The reason that the outlook for Treatment.com AI Inc. (TRUE:CSE; TREIF:OTCMKTS; 939:FRA) and its stock is so outstandingly bright is that the company has positioned itself to revolutionize the healthcare industry using AI and advanced machine learning technologies is set to transform the current archaic system so that no longer do patients have to sit for hours in waiting rooms to see a doctor or doctors, and doctors and other healthcare professionals have to suffer a crushing burden of often unnecessary patient visits and tedious repetitive bureaucracy.

Treatment AI's platform will take care of most of it. Before reviewing the latest stock charts for the company, we will review its stellar fundamental situation.

Using slides from the company's latest investor deck, we will see exactly why Treatment AI's platform is set to make such sweeping and positive changes.

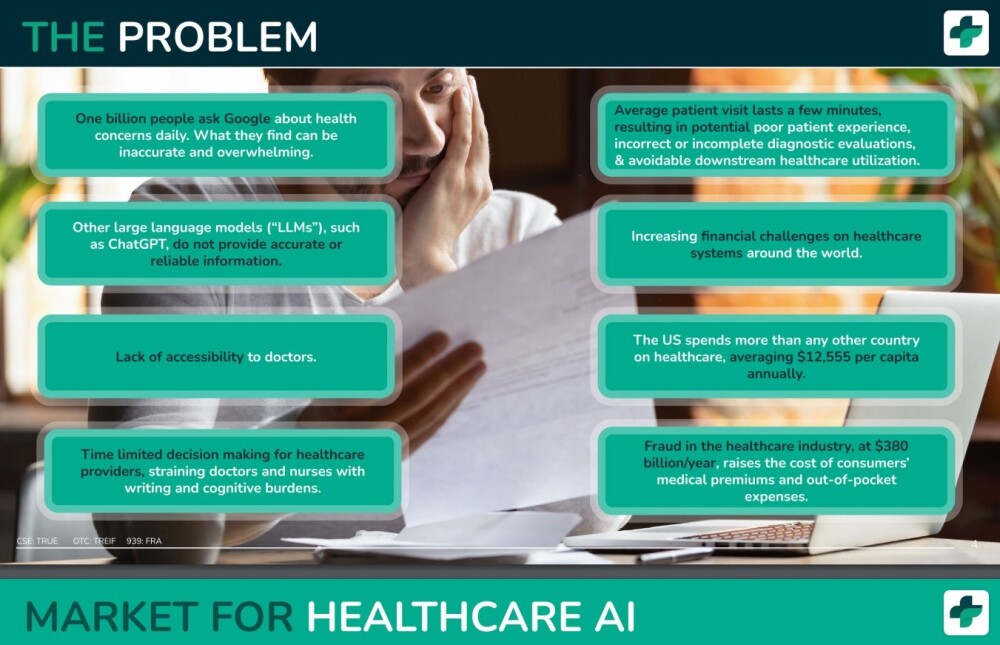

The problem (problems) are set out on this first slide.

The AI Healthcare market is set for massive growth, and Treatment AI is centrally positioned to be a big part of it.

