All the technical indications are that Tectonic Metals Inc.'s (TECT:TSX.V; TETOF:OTCQB) stock is ready to begin a major bull market that, from its current low level, could result in spectacular gains.

Before we review the latest stock charts for the company, we will first consider its fundamentals with the help of its latest investor deck and relevant news ítems.

Note that for reasons of space, we will not go into the details of the strong management team and technical advisory committee, the supportive infrastructure for the project, and the more detailed information on the geology, which can be accessed via the link to the deck above.

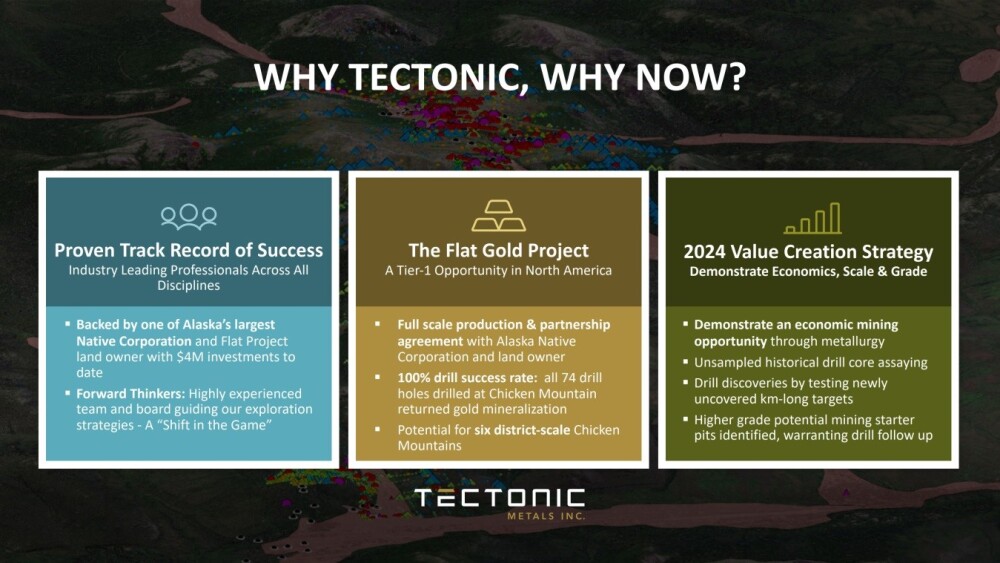

The answers to the questions "Why Tectonic, Why Now?" are given on the following slide.

Tectonic Metals has one gold project in Alaska but it is a big project with a tremendous amount of scale and in addition to having strong supportive shareholders the company has established good relations with the locals.

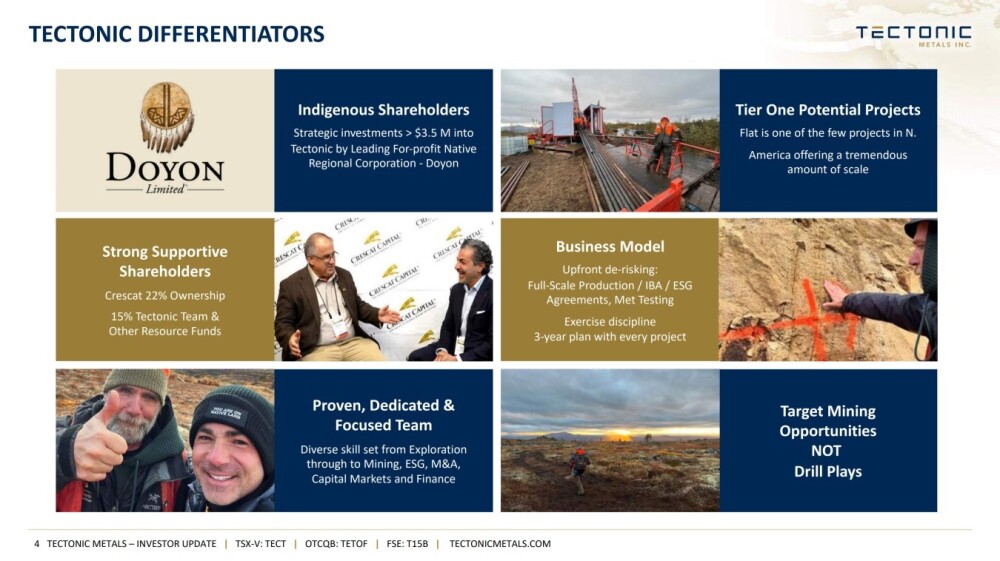

These points are set out on the next slide.

