NEWSFLASH — There’s big news out this morning that NexGold Mining Corp. (NEXG.V:TSXV; NXGCF:OTCQX; TRC1.F:FRA) is to merge with Signal Gold (TSX: SGNL; OTCQB: SGNLF) to create one of Canada’s most advanced near-term gold developers with a combined 4.7 million ounces gold (Moz Au) of measured and indicated resources and a plan to achieve 200,000-plus ounces of annual production.

This development is seen as a major positive development for both companies, especially as the concurrent financing looks set to be well taken up, with the stocks of both companies at good entry points. Note that Signal Gold is rated AN IMMEDIATE STRONG BUY as it is at a very good entry point following a severe bear market from its 2021 high at C$1.05 that has taken it down to the current 9 cents.

Previous Story from October 9:

NexGold Mining Corp. (NEXG.V:TSXV; NXGCF:OTCQX; TRC1.F:FRA) is the company resulting from the completed business combination of Blackwolf Copper & Gold Ltd and Treasury Metals Inc., which became effective on July 10, with Blackwolf shareholders' holdings being swapped in for Treasury Metals stock prior to that date with the combined company assuming its new identity with its new current name and stock symbol on July 10.

The main driver for the business combination was the economies of scale and efficiencies that would result in the combined company being more than the sum of its parts. We last looked at both companies ahead of the merger on June 26 when NexGold stock, at that time Treasury Metals, was recommended following a dip.

Before we proceed to examine the stock charts for NexGold, which make very clear why the stock is so attractive for investors here, we will first overview the company with the assistance of its latest investor deck.

The company aspires to become a mid-tier gold producer and to this end is working to develop its substantial Goliath Gold Complex. Its principal attributes are set out on this introductory slide.

NexGold's two main assets are the Goliath Gold Complex in Ontario and Niblack in British Columbia which it acquired as a result of the merger with Blackwolf Copper & Gold.

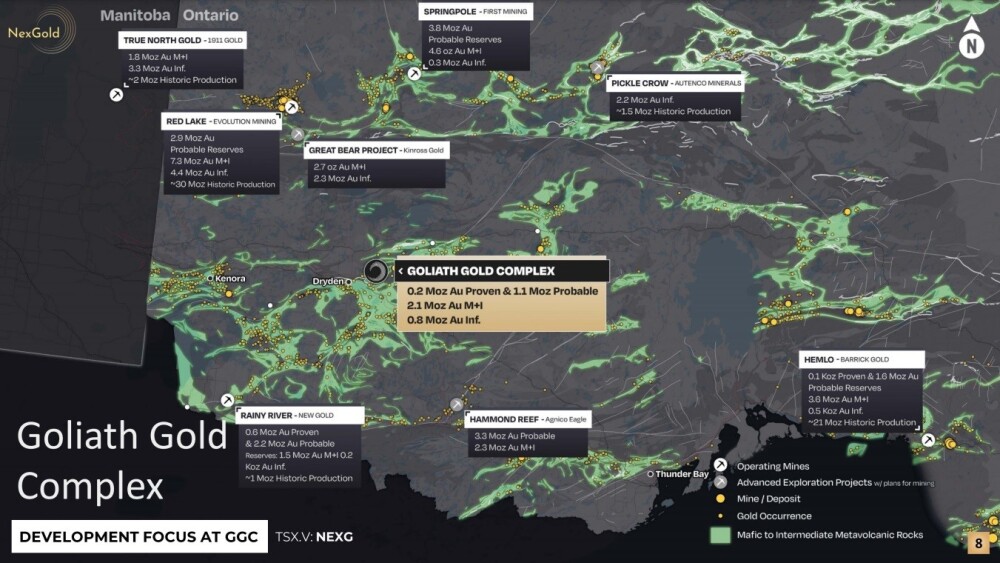

The Goliath Gold Complex is situated in a prolific gold-bearing part of Ontario, and it is in good company with some big and important names nearby as neighbors, such as Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE), Barrick Gold Corp. (ABX:TSX; GOLD:NYSE), New Gold Inc. (NGD:TSX; NGD:NYSE.MKT), and Kinross Gold Corp. (K:TSX; KGC:NYSE), who would not be there without good reason and this alone bodes well for further important discoveries at Goliath.