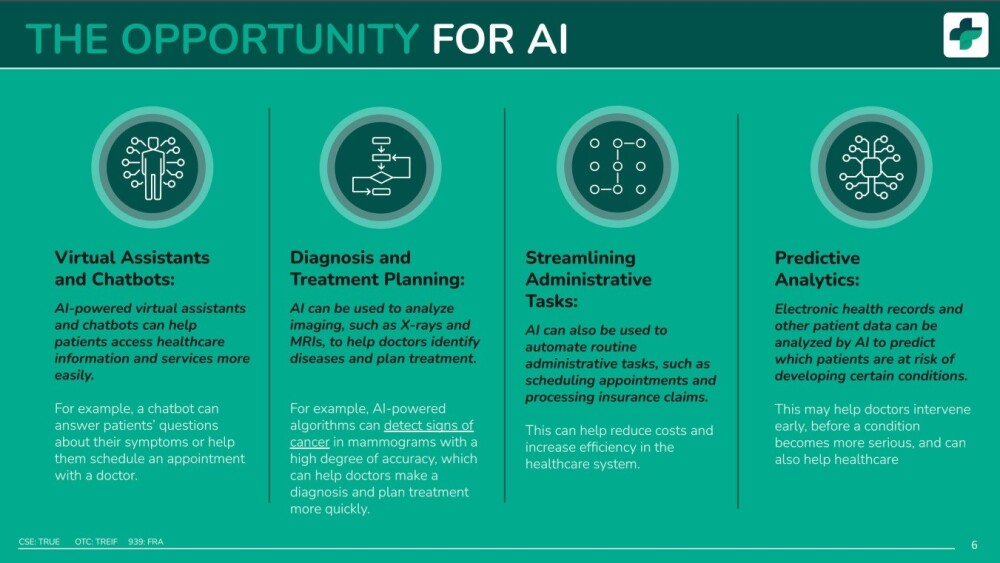

AI is set to expedite and streamline the healthcare industry, making it vastly more efficient for the benefit of both healthcare professionals and patients.

Below are the areas in which AI can make an immense contribution.

