Last week, the title of my missive was "Hail the Silver Bull," and as I was writing the title, I thought to myself that if there ever was a "top-ticking" headline and one that invited and embraced the phrase "pride cometh before a fall," that phrase would be it. I am not normally superstitious, but I am totally "in sync" with the concept of never tempting the gods when it comes to the markets, but that is doubly true for the commodity markets and true to the tenth power for the silver market.

Mark Twain has a famous quote that goes like this: "It ain't what you don't know that often gets you into trouble; it's what you know for sure that turns out to be not exactly so." No truer words were ever written. Silver broke out to new highs a week and a half ago — just like tech stocks have done every other week since the bankers decided to promulgate the "asymmetric wealth effect" by juicing stocks whenever required. I decided to join the "feasting fray" of silver bulls, all salivating at the gums and chastising anyone and everyone who challenged the Sprott-ian mantra of $200 silver. I knew "for sure" in Twainian fashion that silver just had to go higher.

However, secretly, and under cover of anonymity by way of a fake nose and mustache, I was terrified that my agnosticism for the silver religion had been belly-whipped into choking submission. I wrote last week's missive on the assumption that silver, like the tech stocks, would respond to the technical break-out and gap higher.

Full stop. It failed.

We close the week out with me in full "depression mode" as the one commodity that should be trading in the $40's once again closes below the break-out point ($32.75-33.00 basis December) and now forces me to re-assess my thinking.

No. Wait. "Re-assess my thinking" is a newsletter writer's way of saying, "Find a way to admit error without admitting that your annual subscription fee is too high."

Silver, my friends, drives me absolutely batty because there is no circumstance under which it acts "normally." It is a heathen market driven by underworld sirens with a diabolical agenda.

I own the iShares Silver Trust (ETF) (SLV:NYSE) as well as a bunch of November and December calls that are now seriously underwater. I await the election results, after which I will be rendered either "hero" or "bum."

How is that for technical prowess?

Stocks

I usually go into U.S. elections fully hedged, but this year, I am flying free with nary a VIX call or ETF in my portfolio. I cannot get beyond the idea that corporate America has filed over a TRILLION dollars of buybacks, and they all started November 1.

Yes. November 1 was a day like no other when the jobs report showed an absolute CRASH in employment yet an across-the-board surge in the major averages. I own the Invesco QQQ ETF (QQQ:NASDAQ) and the December $525 calls, and I am truly nervous on both counts. However, I am nervous that I am holding too much cash-in-reserve as the bearishness that I detect is absolutely rampant going into "Trump Tuesday." I had been an ardent bear at the April and late-July peaks but always in total distrust of the "triad of evil" (Fed, Treasury, and Wall Street); I made damn sure I covered at (or at least near) the lows of those declines.

This time, I have the distinct impression that the fully-hedged bears are going to get summarily stuffed in the heady days after the election outcome, regardless of who the Powers That Be decide is going to run the Free World.

Copper

The copper stocks have cooled off as the ETF represents the biggest of the copper producers. Global X Copper Miners ETF (COPX:NYSE), is off 16.4% from the May 20 peak at $52.90. I absolutely love copper's fundamental and technical narrative and continue to believe that when arguing from either the demand or supply side of the debating table, one is drawn into a feedback loop that continues to drumroll the resource depletion argument to the detriment of China's demand destruction argument.

China is not quitting with its 5-year-plan to upgrade its electrical grid simply because a few Chinese property billionaires are now only millionaires. The nuclear power growth curve is not only in an uptrend in depressingly low China but also in Latin America and most countries classified as "emerging markets" (otherwise known as "Third World" inhabitants).

Copper is going to all-time high ground for the oldest and truest reason in the Econ101 textbook: there is too much demand chasing too little supply. And it is only going to get worse — meaning that prices can only go sideways or up.

Gold and the GLD:NYSE

The one market in the universe that has kept its cool is the gold market. It has behaved as though someone drew the chart first and instructed it to follow the lines.