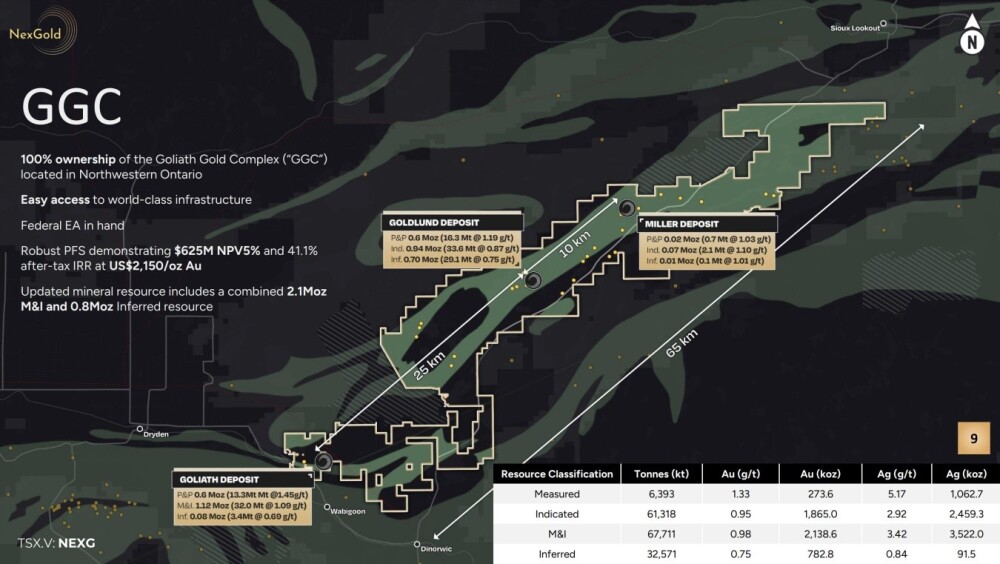

The Goliath Gold Complex itself is extensive, with some important deposits having already been defined.

On August 7, the company announced the important news that it had commenced Phase 1 of a 25,000-meter expansion and discovery and drilling campaign at the Goliath Gold Complex.

The President of NexGold, Morgan Lekstrom, commented, "We are refocusing the company on a dual path that emphasizes high potential exploration and working through the provincial permitting along with local steps for a build. This drill season will mark a new step for NexGold and our Goliath Gold Complex," continued Lekstrom. "We intend to show the potential scale and size of this district while advancing key discovery areas within our 65-kilometer strike length."

