Canter Resources Corp. (CRC:CSE; CNRCF:OTC; 601:FRA) is a lithium–boron exploration and development company whose stock is most attractive for investors here principally for three big reasons.

One is that the stock is at a very favorable entry point, being priced at some 8% of its price at its late 2023 peak following a severe bear market.

Another is that the company has made considerable progress towards its goals during this period when the stock has paradoxically lost most of its value, and the third reason is that the price of lithium is stabilizing in a zone of strong support at a low level following a severe bear market from its 2022 peak and is thus in a position to start higher again before long which can logically be expected to have a very beneficial effect on companies like Canter and especially on their stock prices.

Before examining the latest stock charts for Canter to see why it looks so attractive here, we will first overview the fundamentals of the company with the assistance of some slides from its latest investor deck.

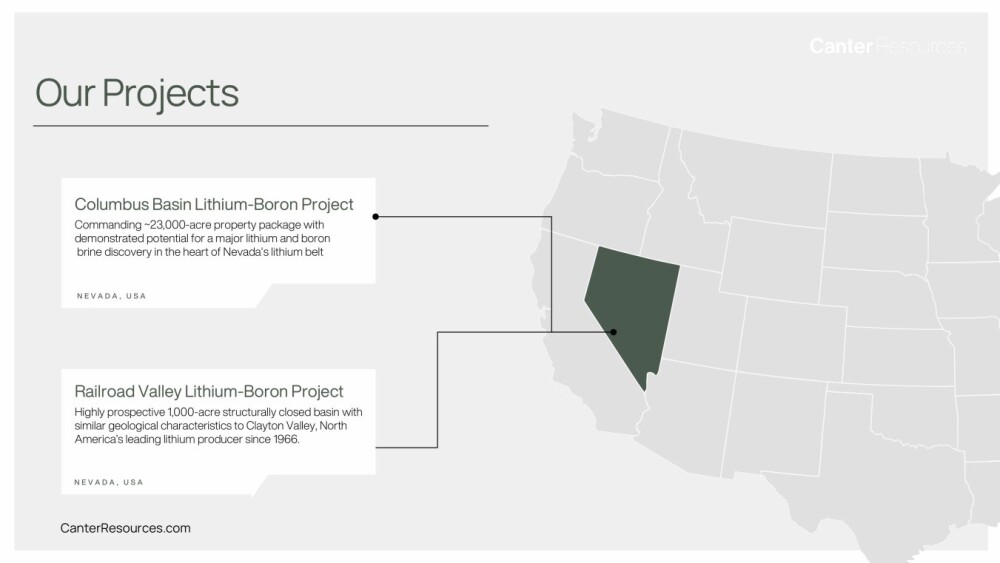

The company has two lithium–boron projects, the Columbus Basin Project and the Railroad Valley Project which are both in the highly favorable jurisdiction of Nevada. Some basic information on these projects is provided on the following slide.

