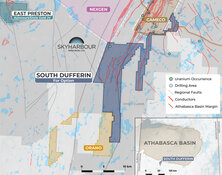

Aero Energy Ltd. (AERO:TSXV; AAUGF:OTC; UU3:FRA) has announced significant advancements at its Murmac and Sun Dog uranium projects in Northern Saskatchewan, with the first drill program revealing high-grade uranium potential. Situated near Uranium City on the Athabasca Basin's northern margin, the projects aim to capitalize on basement-hosted uranium deposits similar to high-grade discoveries in the region.

The initial drill campaign completed 16 holes, targeting 12 key areas, with 12 holes yielding anomalous radioactivity. A major highlight is the new high-grade uranium discovery in drill hole M24-017, which intersected 8.4 meters of mineralization at 0.3% U3O8, including assays peaking at 13.8% U3O8 at just 64 meters below surface. The results confirm Aero's exploration model, which focuses on basement-hosted deposits within graphitic structures, a common feature in Athabasca Basin uranium deposits like Arrow and Triple R.

"From the launch of the company in January, we took a very diligent yet aggressive approach to discovery," stated Galen McNamara, CEO of Aero Energy. "The combination of historical data and the results from the first drill program serve as evidence that basement-hosted mineralization akin to the large deposits beneath and adjacent to the Athabasca Basin is present in the area."

The Murmac project spans 25,607 acres and holds a production legacy of approximately 70 million pounds of U3O8. Similarly, the 48,443-acre Sun Dog property hosts the historic Gunnar uranium mine, which once held the title of the world's largest uranium producer. Past exploration focused on fault-hosted mineralization, missing the basement-hosted uranium potential that Aero's recent findings have validated.

Recent exploration efforts included a VTEM Plus survey, flown over 3,350 kilometers, identifying graphite-rich rocks that support Aero's exploration thesis. Additionally, two new occurrences of strong radioactivity were identified at surface-level scout locations: Target A15 showed 60,793 counts per second, and Target P4 displayed 13,533 counts per second. Summer 2024 drilling included 1,550 meters at Murmac and 1,600 meters at Sun Dog, highlighting shallow, high-grade potential in both areas.

In parallel, Aero Energy has announced a CA$2.5 million non-brokered private placement to support further exploration. The proceeds from flow-through units will fund work programs across Murmac, Sun Dog, and the Strike property, with the remaining funds allocated to general working capital.

Why Uranium?

The uranium sector has recently experienced strong growth, largely driven by increasing global demand and efforts to diversify from Russian supply chains. On September 30, The New York Times discussed the resurgence in Western uranium production, highlighting that "uranium mines are ramping up across the West, spurred by rising demand for electricity and federal efforts to cut Russia out of the supply chain." Aero Energy's recent discoveries and forthcoming winter drilling plans at Murmac and Sun Dog reflect this trend, with CEO Galen McNamara remarking, "The combination of historical data and the results from the first drill program serve as evidence that basement-hosted mineralization . . . is present in the area," suggesting strong potential for the Canadian uranium market to contribute to non-Russian nuclear fuel supplies.

Jeff Clark of The Gold Advisor highlighted his continued confidence in the company by stating, "I remain overweight the stock."

On October 9, Reuters reported that demand from U.S. buyers has been on the rise, as "a strong rise in demand from its U.S. customers" pushed Orano's recent plans to expand uranium enrichment in the United States and France. This shift underscores Aero Energy's recent investments in Northern Saskatchewan, where the company has identified high-grade uranium mineralization in both the Murmac and Sun Dog projects, aiming to meet future supply demands with a focus on basement-hosted deposits.

As Forbes reported on October 11, the uranium market experienced renewed momentum after Russian President Vladimir Putin hinted at the possibility of a ban on uranium exports to Western nations. This suggestion "jolted the uranium market," which had been declining after peaking earlier in the year. The price of uranium rebounded to US$83.50 per pound, reflecting rising concerns about potential supply disruptions. Citi analysts noted that “Russia supplies close to 12% of U3O8, 25% of UF6, and 35% of EUP to international markets,” underscoring the challenges that Western nations, particularly the U.S. and Europe, could face in replacing these critical materials. This market dynamic positions uranium companies operating outside of Russia, like those in the Athabasca Basin, to benefit from supply gaps and heightened demand.

MSN reported on October 13 that the UK's nuclear power capacity is set to decrease dramatically in the coming years, with the planned closure of four out of five remaining nuclear plants by 2028. This reduction in capacity is expected to increase pressure on global uranium supplies as demand for nuclear energy continues to rise amid efforts to meet climate goals. The ongoing shift toward low-carbon energy sources, coupled with the planned closures, could create further supply constraints and drive demand for uranium from alternative sources.

Aero's Catalysts

According to the company's October 2024 investor presentation, the ongoing development at Murmac and Sun Dog highlights Aero Energy's strategy to enhance shareholder value by targeting high-grade uranium deposits in underexplored regions. Aero has leveraged recent technology investments, including VTEM Plus aerial surveys, which identified graphite-rich formations favorable for uranium. The exploration efforts build on the CA$7.6 million previously invested by project partners Fortune Bay and Standard Uranium, which has contributed to refining the drill targets. As Aero works with its partners to maximize the impact of this winter's drilling program, the company's strategic location on the north rim of the Athabasca Basin positions it well to expand these discoveries and attract continued investor interest.

The recently announced CA$2.5 million private placement will further strengthen Aero's financial capacity to carry out its targeted drill campaigns and exploration work.

Analyzing Aero

Jeff Clark of The Gold Advisor, in his October 17 update, noted that Aero Energy has "identified more than 70 kilometers of strike to test for high-grade basement-hosted uranium," emphasizing the company's significant exploration potential in a region known for some of the world's richest uranium deposits.

Clark further commented on Aero Energy's recent results, underscoring the importance of drill hole M24-017, which intersected 8.4 meters of uranium mineralization, grading 0.3% U3O8, with assays reaching as high as 13.8% U3O8. He stated, "While not a discovery hole, per se, this hole underscores the company's thesis that these two projects are prospective for the same type of uranium mineralization as Arrow and Triple R." This observation reinforces Aero Energy's exploration model, which targets basement-hosted uranium deposits similar to those found at other significant Athabasca Basin discoveries.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Aero Energy Ltd. (AERO:TSXV;AAUGF:OTC;UU3:FRA)

Additionally, Clark expressed optimism regarding Aero Energy's current valuation and future prospects, recommending it as a strong buy at current levels. He highlighted his continued confidence in the company by stating, "I remain overweight the stock," suggesting that Aero Energy presents a compelling opportunity for speculative investors in the uranium exploration space.

The recently announced CA$2.5 million private placement was also acknowledged by Clark as a necessary step to fund further exploration activities. While he expressed some caution about potential dilution, he affirmed his overall support for the financing, noting that "its projects are very much worthy of follow-up."

Ownership and Share Structure

According to Refinitiv, management and insiders own 3.11% of Aero Energy. Of those, CEO Galen McNamara has the most at 2.97%. Institutions owns 4.79% with MMCAP Asset Management holding 3.89%. The rest is retail.

Aero has 92.3 million free float shares and a market cap of CA$4.5 million. The 52 week range is CA$0.040–$0.26.

| Want to be the first to know about interesting Uranium investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

1) James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

2) This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.