MiMedia Holdings Inc. (MIMDF:OTC; MIM:TSXV; KH3:FSE) recently reported an update on its rollout with American smartphone manufacturer Schok LLC.

Schok works with many big-name brands, including Version, T Mobile, and AT&T, to provide "entry and mid-segment smartphones" to the market by, according to the company, "delivering best-in-class devices with proprietary AI software and services that improve our consumers’ lives." The company's goal is to "redefine the market for entry-level smartphones." With this gold in mind, they announced the first market launch with MiMedia on August 26.

MiMedia offers an advanced personal cloud storage solution, partnering with mobile device manufacturers and telecom companies worldwide. Its platform allows users to securely store, easily access, and seamlessly manage all types of personal media across various devices and operating systems.

For Shock, incorporating MiMedia's cloud platform provides several benefits:

- A product that may help reduce customer turnover

- A way to stand out in the market immediately

- Opportunities for multiple high-profit, recurring revenue streams

The companies have entered into a multi-year agreement. As part of this deal, MiMedia will integrate its platform onto 5 million mobile devices, including both smartphones and tablets, over the next two years. The integration process has already begun, with MiMedia-equipped Shock smartphones now available in the United States.

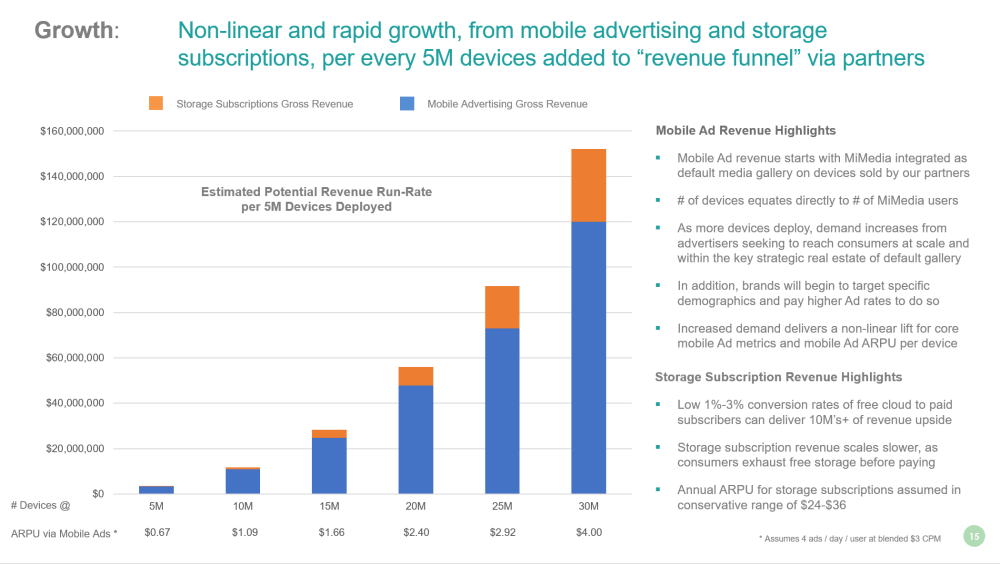

Since this agreement was announced, MiMedia CEO Chris Giordano commented on the rollout update, stating, "While early in the integrated smartphone deployment with our partner Schok, we are pleased to report that MiMedia is already seeing US$12+ CPM [CPMs represent the cost per thousand mobile ad impressions delivered, a metric that advertisers use to pay networks that publish or show their ads.] rates for mobile advertising in our numbers. Maintaining this level of mobile advertising CPMs and delivering on the contracted number of integrated devices of 5M over two years, we believe, can result in a US$125M+ gross revenue opportunity from this partnership alone."

"We are excited about this data, as it is in line with our expectations for the U.S. mobile advertising market," Giordano continued. "However, we are encouraged to see these results so early in our rollout with Schok. We believe this data speaks to the strength of mobile advertising in the U.S. market and MiMedia's unique capability to capture that market within our consumer cloud platform. We expect CPMs in the U.S. to climb even further for the company as we project Schok device volume to pick up in Q4 and head into a strong 2025."

Why Cloud Storage?

Cloud storage has become more and more popular over the years, with the market projected to expand greatly.

According to Markets and Markets, "the global cloud storage market size is expected to grow from US$99.2 billion in 2023 to US$234.9 billion by 2028 at a compound annual growth rate (CAGR) of 18.8%."

Nicholas Rossolillo of The Motley Fool also commented on the cloud storage market, writing, "Cloud computing is also closely tied to other tech developments such as mobile 5G networks, the Internet of Things, and artificial intelligence. By the end of the decade, some estimates put total annual global cloud spending at US$1 trillion. Cloud computing stocks are a top investment theme for 2021 and the decade ahead."

The need for these storage platforms will also only grow, with the increase of smart devices. Internet of Things or IoT devices are devices that have technology to connect to other devices. These include things such as smartphones, iPads, and other smart home devices.

As reported by IOT Analytics, the "number of connected IoT devices to grow 13% by end of 2024 . . . There were 16.6 billion connected IoT devices by the end of 2023 (a growth of 15% over 2022). IoT Analytics expects this to grow 13% to 18.8 billion by the end of 2024."

This increase could lead to more cloud storage demand and might benefit companies like MiMedia.

A "Strong Buy"

*On August 14, Technical Analyst Clive Maund wrote a contributor opinion, where he spoke positively about the company In the article, he detailed MiMedia's main platform, which you can view here.

In his opinion piece, Maund shared the below graphic, writing, "Probably the most impressive page in the deck is this, which shows how revenues and gross profits are poised to take off like a rocket over the next couple of years — and you don't need to be Bernard Baruch to figure out what this will mean for the stock price."

Maund concluded by saying, "MiMedia is therefore viewed as attractive here and rated an Immediate Strong Buy."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

MiMedia Holdings Inc. (MIMDF:OTC; MIM:TSXV;KH3:FSE)

Ownership and Share Structure

According to the company, it has 73.7 million basic shares and 99.9 million fully diluted shares outstanding, with 8% of the company owned by insiders and management and the rest is in retail.

Its market cap is CA$14.61 million (based on basic shares), and it trades in a 52-week range of CA$0.47 and CA$0.19.

Important Disclosures:

- MiMedia Holdings Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of MiMedia Holdings Inc.

- Katherine DeGilio wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

* Disclosure for the quote from the Clive Maund article published on August 14, 2024

- For the quoted article (published on August 14, 2024), the Company has paid Street Smart, an affiliate of Streetwise Reports, between US$2,250.US

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing the article quoted. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in the article accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

Clivemaund.com Disclosures

The quoted article represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.