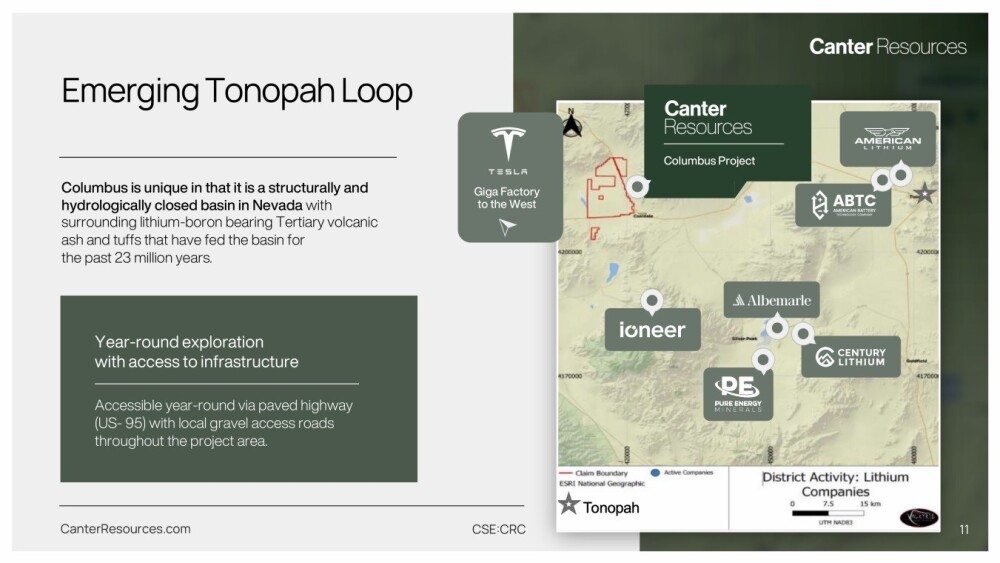

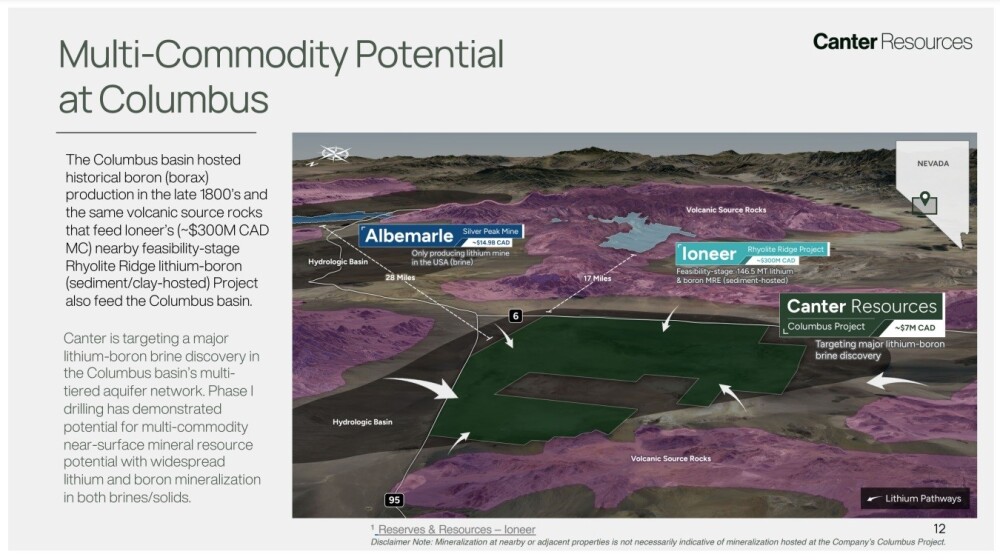

Nevada is the home of world-class lithium projects like Albermarle's Silver Peak lithium brine project, which is the only lithium-producing mine in the U.S. and has been in production since the 1960s.

It is only 28 miles away from the company's Columbus Project, which is considered to have similar geology. The Columbus Project is close to Silver Peak and a range of other big lithium projects in the area, which bodes well for discoveries and subsequent production, as shown on this slide.

The following slide shows more of the geography of the Columbus Basin and its environs.

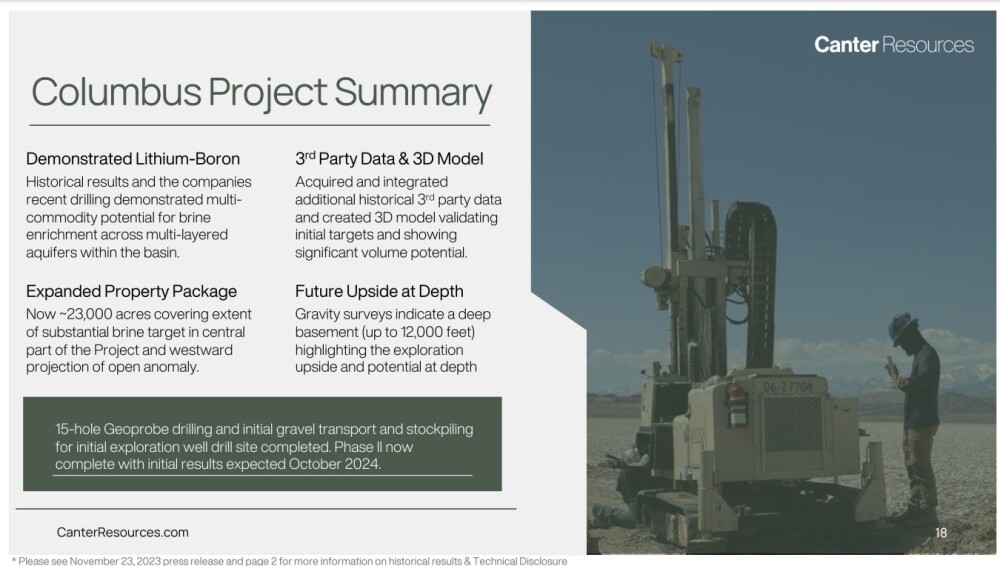

Here is a summary of the Columbus Project:

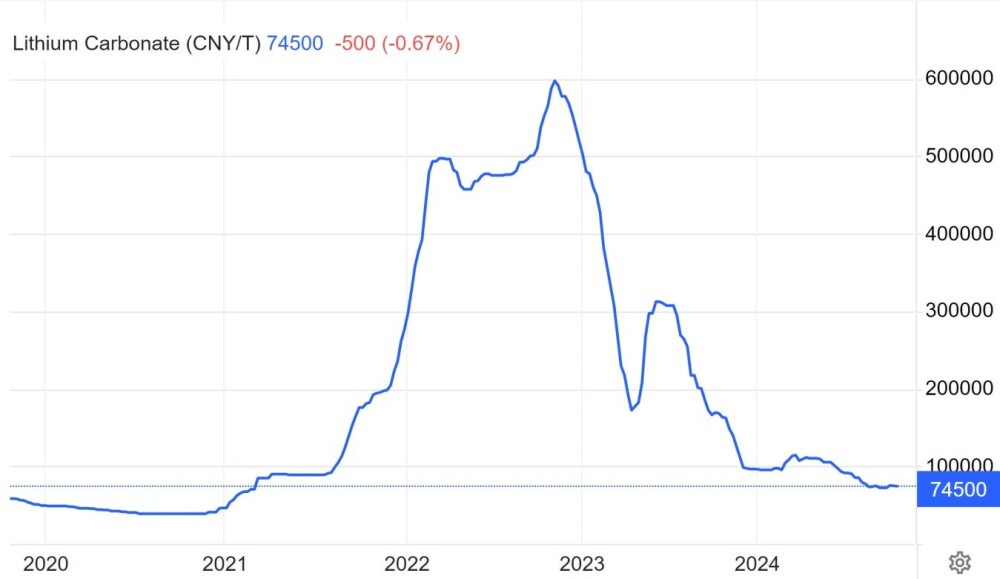

Part of the explanation for the recent bear market in lithium stocks like Canter is, of course, the severe bear market in the price of lithium itself from its late 2022 peak, as shown in the following chart.

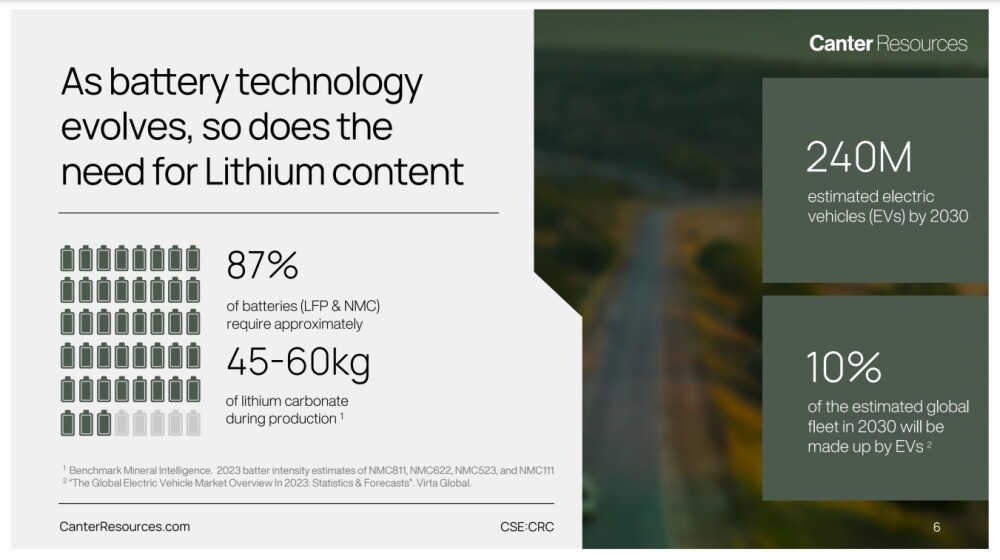

However, the outlook for lithium demand strongly suggests that lithium prices will not remain at these low prices for long.

The earlier news that Chinese battery giant Contemporary Amperex Technology Co. halted production at a major mine should help stabilize the lithium price.

As this article sets out:

"Based on recent lithium market conditions, CATL plans to make adjustments to the lithium carbonate production in Yichun, according to the company spokesperson. The stoppage will spur an 8% cut in China’s monthly lithium carbonate output and "will help rebalance the supply with demand," UBS analysts led by Sky Han wrote in a note.