I have not seen a better-looking chart in decades as the ultimate form of money and wealth preservation continues to send the CNBC anchors into panic-driven grand mal seizures.

Every gold guru and their dog are coming out with post-election predictions for the price of gold, and they are all pointing to weakness if there is a Trump victory but continued strength in the event of a Harris victory.

From where I sit, neither candidate has voiced anything vaguely resembling fiscal or monetary restraint. In fact, I have never even heard the words "deficit" or "debt" in any of the speeches by either candidate. Both Trump and Harris are can-kicking spenders who will do anything and everything to maintain the status quo of where the U.S. dollar remains the world's reserve currency (and the easiest to debase) and the S&P 500 is the benchmark by which economic leadership is judged.

With that as a backdrop, gold will power higher, and my forecast from two years ago of a top in the $2,750 range will be a far cry from "pinpoint accuracy" or "analytical precision." I would have been better off calling the direction rather than the amplitude of gold's move because all indications point to $3,000 and above before any kind of top can be established.

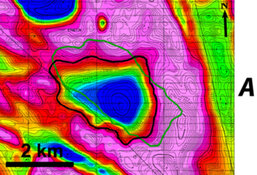

Where the practice of gold ownership has failed miserably is in the use of gold mining stocks as a leverage play on the gold price. One glimpse at the chart above tells a tale of two worlds: rejoice in the physical gold world and abject forlornness in the world of the miners.

Gold miners have been underperforming the gold bullion price since August 2020, largely due to poor price performance by the two companies with the biggest weighting in the gold indices — Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) and Newmont Corp. (NEM:NYSE).\

Newmont has a habit of delivering nasty little surprises when it comes to reporting earnings. They did last February when they missed revenue and earnings guidance numbers, resulting in an ugly plunge to the COVID Crash lows under $30. I went bullish after a number of prominent podcasters began to rage eloquently about that "worthless POS!" after which the stock climbed to a high of $59.72, a double from the lows seen in February.

However, fast forward to October 2024 at the point where one would assume that all of the acquisitions (particularly the Aussie gold miner Newcrest Mining Ltd. (NCM:ASX) made in the prior three years would finally become wildly accretive with bullion trading north of $2,500. Alas, for the reporting period, NCM shocked the Street by completely missing on both revenues and earnings, citing an inordinate and unforeseen spike in the AISC due to cost overruns at Newcrest.

Managerial errors of this magnitude were fully responsible for the diminished reputation and optics of a sector that took a 90% haircut in enterprise value in the period of 2002-2011 through botched acquisitions and costly exploration endeavors

Sadly, the mistakes of that period had been largely remedied by a revolution from size (ounces vs. profits) to efficiency, with well-run companies like Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) knocking the cover off the ball in every single quarter. However, AEM is not considered to be the "big dog" in the manner that NCM and GOLD are, and that is reflected in the relative weighting in the gold indices and in the gold ETFs (like VanEck Gold Miners ETF (GDX:NYSEARCA:)) that took a 10% haircut thanks to the NCM earnings fiasco. I get dozens of emails every week inquiring about the dismal state of the junior miners, with particular attention to the junior explorers who have been left for dead at the side of the canyon road as the buzzards circle ravenously above.

My response is always the same: in an industry plagued by reputational challenges from managerial incompetence to outright fraud, the gold mining executives have to be doubly diligent in preventing "nasty surprises" by paying greater attention to the "forward guidance" that has become a safety valve for the U.S. technology sector.

How many times has Elon Musk been issued a "pass" after promising that his Tesla self-navigating vehicle would not run into a telephone pole while the driver is watching Pornhub?

Elon walks away unscathed time after time, but that group of geriatrics that run Newmont are thrown loudly and demonstrably under the bus because they misjudged the expenses of their kangaroo-land mining venture. I would suggest that something is seriously out of whack and that the gold miners should be afforded the same kind of hall pass that the technology geniuses are granted.

| Want to be the first to know about interesting Base Metals, Silver, Gold and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick Gold Corp. and Agnico Eagle Mines Ltd.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.