As the World Series gets closer, we are reminded of the term in baseball, "triple threat" which typically refers to a player who excels in three key areas of the game: hitting, fielding, and running. A player who is skilled in all three of these aspects is considered highly versatile and valuable, as they can contribute in multiple ways to the success of the team.

When used metaphorically in business or investing, as in the article title, it implies that the company excels in three major areas or possesses three significant strengths. In the case of the mining company, "triple threat" is referring to the company's strong positions in gold, silver, and copper, making it versatile and well-positioned to capitalize on different market trends in these critical metals.

We believe this term applies to McEwen Mining Inc. (MUX:TSX; MUX:NYSE).

October 8, 2024:

- Positioned to capitalize on surging demand for critical minerals in the AI and renewable energy sectors.

- A gold and silver producer with significant exposure to copper, a metal at the heart of electrification.

- Led by Rob McEwen, a mining pioneer, with personal stakes in McEwen Mining and its copper subsidiary.

Introduction

The world is at an inflection point, where the demand for critical metals like copper, gold, and silver is poised to surge as AI, electrification, and renewable energy projects expand. Investors looking for exposure to these transformative markets should have McEwen Mining Inc. on their radar. With an asset-rich portfolio across the Americas, McEwen Mining now represents a triple threat — gold, silver, and copper — all set to benefit from a growing global appetite for these metals.

Under the stewardship of Rob McEwen, a soft spoken, visionary leader, whose track record speaks volumes, McEwen Mining is well-positioned to outperform. Rob McEwen's personal investment of over $225 million in the company and its subsidiary, McEwen Copper, demonstrates his alignment with shareholders and unwavering commitment to value creation.

The New Triple Threat: Gold, Silver, and Copper

In a landscape where technological innovation and sustainability drive market demand, the need for precious and industrial metals has never been more critical.

McEwen Mining's portfolio shines in this regard, offering a mix of gold and silver production along with large-scale copper potential. Here's why each of these metals makes McEwen Mining a compelling investment:

The First Threat Gold: The Cornerstone of Wealth and Technology

Gold's role as a store of value is well-established, but its importance in the tech world is often underappreciated. Gold's unique properties — its malleability, durability, and reliability — make it crucial for the manufacturing of electronic components, particularly in advanced technologies such as AI. Whether in connectors, bonding wires, or high-precision electronics, gold is indispensable for the smooth operation of AI systems.

McEwen Mining's gold assets, particularly in Ontario's Timmins camp and Nevada, are positioned to deliver stable and growing production. Recent exploration results from the Timmins camp have indicated high-grade gold intersections, suggesting there's more value to unlock.

The Second Threat Silver: The Unsung Hero of High-Tech Innovation

Silver is often overshadowed by gold, but its role in technological advancements cannot be ignored. Its superior conductivity makes silver critical in the production of sensors and connectors, which are essential for AI systems and data centers. Additionally, silver is a key component in photovoltaic cells for solar panels, which are vital for renewable energy infrastructure.

McEwen Mining's silver operations, particularly in Mexico and Argentina, position the company to benefit from rising demand in both high-tech and green energy sectors. As silver prices continue to rise, McEwen's diversified production base ensures it can capitalize on this momentum.

The Third Threat Copper: The Backbone of the Green Revolution

Copper is the third pillar of McEwen Mining's triple threat. With the ongoing energy transition, copper's importance cannot be overstated. From EVs to renewable energy grids and AI data centers, copper is the material that underpins the entire infrastructure.

