Golden Cariboo Resources Ltd. (GCC:CSE; GCCFF:OTC; A0RLEP:WKN; 3TZ:FSE) has recently announced a significant extension of its Halo zone discovery with finalized assays that confirmed an increase in grade. Drill hole QGQ24-13 intersected 136.51 meters (447.87 feet) at 1.77 grams per tonne (g/t) gold, including 23.89 meters (78.38 feet) near surface at 3.32 g/t gold, with a higher-grade section of 5.17 meters (16.96 feet) at 13.74 g/t gold. These upgraded intercepts were the result of selective metallic screening assays, which replaced the initial fire assay results and increased gold values by 21%.

This follows the success at drill hole QGQ24-14, which intersected 204.85 meters (672.08 feet) of 0.80 g/t gold from the surface, including 143.85 meters (471.95 feet) at 1.01 g/t gold. This extension highlighted the continuity of mineralization within the Halo zone and strengthened the company's confidence in the resource potential. The mineralization, which includes quartz-carbonate veining and moderate pyrite within altered volcaniclastic rocks, remains open in all directions.

Golden Cariboo's President and CEO, Frank Callaghan, emphasized the significance of the results, stating in the October 1 news release, "Our new Halo zone discovery and multiple successful drill holes on the property show that we appear to be in an immense gold system. I'm excited that selective metallic screening assays on drill hole 13 increased grades over the 136.51 m intercept by 21%. We are systematically following up on the Halo zone and expanding this discovery in all directions." He also pointed out that the property's proximity to the community of Hixon, British Columbia, allows the company to maintain year-round drilling, which will continue to expand the discovery.

Gold Sector Momentum and Growth

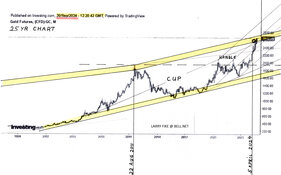

The gold sector has continued to experience significant growth, driven by rising gold prices and increasing investor interest in mining stocks. According to a report by Reuters on September 19, "gold prices rose over 1% on Thursday as the U.S. Federal Reserve launched its monetary easing cycle," pushing bullion to an all-time high just below the US$2,600 mark. This surge reflected strong market sentiment and a favorable environment for gold exploration companies like Golden Cariboo Resources Ltd.

Stockhead highlighted on September 13 that "gold reached a new high of US$2,568/oz," which reinforced confidence in the sector. The report also emphasized that mergers and acquisitions (M&A) across the gold mining sector are helping junior miners capitalize on favorable market conditions, further boosting exploration activities like those of Golden Cariboo.

According to 321 Gold on September 17, gold has entered a "sweet spot" where both short-term investors and long-term holders are benefiting from rising prices. The report added that "Western ETF buyers . . . could trigger a parabolic blowoff," with the potential for gold to reach US$4,000 or higher.

Finally, Kitco reported on September 18 that "momentum in the gold market is creating significant value in the mining sector" as prices pushed above US$2,600 per ounce. This momentum is expected to benefit junior mining companies like Golden Cariboo, which continue to expand their exploration efforts and identify new mineralization zones, adding to their resource potential.

Golden Catalysts

Golden Cariboo Resources is poised for significant growth, with its Quesnel Quartz property showing promising results from its drilling program. The company's exploration strategy targets high-grade gold mineralization across multiple zones and bulk tonnage mining potential. As detailed in the company's investor profile, Golden Cariboo is focused on leveraging its 100% ownership of the property, which spans 3,814 hectares in British Columbia's historic Cariboo Mining District. The property has a long history of mining, with recent discoveries showcasing strong blue-sky potential for further exploration and resource expansion.

The company's management team, with experience developing Osisko's Cariboo Gold Project, is now driving efforts to explore orogenic gold-bearing quartz veins. Phase 2 of the company's drill program is set to commence, which is anticipated to include up to 5,000 meters of drilling, as well as trenching and mapping to further define mineralized zones. The company expects that continued positive results from the drilling program will lead to a new NI 43-101 resource estimate. This positions Golden Cariboo to capitalize on both its strategic location and its strong exploration potential in a historically productive gold region.

Analysis of Golden Cariboo

*John Newell, in his September 6 report, reiterated the strong potential of Golden Cariboo Resources Ltd., particularly following their recent drill results at the Halo zone. He emphasized that the company's latest discoveries are a significant step forward, stating that the broad intersections from the Halo zone, located just 830 meters from the historic Quesnelle Gold Quartz Mine, hint at the possibility of uncovering a major deposit. According to Newell, these results position Golden Cariboo to capitalize on further exploration in one of British Columbia's most prolific gold districts.

Newell also highlighted the company's strategic advantage, noting that its proximity to Osisko Development Corp. enhances its value as a potential acquisition target. The company's management, with a track record of developing successful projects, continues to drive exploration efforts in this historically rich mining region.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Golden Cariboo Resources Ltd. (GCC:CSE; GCCFF:OTC; A0RLEP:WKN;3TZ:FSE)

Additionally, Newell commented that Golden Cariboo's ability to intersect mineralization consistently demonstrates its potential for growth, suggesting that "investors should keep a close eye on this junior exploration stock as it advances its exploration program."

Ownership and Share Structure

According to the company, management and insiders own 30% of Golden Cariboo Resources. President and CEO Frank Callaghan owns 16.45% or 6.93M shares. Elaine Callaghan has 0.97% or 0.41M shares. Director Andrew Rees has 0.79% or 0.33M shares, and Director Laurence Smoliak has 0.3% or 0.13M shares.

Retail investors hold the remaining 81.48%. There are no institutional investors.

According to Golden Cariboo, it has 50.3M shares outstanding, 24.83M warrants, and 3.8M options.

Its market cap is CA$9.2 million, Reuters reports. Over the past 52 weeks, Golden Cariboo has traded between CA$0.075 and CA$0.36 per share.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Golden Cariboo Resources Ltd. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Golden Cariboo Resources Ltd.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

* Disclosure for the quote from the John Newell article published on September 6, 2024

- For the quoted article (published on September 6, 2024), the Company has paid Street Smart, an affiliate of Streetwise Reports, $2,500.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.