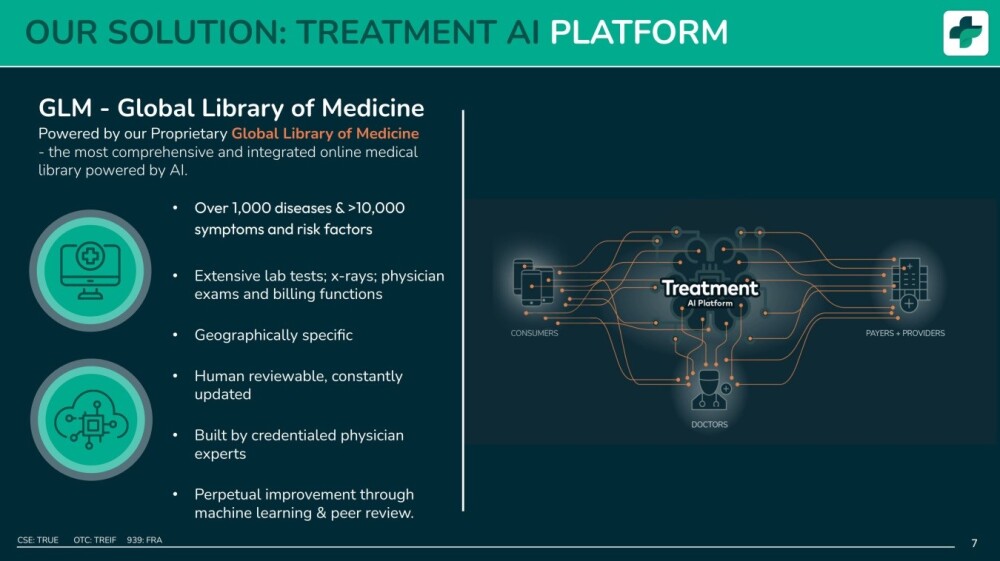

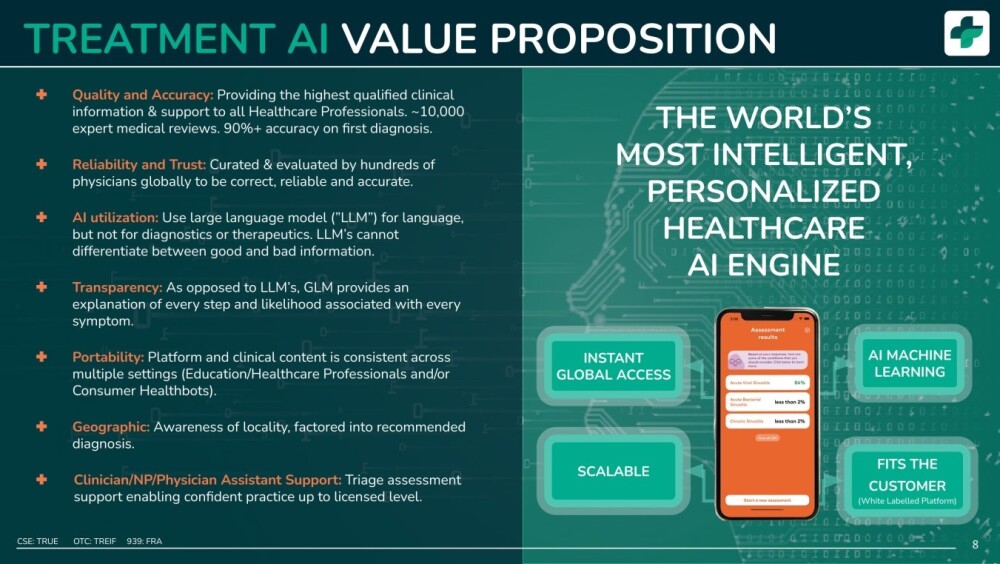

Treatment AI's Platform is powered by its proprietary Global Library of Medicine, the most comprehensive and integrated online medical library powered by AI, which is perpetually improving.

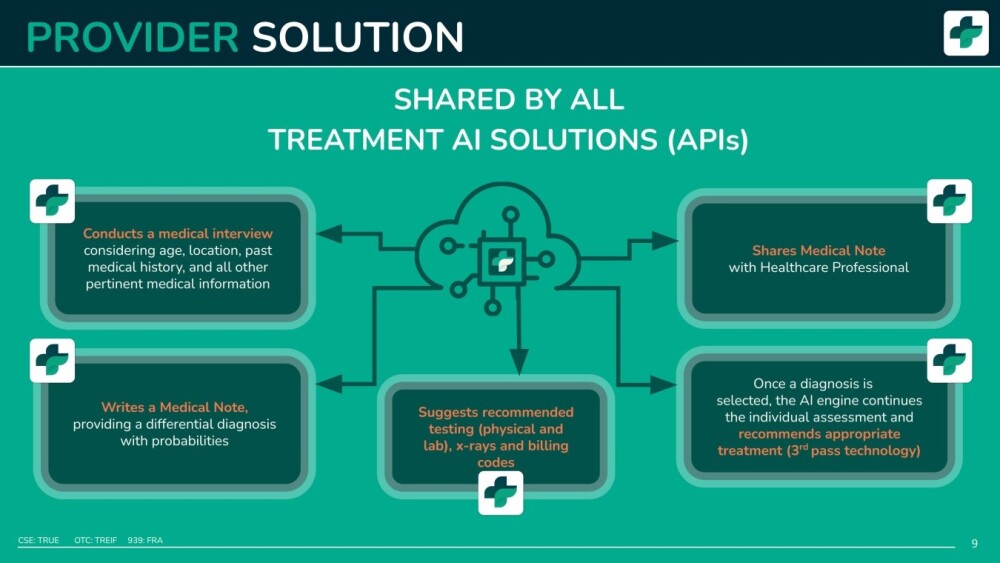

Here is what the Treatment AI platform does:

This slide sets out the impressive and wide-ranging attributes of this system.

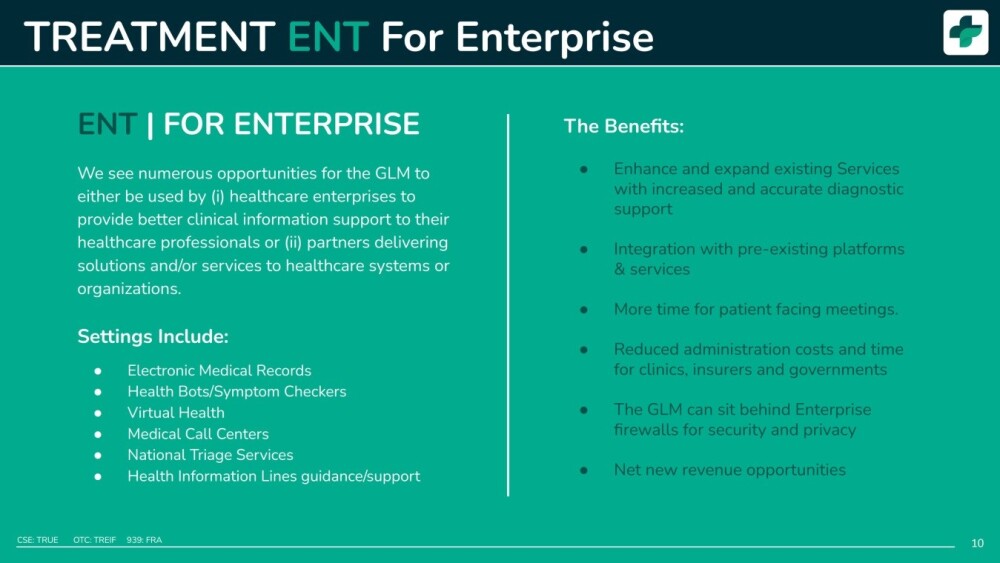

The GLM (Global Library of Medicine) has many practical applications for companies and institutions within the healthcare sector.

