The current economic and geopolitical situation presents a complex landscape for resource investors. Gold has reached a new record high price, while silver also saw a modest increase recently. This development could be viewed positively by those invested in precious metals.

However, the global context remains challenging. The United States, a major world power, is facing internal political difficulties. Meanwhile, there are ongoing conflicts in several regions, including Ukraine and parts of the Middle East, as well as tensions involving China. These situations have raised concerns about potential broader conflicts.

The juxtaposition of record-high gold prices against a backdrop of international tensions creates a mixed outlook for investors. While there are opportunities in the precious metals market, the broader geopolitical risks cannot be ignored. The current global leadership faces significant challenges in navigating these complex issues.

The relationship between gold share prices and the price of gold itself has been on a downward trend since peaking in 1968, as illustrated by market data. Recently, there has been some renewed interest in major and mid-tier mining companies. The junior mining sector, known for its higher-risk profile, may potentially see increased activity in the future.

Victoria Gold Corp. (VGCX:TSX; VITFF:OTCMKTS), a mining company, faced a significant operational challenge in late June when their Eagle Mine in the Yukon experienced a leach pad failure. This mine typically produces around 166,000 ounces of gold annually. Such incidents can have serious implications for mining companies and the broader industry.

The occurrence raises questions about the design, construction, and management processes involved in developing a mid-tier gold mine, which typically requires substantial financial investment. The source of the issue could potentially lie with external engineering firms or internal management decisions.

In the current regulatory and public opinion environment, mining companies are expected to maintain high standards of operational safety and environmental responsibility. Incidents like this can have long-lasting impacts on a company's reputation and the industry's public perception.

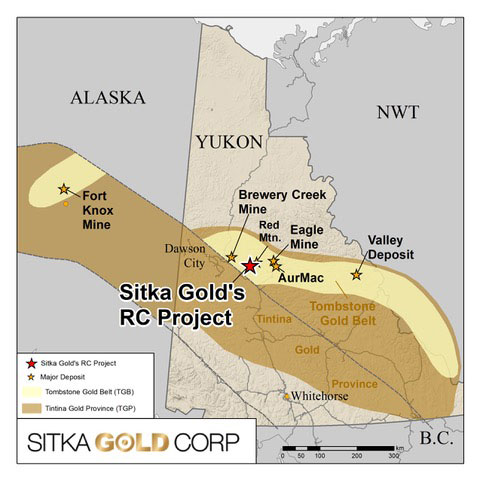

Two mining companies operating in the Yukon, Snowline Gold Corp. (SGD:CSE; SNWGF:OTCQB) and Sitka Gold Corp. (SIG:TSXV; SITKF:OTCQB; 1RF:FSE), experienced different market reactions following an incident at a nearby Victoria Gold operation.

Snowline Gold Corp. has seen significant growth over the past three years. Its share price rose from approximately $0.30 to a peak of $6.40, driven by positive gold exploration results from its Yukon project. However, the stock experienced a decline from $5.40 to $3.90 in early August before showing signs of recovery.

In contrast, during a similar timeframe, Sitka Gold Corp.'s stock price increased from $0.125 to $0.215.

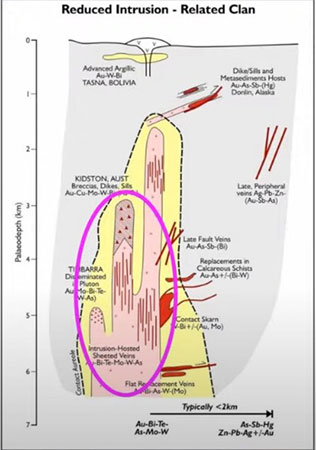

Both companies are exploring what are known as Reduced Intrusion Related Gold Systems (RIRGS). Snowline's project is at a more advanced stage than Sitka's. Snowline has reported a pit-constrained resource estimate of 7.31 million ounces of gold. The company has 158 million shares outstanding, resulting in a market capitalization of $903 million. Additionally, Snowline reports having $63 million in cash reserves.

These figures and stock movements reflect the companies' current positions and recent market performance but do not necessarily indicate future trends or success.

Sitka Gold Corp. reports a resource of 1.34 million ounces of gold, with 315 million shares outstanding and approximately $6 million in cash. Their market capitalization is $105 million. In comparison, Snowline Gold Corp. has about 5.45 times more gold resources and a market capitalization 8.6 times higher than Sitka's.

Snowline's project may have less developed infrastructure compared to Sitka's. Snowline is considered a potential acquisition target at higher valuations. The company's valuation currently equates to about $123 per ounce of gold in the ground, not accounting for their $63 million cash reserves. Industry analysts suggest that as Snowline increases its resource, it could potentially attract acquisition offers closer to $400 per ounce.

Sitka's project benefits from better access and infrastructure. Their current valuation equates to approximately $78 per ounce of gold in the ground. Geologist Quinton Hennigh has noted potential advantages related to glaciation patterns in Sitka's deposit. Unlike Snowline's property, Sitka's deposit may not have been as affected by glacial erosion, potentially leading to a larger gold resource. However, this theory requires further exploration to confirm.

On September 11, Sitka announced results from their deepest drill hole to date, reporting mineralization from surface to 680 meters with numerous instances of visible gold. The company suggests that upcoming results could be comparable to Snowline's findings. Market reaction to these results remains to be seen.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Snowline Gold Corp.

- Bob Moriarty: I, or members of my immediate household or family, own securities of: Sitka Gold Corp. My company has a financial relationship with Sitka Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.