The shutdown is positive for the commodity, according to UBS, which expects 11% to 23% upside for lithium prices in the rest of 2024. While the broker cautioned that past rumors about halted operations at the mine had turned out to be incorrect, it said it received "higher conviction this time."

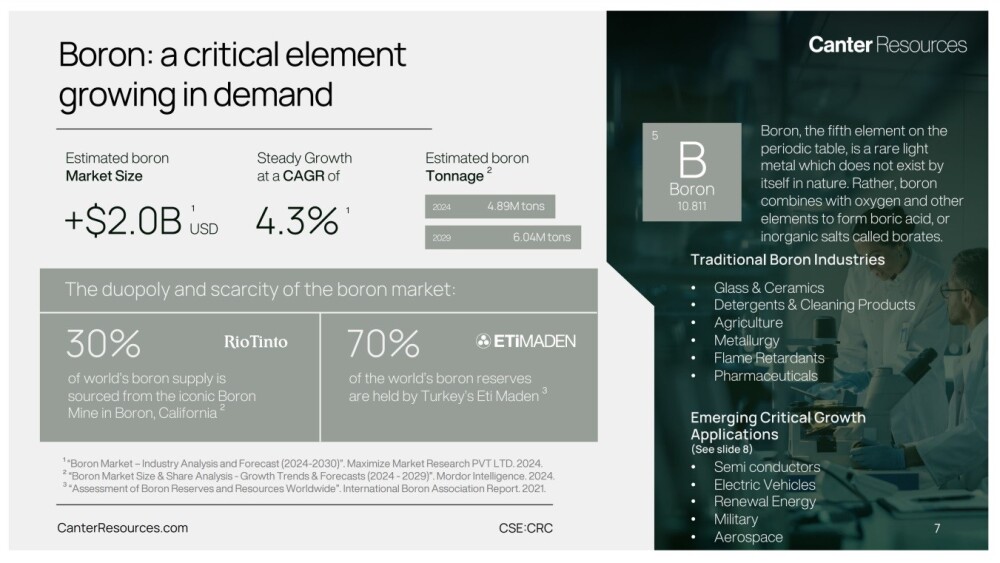

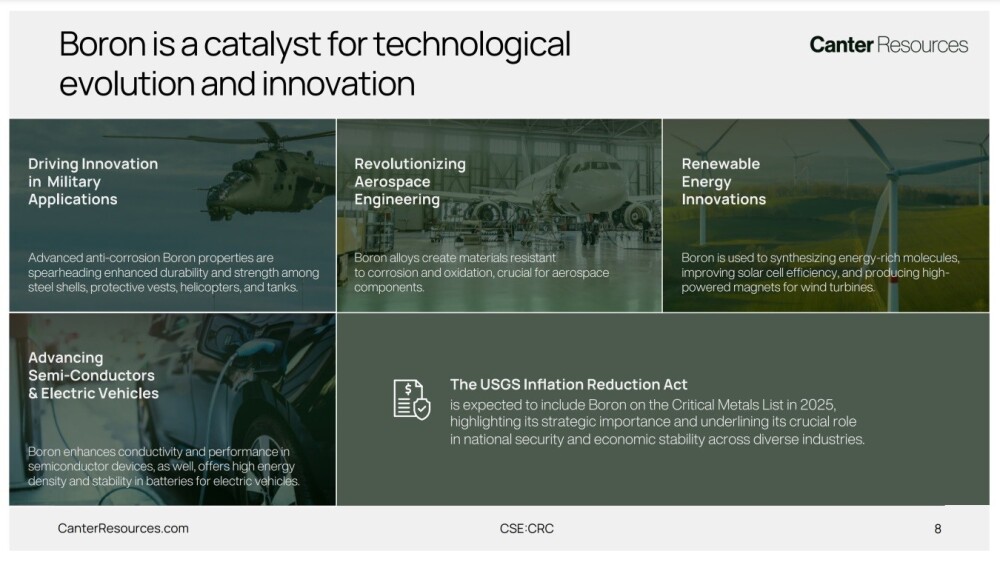

Canter's Project also contain significant quantities of Boron, which is a critical element and a rare light metal. Most people know nothing about Boron — the following slide provides some information about it.