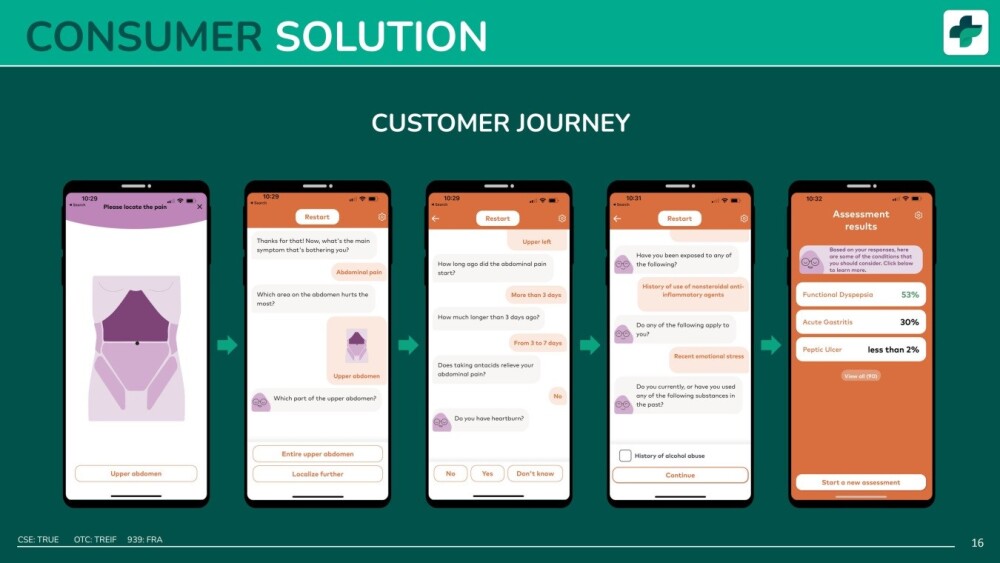

Here is how Treatment AI.com's platform works in a simple step-by-step manner for the customer / patient:

The company has already established the following partnerships.

It also has new partnerships with aiXplain and Novus Health.

Now we will review the latest stock charts for the company which, as mentioned at the outset, are looking very positive indeed.

