In July, I noted a potentially interesting development in the junior mining sector. Rex Resources Corp. (OWN:TSX; 94G:FWB), a relatively obscure company, was showing signs of renewed activity after a period of dormancy.

I had written:

Not to be confused with Orex Minerals, which has the REX.C ticker symbol, or Rex Minerals on the ASX, or the U.S. ethanol company REX American Resources, BC’s own Rex Resources (OWN:TSX) is best known for being unknown — presently.

Inside trades at the company have been stagnant since 2022 — that is, until May through July of this year, when warrant executions and purchases on the market have started [landing] among the control group, right alongside news the company has optioned a property near Port Alberni in BC.

Market cap is just $2m, only 20m shares out. Share price has moved from $0.06 to $0.14 this month before a little fall away.

This type of situation can be intriguing to investors. Often, a struggling junior miner doesn't completely cease operations but enters a period of inactivity. They might let property options lapse or restructure their shares while investors gradually divest at low prices.

Eventually, these companies may show signs of revival, such as changes in management, acquisition of new properties, or small fundraising efforts. During this early stage, insiders may accumulate shares at low prices before actively promoting the company.

The property in question was not well-described in public materials. The company's website was not available, and news releases provided minimal information, mentioning only "8 claims" on 275 hectares without specifying the target metals. This lack of information is sometimes a deliberate strategy in the industry.

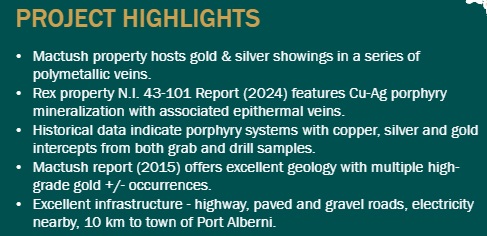

The situation has since evolved, with the company launching a website that provides more details about their project, known as Mactush.

The Mactush property is located in the Alberni Mining Division, approximately 10 kilometers southwest of Port Alberni on Vancouver Island, British Columbia. It consists of eight contiguous mineral claims covering an area of about 274.78 hectares (678.99 acres).

The property contains eleven documented occurrences in the BC MINFILE database, including two prospects, one of which has been developed. Additionally, 31 other mineral occurrences have been previously identified and located on the property.

The area is known for its potential in gold, copper, and silver mineralization.

The property's location on Vancouver Island provides certain logistical advantages. It is in close proximity to infrastructure and transportation routes. Port Alberni, a town of about 18,000 people, offers a deep-water port facility. The property is accessible via paved highways that connect to other parts of the island. Larger urban centers such as Parksville and Nanaimo are also within relatively short distances.

The Mactush property has a long history of exploration, spanning several decades and involving various entities.

Exploration efforts have been conducted by a diverse range of parties, including:

- Individual prospectors such as Walter Guppy

- Larger corporations like Bethlehem Copper Corp in the 1970s

- Several companies in the 1980s, including Pacific Seadrift Resources, Missile Resources, and Cous Creek Copper Mines

- SYMC Resources in the 1990s

- Ashworth Explorations in the 2000s

- G4G Resources and Nahminto Resources in the 2010s

- A numbered company as recently as 2022

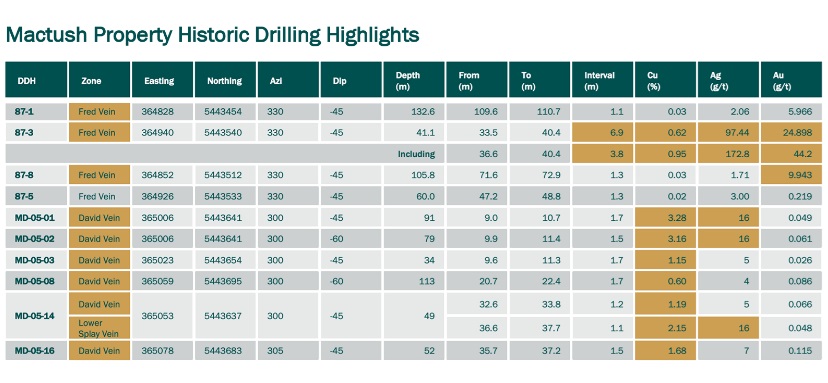

The property has a historical NI 43-101 compliant resource estimate. At the time it was compiled, based on then-current commodity prices, the resource was not considered economically viable for production.

However, the drill results from past exploration efforts may be more significant in the context of current market conditions. Copper prices have increased by approximately 50% since the 2006 resource estimate, and gold prices have also seen substantial increases. These higher commodity prices, combined with projections of continued strong demand, could potentially alter the economic assessment of the property's mineral resources.

Who is behind the curtain? The company has revealed this as well.

On Tuesday, October 1, 2024, the company reported its QP geologist was going to be a director.

They wrote:

Mr. [Kris] Raffle is a partner and principal geologist with the leading Edmonton-based geologic consulting firm Apex Geoscience Ltd. In addition, Mr. Raffle is a current director of Monumental Energy Corp., and has held past director roles at Defense Metals Corp. and New Placer Dome Gold Corp. He has over 25 years of experience conducting project evaluations, exploration program design, data analysis and geological modelling, with respect to Archean- and Carlin-type gold, copper-gold-porphyry, gold-silver-epithermal, volcanic-hosted massive sulphide, rare earth element, and kimberlite diamond deposits throughout Canada, the United States and Mexico.

Kris Raffle is a well-respected figure in the mining industry, particularly in this region. His involvement with Defense Metals Corp. (DEFN:TSX.V; DFMTF:OTCQB; 35D:FSE) is noteworthy.

Craig Taylor, who until recently served as the CEO of Defense Metals, has now taken on the roles of CEO, Chair, and Director at Rex Resources. This transition is significant, given Taylor's track record.

Defense Metals has been recognized in the industry for its methodical approach to junior mining development, consistently building credibility at each stage of its growth. The company has shown considerable potential, and Taylor's leadership was a key factor in its development.

It's worth noting that Defense Metals experienced a decline in share price following Taylor's departure, which some interpret as an indication of his value to the company.

Rex Resources currently has 22 million shares outstanding, and its stock has recently seen an upward trend. The company has submitted permit requests, suggesting it may be preparing for more active operations.

With all of this, Rex Resources Corp. (OWN:TSX) is definitely on my watchlist.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Defense Metals Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Defense Metals Corp.

- Kyle Kuzyk: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Kyle Kuzyk Disclosures:

Rex Resources is not a client, but as mentioned above, I have had commercial connections with companies run by this CEO in the past.