The company is distinguished by having a good working relationship with the local indigenous population to the extent that they are big shareholders in the company via Doyon Ltd. which is one of Alaska's largest native regional corporations.

Doyon holds almost 10% of the company's stock. The next slide provides some information about Doyon.

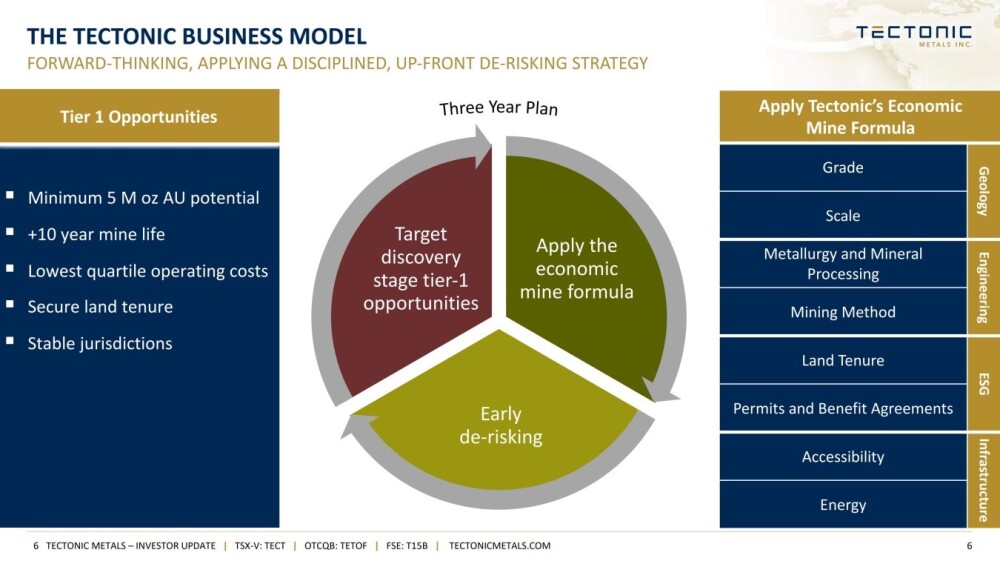

This slide explains Tectonic's business model and the early up-front de-risking strategy, which is or should be a comfort to shareholders.

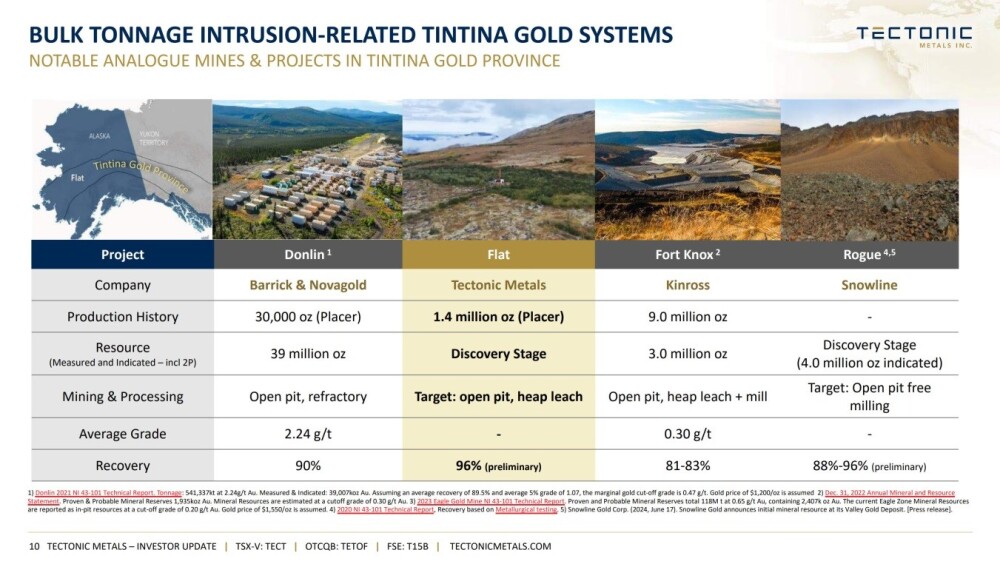

The following interesting slide shows how the company's Flat Project lies within the Tintina Gold Province, which runs right through Alaska and extends deep into the Yukon. and compares the Flat Project to other important projects along the belt owned by other major players.

There are some who would say that Kinross' Fort Knox Project probably contains more gold than the real Fort Knox.