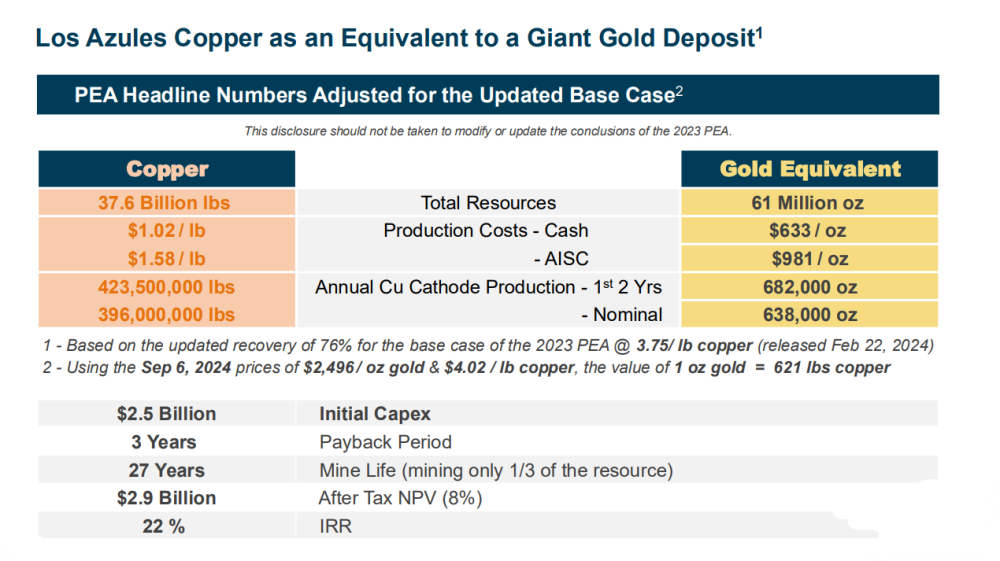

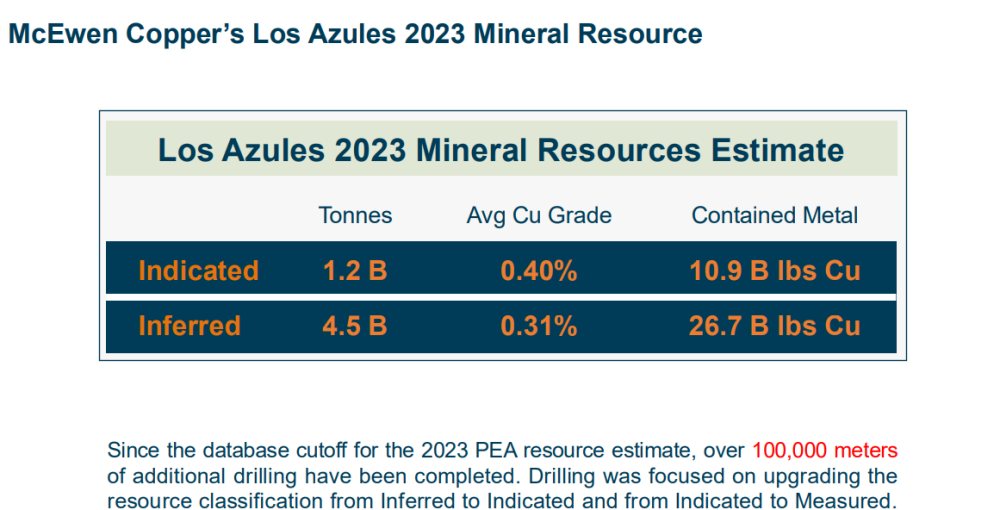

McEwen Copper's Los Azules project in Argentina is a behemoth in the making. With 37.6 billion pounds of copper resources, it ranks among the world's largest undeveloped copper deposits. What makes Los Azules stand out is not just its size but its location and operational advantages. Situated at a lower altitude, it offers significant cost savings compared to many of its competitors. With a projected 27-year mine life and all-in-sustaining costs under $1.60/lb, Los Azules is poised to become a major global supplier as copper shortages intensify.

McEwen's Strategic Positioning for the Future of AI and Electrification

The explosion of AI technologies and the global push for renewable energy have created a critical need for the metals that McEwen Mining produces. Copper and silver are essential for building the infrastructure behind AI data centers, renewable energy systems, and EVs. Meanwhile, gold continues to secure its place as a cornerstone of both wealth and technology.

McEwen Mining's strategic footprint across North and South America ensures it is well-positioned to supply the critical minerals needed to power the future. Its operations in copper, gold, and silver make it a key player in the ongoing technological and energy revolution.