Here is what Boron is used for:

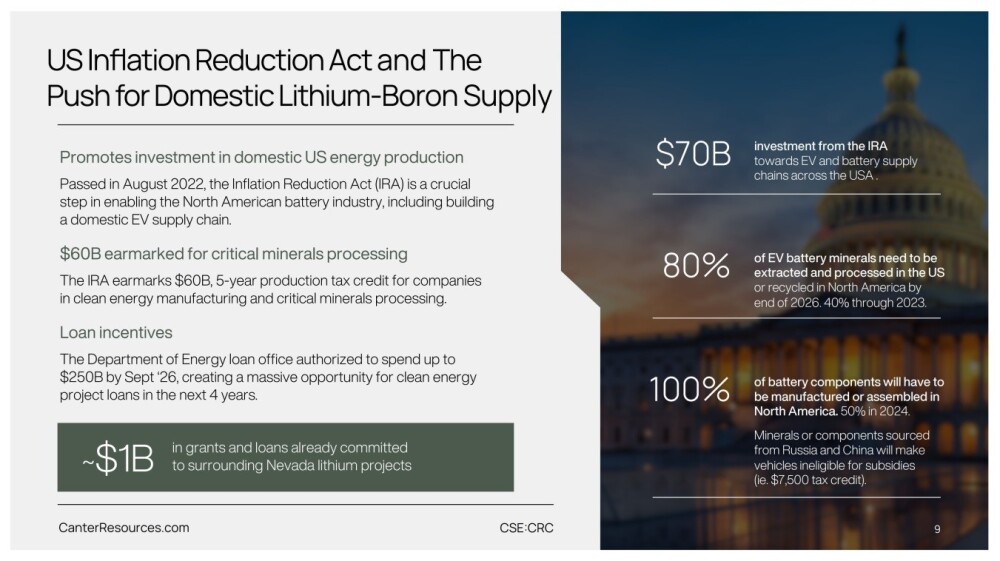

An important positive development for the company is that the government is moving to encourage domestic production of critical elements and metals like Lithium and Boron and is providing incentives for the industry in the form of grants, loans, and tax credits.

The company's other lesser Project is the Railroad Valley Project, a 1,000-acre property consisting of 100 claims. The following slide provides some information about it.

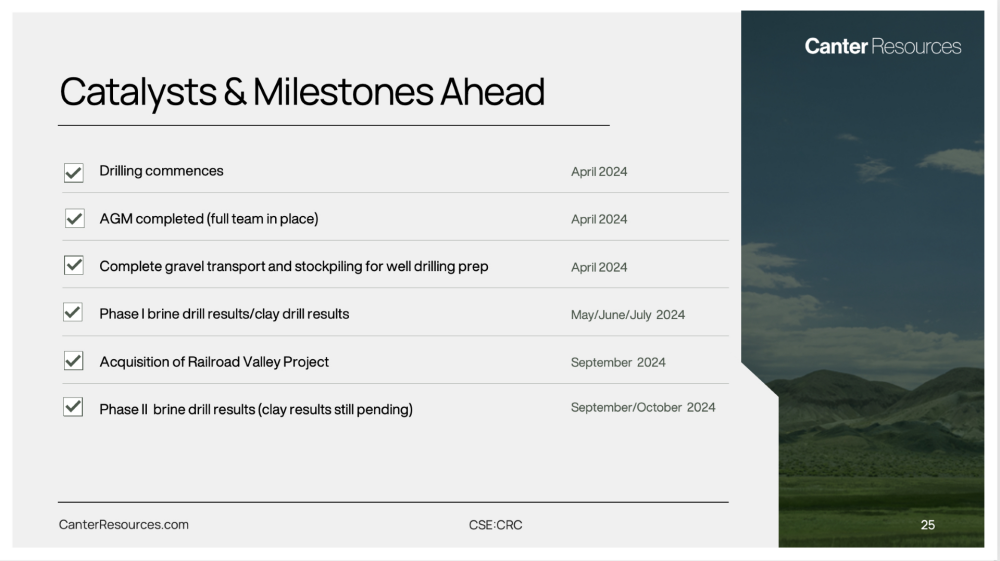

Here, we see key milestones achieved just over the past 12 months.

Of the catalysts and milestones ahead, we see that all of them are now in the rearview mirror, with the Phase II drill results being released just yesterday. These results look very positive and, coming on top of all the other catalysts listed here, look set to provide a "kicker" for the stock, especially as volume ballooned yesterday.

