSI over 75, I will wait for a pullback before taking a position.

Fitzroy Minerals Inc.

I communicated with Fitzroy Minerals Inc.'s (FTZ:TSX.V; FTZFF:OTCQB) management last night, who are in meetings in Zurich pitching the $0.20 funding round associated with the CIRO approval of the Buen Retiro acquisition. It is expected that a Letter of Consent will be emailed to all shareholders for signature, which will further clear the decks for the re-opening of the stock for trading. I do not yet have a timeline nailed down, but after downloading the 43-101 report for Buen Retiro from SEDAR, all that matters to me as a shareholder is that they close this acquisition because, with all the work done on this project, the cost to FTZ/FTZFF is "peanuts" with this asset being highly and immediately accretive.

| Want to be the first to know about interesting Silver, Critical Metals, Base Metals and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.