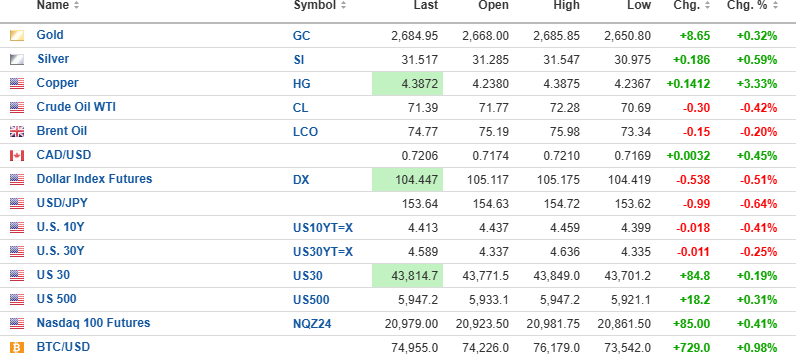

USD Index futures are lower this morning by 0.51% to 104.447, while the 10-yr. yield (-0.41%) is down to 4.413% and the 30-yr. yield (-0.64%) is at 4.589%. Gold (+0.32%), silver (+0.59%), and copper (+3.33%) are all rebounding higher, but oil (-0.42%) is lower to $71.39/bbl.

Stock futures are continuing their lovefest with the Trump victory, with the DJIA futures (+0.19%), S&P 500 (+0.31%), and NASDAQ (+0.41%) all higher. Risk barometer Bitcoin is up 0.98% to $74,955, another record high.

FOMC Day

The Fed Open Market Committee ("FOMC") meetings were held yesterday and again today, with the Fed delivering the interest rate decision at 2:00 pm this afternoon. It is expected that the Fed Funds rate will be lowered by 25 basis points, but the risk is that recent data will force them to pause.

The U.S. bond auction went well yesterday, with solid demand across all maturities well bid. Bond yields have risen 75 basis points (0.75%) since the 50-point cut in September, and bond prices are now deeply oversold.

TLT:US

The iShares 20+ Year Treasury Bond ETF (TLT:US) is in the GGMA 2024 Trading Account at a cost of $91.75, with the TLT December $90 calls on the books at $3.75. With the RSI bouncing above and below the 30 mark, it is close enough to being "oversold" to justify adding to the calls and to the ETF.

- Buy 100 TLT:US at $90.25

New adjusted cost on 1,000 shares moves to $91.00. Target: $100 by year-end

- Buy 25 calls TLT December $90 calls at $2.25

New adjusted cost on 50 contracts moves to $3.00. Target: $10.00 by expiry

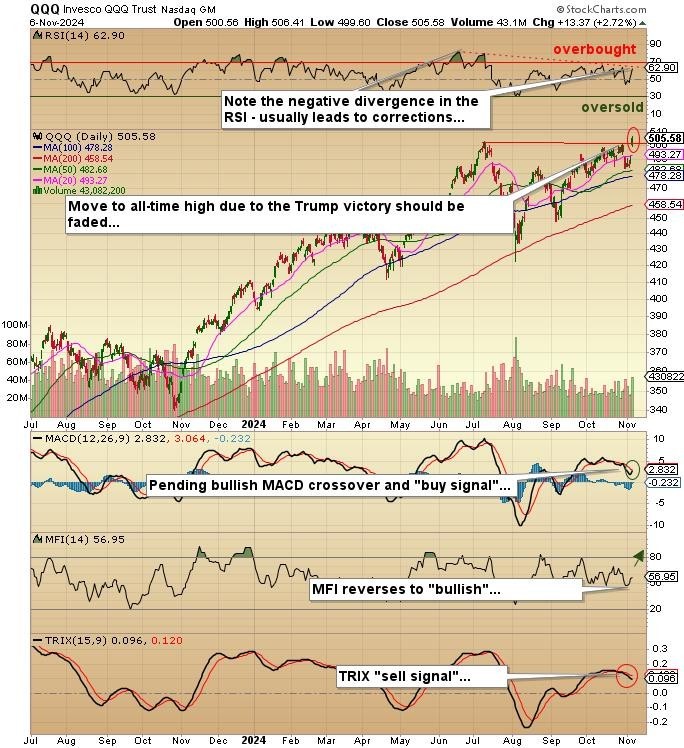

QQQ:NASDAQ

I am flat the call options and have a stop-loss at $500.00 on 100 shares. I am going to move the stop-loss up again this morning to $505 and am looking to take on a short-term position in the Invesco QQQ ETF (QQQ:NASDAQ) December $480 put options in the event that stocks turn down after or during the Powell press conference which begins at 2:30 pm.

The Powell presser has historically seen big reversal days after extended winning or losing sessions. Yesterday's historic rise of the Trump victory took on the image of "panic buying," which is usually a selling opportunity. However, with corporate buybacks now kicking into gear, the only way I short the current market is if it is sharply higher going into the Powell presser and then reverses.

Fitzroy Minerals Trading Halt Update

For Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB), it is expected that all requirements leading to the approval of the Ptolemy Mining Ltd. (Buen Retiro) acquisition will be filed with CIRO by the end of the week leading to a re-opening of the stock for trading mid-next-week. I expect it to be very well-bid as all restrictions on insider activity will be absent. Drilling is expected to commence at Buen Retiro upon approval of the deal.

FTZ/FTZFF remains my top exploration/development play for 2024 and beyond.

| Want to be the first to know about interesting Base Metals and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.