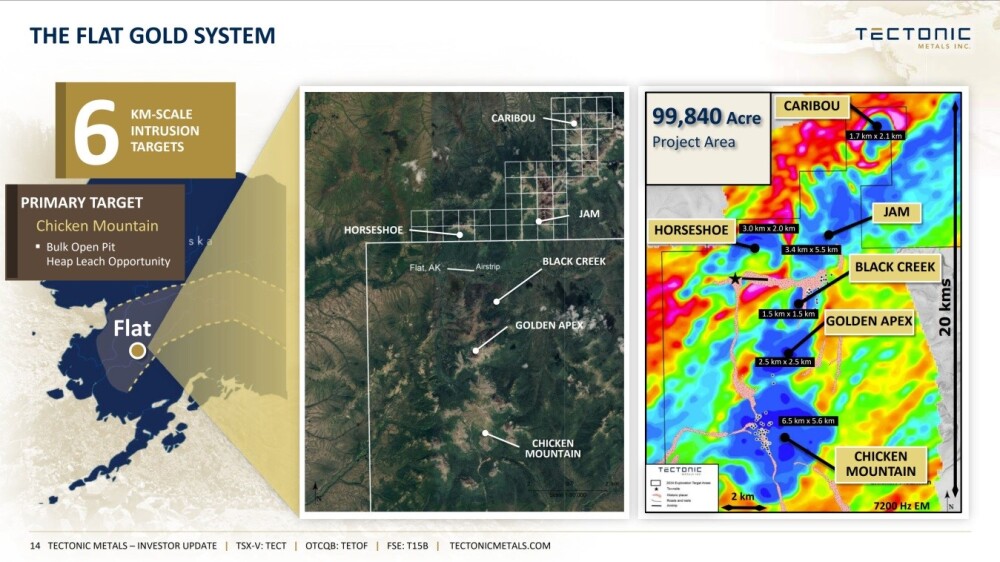

The next slide shows the location of the Flat Gold System and overviews the project, showing the main targets within it.

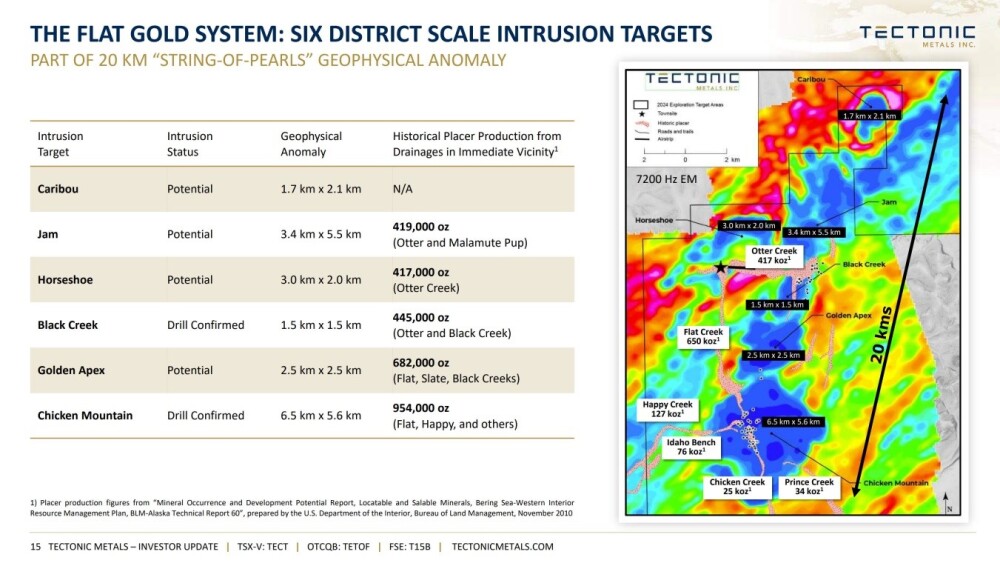

This map and table detail the main targets within the Flat Gold System.