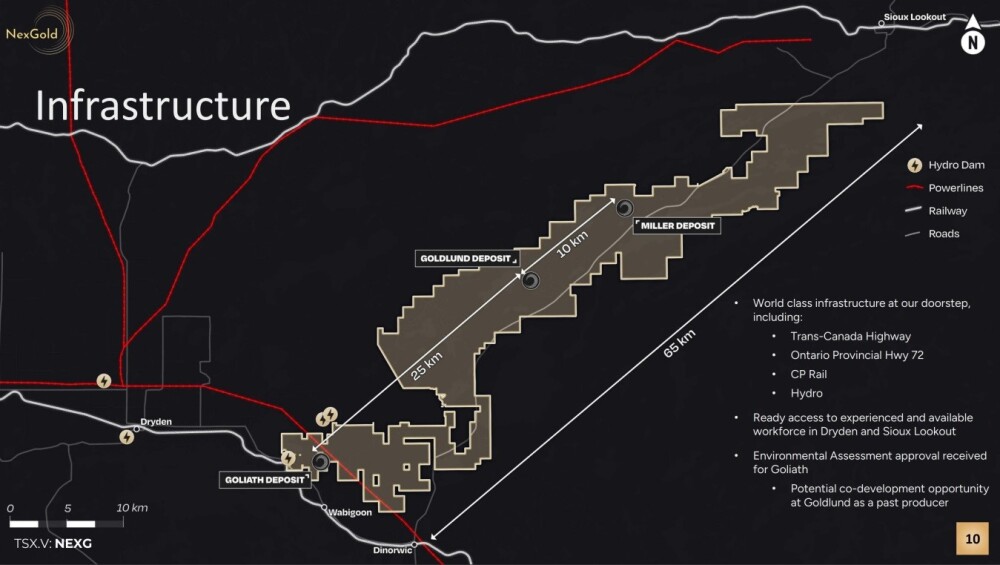

The infrastructure in the vicinity of Goliath is world-class.

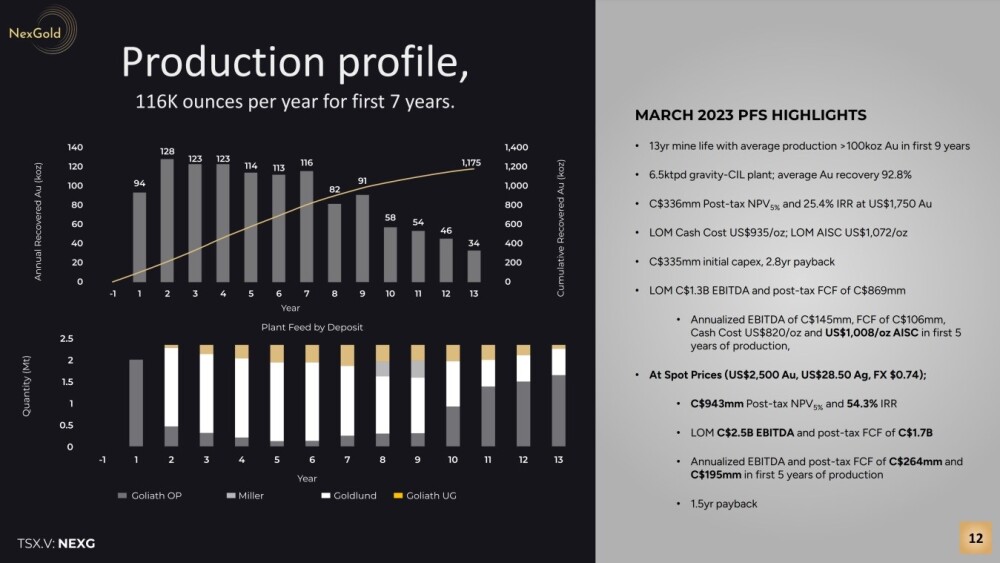

The PFS (Pre-feasibility Study) highlights are certainly encouraging. Note: the AISC is estimated at $1037 per ounce.

The following slide shows the production profile going out 13 years, and on the right, the March 2023 PFS highlights.