Rob McEwen: The Visionary Behind the Company

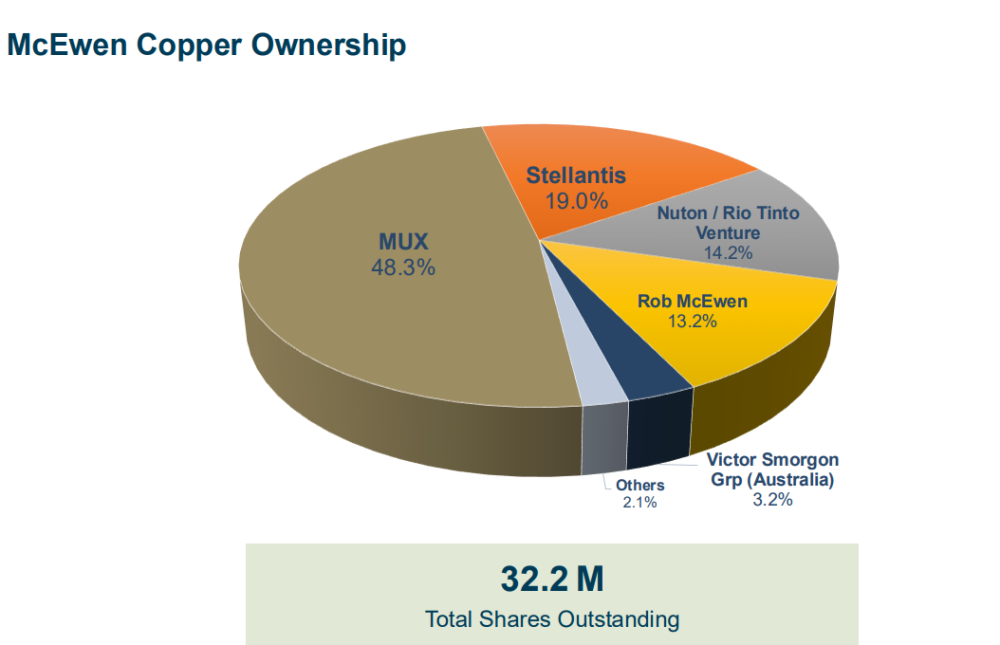

No discussion of McEwen Mining is complete without acknowledging the vision and leadership of Rob McEwen. A legend in the mining industry, McEwen is best known for founding Goldcorp and growing it from a $50 million company to an $8 billion behemoth. Mr. McEwen's foresight led him to be an early investor in Great Bear Resources, personally and with McEwen Mining, and provided critical funding just as it was finding its exploration legs and exploration funds were difficult to raise. Today, he brings the same tenacity and foresight to McEwen Mining, with a personal stake of 16% in the company and 13% in McEwen Copper.

McEwen's commitment to innovation is evident in the company's approach to sustainable mining. Los Azules, for example, will be powered by 100% renewable energy, setting a new standard for responsible copper production. McEwen's vision goes beyond mere resource extraction — he aims to reshape the public perception of mining as an industry that can operate responsibly while delivering significant shareholder value.

Technicals

The shares have pulled back and are currently at Fibonacci Support or 0.618 of the last move higher from the last major low.

We think we could be in the zip/postal code of a low here.

Outlook: Positioned for Growth Amid Global Commodities Demand

As the world increasingly relies on AI, renewable energy, and EV infrastructure, the demand for critical minerals like copper, gold, and silver is only going to rise. McEwen Mining stands at the forefront of this shift, offering investors exposure to three key metals that are essential for the future of technology and sustainability.

McEwen Mining's ability to deliver consistent growth in gold and silver production, combined with the massive potential of Los Azules, positions the company as a prime candidate to benefit from the next commodity supercycle. Investors looking for a diversified, resource-rich company with a proven track record should keep McEwen Mining on their radar.

Conclusion: A Triple Threat with Immense Potential

With its robust portfolio spanning gold, silver, and copper, McEwen Mining is more than just a precious metals producer it is a critical player in the supply chain for the technology and energy sectors. As AI and renewable energy markets continue to expand, the demand for these metals will surge, and McEwen Mining is well-positioned to meet that demand.

Investors should consider McEwen Mining not only for its exposure to gold and silver but also for its growing role in copper, the backbone of the future economy. With Rob McEwen's proven leadership and the company's commitment to responsible mining, this triple threat offers a unique opportunity to capitalize on the next wave of global commodities demand.

| Want to be the first to know about interesting Base Metals, Gold, Critical Metals and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- John Newell: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.