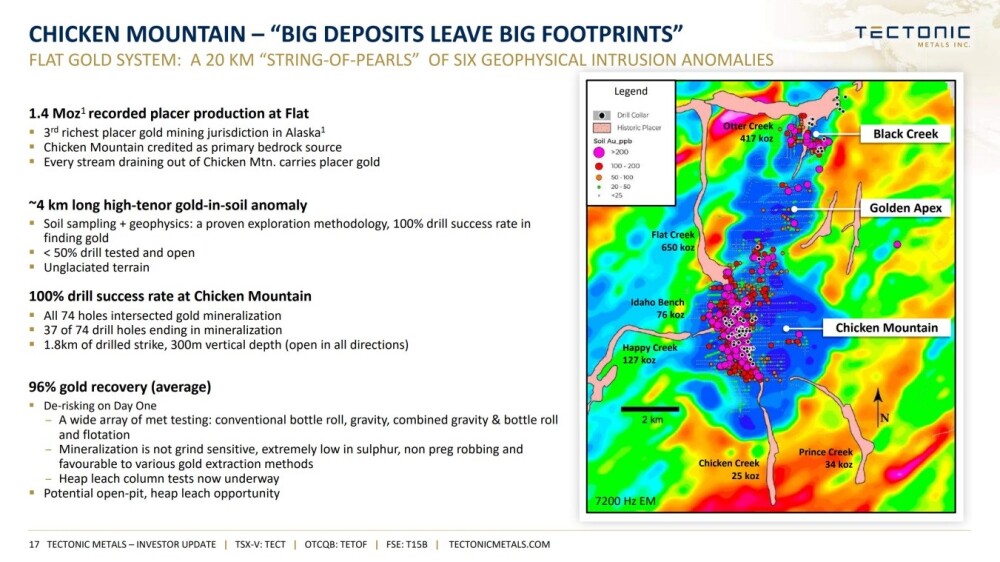

Within the Flat System, by far the most important target is the Chicken Mountain Intrusion, which has multi-million-ounce open-pit potential.

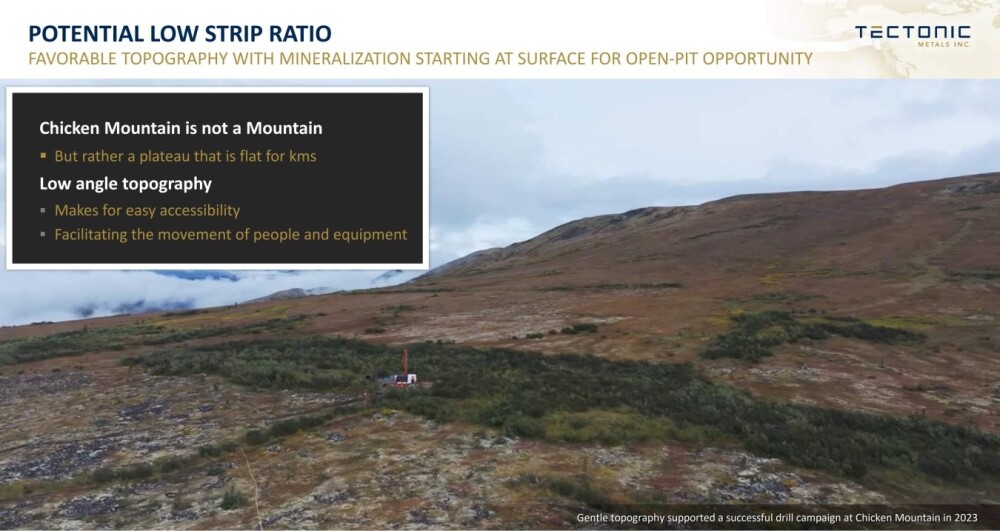

The name Chicken Mountain is a misnomer because it is not a mountain but a plateau with favorable topography for mining, and it is probably a double misnomer as it is very unlikely, given the latitude, that chickens are to be found there.

The following slide provides detailed insights into what is at Chicken Mountain, and it is remarkable that 100% of the 74 drill holes intersected gold mineralization, indicating a high probability that it is a big resource.

For much more information on the geology of Chicken Mountain and the other important targets at the Flat Project, please refer to the investor deck.

