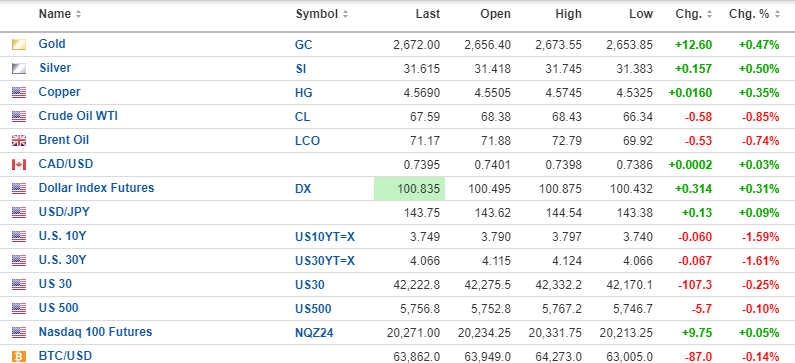

The USD index futures are up .031% today with 10-yr. (-1.59%) and 30-yr. (-1.61%) yields declining in response to the U.S. dockworkers' strike.

December gold (+0.47%), silver (+0.50%), and copper (+0.35%) are higher, while oil is down (-0.85%). Stocks are mixed with the DJIA off 0.25%, the S&P 500 down 0.10%, and the NASDAQ up 0.05%. Risk barometer Bitcoin is down 0.14% to $63,862.

Energy

Oil prices have been in a downtrend since the Russian invasion of Ukraine in March 2022, when they spiked to over $130/bbl. They are now down over 46% to $67.75/bbl and down again this morning (- $.37/bbl) as the American dockworkers' strike is seen by futures traders as dampening demand.

With the 52-week low at $65.17/bbl, I think that there is currently zero "war premium" in oil prices these days, which means the fear of a disruption in oil supplies is non-existent, and that is sorely misguided.

Now, the hedge against a catastrophic outcome to either the war in Ukraine or the Middle East is also gold, and I am more than adequately positioned there, but gold has had an amazing run since the lows in February, so the elasticity of upside potential is minimal based upon a tail- event like an oil shock.

The best method of participating in a rebound in oil is through the producers who are trading as cheaply in terms of price/earnings, price/book, and price/cash- flow as any U.S.-based group of stocks in decades.

The ETF that covers the big multinational oil andHow To Participate in a Rebound in Oil gas producers is the Energy Select Sector SPDR Fund (XLE:NYSEARC) that has traded as low as $78.98 last January and at $82.34 a couple of weeks ago.

As can be seen from the chart, there have been three major "buy signals" since the lows of last month, with MACD, MFI, and now TRIX all kicking into gear. Accordingly, I want to take advantage of today's pullback and take a starting position in the XLE.

I have traded this ETF before, and when it moves, it moves fast with big gaps in price, and while it is not always easy to nail down the exact lows, sentiment numbers and trader positioning are about as dismal as one can get for any specific sector.

In the GGMA Trading Account:

- Buy 50% position (1,000 shares) at $87.00 (no stop)

I am running nearly a $400,000 cash position (46%) in this account, so I intend to allocate half to the energy trade.

For those subscribers in need of a great little Canadian junior that pays a 5.32% dividend yield (CA$0.10/share), I really like Hemisphere Energy Corp. (HME:TSX.V), which continues to grow earnings and free cash flow every quarter and unlike the rest of the sector is trading a shade below its 52-week high.

- Buy 50% position HME:TSXV (25,000 shares) at a $1.90 limit. (no stop)

This one will be a long-term buy on the basis of yield alone.

| Want to be the first to know about interesting Oil & Gas - Exploration & Production investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michael Ballanger: I , or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.