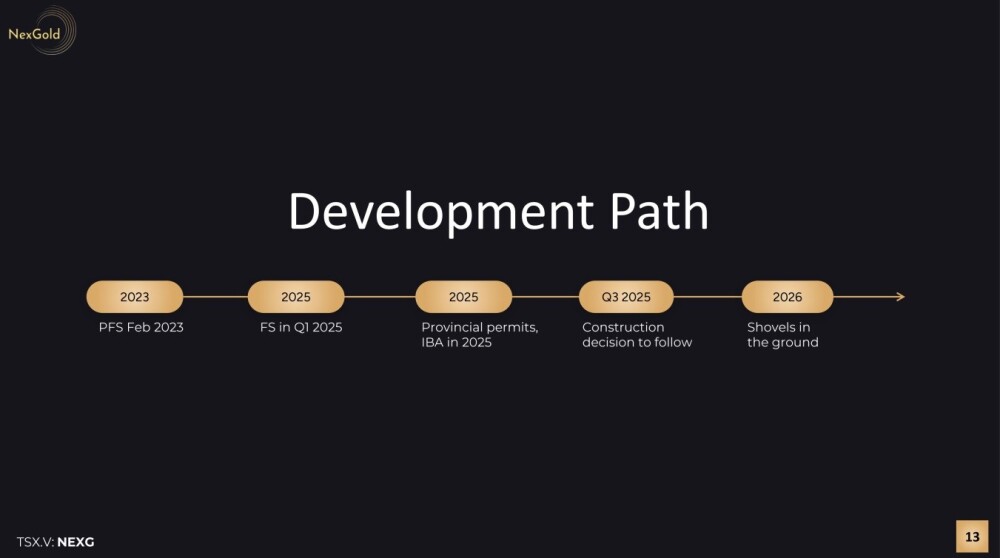

The Development Path is shown below.

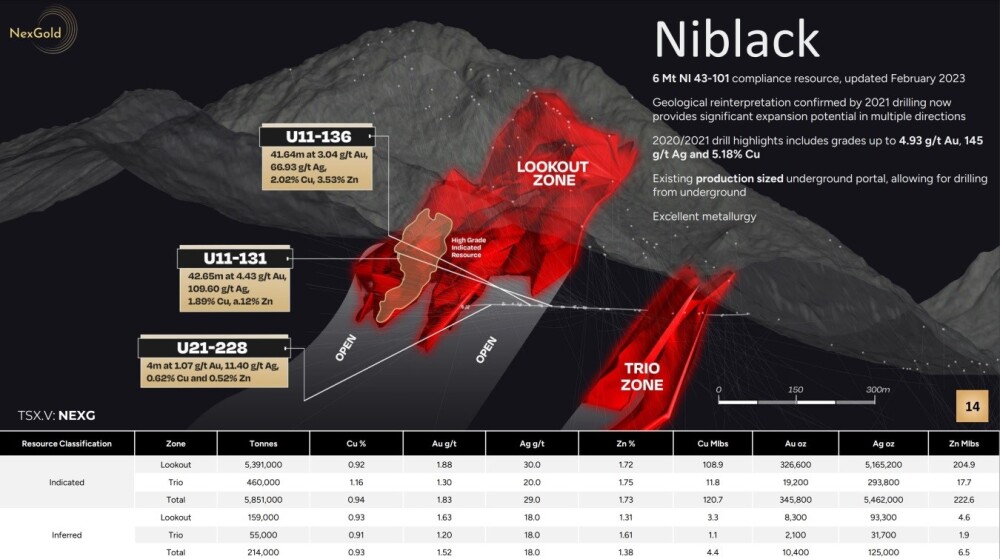

This slide below shows details of the 6M Ton NI 43-101 compliant Niblack resource in British Columbia, acquired as a result of the merger with Blackwolf Copper & Gold, which has significant expansion potential.

