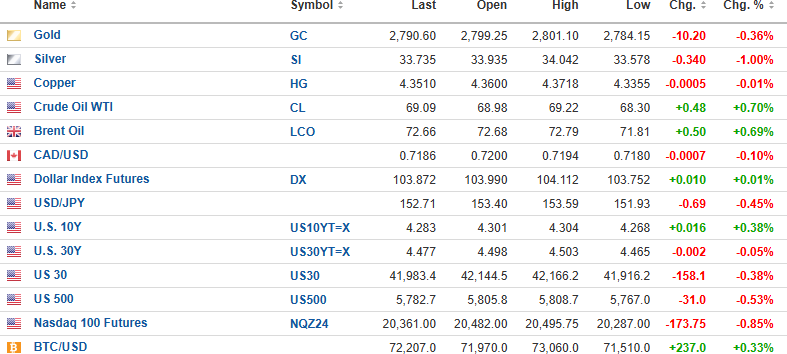

USD Index futures are ahead marginally this morning to 103.872, while the 10-yr. yield (+0.38%) is at 4.283% with the 30-yr. yield (-0.05%) at 4.477%. Metals are lower, with gold (-0.36%) down

$10.20, silver (-1.00%) down $0.34, and copper (-0.01%) down $0.0005. Oil (+0.70%) is ahead at $0.48/bbl. Stock futures are lower as META and MSFT guided lower despite impressive earnings and revenues. The DJIA futures are down 0.38%, S&P 500 futures are down 0.53%, and the NASDAQ is down 0.85%, with risk barometer Bitcoin up 0.33% to $72,207.

Freeport-McMoRan

Yesterday afternoon, I tried to add to the position of Freeport-McMoRan Inc. (FCX:NYSE), but the stock and call options refused to trade at my price, so this morning:

For more conservative investors:

- Buy 50% position (1,000 shares) FCX at $45.50

- Buy the remaining 50% position (1,000 shares) at $44.50, good through November 5 (election day).

For more aggressive traders:

- Buy 50% position (25 contracts) FCX December $40 calls at $6.50

- Buy the remaining 50% (25 contracts) of FCX December $40 calls at $4.50, good through November 5 (election day).

iShares Silver Trust ETF

For iShares Silver Trust (ETF) (SLV:NYSE), yesterday,

- Bought 25 calls SLV December $30 at $2.19

I will own 100 calls by the end of next week unless it breaks below the $33.50 level at which point I will call it a "failed breakout" and be forced to bail.

Stay tuned.

| Want to be the first to know about interesting Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.