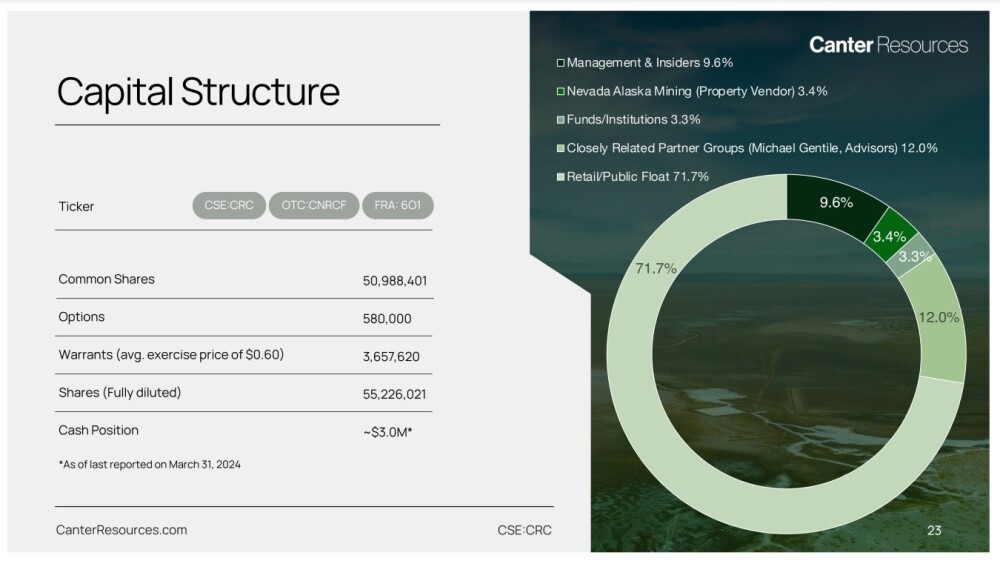

Lastly, we consider the Capital Structure of the company on the following slide, where we see that of the relatively modest 51 million shares in issue, 71.7% of them are in the float.

Turning now to the consideration of the stock charts, we find that a 14-month chart captures all of the action since it started trading. On this 14-month chart, we see that after it started trading in November of 2023, it briefly shot higher before a topping Triangle formed that led to it breaking down at the start of this year into a severe downtrend that has continued right up to the present and has inflicted heavy damage, with the stock losing some 92% of its value from its peak.

Using a log-scaled chart, we can see that it has been stuck in a persistent parallel downtrend, which it is now close to the bottom of — so this could be a very good point to buy — provided that there are other significant indications that it is bottoming and fortunately there are as we will proceed to see on the 3-month chart which shows recent action in much more detail.

Before leaving this chart, an important point to observe is that, despite the price plumbing new lows in recent months, downside momentum has been steadily dropping out, as shown by the MACD indicator creeping steadily back toward the zero line. It is also now heavily oversold relative to its 200-day moving average, which is falling far above the price and far above the 50-day moving average, which, at the least, creates the potential for a "snapback" rally.

On the 3-month chart, we can see the potential base pattern that has formed above support in the 7-cent area following the appearance of a prominent long-tailed "hammer" candle in the middle of September.

Note that the parallel downtrend channel shown on this chart is an inner one that has formed inside the larger parallel downtrend channel that we looked at on the 14-month chart. Bullish factors to observe on this chart include the healthy upside volume that has appeared since about the third week in September, the run of several "long-tailed" candles that has appeared since mid-September, which indicates buyers "snapping at" the stock when it dips and driving the price back up by the close of trading, which is bullish as it is an indication of underlying demand, and the steady diminution of downside momentum as shown by the MACD indicator, which has been easing since May.

All of these factors taken together, when coupled with the current very low price of the stock, indicate a high probability that it is in the process of reversing to the upside here.

Last but definitely not least, as mentioned above but worth repeating, the company came out with this important news yesterday morning: Canter Resources extended widespread lithium-boron brine mineralization in Phase II drilling at the Columbus Project.

Whilst the price did not move much in response to this news, volume exploded to over 450,000 shares traded, the second-highest tally since November last year. So it is clear that someone understood the positive implications of this news and was mopping up all the available supply at this level, which suggests that the price is likely to break out shortly.

So, with a positive fundamental outlook and good news out of the company yesterday and its charts making a good case for it to break out of its current downtrend into a new bull market, Canter Resources is rated an Immediate Strong Buy here and in this general area.

Canter Resources Corp. (CRC:CSE; CNRCF:OTC; 601:FRA) closed for trading at CA$0.08, US$0.0592 on October 15, 2024.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$2,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Canter Resources Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.