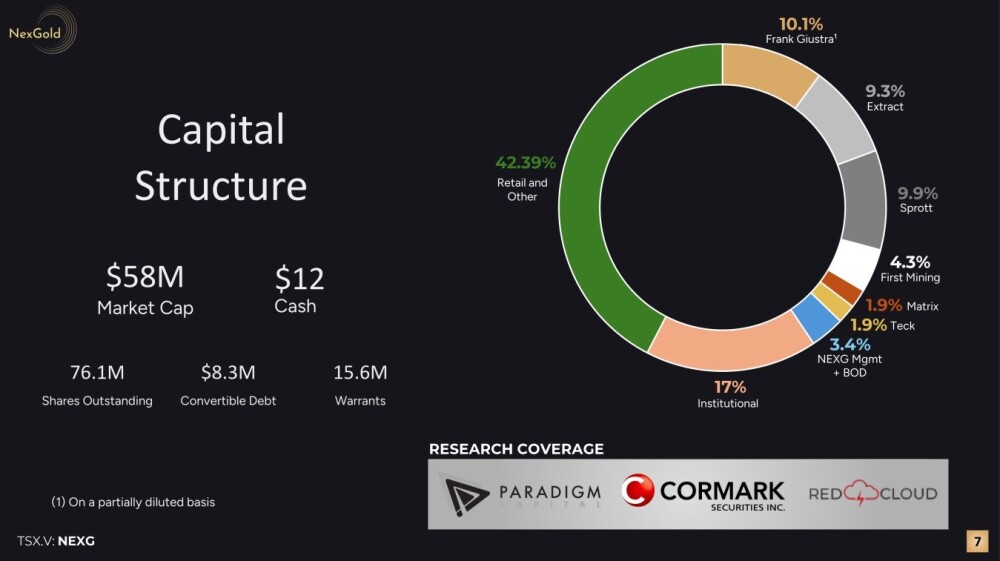

The last slide shows the capital structure. On it, we see that of the 76.1 million shares outstanding, sizeable positions are held by Eric Sprott / Sprott Capital, Frank Giustra, institutional investors, and others, leaving about 42.4% in the float, so the number of shares available to retail investors is quite modest which gives the stock substantial upside potential in the event that demand kicks in as is expected in the environment that we are moving into.

Now, we will review the latest stock charts for NexGold where the first point to make is that, as the long-term charts for NexGold (which are back extrapolated for all the dates prior to July 10 when the merger between Blackwolf and Treasury Metals became effective and the stock symbol changed to its current one) match exactly the long-term charts for Treasury Metals, technical analysis can be validly applied to the long-term NexGold chart.

So, starting the 10-year weekly chart, we see that the severe bear market from its 2017 peak when it briefly got above CA$10.50 had erased over 95% of the stock's value by the time it had run its course early this year. However, the rate of decline had been decelerating long before the final low was reached, with downside momentum (MACD) steadily dropping out so that it is now about to go positive, and it is clear that a basing process started late in 2022.

The persistent high volume since mid-2023 is interpreted as bullish, as it means that there has been a lot of stock rotation from weaker to stronger hands since the buyers are obviously savvier than the sellers, who are selling for a heavy loss. Curiously, the Accumulation line on this weekly chart is really strong this year, which by itself is very bullish, and it is curious because it is not impressive on the daily chart.

Zooming in via the 16-month chart enables us to identify the base pattern that has formed since mid-2023 — it is a clear large Cup and Handle base, and the good news for investors in the stock here is that this base pattern, whose duration has allowed time for sentiment to recover as a large quantity of stock has changed hands, for downside momentum to drop out and for moving averages to swing into bullish alignment, now looks to be complete and if so it is ready to break out into a new bull market and advance.

The downward drift of recent months has, therefore, presented a great buying opportunity for investors showing up now, as once it does break out, it could advance smartly, especially once it gets above the resistance level shown near the top of the pattern.

The 6-month chart is also useful as it reveals that within the latter part of the Handle part of the Cup and Handle shown on the 16-month chart, an embedded Head-and-Shoulders bottom has formed as shown.

If this is indeed the case, then from a price / time perspective (in layman's parlance, meaning "bang for your buck") we really are at an excellent entry point here with the price having dipped over the past couple of weeks to mark out the Right Shoulder low of this pattern.

So from here it should advance and break out of the Cup and Handle base into a major new bull market.

Anyone holding should, therefore, stay long, and NexGold Mining is rated a Strong Buy here for all time horizons.

NexGold Mining's website.

NexGold Mining Corp. (NEXG.V:TSXV; NXGCF:OTCQX; TRC1.F:FRA) closed for trading at CA$0.73, US$0.5324 on October 8, 2024.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- NexGold Mining Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

-

For the October 9 portion of this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of NexGold Mining Corp., Agnico Eagle Mines Ltd., and Barrick Gold Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.