Golden Cariboo Resources Ltd. (GCC:CSE; GCCFF:OTC; A0RLEP:WKN; 3TZ:FSE) saw more visible gold and extensive quartz-carbonate veining in four recent drill holes, part of the program underway at its past-producing Quesnelle project in British Columbia's Cariboo Camp, a news release noted.

This quartet of holes, targeting the Halo zone, consists of QGQ24-16, QGQ24-17, QGQ24-18, completed to depths of approximately 485 meters (485m), and QGQ24-19, in progress and currently at a depth of approximately100m. With hole QGQ24-19, the company is pushing to expand the Halo zone to the north as it remains open in all directions. Assays for the completed holes are pending.

"This drilling has intersected prospective veining, extensive alteration plus visible gold within the veins," Cariboo President and Chief Executive Officer (CEO) Frank Callaghan said in the release. "Early signs point to a robust gold system with bulk tonnage mining potential, starting from surface."

"This drilling has intersected prospective veining, extensive alteration plus visible gold within the veins," Cariboo President and Chief Executive Officer (CEO) Frank Callaghan said in the release. "Early signs point to a robust gold system with bulk tonnage mining potential, starting from surface."

Callaghan added, "We're getting a grasp on the geometry of the system and systematically exploring the large gold-bearing trends. We see extraordinary prospectivity along these trends."

The company will have more capital to spend on its ongoing exploration at Quesnelle when its recent, oversubscribed non-brokered private placement closes, Streetwise Reports noted. The raise generated total proceeds of CA$1.26 million (CA$1.26M).

Previously, the company reported observing multiple instances of visible gold in hole QGQ24-16 earlier this month and in holes QGQ24-13 through QGQ24-15 in July.

"Visible gold in current drilling indicates potential for high-grade assays from mineralized targets," Couloir Capital Senior Mining Analyst Ron Wortel wrote in a recent research report.

Rediscovering the Cariboo Camp

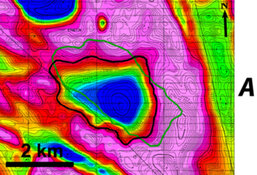

Golden Cariboo, a Canadian explorer-developer, is targeting a potential multimillion-ounce gold resource at its 3,814-hectare Quesnelle project, where gold, silver, lead and zine were produced historically, according to its Investor Presentation.

The company's neighbors in the mining district include Osisko Development Corp. (ODV:TSX.V) (Cariboo gold project), Spanish Mountain Gold Ltd. (SPA:TSX.V) (Spanish Mountain deposit), Omineca Mining and Metals Ltd. (OMM:TSX.V; OMMSF:OTCMKTS) (Wingdam mine) and Taseko Mines Ltd. (TKO:TSX; TGB:NYSE.MKT) (Gibraltar mine).

Callaghan began rediscovering the Cariboo Camp in the mid-1990s as Barkerville Gold Mines Ltd. He and his then team discovered a gold deposit at Bonanza Ledge and advanced the project to production. He also assembled and developed the Cariboo Gold Project. Ultimately, Osisko Royalties acquired Barkerville and the assets in 2015 for US$338M, and Osisko Development Corp. is about to restart mining operations in the camp.

Subsequently, in 2019, Callaghan acquired the Quesnelle Gold Quartz project, where he aims to repeat his previous successes, given the property's geology is similar to that of the other two projects.

Bull Run Ahead for Mining Stocks

The gold price broke through the US$2,700 per ounce (US$2,700/oz) barrier last week and ended today at US$2,788/oz. Safe haven demand is buoying the gold and silver prices ahead of the U.S. jobs report due out this Friday and the U.S. elections next week, Kitco News reported on Oct. 29. The trepidation about the outcomes of these two events is "supporting buying interest in the safe-haven gold and silver markets."

Recently polled London Bullion Market Association members indicated they believe the gold price could reach US$2,940/oz during 2025, reported Stockhead on Oct. 28.

"Combined with expectations of lower global interest rates, this further enhances gold's attractiveness as an investment," the article noted.

As for gold equities, the S&P/TSX Venture Composite Index (SPCDNX) confirmed a multidecade bull run for junior, intermediate, and senior mining stocks when it closed above 1,000 recently, Stewart Thomson with 321Gold wrote. The index is a key indicator of the health of the general gold, silver, and mining stocks market.

Experts predict the gold price will keep climbing. In its revised forecast, Citi Research expects the gold price to hit US$2,800/oz in three months versus its previous estimate of US$2,700, according to Reuters. The analysts based their new projection on potential further U.S. labor market deterioration, interest rate cuts by the U.S. Federal Reserve, and physical gold and exchange-traded funds buying. Looking six to 12 months out, Citi forecasts US$3,000/oz gold.

InvestingHaven's price prediction is even more bullish, US$3,100/oz gold in 2025, it wrote on Oct. 22. The investing research service derived this estimate from leading gold price indicators, including heightened inflation and increasing central bank demand, and from patterns on long-term gold charts, it noted.

The Catalysts

Given that Golden Cariboo is continuing its exploration program at Quesnelle throughout 2024, near-term catalysts include drill and assay results demonstrating significant grades or widths and better-defined mineralization controls and trends, according to Couloir Capital's Wortel.

External catalysts include market transactions in the junior mining space involving projects or companies in the Cariboo region. Reports by Osisko Development of project advancements or production results relative to adjacent land also could boost Golden Cariboo's stock price.

New Gold Investment Story

Wortel recommended Golden Cariboo as a Buy "for exposure to gold resource discovery in a Tier 1 jurisdiction as the market delivers record gold prices."

He highlighted the potential for gold discovery at Quesnelle plus exploration upside, given Golden Cariboo's three additional claim groups in the Cariboo Camp: Rainbow, RimRock, and White Pine.

"The company's project is at an early stage of exploration, with known gold intercepts located in a well-serviced location," Wortel wrote. "It is being run by a competent team that is seeing the project advance through diligent analysis and exploration. The team is excited to see the project advance to [create] a new advancing gold exploration investment story."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Golden Cariboo Resources Ltd. (GCC:CSE; GCCFF:OTC; A0RLEP:WKN;3TZ:FSE)

Wortel's fair value price on Golden Cariboo implies a 90.5% lift from the current share price.

Ownership and Share Structure

According to Golden Cariboo, management and insiders own 30% of Golden Cariboo Resources. President and CEO Frank Callaghan owns 16.45% or 6.93 million shares; Elaine Callaghan has 0.97% or 0.41 million shares; Director Andrew Rees has 0.79% or 0.33 million shares; and Director Laurence Smoliak has 0.3% or 0.13 million shares.

Retail investors hold the remaining. There are no institutional investors.

The company said it has 50.3 million shares outstanding, 24.83 million warrants, and 3.8 million options.

Its market cap is CA$9.7 million. Over the past 52 weeks, Golden Cariboo has traded between CA$0.08 and CA$0.36 per share.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Golden Cariboo Resources Ltd. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Golden Cariboo Resources Ltd.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.