West Red Lake Gold Mines Inc. (WRLG:TSXV; WRLGF:OTCQB) has announced initial drill results from the Upper 8 Target at its 100%-owned Madsen Property in the historic Red Lake Gold District of Northwestern Ontario.

One hole, WRL24-002, intersected 4.1 meters of 14.2 grams per tonne gold (g/t Au), including 1.3 meters of 44.17 g/t Au. Hole WRL-24-003 intersected 1.85 meters of 6.33 g/t Au, including 0.5 meters of 20.63 g/t Au.

The company said Upper 8 is a "shallower geologic analog" to the high-grade 8 Zone, which contains an indicated mineral resource of 87,700 ounces grading 18 g/t Aug, with an additional inferred resource of 18,2000 ounces grading 14.6 g/t Au.

"The initial results from Upper 8 drilling are quite encouraging and not only demonstrate proof-of-concept for our regional targeting model, but also reinforce our thesis that there is very real potential for discovery of another 8-Zone type deposit on our highly prospective Madsen property," Vice President Exploration Will Robinson said. "The relatively shallow position of Upper 8 allows for us to drill this target effectively from surface with a high degree of accuracy."

Robinson said the results have encouraged the company to add a second drill dedicated to drilling at Upper 8.

In a release, West Red Lake noted that the drill results were the first to be announced from an ongoing 10,000-meter surface exploration program designed to test a number of high-priority targets across the Madsen property.

The Red Lake Camp is a cornerstone of Canada's role as the fifth-largest gold producer in the world. Gold was first discovered there in 1897, but it took 20 years for it to be explored fully because of the area's remoteness. Since large-scale mining began there in 1938, more than 26 million ounces (Moz) Au have been produced from underground mines there.

"The area is known for exceptionally high-grade Au, with one famous sample, the Campbell Mine Whopper, containing 431 ounces in a football-sized rock," Ian Burron wrote for Geology for Investors.

Nearly a century later, "the last few years have seen the tide once again turn in Red Lake's favor," Burron wrote.

Mine Hosts NI 43-101 Indicated Resource of 1.65 Moz

West Red Lake said Upper 8 target drilling is designed to test the projected, near-surface extension of the mineralized shear corridor that hosts the highly prospective 8-Zone. The Upper 8 target was intercepted in only a few historic drill holes, which encountered a zone of strong shearing, alteration and quartz veining equivalent to 8-Zone style mineralization.

"Elevated gold at Upper 8 is shown to occur within deformed and re-crystalized blue-grey quartz and quartz-sulfide veinlets," the company said in a release. "These veinlets are hosted within shear domains, which are easily recognizable by their locally intense deformation fabrics, and the presence of silica, biotite, potassium feldspar, and amphibole alteration."

"West Red Lake is one of my favorite two companies for those looking to invest in Canada," Bob Moriarty of 321 Gold said.

The Upper 8 shear domain is hosted within the Russet Lake Ultramafic, which also hosts the 8-Zone deposit, the company said.

"Recognition that the gold mineralization at the Upper 8 target is comprised of transposed quartz veinlets within a definable and recognizable shear corridor provides excellent opportunity for additional drilling and expansion potential," the company said.

The Madsen Mine deposit hosts a National Instrument 43-101 Indicated resource of 1.65 million ounces (Moz) grading 7.4 g/t Au and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t Au, the company said.

"The company's flagship project is the Madsen Mine, which it acquired approximately 18 months ago for US$6.5 million plus shares, significantly less than the previous owner's US$350 million investment," wrote 321Gold.com's Bob Moriarty on October 1 for Streetwise Reports. "At its height, the mine was valued at US$1.15 billion."

The company has initiated a four-month test mining and bulk sampling program at the project and a preliminary feasibility study (PFS) is due for release this quarter, he noted.

"West Red Lake is one of my favorite two companies for those looking to invest in Canada," Moriarty said. "CEO, President, and Director Shane Williams and I have talked multiple times, and I truly believe he is the top mine operator in Canada."

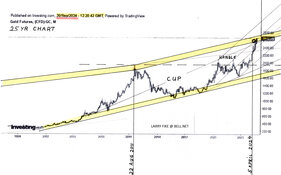

The Catalyst: Gold Bull Market Gathers Steam

Gold was slightly down 0.53% to US$2,646.10 per ounce on Thursday after hitting an all-time high of US$2,685.42 last week.

Goldman Sachs on Monday raised its forecast for gold in early 2025 to US$2,900 from the previous US$2,700, Investing.com reported.

"Firstly, they anticipate faster declines in short-term interest rates in Western countries and China, adding that the gold market 'doesn't fully price in the rates boost to Western ETF holdings backed by physical gold yet, which tends to be gradual,'" Goldman Sachs noted, according to Investing.com's Vahid Karaahmetovic. "Secondly, ongoing robust purchases by emerging market (EM) central banks in the London over-the-counter (OTC) market are expected to continue fueling the gold rally that began in 2022. Strategists believe 'that these purchases will remain structurally elevated.'"

Streetwise Ownership Overview*

Streetwise Ownership Overview*

West Red Lake Gold Mines Inc. (WRLG:TSXV;WRLGF:OTCQB)

According to Reuters, gold is on-track for its best quarter in four years. The rise was "fueled by the U.S. Federal Reserve's half-percentage-point cut and flare-ups in the Middle East," author Sherin Elizabeth Varghese wrote.

The Fed's cut could "increase the tailwind for gold and pull forward the timing for attainment of US$3,000" per ounce for gold, Peter A. Grant, vice president and senior metals strategist at Zaner Metals, said in a Reuters report by Anushree Ashish Mukherjee and Anjana Anil.

"Gold market bulls are locking in bullion prices surging to fresh records, with a milestone of US$3,000 per ounce coming into focus, fired up by monetary easing by major central banks and a tight U.S. presidential election race," Mukherjee and Anil wrote.

Ownership and Share Structure

Advisor Frank Giustra owns 9.4% of West Red Lake as a strategic investor and insider, according to the company's investor presentation. Sprott Resource Lending Corp. owns 18.6%, VanEck Gold Fund owns 4.1%, Accilent Capital Management owns 4%, and Evolution Mining Ltd. owns 1.6%. About 31% is with institutions, the company, with the rest in retail.

The company's market cap is CA$212 million. The 52-week range for the stock is CA$0.47 to CA$1.04.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of West Red Lake Gold Mines Inc.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.