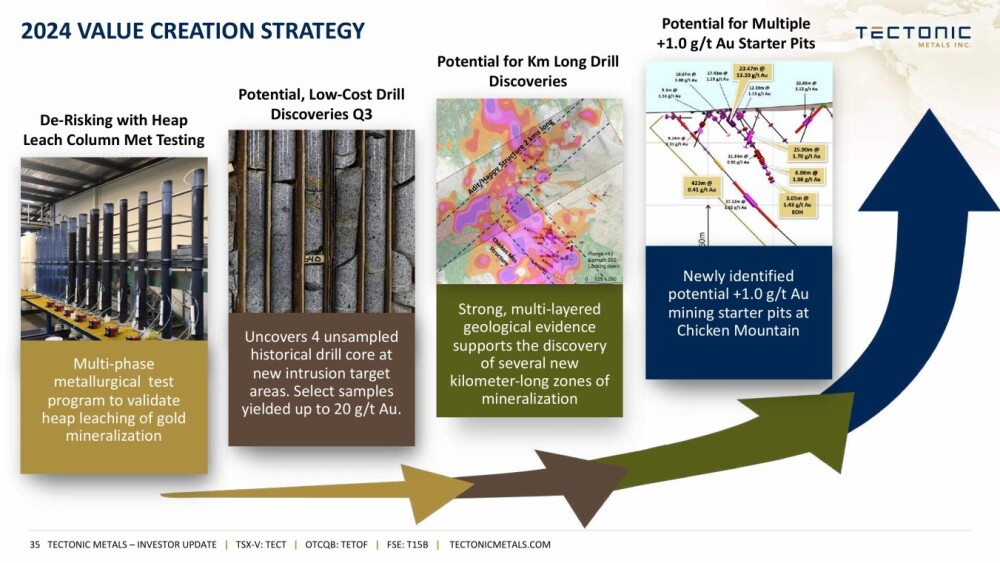

The next slide shows the 2024 value creation strategy, and a point to note is that the potential multiple "starter pits" will serve to create cash flow.

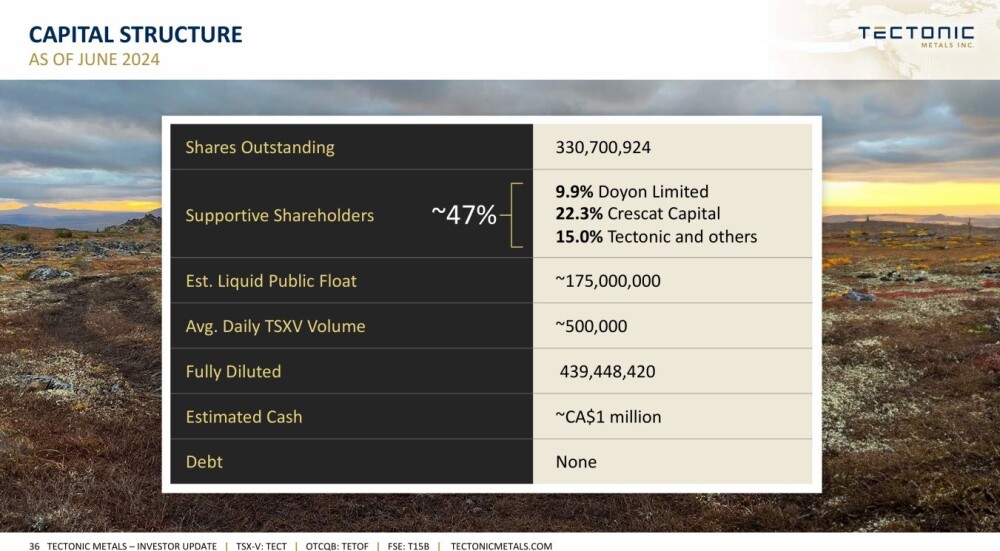

Finally, the last slide shows the capital structure and the most important point to note on this is that the "supportive shareholders" hold approximately 47% of the stock.

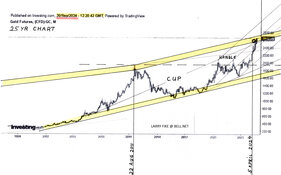

Turning now to the charts and starting with the long-term 6-year chart, we see that following a severe bear market that took it down from its mid-2020 highs above 33 cents to hit bottom late in 2022 at 4 cents, a giant Double Bottom base pattern has formed, with the first low around the time it bottomed in 2022 and the second low occurring just last month when it got down to 4.5 cents, so a shade above the 2022 lows.

Right now, it is just starting to rally out of these lows with the exceptionally positive volume pattern of recent weeks and strong Accumulation line that is already at new highs, suggesting that it won't tarry long at these low levels.

On the 14-month chart, we can see how the downtrend into the second low of the Double Bottom has taken the form of a Falling Wedge, which is indicative of dwindling downside momentum, which is a reason it is bullish in purport.

On this chart, we can also better see the marked buildup in upside volume in recent months and how it has driven the Accumulation line strongly higher, which are both strongly bullish indications. Currently, the price is very close to breaking out of the downtrend in force from last November, and given what we have just observed, a breakout looks likely very soon.

The 6-month chart is useful as it enables us to see more clearly the persistent strong upside volume since mid-July, which has driven the Accumulation line higher and ballooned in recent weeks.

This is a sign that somebody — or something — "knows something" and is accumulating the stock in an increasingly aggressive manner, and clearly, it is a very bullish indication.

With all these positive indications and the price still at a low level, this is clearly a good point to take positions in Tectonic Metals which is rated an Immediate Strong Buy here.

Tectonic Metals' website.

Tectonic Metals Inc.'s (TECT:TSX.V; TETOF:OTCQB) closed for trading at CA$0.06, US$0.0444 on October 1, 2024.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$2,500.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.