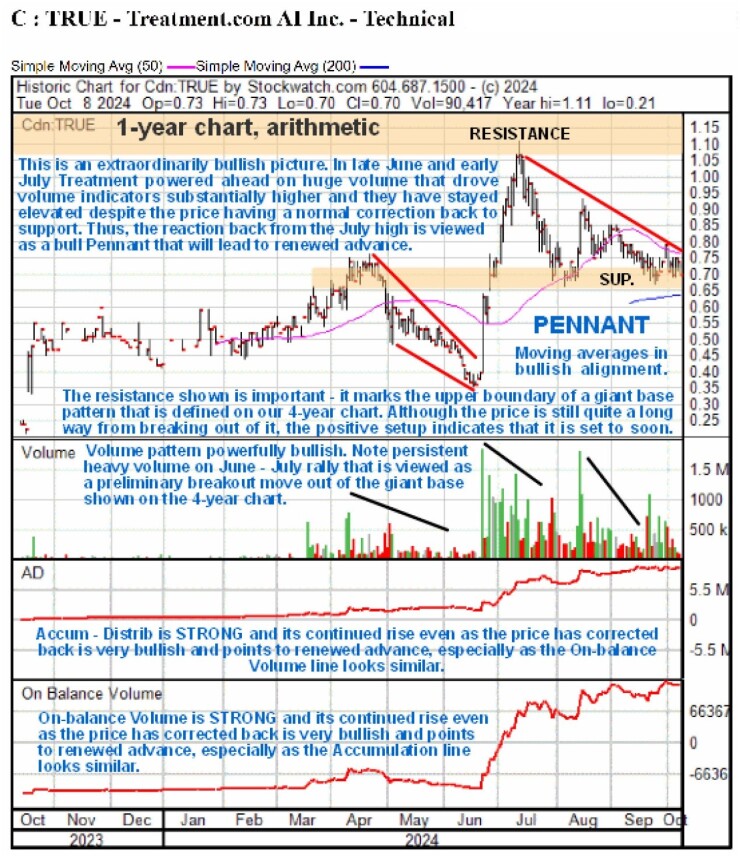

Starting with the 1-year arithmetic chart, we see that the trend is now higher with higher highs and higher lows and the 200-day moving average rising. Of particular note is the big upleg late in June and early in July on persistent heavy volume, which broke the price clear above the May high and drove volume indicators steeply higher.

This is very bullish price / volume action, especially as the volume indicators have not just held up but have actually advanced as the price has reacted back in a normal manner from the early July high to arrive at a support level where it has stabilized above the 200-day moving average in readiness for renewed advance, so the correction looks like a large bull Pennant that, as it is now closing up, promises renewed advance soon.

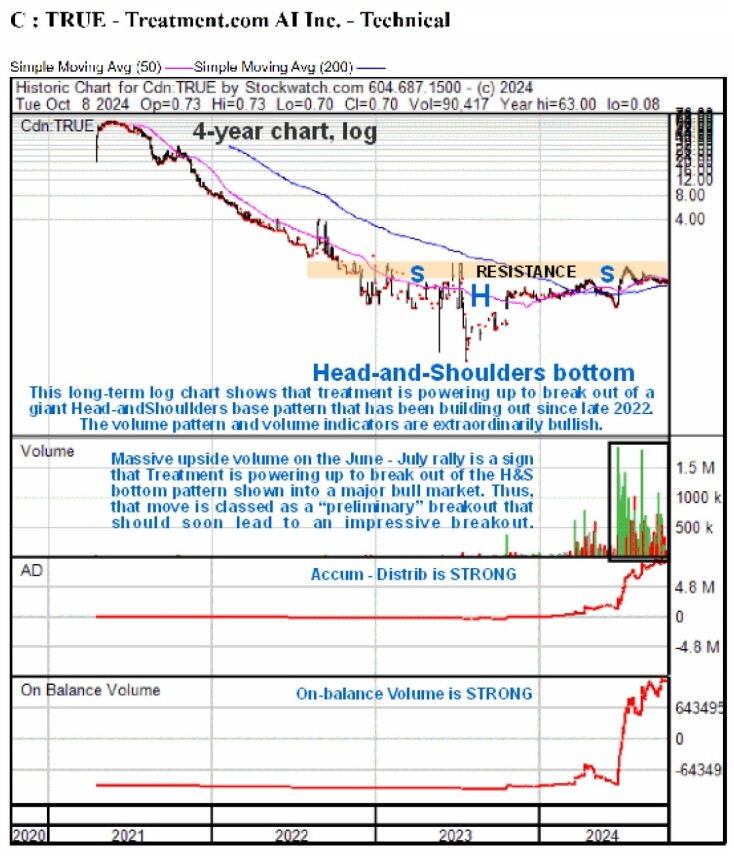

The 4-year log chart puts recent action in perspective and makes clear that the strong rally of late June – early July was the price rising up to complete the Right Shoulder of the Head-and-Shoulders bottom shown, which means that the price has not even broken out of the base pattern yet, so the June – July rally must be classed as a "preliminary" breakout, but that said the exceptionally bullish price / volume action of recent months does promise a genuine breakout soon that looks set to lead to a sustained and substantial uptrend.

Holders should, therefore, stay long, and Treatment AI.com is rated a Strong Buy here, and this is a stock that it is thought worth going overweight on.

Treatment.com AI Inc.'s website.

Treatment.com AI Inc. (TRUE:CSE; TREIF:OTCMKTS; 939:FRA) closed for trading at CA$0.70 and US$0.465584 on October 8, 2024

| Want to be the first to know about interesting Healthcare Services, Technology and Life Sciences Tools & Diagnostics investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Treatment.com AI Inc. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

-

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Treatment.com AI Inc.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

- This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.